Multiple positive factors combined, BTC temporarily stabilizes, but the dilemma remains unresolved (10.20~10.26)

Risk appetite has not yet increased, and liquidity in the crypto market remains extremely tight.

The information, opinions, and judgments regarding markets, projects, and cryptocurrencies mentioned in this report are for reference only and do not constitute any investment advice.

The information, opinions, and judgments regarding markets, projects, and cryptocurrencies mentioned in this report are for reference only and do not constitute any investment advice.

Written by 0xBrooker

Over the weekend, the US-China trade negotiation delegations held their fifth round of talks this year in Malaysia, making final preparations for the upcoming summit between the two heads of state at the end of the month.

Previously, as both sides—especially the US—continued to send signals of their desire to reach an agreement, and with a short-term improvement in liquidity in the US financial markets, the Nasdaq gradually stabilized and rebounded from the declines and volatility of the previous two weeks. After the release of the US September CPI data on Friday, it reached a new all-time high. On Sunday, both sides announced a consensus on the "agreement framework," which stimulated a collective rise in BTC and the crypto market.

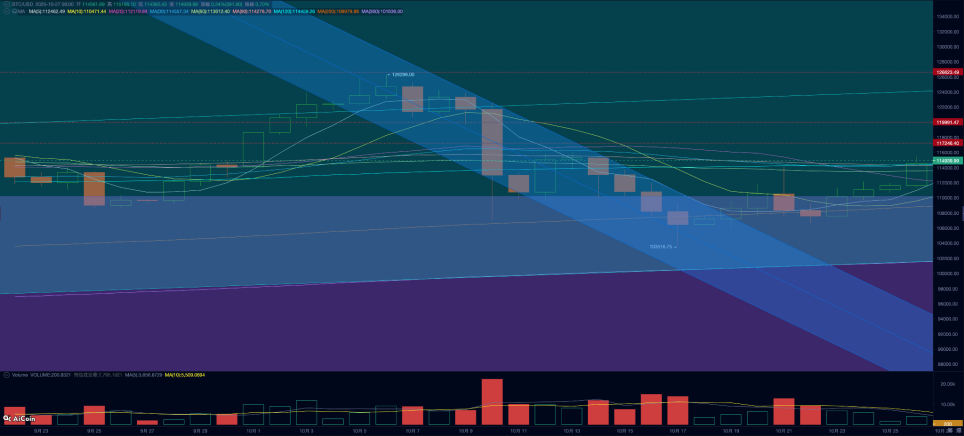

The three main factors suppressing the market bulls—US-China trade conflict, short-term financial liquidity, and inflation data—have all improved, leading to another record high in US stocks this week. However, BTC and the crypto market, with overall risk appetite still suppressed and troubled by historical cyclical patterns, remain weak. Although there was a weak rebound after finding support at the 200-day moving average and regaining the "Trump bottom," the market has not yet returned to a bull state. There is still a lack of hot topics within the crypto market, and Altcoins remain weaker than BTC.

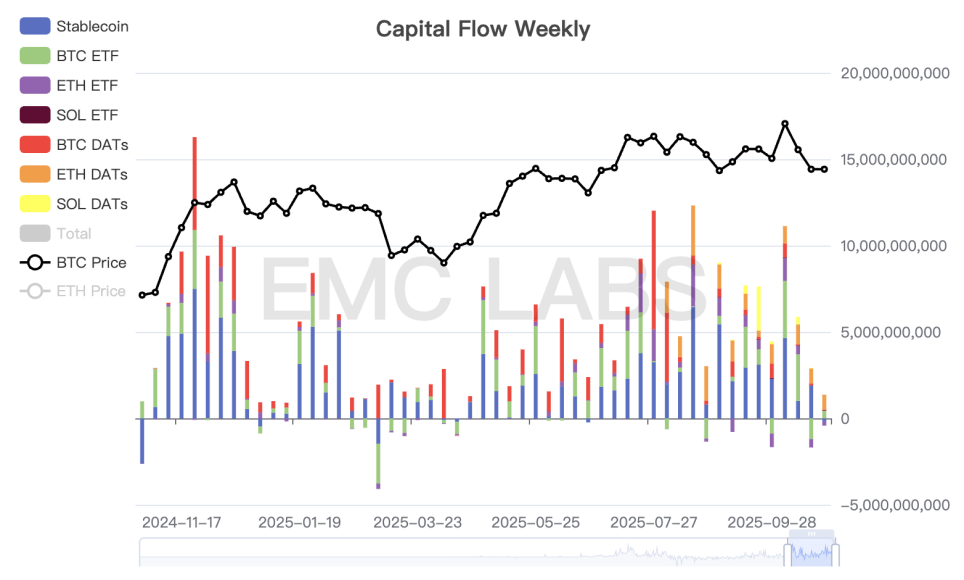

Capital inflows remain weak, making it difficult to offset the market pressure from long-term holders selling. It is necessary to continue observing whether, with interest rate cuts and the easing of US-China trade tensions, capital can return to a state of abundant inflows, reverse the downward trend, and even reshape the old cyclical pattern.

Policy, Macro Finance, and Economic Data

Two weeks ago, the US-China tariff dispute suddenly escalated, causing another shock to global financial markets. Afterwards, both sides—especially the US—continued to send positive signals and expressed a strong desire to reach an agreement. The market gradually interpreted this as a "fight to promote talks" approach, and then gradually stabilized.

Over the weekend, the delegations held their fifth round of talks in Malaysia. According to Sunday’s joint announcement: over two days, both sides had "constructive discussions" on topics such as export controls, extension of reciprocal tariffs, fentanyl and anti-drug cooperation, further expansion of trade, and 301 "vessel charges," and "reached a preliminary consensus." The next step will be internal approval procedures. The summit between the two heads of state at the end of the month is highly likely to proceed as scheduled.

Since the US government shutdown, the market has been operating without economic and employment data, but finally received the first key data on October 24—CPI. The data showed: US September CPI increased by 3% year-on-year, lower than the estimated 3.1% but higher than the previous 2.9%. This means the probability of a Fed rate cut in October is close to 100%, and the rate cut expectation for December has reached 91.1% on FedWatch. The rate-cutting cycle continues, dispelling previous market concerns, and all three major stock indexes hit record highs after the data release. BTC also continued its weak rebound, but is still far from its historical high.

The US government shutdown has caused short-term liquidity issues. As Powell stated that "the Fed will soon stop QT," this pressure on the market has begun to ease.

US stock AI and tech companies have started to release Q3 earnings reports. Tesla's report was below expectations but still closed higher, indicating that AI spending is still favored by the market. Several leading companies will continue to release earnings next week, which should be closely watched.

The US Dollar Index rebounded by 0.39% this week, closing at 98.547, remaining in a moderate state. After several weeks of short squeezes, gold began to plummet violently on Tuesday and has remained weak since.

Crypto Market

In addition to the impact of the macro financial market, BTC and the crypto market are still trapped by the influence of historical "cyclical patterns."

This week, exchanges still recorded inflows of over 130,000 BTC, slightly less than last week, but net outflows shrank to 2,775 coins, the lowest in recent times. This shows that during the transition between old and new cycles, cyclical patterns have a significant impact on the market.

Long-term holders reduced their positions by more than 39,000 coins. Such continuous selling during a decline often occurs during the confirmation phase of a bull-to-bear market transition. At this time, short-term buyers are not strong enough to absorb the selling pressure.

In the new market structure, the main forces absorbing the selling pressure—DATs companies and BTC Spot ETF channel funds—also performed weakly this week. According to eMerge Engine statistics, the total capital inflow into the crypto market this week was only 943 million, the lowest in months.

Weekly Statistics of Crypto Market Capital Inflows

The weak trading status is due to the "cyclical pattern" that we have continuously emphasized recently, which suppresses market sentiment. To change this state, either the long forces in the new structure need to actively go long and absorb the selling pressure as global risk appetite rises, or relentless selling by both long and short-term holders will confirm the bear market.

Technically, BTC stabilized above the 200-day moving average and the "Trump bottom" (the $90,000~$110,000 range) this week and continued a weak rebound, achieving a 5.4% weekly increase. ETH stabilized above the 120-day moving average.

BTC Price Trend Daily Chart

The renewed US-China conflict triggered continued liquidations in the derivatives market, resulting in a nominal loss of over $20 billion. Recently, BTC has rebounded weakly along with US stocks, but the total volume of open contracts remains low, indicating that leveraged funds are unlikely to be the key force driving the rebound in the short term.

Based on multiple dimensions of judgment, we believe that the actions of DATs and BTC Spot ETF channel funds remain the only two forces maintaining the BTC rebound and even returning to a bull market state.

Cycle Indicators

According to eMerge Engine, the EMC BTC Cycle Metrics indicator is 0, indicating a transition period.

EMC Labs was founded in April 2023 by crypto asset investors and data scientists. It focuses on blockchain industry research and secondary market investment in crypto, with industry foresight, insight, and data mining as its core competencies. It is committed to participating in the booming blockchain industry through research and investment, promoting blockchain and crypto assets to bring benefits to humanity.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Passkey Wallet: The “Tesla Moment” for Crypto Wallets

The real transformation lies not in better protecting keys, but in making them impossible to steal. Welcome to the era of Passkey wallets.

The market is not driven by individuals, but dominated by emotions: how trading psychology determines price trends

Crypto Coins Surge: Major Unlocks Impact Short-Term Market Dynamics

In Brief Crypto market anticipates large-scale unlocks, exceeding $309 million in total market value. Significant cliff-type unlocks involve ZK and ZRO, impacting market dynamics. RAIN, SOL, TRUMP, and WLD highlight notable linear unlocks within the same period.

Bitcoin Stable But Fragile Ahead Of BoJ Decision