Ripple’s Trust Bank Review Nears Finish Boosting XRP Sentiment

Quick Take Summary is AI generated, newsroom reviewed. The conclusion of the 120-day OCC review for Ripple National Trust Bank is set for October 30. Approval could allow Ripple to manage digital assets under a national banking license and integrate its blockchain with the U.S. financial system. Ripple's strong compliance and utility-based approach, including its RLUSD stablecoin, may fast-track the approval process. The potential bank approval is seen by investors as a major validation of Ripple's long-te

Ripple’s 120-day review period with the Office of the Comptroller of the Currency (OCC) is set to conclude on October 30. This marks a major milestone in its plan to establish the Ripple National Trust Bank. The development has sparked renewed optimism among XRP holders. As analysts suggest, the company’s strong regulatory track record could fast-track approval.

Ripple’s OCC Review Nears Key Decision

The OCC review process typically takes six months to a year. But Ripple’s case appears different. According to industry observers, the company’s strict adherence to compliance standards and its progress with RLUSD. Ripple’s recently launched stablecoin may allow regulators to skip the preliminary approval stage.

If true, Ripple could receive full authorization sooner than expected. It is potentially streamlining its entry into formal banking operations. The move would allow Ripple to manage digital assets and provide custodial services directly under a national banking license. This further integrates its blockchain solutions with the U.S. financial system. For the broader crypto community, this signals that Ripple is continuing to move toward mainstream financial legitimacy. At a time when regulatory clarity remains uncertain across the industry.

Ripple’s Utility-Based Approach Sets It Apart

While speculation often drives token prices in crypto markets. Ripple’s ecosystem has built its reputation on utility and function, not hype. Analysts highlighted how XRP’s value stems from organic demand tied to real-world usage. Unlike some networks that see price surges from trend-based tokens. Ripple’s growth is rooted in adoption. XRP serves two key purposes: it secures the network and acts as a bridge currency for cross-border payments. These functions ensure that XRP has consistent demand as Ripple’s network scales.

Each Ripple account requires users to hold a small amount of XRP as a reserve to prevent spam attacks. Transaction fees are also paid in XRP, creating a steady burn rate that slightly reduces total supply over time. With 100 billion XRP tokens ever created and none to be added, its scarcity strengthens long-term value. This design underpins Ripple’s claim that XRP demand grows naturally as more institutions adopt its payment protocol. It’s a model that emphasizes sustained growth through functionality rather than speculation.

Market Sentiment Turns Bullish Ahead of Decision

The approaching OCC decision has stirred enthusiasm within the XRP community. Investors see the potential bank approval as a validation of Ripple’s long-term strategy. To blend traditional finance with blockchain infrastructure. Ripple’s leadership has consistently positioned the company as a bridge between the two worlds. It is leveraging compliance-first innovation.

While promoting XRP as a tool for efficiency and liquidity in cross-border settlements. If the Ripple National Trust Bank receives approval. It would mark one of the most significant regulatory milestones for any blockchain firm to date. It could also serve as a model for how digital asset companies integrate with the global banking system responsibly.

A Turning Point for Ripple and XRP

If Ripple’s trust bank receives final approval. It could become a defining moment for the company and the XRP ecosystem. The move would enable Ripple to offer regulated digital asset services under federal law. A first for a company born in the blockchain sector. For XRP holders and the wider crypto community, the conclusion of the OCC review signals more than just a regulatory milestone.

It reflects growing institutional confidence in Ripple’s technology and its ability to operate within traditional finance structures. As October 30 approaches, optimism continues to rise. Ripple’s steady progress. It coupled with XRP’s increasing real-world use, paints a promising picture for the project’s future, one rooted not in hype. But in lasting value and global adoption.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

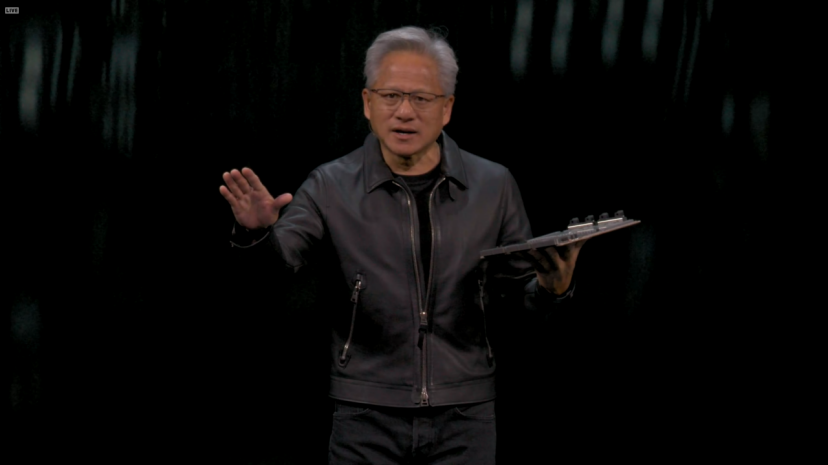

Give Nokia 1 billion, Jensen Huang wants to earn 200 billions

Jensen Huang unveiled some major announcements at the 2025 GTC.

When AI Agents Learn to Make Autonomous Payments: PolyFlow and x402 Are Redefining the Flow of Value on the Internet

x402 has opened the channel, while PolyFlow extends this channel to the real business and AI Agent world.

PolyFlow integrates x402 protocol to drive the next-generation AI Agent payment revolution

PolyFlow's mission is to seamlessly connect traditional systems with the intelligent world through blockchain technology, gradually reshaping everyday payments and financial activities to make every transaction more efficient and trustworthy—making every payment more meaningful.

BNB Price Chart Targets $10,000 as Macro Bull Run Strengthens in 2025