Uniswap Breakout Builds at $6.50, ETH Whales Buy the Dip, BlockDAG’s $0.0015 Batch 31 Price Sparks Buyer Rush!

The crypto market is showing a clear divide between consolidation and acceleration. Ethereum (ETH) is witnessing steady whale accumulation as large holders rebuild positions, signaling renewed long-term confidence after recent selloffs. Uniswap (UNI) remains firm above the $6.20 mark, with traders eyeing a breakout chance amid rising open interest and growing liquidity.

Points Cover In This Article:

ToggleEthereum Whales Signal a $4,100 Comeback

Ethereum’s biggest holders are quietly buying again, adding over 218,000 ETH in the past week after selling 1.36 million earlier this month. These whales, typically holding between 10,000 and 100,000 ETH, have regained confidence in the asset as prices hover around $3,940.

Technical indicators suggest a possible push toward $4,100 if momentum holds. For investors, whale accumulation often hints at a market shift before retail traders catch on. While this could be a promising entry point for those eyeing Ethereum’s next leg up, it’s still wise to stay disciplined, manage risk, take profits early, and not chase hype.

Uniswap Holds Strong, Breakout Looms

Uniswap (UNI) has held firm above the $6.20 support level, showing steady buyer confidence despite broader market uncertainty. Trading activity and open interest are rising, suggesting traders are positioning for a possible move higher.

Technical charts indicate UNI is testing resistance near $6.45–$6.50, and a breakout could push prices toward the $6.80–$7.00 zone. For investors, this setup offers a clear balance between risk and reward, support remains well-defined, and upside potential looks promising. However, caution is advised; a drop below $6.20 could signal weakening momentum and delay any breakout attempt.

BlockDAG 2025 Crypto Investment Spotlight

BlockDAG is drawing attention in the 2025 crypto race, focusing on execution and growth. With significant funds raised and a strong user community, the project’s development resembles that of a post-launch success.

Its F1® sponsorship deal has added a layer of mainstream credibility that few crypto projects achieve before listing. Buyers are taking note of BlockDAG’s unique hybrid architecture, a Layer-1 DAG-PoW network combining Bitcoin’s security with the scalability of modern blockchains.

The momentum around BlockDAG is built on technology, partnerships, and verifiable demand. Analysts argue that traction and institutional visibility offer potential for sustained growth. In a year where many coins chase narratives, BlockDAG is creating one based on innovation and fundamentals.

Whether you’re an early adopter or a cautious buyer, this might be the moment before BlockDAG transitions to become a global phenomenon, presenting an opportunity for those anticipating standout projects in 2025. As anticipation builds, early participants look forward to key milestones that could define BlockDAG’s performance in the coming year.

BlockDAG Dominates 2025’s Crypto Spotlight

In a market full of price chasers, Ethereum (ETH) and Uniswap (UNI) remind investors of the value of patience and positioning. ETH’s whale accumulation continues to reinforce the network’s credibility, while UNI’s breakout chance hints at near-term trading momentum.

But it’s BlockDAG (BDAG) that’s redefining what early conviction looks like. Its hybrid Layer-1 DAG-PoW model, vast X1 mining community of 3 million users, and strong fundraising have created an ecosystem that feels post-launch before the listing even happens.

The contrast is stark: ETH and UNI are mature players moving steadily, while BDAG is the next-generation growth engine attracting both whales and retail alike. For those scanning the top crypto coins right now, BDAG stands as a project where fundamentals, innovation, and rising attention intersect, offering opportunities that can shape upcoming market cycles.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ConsenSys-backed Intuition launches mainnet and $TRUST token, aiming to build a public trust layer for the internet

Mt. Gox delays $4B Bitcoin repayments: Bullish or bearish for BTC price?

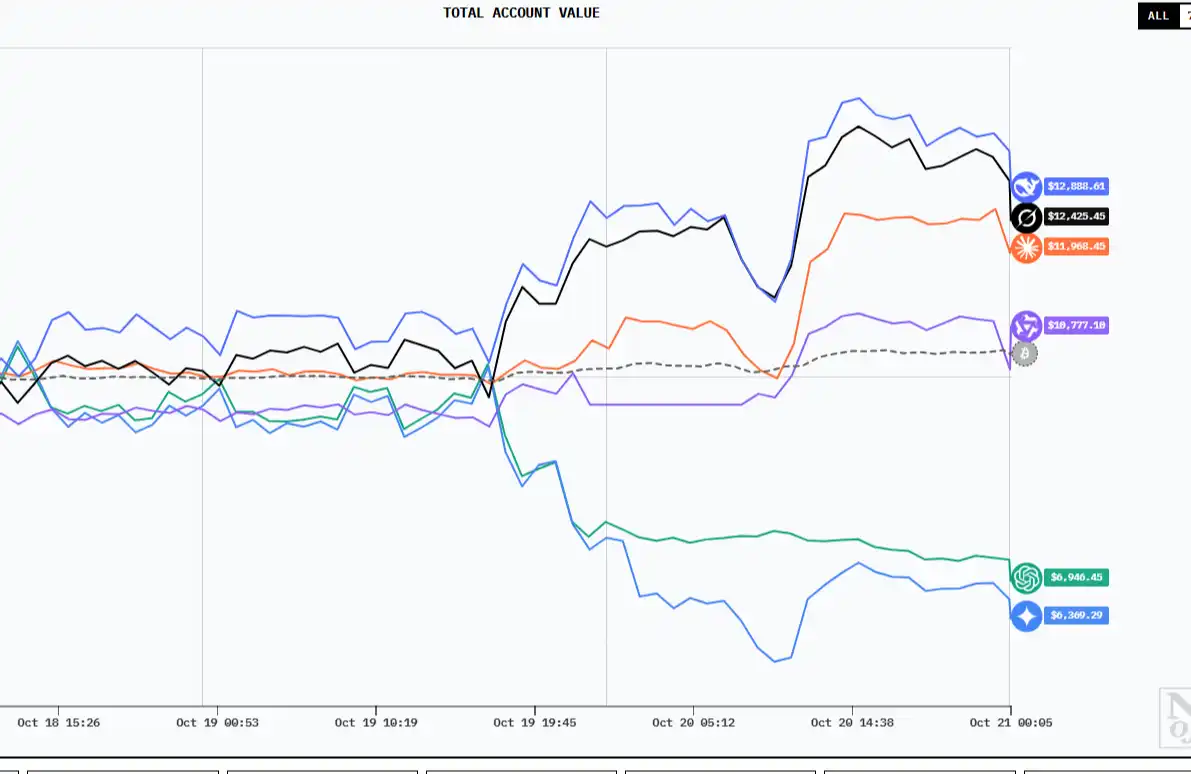

Six major AI "traders" ten-day showdown: Who can survive in a market with "no information asymmetry"?

AI is shifting from being a "research tool" to becoming a "frontline trader." So, how do they think?

Financial Black Hole: Stablecoins Are Devouring Banks

Stablecoins, acting as "narrow banks," are quietly absorbing liquidity and reshaping the global financial architecture.