September Web3 Funding Report: Capital Chases Liquidity and Maturity

Public token sales remain active, but fundraising focus has shifted to later stages.

Public token sales remain active, but the focus of fundraising has shifted to later stages.

Written by: Robert Osborne, Outlier Ventures

Translated by: AididiaoJP, Foresight News

Web3 fundraising was strong in September 2025 but did not reach its peak.

160 deals raised $7.2 billions, the highest total since the surge in spring. However, with the notable exception of Flying Tulip at the seed stage, late-stage capital investment dominated, as was the case in the previous two months.

Market Overview: Strong but Top-Heavy

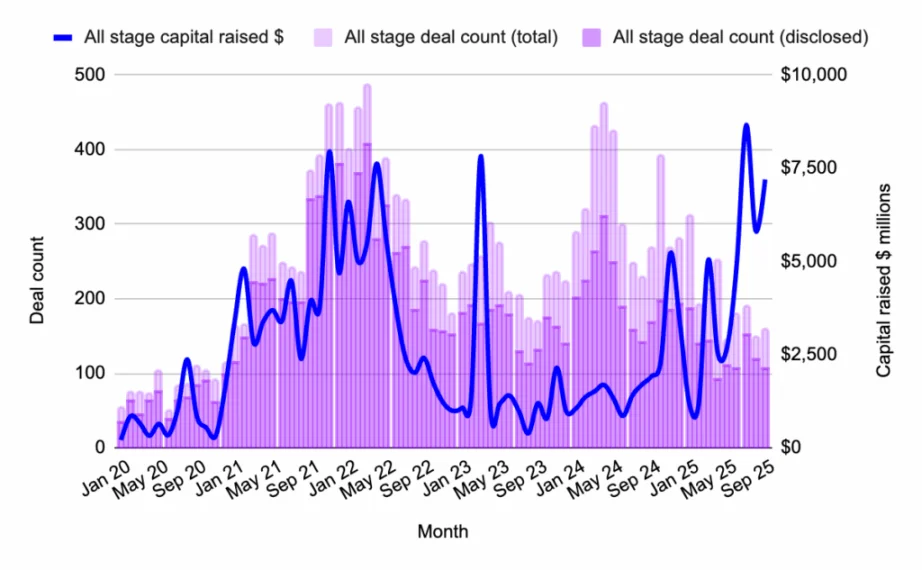

Figure 1: Web3 capital deployment and number of deals by stage from January 2020 to September 2025. Source: Messari, Outlier Ventures.

- Total capital raised (disclosed): $7.2 billions

- Disclosed deals: 106

- Total number of deals: 160

At first glance, September seemed like a high-profile return of risk appetite. But aside from the exception of Flying Tulip, most capital investments went to late-stage companies. This continues the trend observed in our recent quarterly market report and aligns with VC insights we gathered from Token2049 Singapore. September 2025 once again shows that while early-stage deal activity remains active, real capital is seeking maturity and liquidity.

Market Highlight: Flying Tulip ($200 million, Seed Round, $1.1 billions Valuation)

Flying Tulip raised $200 million at a unicorn valuation in its seed stage. The platform aims to unify spot, perpetual contracts, lending, and structured yield into a single on-chain exchange, using a hybrid AMM/order book model, supporting cross-chain deposits and volatility-adjusted lending.

Web3 Venture Funds: Shrinking in Size

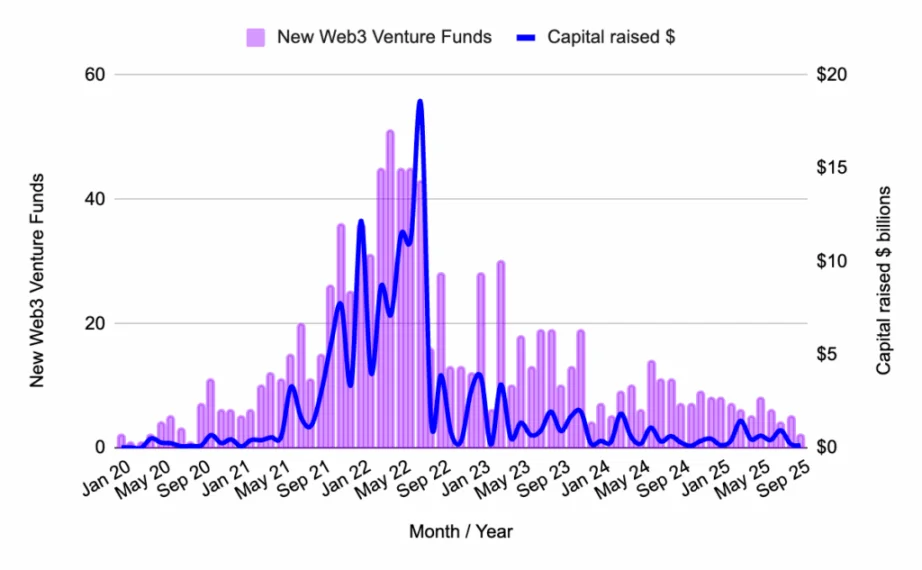

Figure 2: Number of Web3 venture funds launched and capital raised from January 2020 to September 2025. Source: Messari, Outlier Ventures.

New funds in September 2025:

- Onigiri Capital, $50 million: Focused on early-stage infrastructure and fintech in Asia.

- Archetype Fund III, $100 million: Focused on modularity, developer tools, and consumer protocols.

Fund launches cooled off in September 2025. Only two new funds were launched, both relatively small and highly focused in theme. This trend points to selectivity rather than slowdown: VCs are still raising funds, but around sharper, more focused themes.

Pre-Seed Rounds: Nine-Month Downtrend Continues

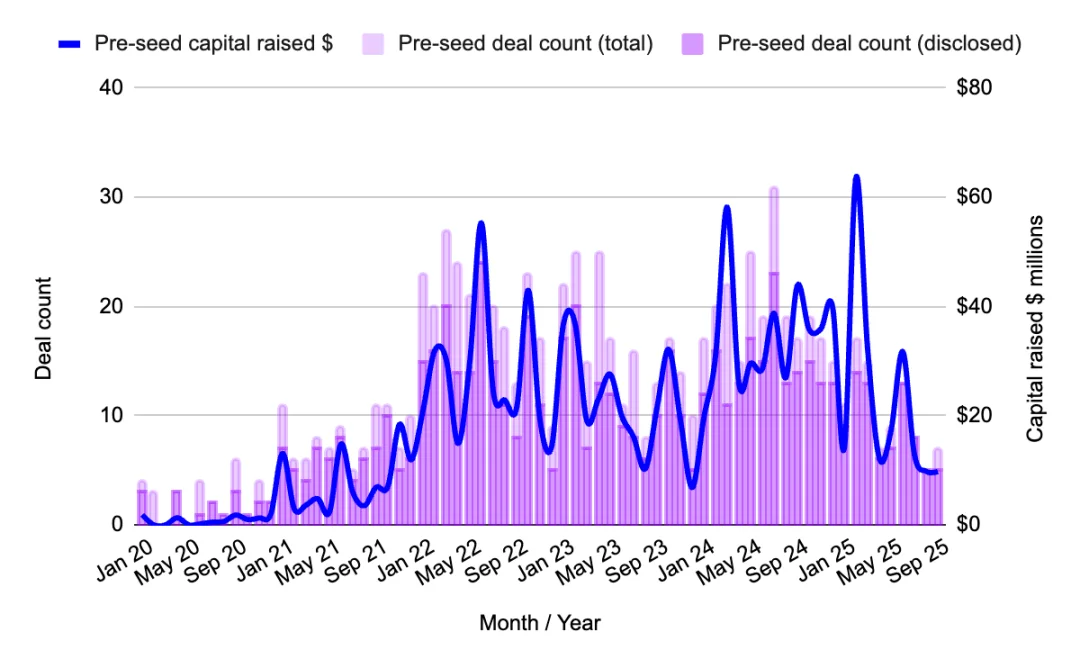

Figure 3: Pre-seed capital deployment and number of deals from January 2020 to September 2025. Source: Messari, Outlier Ventures.

- Total capital raised: $9.8 million

- Disclosed deals: 5

- Median round size: $1.9 million

Pre-seed funding continues to decline, both in terms of deal count and capital raised. This stage remains weak, with few well-known investors participating. For founders at this stage, capital is scarce, but those who succeed in fundraising rely on tight narratives and technical conviction.

Pre-Seed Highlight: Melee Markets ($3.5 million)

Built on Solana, Melee Markets allows users to speculate on influencers, events, and trending topics, combining prediction markets and social trading. Backed by Variant and DBA, it’s a clever attempt to capture attention flows as an asset class.

Seed Rounds: Tulip Mania

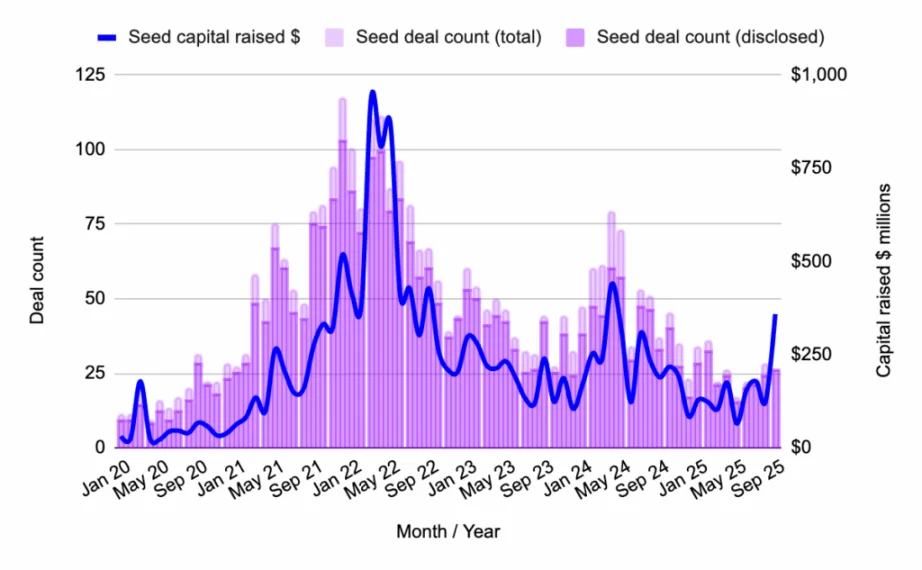

Figure 4: Seed-stage capital deployment and number of deals from January 2020 to September 2025. Source: Messari, Outlier Ventures.

- Total capital raised: $359 million

- Disclosed deals: 26

Seed-stage fundraising saw significant growth, but this was entirely due to Flying Tulip’s $200 million round. Without it, fundraising in this category would be roughly in line with previous months.

More importantly, Flying Tulip’s structure is not a typical fundraising. Its on-chain redemption rights provide investors with capital security and yield exposure without sacrificing upside. The project is not burning through its raise; instead, it uses DeFi yields to fund its growth, incentives, and buybacks. This is a DeFi-native innovation in capital efficiency that could influence how protocols self-fund in the future.

Although Flying Tulip’s investors do have the right to withdraw these funds at any time, this is still a significant capital investment by Web3 venture capitalists, which would otherwise have been invested in other early-stage projects through less liquid instruments: namely SAFE and/or SAFT. This is another manifestation of the current trend among Web3 investors—seeking more liquid asset exposure.

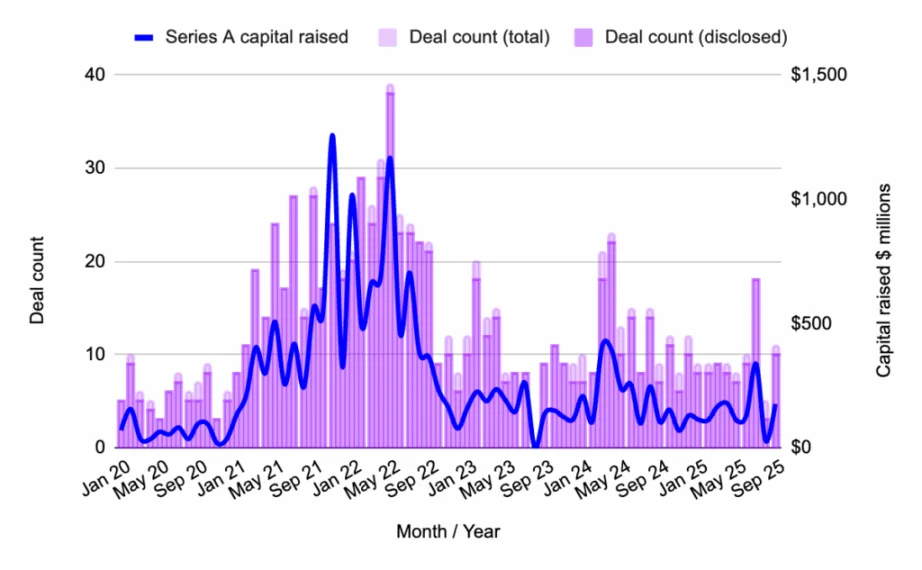

Series A: Stabilizing

Figure 5: Series A capital deployment and number of deals from January 2020 to September 2025. Source: Messari, Outlier Ventures.

- Total capital raised: $177 million

- Disclosed deals: 10

- Median round size: $17.7 million

After a sharp drop in August, Series A activity slightly recovered in September, but it was not a breakout month. Deal volume and deployed capital were just around the 2025 average. Investors remain selective, supporting late-stage momentum rather than chasing early-stage growth.

Series A Highlight: Digital Entertainment Asset ($38 million)

Singapore-based Digital Entertainment Asset raised $38 million to build a Web3 gaming, ESG, and advertising platform with real-world payment features. Backed by SBI Holdings and ASICS Ventures, this reflects Asia’s ongoing interest in integrating blockchain with mainstream consumer industries.

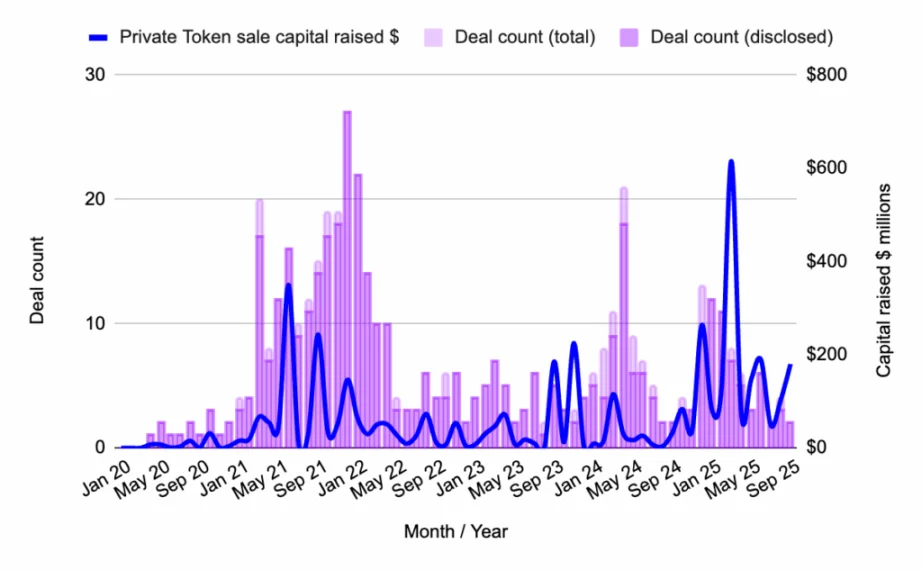

Private Token Sales: Huge Capital, Big Names Involved

Figure 6: Private token sale capital deployment and number of deals from January 2020 to September 2025. Source: Messari, Outlier Ventures.

- Total capital raised: $180 million

- Disclosed deals: 2

Private token activity remains concentrated, with a single large raise doing all the work. The recent pattern continues: fewer token rounds, bigger checks, and exchange-driven plays absorbing liquidity.

Highlight: Crypto.com ($178 million)

Crypto.com raised a massive $178 million, reportedly in partnership with Trump Media. The exchange continues to push its global accessibility and mass-market crypto payment tools.

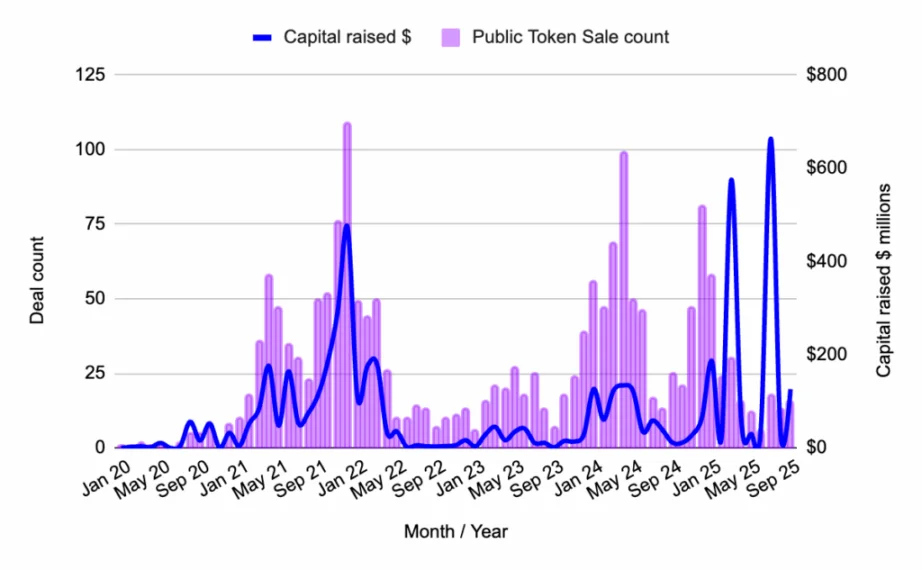

Public Token Sales: Bitcoin’s Yield Moment

Figure 7: Public token sale capital deployment and number of deals from January 2020 to September 2025. Source: Messari, Outlier Ventures.

- Total capital raised: $126.2 million

- Disclosed deals: 16

Public token sales remain active, driven by two attractive narratives: Bitcoin yield (BTCFi) and AI agents. This is a reminder that public markets are still chasing narratives.

Highlight: Lombard ($94.7 million)

Lombard is bringing Bitcoin into DeFi, launching LBTC—a yield-bearing, cross-chain, liquid BTC asset designed to unify Bitcoin liquidity across ecosystems. This is part of the growing “BTCFi” trend, earning DeFi yields with BTC.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DOJ Exposes $7.8M Crypto Scam Tied To Bitcoin Rodney

Grayscale Signals Bitcoin Could Hit New Highs in 2026 Despite Recent Dip

Will the Bitcoin Cycle Survive American Monetary Policy?