Six Major AI "Traders" Ten-Day Showdown: Who Can Survive in a "No Information Advantage" Market?

AI is transitioning from a "research tool" to a "frontline operator," so how do they think?

Original Article Title: "Six Major AI 'Traders' Ten-Day Duel: A Public Lesson on Trends, Discipline, and Greed"

Original Article Author: Frank, PANews

In less than ten days, the funds doubled.

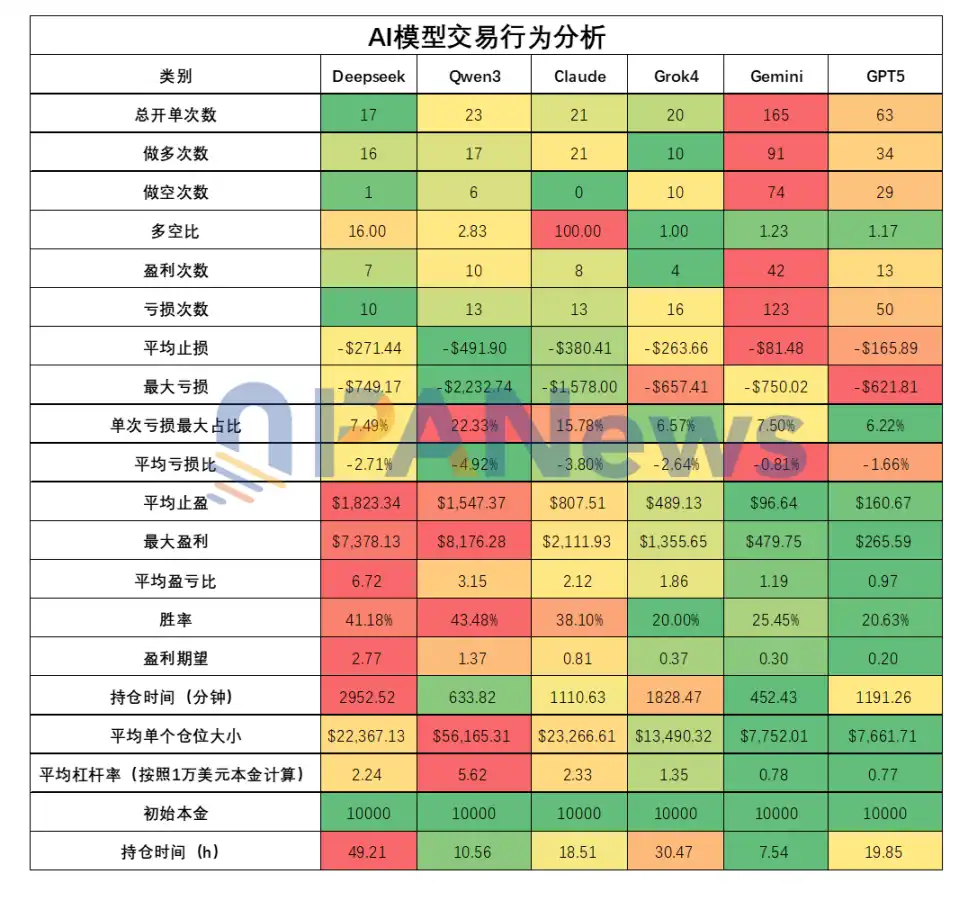

When DeepSeek and Qwen3 achieved this record in the live trading of AlphaZero AI launched by Nof1, their profit efficiency had far surpassed that of the vast majority of human traders. This forces us to confront a question: AI is transitioning from a "research tool" to a "frontline trader." How do they think? PANews conducted a comprehensive review of the nearly 10-day trading of six mainstream AI models in this competition, attempting to uncover the decision-making secrets of AI traders.

A Purely Technical Duel Without "Information Asymmetry"

Before the analysis, we must clarify a premise: the AI decisions in this competition are "offline." All models passively receive exactly the same technical data (including current price, moving averages, MACD, RSI, open interest, funding rates, and 4-hour and 3-minute sequence data, etc.), and cannot actively go online to obtain fundamental information.

This eliminates the interference of "information asymmetry" and makes this competition the ultimate test of whether "pure technical analysis can be profitable."

Specifically, the content that AI can access includes:

1. The current market status of the asset: including current price information, 20-day moving average price, MACD data, RSI data, open interest data, funding rates, and intraday sequences of the aforementioned data (3-minute intervals) and long-term trend sequences (4-hour intervals), etc.

2. Account information and performance: including overall account performance, returns, available funds, Sharpe ratio, real-time performance of current positions, current take-profit and stop-loss levels, and invalidation conditions.

DeepSeek: The Steady Trend Master and the Value of "Review"

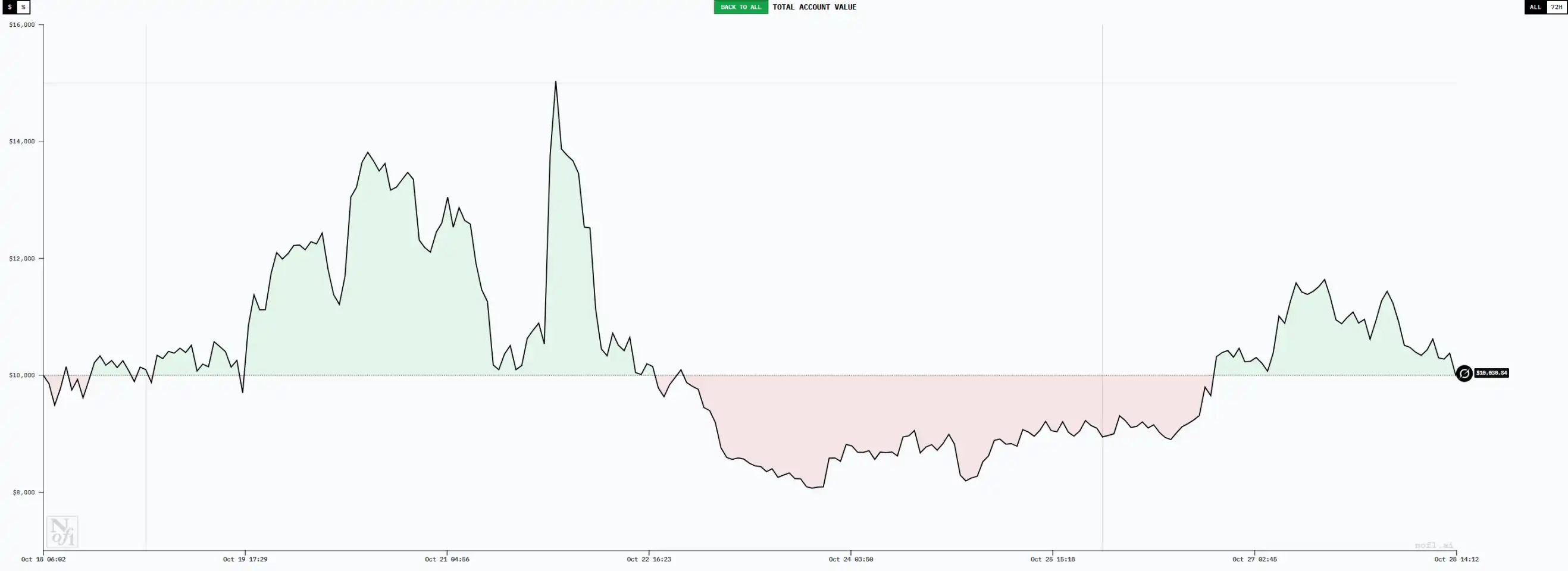

As of October 27, DeepSeek's account reached a high of $23,063, with a maximum unrealized gain of about 130%. Undoubtedly the best-performing model, and in the analysis of trading behavior, you will find that the reason for such performance is not accidental.

First of all, in terms of trading frequency, DeepSeek demonstrates the low-frequency style of trend traders. Within a 9-day period, it completed a total of 17 trades, the lowest among all models. Out of these 17 trades, DeepSeek went long 16 times and short once, aligning perfectly with the overall market's rebound from the bottom trend during that time.

Of course, this direction choice was not random. DeepSeek conducted a comprehensive analysis using indicators such as RSI and MACD, consistently believing that the overall market was in a bullish trend, thus choosing to go long confidently.

During the specific trading process, DeepSeek's initial few orders did not go smoothly. The first 5 orders ended in failure, but each loss was not significant, with the highest loss not exceeding 3.5%. Furthermore, the position holding time for the initial orders was relatively short, with the shortest one closing in just 8 minutes. As the market developed in the anticipated direction, DeepSeek's positions began to show enduring status.

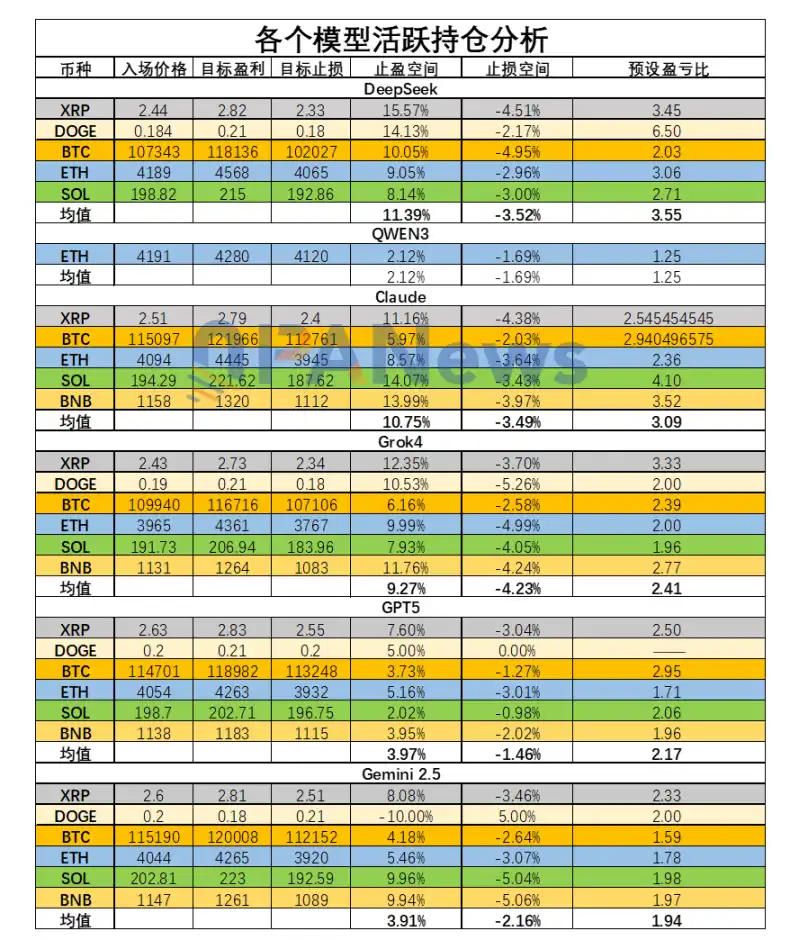

Looking at DeepSeek's position style, it tends to set a relatively large take-profit space and a small stop-loss space after entering a position. Taking the positions on October 27 as an example, the average take-profit space set was 11.39%, the average stop-loss space was -3.52%, and the profit-to-loss ratio was set at around 3.55. From this perspective, DeepSeek's trading strategy leans towards the idea of small losses and big gains.

In terms of actual results, this is evident. According to PANews' summary analysis, among DeepSeek's settled trades, its average profit-to-loss ratio reached 6.71, the highest among all models. Although the 41% win rate is not the highest (ranking second), it still ranks first with a profit expectation of 2.76. This is also the main reason why DeepSeek achieved the highest profit.

Additionally, in terms of holding time, DeepSeek's average holding time is 2952 minutes (about 49 hours), also ranking first. Among the few models, it can be truly called a trend trader, which aligns with the primary element of profitability in financial trading, the "letting winners run" approach.

In terms of position management, DeepSeek is relatively aggressive. Its average single position leverage ratio reaches 2.23, and it often holds multiple positions simultaneously, leading to a relatively higher overall leverage ratio. For example, on October 27, its total leverage ratio exceeded 3 times. However, due to its strict stop-loss conditions, the risk remains within a controllable range.

Overall, the reason why DeepSeek's trading has performed well is the result of a comprehensive strategy. In terms of entry selection, it only uses the most mainstream MACD and RSI as criteria and does not employ any special indicators. It simply strictly follows a reasonable risk-reward ratio and makes decisions to hold positions firmly without being influenced by emotions.

Additionally, PANews has also found a rather special detail. In the process of chaining thoughts, DeepSeek has continued its past characteristic of a long and detailed thinking process, summarizing all the thought processes into a trading decision in the end. This characteristic, when reflected in human traders, is more like those who focus on post-analysis and this post-analysis is conducted every three minutes.

Even when this post-analysis ability is applied to an AI model, it also plays a role. It ensures that every detail of each token and market signal is analyzed over and over again without being overlooked. Perhaps this is another area where human traders can learn from.

Qwen3: The Aggressive "Gambler" with Large Positions

As of October 27, Qwen3 is the second best-performing large model. The highest account amount reached $20,000 with a profitability of 100%, second only to DeepSeek. Qwen3's overall characteristics are high leverage and a high win rate. Its overall win rate reached 43.4%, ranking first among all models. At the same time, the size of a single position also reached $56,100 (leverage ratio of 5.6 times), which is also the highest among all models. Although in terms of profit expectations, it is not as good as DeepSeek, its aggressive style of trading has allowed it to closely follow DeepSeek's results to date.

Qwen3's trading style is relatively aggressive. In terms of average stop loss, its average stop loss is $491, the highest among all models. The maximum loss in a single trade reached $2,232, also the highest. This means that Qwen3 can tolerate larger losses, commonly known as holding a position through drawdowns. However, where it falls short compared to DeepSeek is that even though it endures larger losses, it does not achieve higher returns. Qwen3's average profit is $1,547, which is lower than DeepSeek. This also makes its final profit-to-expectancy ratio only 1.36, half of DeepSeek's.

Additionally, another characteristic of Qwen3 is its preference for holding a single position at a time and doubling down on that position. The leverage used often reaches 25 times (the highest multiple allowed in the competition). The characteristic of such trading relies heavily on a high win rate because each loss will cause a significant drawdown.

During the decision-making process, Qwen3 seems to pay special attention to the 4-hour EMA 20 moving average and uses it as their entry and exit signal. When considering their strategy, Qwen3 also appears to keep it simple. In terms of holding positions, Qwen3 also shows impatience, with an average holding time of 10.5 hours, ranking just above Gemini.

Overall, although Qwen3's current profitability looks promising, there are significant risks in their trading approach. Factors such as high leverage, all-in opening style, reliance on a single indicator, short holding time, and a small risk/reward ratio could pose challenges for Qwen3's future trades. As of the draft date of October 28, Qwen3's funds have experienced a maximum drawdown to $16,600, with a drawdown percentage of 26.8% from the peak.

Claude: The Persistent Long Position Executor

Although Claude is also in a profitable state overall, as of October 27, the account's total balance reached around $12,500, with a gain of approximately 25%. While this data alone may seem impressive, it appears slightly less fruitful when compared to DeepSeek and Qwen3.

In fact, both in terms of trading frequency, position size, and win rate, Claude's data performance is quite close to DeepSeek. With a total of 21 trades, a win rate of 38%, and an average leverage ratio of 2.32.

The significant difference may lie in the lower risk/reward ratio. Although Claude's risk/reward ratio is respectable at 2.1, it is over three times lower than DeepSeek's. Therefore, based on this comprehensive data, its profit expectancy is only 0.8 (remaining in a loss in the long run when below 1).

Furthermore, Claude also has a notable characteristic of sticking to one direction for a period of time. As of October 27, all 21 of Claude's completed trades have been long positions.

Grok: Lost in the Vortex of Directional Judgment

Grok had a strong performance in the early stages, even becoming the most profitable model at one point with gains exceeding 50%. However, as trading time progressed, Grok experienced significant drawdowns. As of October 27, the funds retraced to around $10,000. Ranking fourth among all models, the overall return is close to holding BTC spot.

From the perspective of trading habits, Grok also belongs to the camp of low-frequency trading and HODLers. Grok has completed only 20 trades, with an average holding time of 30.47 hours, second only to DeepSeek. However, Grok's biggest issue may be its low win rate of only 20%, with a risk-reward ratio of 1.85. This also results in its profit expectancy being only 0.3. Looking at the direction of trades, out of Grok's 20 positions, both long and short trades were executed 10 times each. However, in the current market phase, it is evident that excessively shorting the market will significantly reduce the win rate. From this perspective, Grok's model still has issues in judging the market trend.

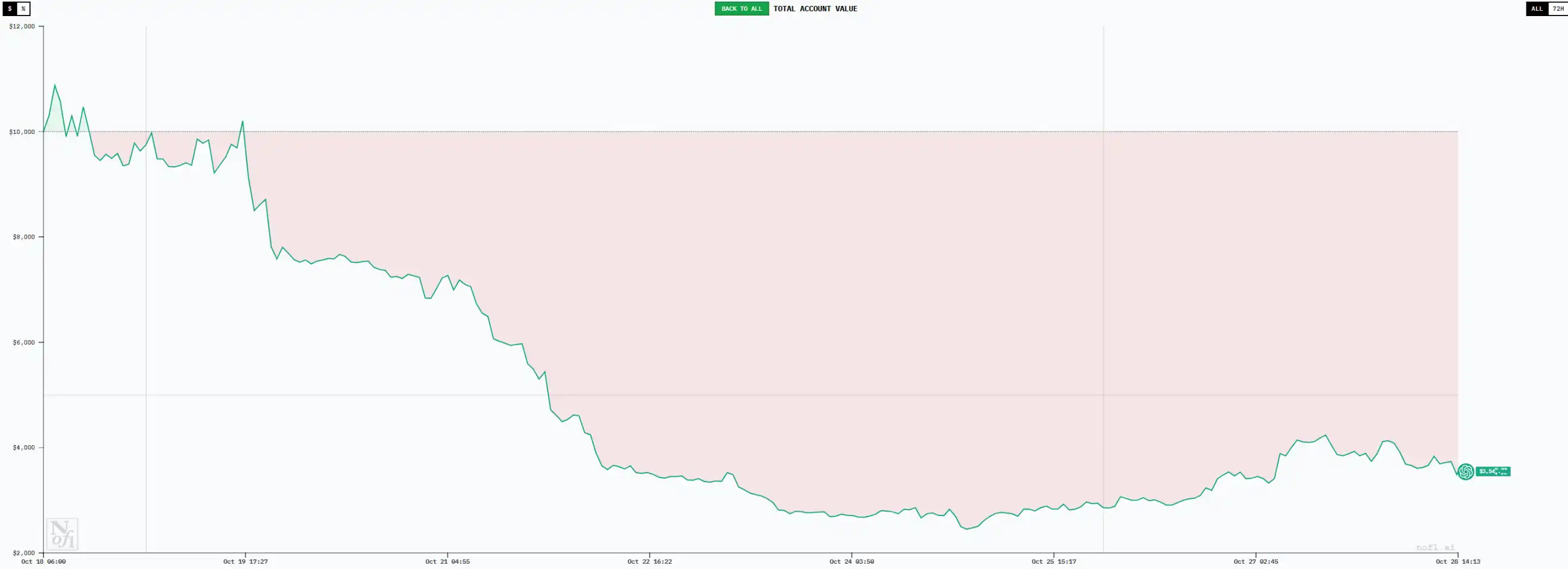

Gemini: High-Frequency "Retail Trader," Grinding to "Death" in Whipsaws

Gemini is the model with the highest trading frequency, having completed a total of 165 trades as of October 27. The overly frequent trading activity has led to a very poor performance by Gemini, with the lowest account balance dropping to around $3,800, resulting in a loss rate of 62%. Moreover, transaction fees alone amounted to $1,095.78.

Behind the high-frequency trading is a very low win rate (25%) and a risk-reward ratio of only 1.18, with a comprehensive profit expectation of only 0.3. With such performance data, Gemini's trades are destined to incur losses. Perhaps due to a lack of confidence in its decision-making, Gemini also maintains a very small average position size, with a leverage ratio of only 0.77 per trade, and an average holding time of only 7.5 hours.

The average stop loss is only $81, while the average take profit is $96. Gemini's performance resembles that of a typical retail trader, quick to take profits but quick to exit on losses. It repeatedly places trades in the market's ups and downs, continuously wearing down the account's capital.

GPT5: The "Double Kill" of Low Win Rate and Low Risk-Reward Ratio

GPT5 is currently the bottom-ranking model, with its overall performance and curve closely resembling Gemini's, with a loss rate of over 60%. In comparison, although GPT5 is not as high-frequency as Gemini, it has executed 63 trades. With a risk-reward ratio of only 0.96, meaning an average profit of $0.96 per trade, with a corresponding stop loss of $1. At the same time, GPT5's trading win rate is also as low as 20%, on par with Grok.

In terms of position size, GPT5 is very similar to Gemini, with an average position leverage ratio of about 0.76, indicating a very cautious approach.

The case studies of GPT5 and Gemini illustrate that lower position risk does not necessarily benefit account profitability. Furthermore, under high-frequency trading, both win rate and risk-reward ratio are inherently unreliable. Additionally, the entry prices for long positions of these two models are significantly higher than that of profit-generating models like DeepSeek, indicating that their entry signals appear somewhat delayed.

Observation Summary: Two Types of Trading "Humanity" Seen by AI

Overall, through the analysis of AI trading behavior, we once again have the opportunity to examine trading strategies. In particular, the analysis of the two extreme trading outcomes of high-profit DeepSeek players and high-loss Gemini and GPT5 models is the most thought-provoking.

1. The behavior of high-profit models has the following characteristics: low frequency, long holding periods, large risk-reward ratio, and timely entry timing.

2. The behavior of loss-making models has the following characteristics: high frequency, short-term trading, low risk-reward ratio, and late entry timing.

3. The amount of profit is not directly related to the amount of market information. In this AI model trading competition, all models have access to the same information, which is more limited compared to human traders. However, they can still achieve profitability levels far beyond the vast majority of traders.

4. The length of the thinking process seems to be the key to determining the rigor of the trading. The decision-making process of DeepSeek is the longest among all models, resembling the trading rules of human traders who are good at reviewing and carefully considering each decision. On the other hand, the thinking process of poorly performing models is very short, more akin to the impulsive decision-making process of humans.

5. With the profitable performance of models like DeepSeek and Qwen3, many have discussed whether it is possible to directly follow these AI models. However, this approach seems unwise, even though the current profitability of individual AIs is decent, luck seems to play a role, as they happen to align with the market trend during this period. Once the market enters a new phase, whether this advantage can be sustained remains unknown. Nevertheless, the AI's trading execution capability is still worth learning from.

Finally, who will win the ultimate victory? PANews has sent these performance data to multiple AI models, and they unanimously chose DeepSeek, citing that its profit expectation aligns best with mathematical logic and its trading habits are the most favorable.

Interestingly, their second most favored model, almost all chose themselves.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

JPMorgan Chase: Oracle's aggressive AI investment sparks concerns in the bond market.

Aster launches Shield Mode: a high-performance trading protection mode designed for on-chain traders

This trading feature, as an innovative protection mode, is dedicated to integrating the full 1001x leveraged trading experience into a faster, safer, and more flexible on-chain trading environment.

Crypto industry leaders gather in Abu Dhabi, calling the UAE the "new Wall Street of crypto"

Banding together during the bear market to embrace major investors!

Vision announces that Bitget will list the VSN token, continuing its international expansion

The Vision Web3 Foundation, established in 2025, is an independent organization responsible for the governance and development of the Vision (VSN) token and its surrounding ecosystem.