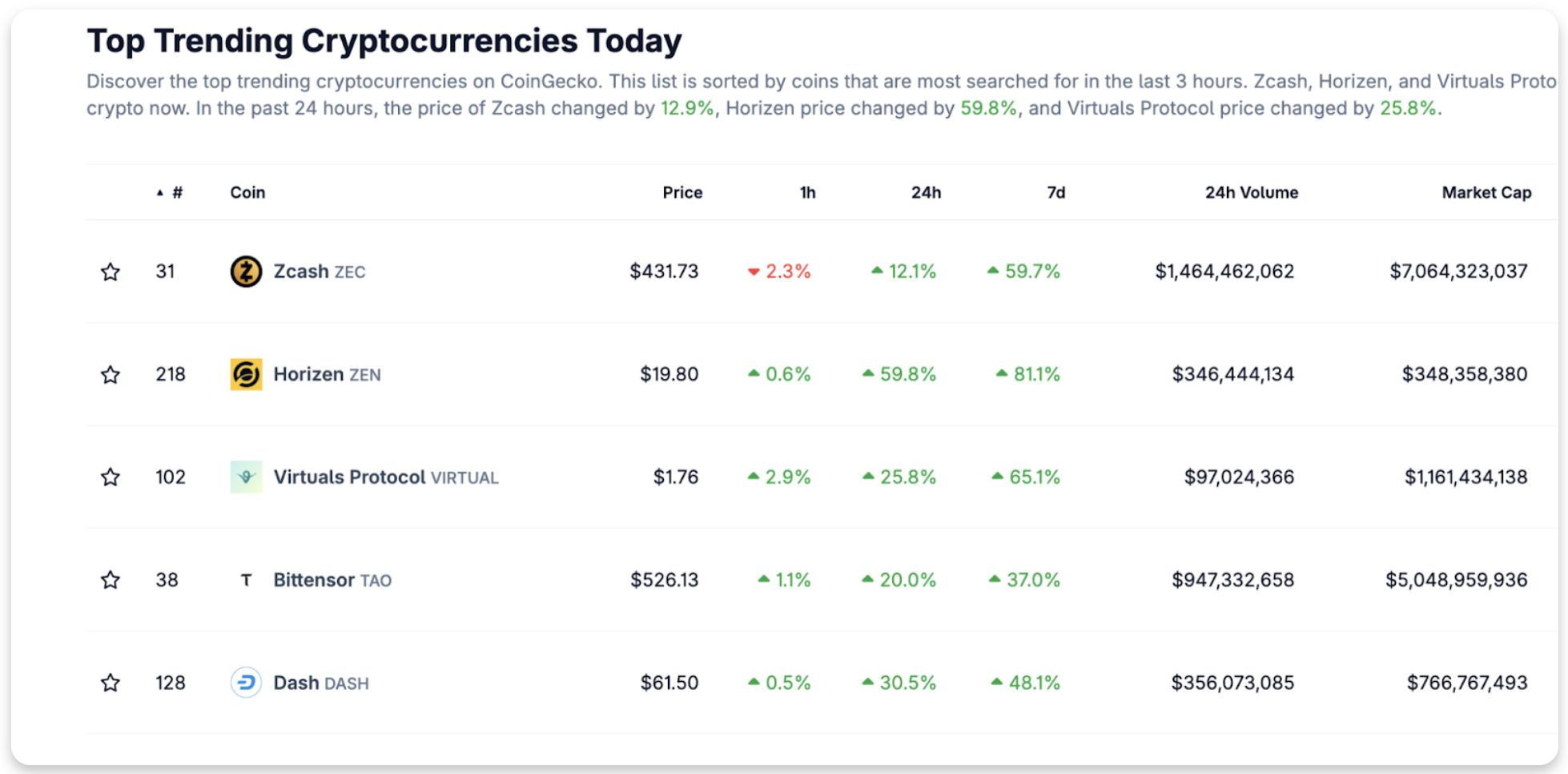

This week, privacy-focused cryptocurrencies have surged to the top of CoinGecko’s “Most Trending Cryptocurrencies” list, capturing renewed attention. Based on search volumes over the past three hours, Zcash (ZEC), Dash (DASH), and Monero (XMR) have emerged as notable players.

Monero’s Unique Privacy Model and Regulatory Concerns

Zcash experienced a 15.7% increase over the last 24 hours, reaching $439.79. With a market cap exceeding $7.1 billion, Zcash’s daily trading volume hit $1.45 billion. Zcash saw a weekly gain of 63% and a monthly increase of 191%, providing investors with a 1,091% return over the past year. Similarly, Dash rose by 29.5% in the last 24 hours to $61.44, with a daily trading volume settling at $322 million. Its weekly growth rate was recorded at 50%, with a monthly increase of 84%.

Monero (XMR) presented a more moderate growth in comparison, rising by 8.3% to reach $347.63 with a trading volume of $134 million. Monero differentiates itself by automatically concealing transactions, wallet addresses, and amounts through technologies like RingCT and stealth addresses, ensuring untraceable transactions. However, these robust privacy features raise concerns regarding money laundering and Know Your Customer (KYC) regulations.

Zcash is distinguished by its “optional privacy” approach, allowing users to choose between transparent or private addresses. Thanks to “zk-SNARKs” technology, sender, recipient, and amount details remain hidden, and “view keys” enable the optional sharing of transaction details.

Rising Interest in Digital Privacy and Market Impacts

CoinGecko’s trending list reflects investors’ resurging interest in privacy and anonymity. As global regulatory bodies closely monitor privacy-centric cryptocurrencies for money laundering risks, individual investors emphasize the importance of financial privacy.

Meanwhile, the global cryptocurrency market maintains a robust stance, with a total market value hovering around $3.78 trillion and daily trading volumes exceeding $140 billion. Bitcoin $110,030 and Ethereum $3,876 lead with market shares of 57.9% and 12.3%, respectively. Although the overall share of privacy coins remains low, this trend indicates sustained interest in secure and untraceable transactions from users.

The U.S. Securities and Exchange Commission ( SEC ) and European Union authorities have proposed new legislative drafts to tighten oversight over privacy coins. Projects supporting anonymous transactions, like Monero and Zcash, are being urged to demonstrate greater transparency in compliance with Anti-Money Laundering (AML) standards. This scenario may cause short-term price fluctuations, but it could contribute to a more robust market structure in the long run.

In conclusion, the rise of privacy-focused cryptocurrencies illustrates the enduring pursuit of privacy in the digital realm. Despite regulatory pressures, investor interest reveals increased sensitivity towards financial privacy. To survive, these projects must balance security with legal boundaries in the future.