What To Expect From Solana Price In November 2025?

With $381 million in institutional inflows and easing holder sell pressure, Solana is positioned for a potential breakout above $213 as November 2025 begins.

Solana (SOL) enters November with strong bullish momentum, setting the stage for a potential breakout rally. The altcoin is benefiting from a series of positive developments recorded throughout October.

After weeks of consolidation, optimism for a strong upward move in the coming month is being fueled.

Solana Has Considerable Support

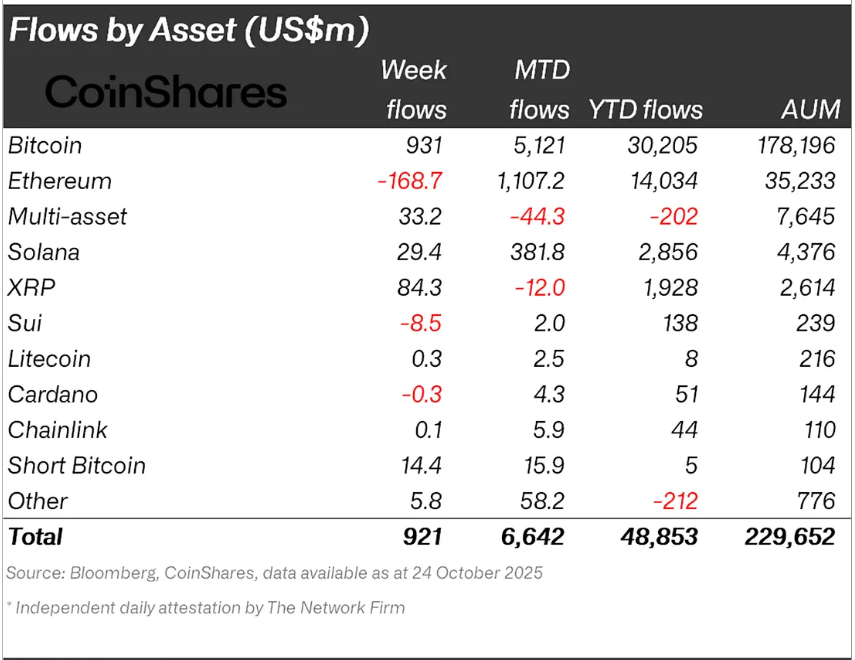

Institutional investors have continued to show remarkable confidence in Solana over the past four weeks. Since early October, SOL has recorded more than $381 million in inflows from institutional players — exceeding the combined inflows of all other altcoins.

This surge in capital highlights growing conviction in Solana’s long-term potential and its emerging dominance in the Layer-1 blockchain sector. Despite a largely bearish October for the broader crypto market, institutions maintained steady buying activity.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

Solana Institutional Flows. Source:

Solana Institutional Flows. Source:

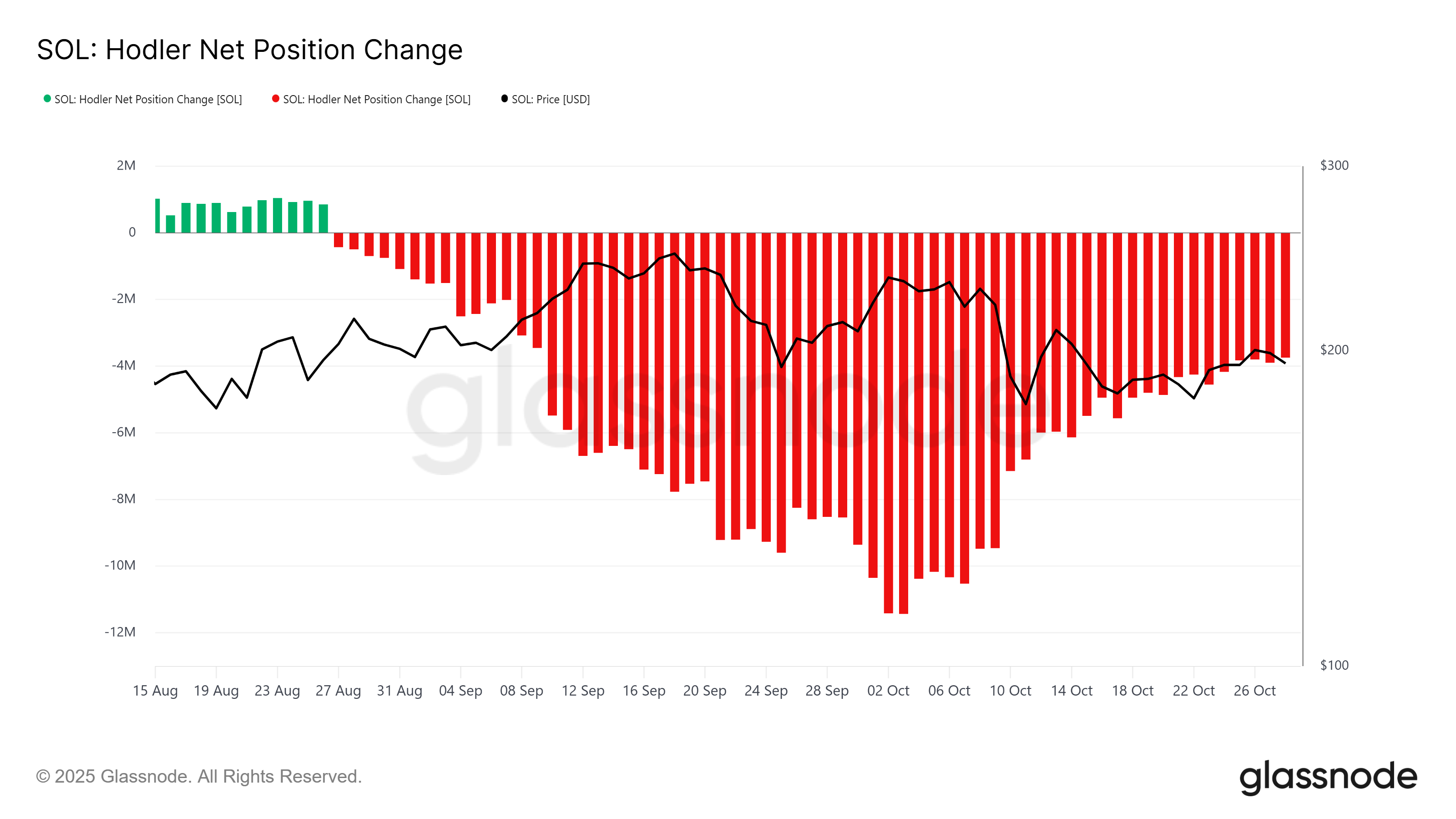

The HODLer Net Position Change metric adds to the bullish narrative. The recent receding red bars signal that selling pressure from long-term holders is easing. This is a positive shift considering September and half of October were marked by persistent LTH selling, which had previously weighed heavily on SOL’s price performance.

If this trend continues into November and transitions into accumulation, Solana’s market structure could strengthen considerably. Renewed long-term holder confidence often supports sustainable price growth, making this decline in selling a crucial factor for a potential rally.

Solana HODLer Net Position Change. Source:

Solana HODLer Net Position Change. Source:

What Does The History Say?

Historically, November has been one of the strongest months for Solana investors. Data shows an average monthly return of 13.9% and a median return of 27.5% for this period.

This seasonal strength reinforces market confidence, helping attract new inflows and strengthening bullish momentum across the broader ecosystem.

Solana Monthly Returns. Source:

Solana Monthly Returns. Source:

SOL Price Awaits Breakout

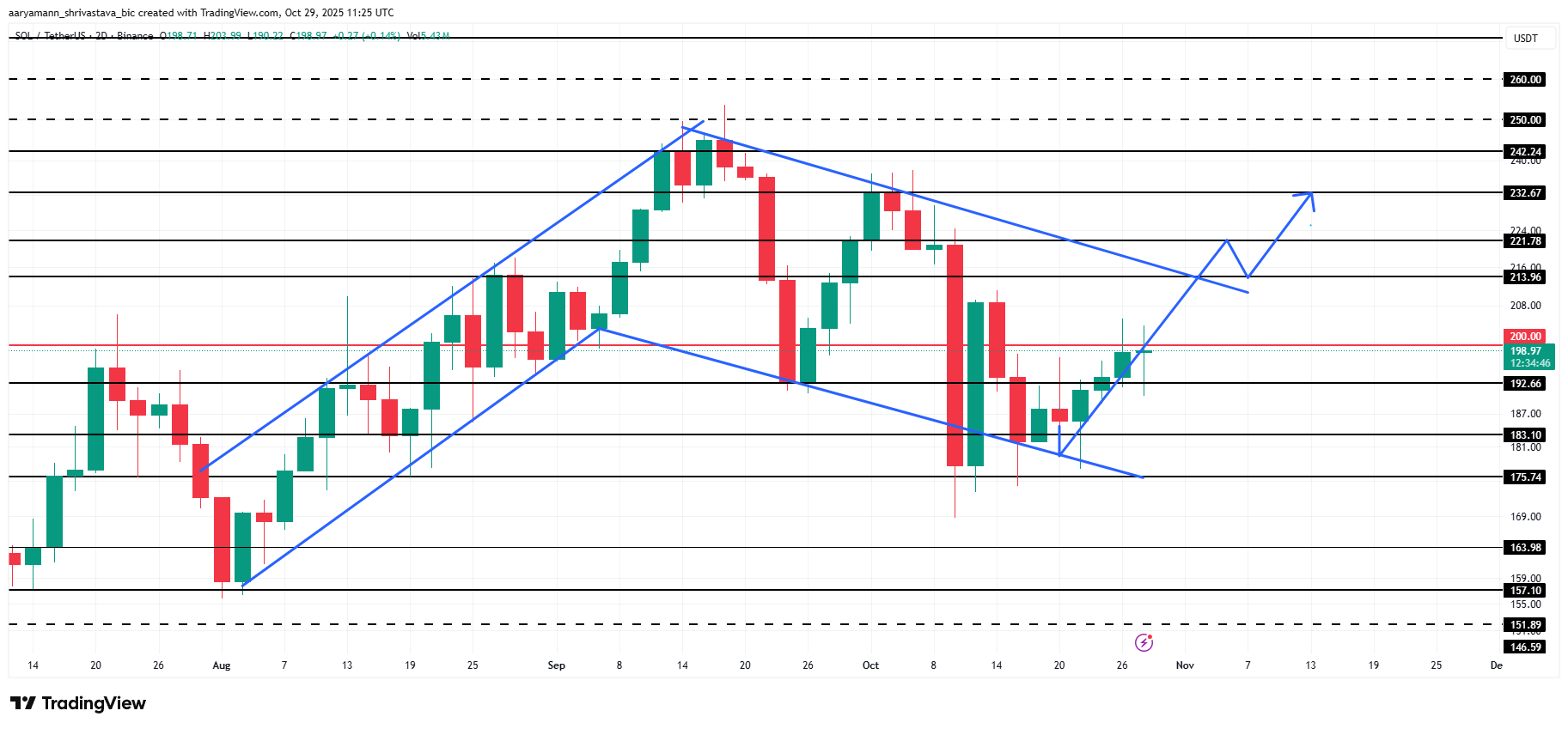

Solana’s price is sitting at $198 at the time of writing, right under the $200 mark. Adding bullishness to the expectations is the fact that SOL is moving within a flag pattern. This bullish pattern tends to hint at a breakout rally following a period of sideways movement.

BeInCrypto predicted a bullish breakout recently, and SOL seems to be moving in that direction. The breakout would be confirmed once Solana’s price crosses the $213 resistance, enabling a rise towards $232 and higher.

Solana Price Analysis. Source:

Solana Price Analysis. Source:

On the other hand, if the breakout fails, Solana’s price could fall back down into the pattern. At the same time, if Solana’s price fails to breach $200, it could end up falling back down to $175, invalidating the bullish thesis

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Coins Face Turbulence: A Look at Stellar, Dogecoin, Chainlink, and Aave

In Brief XLM, DOGE, LINK, and AAVE followed different trends, diverging from the broader market. Dogecoin faced a significant 5.5% drop, losing a critical support level. Chainlink and AAVE experienced institutional selling pressure, impacting their market performance.

Bitcoin Faces October Setback with BNB and Altcoins Showing Resilience

In Brief Bitcoin experienced a decline in mid-October due to a broader market sell-off. Binance Coin (BNB) and certain altcoins showed resilience amid Bitcoin's downturn. Market dynamics indicate a growing interest in alternative cryptocurrencies with unique applications.

Privacy Coins Captivate Attention With Rapid Market Boost

In Brief Privacy coins like Zcash and Dash climbed CoinGecko's "Most Trending Cryptocurrencies" list. Monero operates with unique privacy features, raising regulatory concerns over money laundering. Rising digital privacy interest shows despite low market share, users seek secure transactions.

Monero Consolidates Near $342 as Traders Monitor Key Support and Resistance Levels