Bitcoin & Ethereum Spot ETFs See Significant Outflows

Spot Bitcoin and Ethereum ETFs recorded combined outflows of more than $550 million on October 29. Broader macro‑economic concerns and evolving investor sentiment are influencing fund flows in the US crypto market.

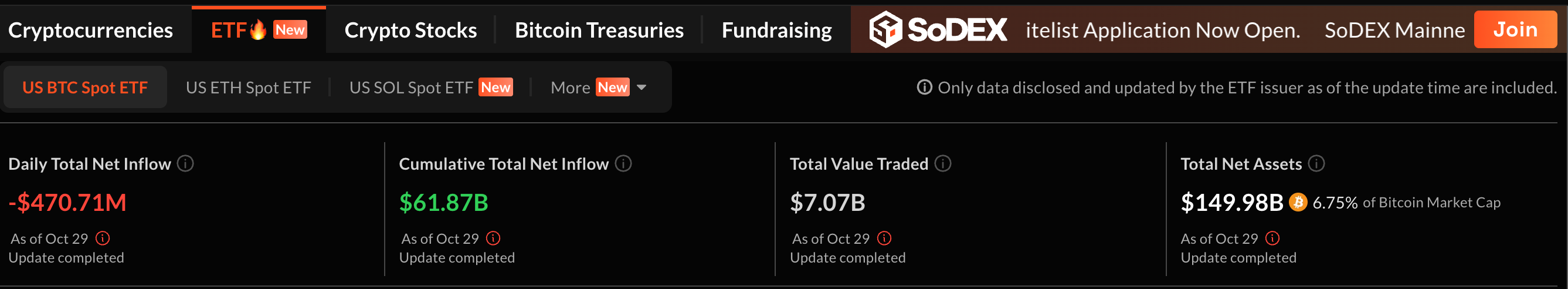

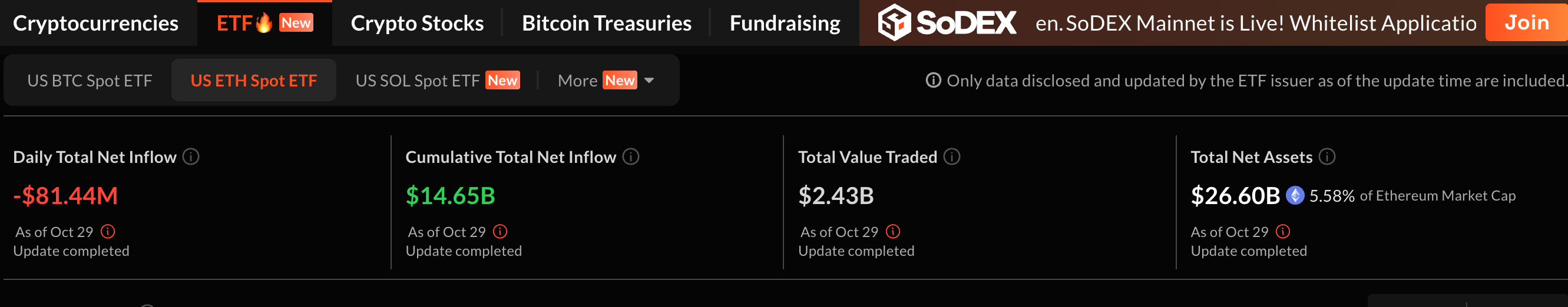

Spot Bitcoin and Ethereum exchange‑traded funds (ETFs) recorded substantial net outflows, with US investors withdrawing approximately $471 million and $81.44 million, respectively.

These movements reflect growing concerns over macroeconomic conditions and investor sentiment in the US crypto market.

Macro‑economic Dynamics Drive ETF Withdrawals

On Wednesday, US spot Bitcoin ETFs registered net outflows of about $471 million. None of the twelve major Bitcoin‑tracking funds posted inflows. Similarly, the aggregated net outflow for spot Ethereum ETFs was approximately $81.44 million.

According to the data provider SoSoValue, the outflow for Bitcoin‑based ETFs placed the market firmly in “fear” territory. The Fear & Greed Index showed only 34 out of 100 points, down from 51one day prior.

Source:

SoSoValue ETF Dashboard

Source:

SoSoValue ETF Dashboard

These outflows coincide with broader macro‑financial headwinds. Investors are concerned about rising interest rates, inflationary pressures in the US economy, and regulatory uncertainty for digital assets. Institutional and retail investors appear to be recalibrating risk exposure. They are shifting away from higher‑volatility assets, including crypto ETFs. Higher financing costs and tighter monetary policy indirectly amplify pressure on speculative investment vehicles such as crypto ETFs.

The scale of outflows suggests that cryptocurrency‑related ETFs are highly sensitive to macroeconomic sentiment. They can quickly reverse inflow momentum when economic signals become less favorable.

Investor Sentiment and Portfolio Re‑allocation

Market participants indicate that the recent capital withdrawals stem from strategic re‑balancing and cautionary positioning. Investors may be locking in gains after prior crypto rallies. They may also reallocate funds ahead of corporate earnings and economic data releases. Some funds may face redemption requests triggered by liquidity risk or margin pressures elsewhere in the portfolio.

Among Ethereum ETFs, ETHA (BlackRock’s product) was a notable exception. It was the group’s only fund to post net inflows on the day, demonstrating selective investor preference for certain fund features such as lower fees, larger scale, or stronger brand reputation.

Source:

SoSoValue ETF Dashboard

Source:

SoSoValue ETF Dashboard

Additionally, the standout $46.5 million inflow into a spot Solana ETF highlights an investor shift toward alternative crypto‑assets beyond Bitcoin and Ethereum, even amidst a broader outflow trend.

Implications for the US Crypto ETF Ecosystem

The large‑scale outflows from flagship Bitcoin and Ethereum ETFs raise questions about the resilience of the US crypto ETF ecosystem. While earlier months had seen sustained inflows, the rapid reversal underscores investor confidence in this nascent asset class remains fragile under stress.

ETF inflows and outflows often barometer market sentiment, liquidity preferences, and institutional engagement. Some analysts interpret the drop in the Fear & Greed Index and the magnitude of outflows as a response to macro conditions and a signal of “faster money” (short‑term capital) pulling out ahead of deeper structural issues in crypto markets.

If outflow dynamics persist, they may exert downward pressure on underlying crypto asset valuations and hamper future fundraising in the sector. Fee structure, liquidity, market positioning, and brand credibility can increasingly influence which ETFs capture or lose capital.

For the broader crypto market, these developments suggest that while digital assets continue to attract institutional attention, their integration into mainstream portfolios may still depend on stabilizing macro‑conditions, regulatory clarity, and improved product maturity.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

OpenAI aims for a trillion-dollar IPO, possibly going public as early as the end of 2026?

OpenAI is reportedly preparing for an IPO as early as the end of 2026, with a potential valuation of up to 1 trillion dollars. The minimum fundraising target under consideration is 60 billion dollars, and the actual amount may be even higher.

KRWQ Emerges as a Pioneer in Stablecoin Innovation

In Brief IQ and Frax launched KRWQ, a stablecoin pegged to the South Korean won. The multi-blockchain KRWQ aims to fill gaps in the current stablecoin market. South Korea's regulatory stance still prevents local access to KRWQ.

Fight Fight Fight LLC in Talks to Acquire Republic’s U.S. Unit as TRUMP Token Targets Startup Funding Push

Consensys Advances IPO Plans With JPMorgan and Goldman Sachs Amid Crypto Market Shift