Billions on the Move: October’s Winners and Losers in the Stablecoin Market

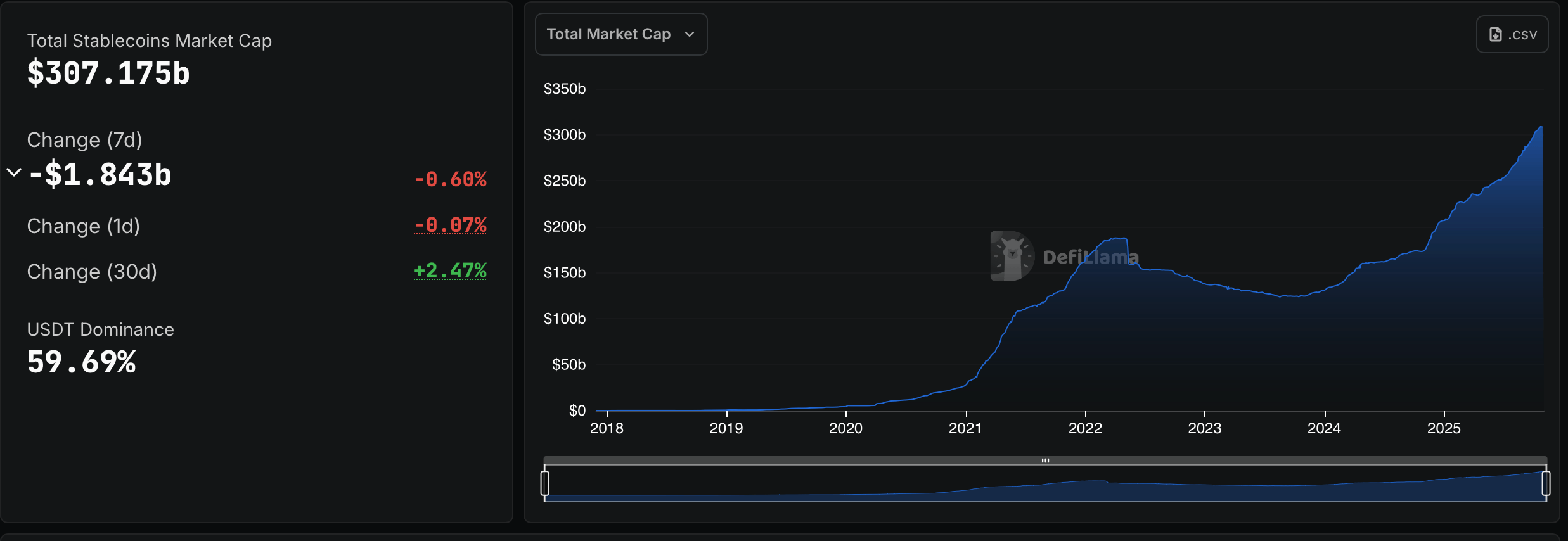

The latest data from defillama.com shows the stablecoin market didn’t skip a beat in October, climbing 2.47% even after trimming $1.84 billion in the past week. Tether ( USDT) was the main heavyweight, swelling its market cap by roughly $7.78 billion during the monthlong stretch.

October’s Stablecoin Snapshot: Who Rose, Who Fell, and Who’s Still Dominant

USDT continues to reign supreme, Defillama figures show it flexing a 4.43% monthly climb to a hefty $183.35 billion market cap. It currently commands 59.69% of the stablecoin sector’s $307.175 billion total value.

Circle’s USDC had its own moment in the spotlight this week, finally breaking past the $75 billion milestone. The runner-up stablecoin tacked on $1.744 billion, marking a 2.36% gain and landing at a tidy $75.51 billion cap.

Ethena’s USDe took a nosedive in October, tumbling 36.57% to settle at $9.36 billion after losing a hefty $5.39 billion in just a month. Sky Dollar (USDS) had a brighter story, leaping 21.67% to hit $5.19 billion, while DAI barely budged—up a modest 0.61% to $5.10 billion.

World Liberty Financial’s USD1 added some flair with an 11.08% lift to $2.98 billion, and Paypal’s PYUSD joined the climb, popping 14.82% to reach $2.81 billion. According to Defillama, Blackrock’s BUIDL inched up 2%, bringing its total to $2.59 billion.

Falcon USD (USDf) took flight with a 24.35% jump to $2.02 billion, while Ethena’s USDtb barely moved, ticking up 0.17% to $1.83 billion. Global Dollar (USDG) rocketed 37.84% to $991.35 million, and rounding out the top 12, Ripple’s RLUSD kept pace with a 21.97% climb to $963.09 million.

Overall, the stablecoin sector showed a mix of steady gains and sharp dips in October, with USDT and USDC tightening their grip on dominance. While Ethena’s USDe stumbled, several competitors like USDG and RLUSD posted eye-catching growth.

The month’s movements highlight how capital keeps flowing across the stablecoin spectrum, even amid the shifting market tides we’ve seen in recent times.

FAQ ❓

- What is the total value of the stablecoin market?

The global stablecoin market is valued at about $307.175 billion as of Oct. 2025. - Which stablecoin holds the largest market share?

Tether ( USDT) leads the pack with 59.69% of the total stablecoin market. - How much is Circle’s USDC worth now?

USDC recently crossed the $75 billion mark in market capitalization. - Which stablecoin saw the biggest decline in October?

Ethena’s USDe dropped 36.57%, losing more than $5 billion in value.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

YFI Gains 0.38% Over 24 Hours Despite Year-Long Downtrend

- YFI rose 0.38% in 24 hours to $4768, contrasting a 40.84% annual decline and 5.56% weekly drop. - Analysts highlight need for improved utility/adoption to reverse long-term bearish trends despite short-term resilience. - Technical indicators show no strong reversal patterns, with bearish pressure dominating despite 1-month 0.45% recovery. - Mixed performance reflects complex market dynamics between temporary buying interest and structural bear market challenges.

Bitcoin News Update: Hyperliquid's BTC Short Balances on Edge: $17 Million Profit Nears as $111,000 Liquidation Threatens

- Hyperliquid's largest BTC short holds $17M unrealized gains, risking liquidation above $111,770 amid volatile $106K price. - 20x leveraged position shows 4.86% profit from $111K entry, with 55% of platform's $5.3B total positions in shorts. - $30M POPCAT manipulation incident exposed liquidity risks, causing $63M liquidations and $4.9M HLP losses. - BTC faces bearish pressure below $101K despite 15/1 technical buy signals, as ETF inflows revive institutional demand.

Bitcoin News Today: Bitcoin’s Recent Decline Ignites Discussion: Is This a Temporary Correction or the Start of a Larger Downtrend?

- Bitcoin long-term holders offloaded 815,000 BTC in 30 days, pushing price below $100,000 and triggering $683M liquidations. - Analysts link the selling to profit-taking after prolonged rallies, with open interest dropping 27% to $68.37B as demand remains subdued. - Market debates whether this marks a mid-cycle correction (22% average drawdowns historically) or a broader bearish shift. - Despite volatility, 72% of BTC supply remains in profit, and DeFi TVL exceeding $1T signals potential long-term resilie

Bitcoin Updates: Metaplanet Increases Its Bitcoin Assets While Competitors Shift Focus from Mining

- Metaplanet boosted Bitcoin holdings via $100M credit and 75B yen buybacks, now holding 30,823 BTC ($3.5B) to drive capital strategy. - Q3 revenue surged 115.7% to ¥2.438B as peers like TeraWulf shift from mining to HPC amid declining crypto profitability. - Japan's JPX considers stricter crypto treasury rules after Metaplanet lost 82% of peak value since May amid market volatility. - BitMine Immersion accelerated Ethereum accumulation to 110,288 ETH ($12.5B) while Hyperscale Data targets 100% Bitcoin/mar