Bitcoin falls below $105,000 as decentralized finance turmoil and a stronger US dollar exert pressure

Jinse Finance reported that bitcoin continued to decline on Tuesday, extending its downward trend in October. A stronger US dollar and turmoil in the decentralized finance sector further weighed on the performance of the largest digital asset. Bitcoin fell as much as 2.5% today to $104,200 per coin, marking its lowest level in more than two weeks. Ethereum dropped 3.4%, falling below $3,500. This decline comes after a historic sell-off three weeks ago, when leveraged positions in the crypto market were liquidated, resulting in losses of several billions of dollars. Since then, investors have clearly remained cautious about bitcoin's ability to rebound. Market maker Keyrock stated that traders are "still reluctant to return to large-scale positions." The total open interest in bitcoin perpetual futures is currently about $68 billion, down approximately 30% from the October peak. According to CoinGlass data, in just the past 24 hours, broad-based selling pressure in the crypto market has led to the liquidation of about $1.2 billion in long positions. Meanwhile, investors have withdrawn more than $1.8 billion from spot bitcoin and ethereum ETFs over the past four trading days. (Golden Ten Data)

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

49,999 ETH were transferred from an exchange to an unknown wallet, valued at approximately $175,445,747.

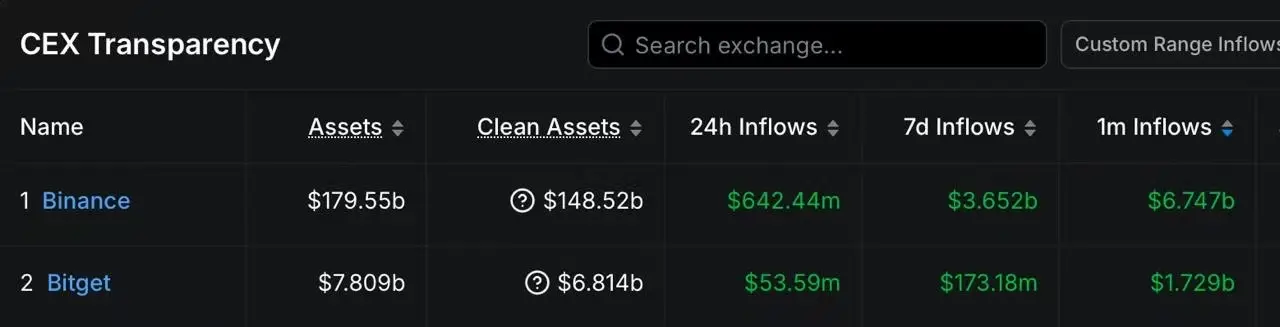

Data: In the past 30 days, the main capital inflows have been to a certain exchange and leading CEXs such as Bitget.