Date: Wed, Oct 29, 2025 | 10:24 AM GMT

The cryptocurrency market is showing a cautious tone today ahead of the Federal Reserve’s interest rate decision, where a potential rate cut remains under discussion. Both Bitcoin (BTC) and Ethereum (ETH) are slightly in the red, while a few altcoins are showing early signs of strength — one of them being the decentralized exchange (DEX) token, Hyperliquid (HYPE).

HYPE is up more than 35% over the last 7 days, signaling strong momentum. Interestingly, its current chart structure appears to mirror a historical fractal pattern similar to Ethereum’s (ETH) May 2025 breakout — a setup that previously preceded a major bullish rally.

Source: Coinmarketcap

Source: Coinmarketcap

HYPE Mirrors ETH’s Past Price Behavior

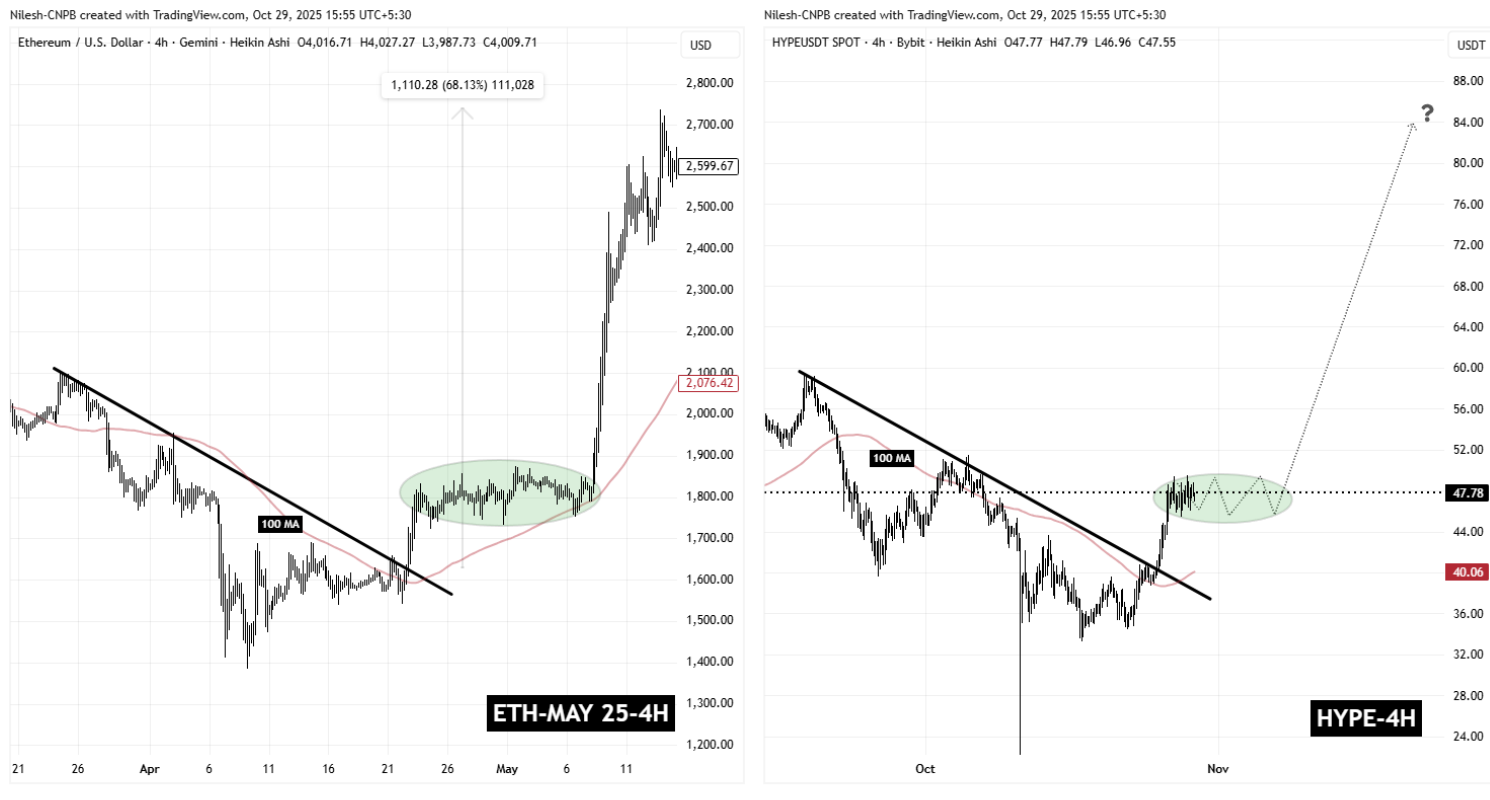

As seen on the chart, HYPE’s price structure and consolidation phase bear a striking resemblance to Ethereum’s breakout move from May 2025.

Back then, Ethereum had experienced a sharp correction, only to reclaim its 100-hour moving average (MA) and break above a descending resistance trendline. This move was followed by a brief sideways consolidation, after which ETH launched into a powerful 68% rally.

HYPE and ETH Fractal Chart/Coinsprobe (Source: Tradingview)

HYPE and ETH Fractal Chart/Coinsprobe (Source: Tradingview)

Now, HYPE seems to be tracing the same trajectory. Following a strong recovery from the October 10 market dip, HYPE has reclaimed its 100-hour MA, broken out from its descending resistance, and is now consolidating in a tight range between $45 and $50 — just as ETH did before its explosive breakout.

What’s Next for HYPE?

If this Ethereum fractal setup continues to unfold, HYPE could continue consolidating in its current range before launching into a new upward leg. A breakout above $50 resistance could act as the trigger, potentially driving the token toward the $80–$85 region — a move that would mark an approximate 75% surge from current levels.

However, traders should note that fractal patterns are guides, not guarantees. While the similarities between HYPE and ETH’s prior setup are compelling, broader market conditions and sentiment will ultimately determine whether this pattern plays out.

For now, the technical picture remains bullish, and the resemblance to Ethereum’s historic setup suggests that HYPE may be gearing up for another major move.