Bitcoin Stays Flat Despite Historic US–China Trade Deal Announcement

Despite the US-China breakthrough, Bitcoin showed little reaction, rising less than 1% as selling pressure from long-term holders persisted.

The United States and China have taken a major step toward easing trade tensions, agreeing to suspend several tariffs that have rattled global markets this year.

Yet, despite the diplomatic breakthrough, Bitcoin’s price has not mirrored the optimism expected from such a deal.

US-China Reach Historic Agreement

On November 1, the White House announced that President Donald Trump and Chinese President Xi Jinping had reached a trade and economic agreement. The deal was finalized during meetings held in the Republic of Korea.

Under the deal, China will suspend new export controls on rare earth elements and grant general licenses for their shipment. Beijing also pledged to curb fentanyl exports to the United States and pause all retaliatory tariffs imposed since March 4.

In return, Washington will reduce tariffs on Chinese goods by 10% and extend existing tariff exemptions through November 2026.

“[This is] a massive victory that safeguards US economic strength and national security while putting American workers, farmers, and families first,” The White House stated.

The Kobeissi Letter, a macroeconomic research firm, described the accord as the most substantial thaw in US–China trade relations in years, noting its potential to ease global supply-chain strain.

Bitcoin Shrugs Off Diplomatic Optimism

Yet financial markets are showing little enthusiasm to the news.

Bitcoin, which often reacts to geopolitical and macroeconomic signals, recorded a modest gain of less than 1% in the past 24 hours. It was trading at $110,785 at press time.

Indeed, the muted response contrasts sharply with the volatility recorded in October. At the time, Trump’s announcement of new retaliatory tariffs sparked a $20 billion liquidation wave across crypto markets.

Meanwhile, industry analysts say the muted price response this time reflects deeper structural shifts in Bitcoin ownership rather than a loss of macro sensitivity.

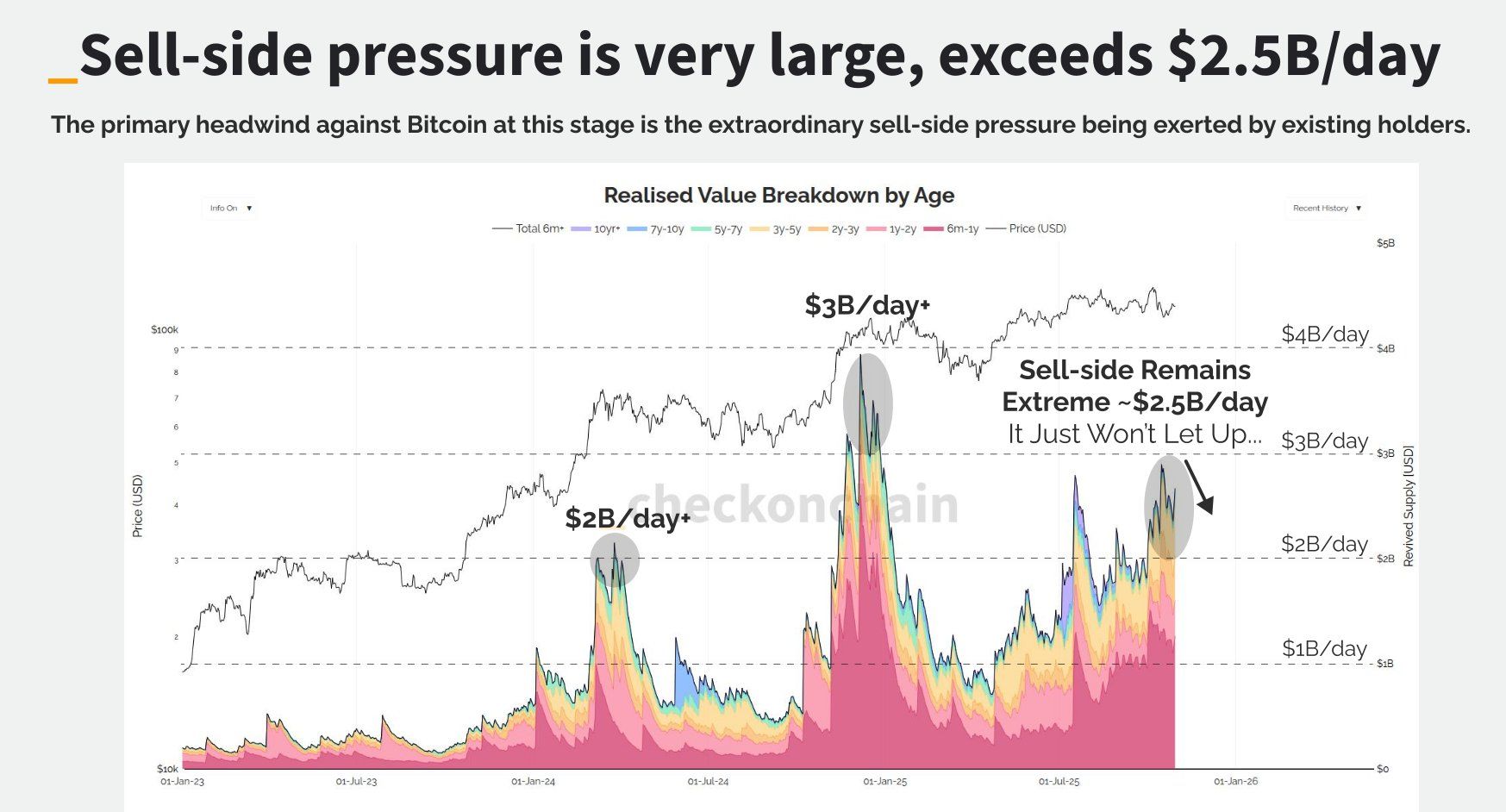

James Check, a Bitcoin on-chain analyst, observed that older holders are offloading coins at an accelerated rate in comparison to previous cycles.

He noted that Bitcoin’s sell-side pressure remains intense, with the average age of coins being sold now around 100 days. This represents a sharp rise from the 30-day average seen in the previous period.

Bitcoin Selling Pressure. Source:

Bitcoin Selling Pressure. Source:

This shift, he explained, signals a transition in which long-term holders are offloading their positions to patient, deep-pocketed newcomers entering the market.

“We are watching a changing of the guard, from the OGs who rode the early risky waves, into the new pool of TradFi buyers who like calmer waters,” Check explained.

Despite the short-term price weakness, experts maintain that Bitcoin’s long-term fundamentals remain intact. The current rotation, they argue, marks a natural evolution of the asset’s maturity — where seasoned traders exit and traditional finance begins to take hold.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Market value evaporates by 60 billions! Faith shaken, institutions on the sidelines—has bitcoin’s “post-halving crash” curse come true?

A major reason for the recent plunge is market concerns over a repeat of the "halving cycle"—that is, after a supply reduction triggers a boom, a deep correction inevitably follows. Panic selling by investors, combined with a stagnation of institutional funds and macroeconomic headwinds, have collectively led to a collapse in market confidence.

SharpLink and Upexi: Each Has Its Own Strengths and Weaknesses in DAT

For this model to be sustainable, one of the following two scenarios must occur: either staking truly becomes a corporate cash engine, continuously providing funds for digital asset purchases; or companies must incorporate the planned sale of digital assets into their digital asset strategies to achieve systematic profits.

80% is hype? Six major red lines reveal the true intentions of Stable

It appears to be an infrastructure upgrade, but in essence, it is an early, insider-friendly issuance.

Global assets are falling simultaneously—why have safe havens collectively failed?