OceanPal’s $120 Million NEAR Push Sends Stock Plummeting By Nearly 21%

OceanPal’s $120 million NEAR bet marks a bold shift toward digital assets and AI infrastructure, but the sharp drop in its stock price shows investors remain wary of its high-stakes strategy.

OceanPal Inc. announced that it has raised $120 million to launch its digital asset treasury strategy, centered on the NEAR Protocol’s native token. The Nasdaq-listed shipping firm becomes the latest traditional company to diversify into digital assets, reflecting a broader trend of corporate adoption across the crypto sector.

Still, OceanPal’s shares fell following the announcement, highlighting possible investor skepticism about its pivot toward blockchain-based holdings.

OceanPal Dives into Digital Assets with $120 Million NEAR Bet

According to the press release, OceanPal closed its $120 million private investment in public equity (PIPE) to fund SovereignAI Services LLC. It is a subsidiary tasked with commercializing the NEAR Protocol.

SovereignAI’s treasury goal is to acquire at least 10% of NEAR’s token supply, making it one of the leading institutional holders of this asset.

“As a result of this transaction, OP, through SovereignAI, is expected to serve as the leading public investment vehicle to gain exposure to NEAR, the NEAR Protocol’s native token, and the foundational AI infrastructure needed to enable agentic commerce,” the press release reads.

The company also plans to leverage the capital generated through its treasury management strategy to develop a confidential AI cloud infrastructure built on NVIDIA technology and powered by NEAR.

Notable investors backed the transaction, including Kraken, Proximity, Fabric Ventures, and the G20 Group. OceanPal also announced new executive appointments to bolster the digital asset venture.

Sal Ternullo joins as co-CEO, and David Schwed is COO. The advisory board features NEAR CEO Illia Polosukhin and advisors from OpenAI and Fabric Ventures.

“This is a public company launching as an active, strategic partner with the NEAR Foundation to advance a shared vision of universal AI sovereignty by leveraging the NEAR Protocol’s vertically integrated AI products and rails, which were purpose-built for these exact use cases. We plan to use this decentralized, confidential compute infrastructure to capitalize on the explosive demand for privacy-first, regulatory compliant AI across enterprise markets including finance, healthcare, and media while enabling businesses and consumers to maintain control and ownership,” Ternullo said.

Market Reaction and Stock Performance

While OceanPal pursues its new crypto and AI strategy, it says global shipping operations will continue. Yet, recent financial results point to challenges.

As of June 2025, revenue was $3.08 million, down 54.3% year over year. The company’s net loss was $5.22 million, and its profit margin was -169.53%.

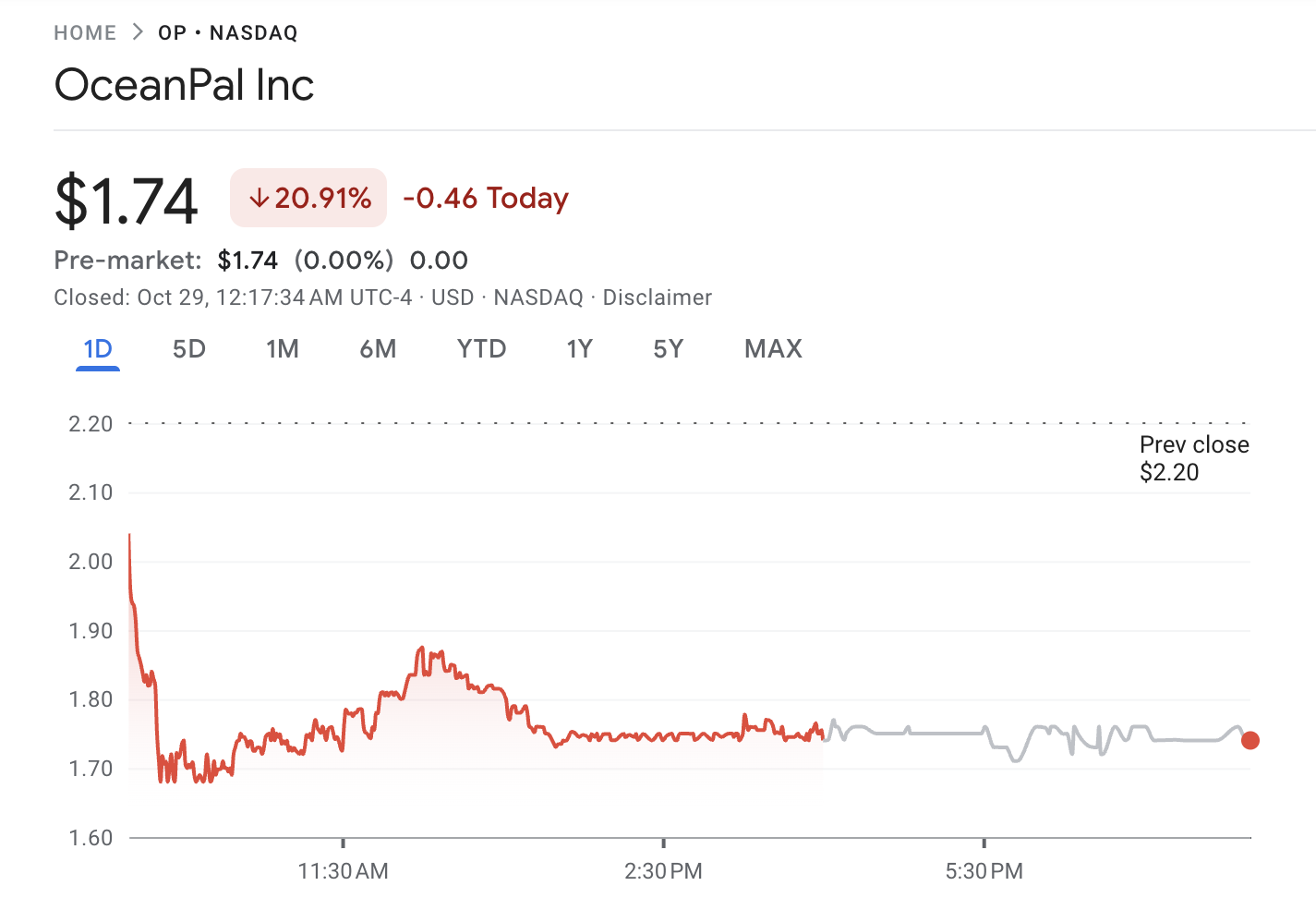

Meanwhile, Google Finance data showed that OceanPal’s latest announcement caused the stock prices to drop. OP closed at $1.74, down 20.91%. Overall, the stock has faced a tough time this year, decling 94% year-to-date.

OceanPal Stock Performance. Source:

Google Finance

OceanPal Stock Performance. Source:

Google Finance

NEAR Protocol’s native token has also declined alongside OceanPal’s stock. According to BeInCrypto Markets data, NEAR traded at $2.24 at press time, showing a 4.37% loss over the past 24 hours and a 20.7% decline over the month.

NEAR Token Price Performance. Source:

BeInCrypto Markets

NEAR Token Price Performance. Source:

BeInCrypto Markets

As both OceanPal and NEAR face market headwinds, the success of this ambitious pivot into blockchain-powered AI remains to be seen.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Gain Insight into Cryptocurrency’s Promising Future for 2026

In Brief The next major crypto bull cycle will start in early 2026. Institutional investors and regulation drive long-term market confidence. Short-term shifts show investors favoring stablecoins amid volatility.

Stunning $204 Million USDT Transfer Ignites Market Speculation