Governor of the Bank of Korea: Premature introduction of a Korean won stablecoin raises concerns over exchange rate volatility and capital outflows

Jinse Finance reported that Bank of Korea (the central bank) Governor Rhee Chang-yong stated, "If the Korean won stablecoin is introduced rashly, there will be serious concerns about exchange rate volatility in the foreign exchange market and capital outflows." Governor Rhee pointed out at the National Assembly's Planning and Finance Committee audit that, "Many people would take the Korean won stablecoin overseas, and this is indeed worrisome." He also emphasized, "It is important to first conduct pilot programs centered on banks, and only expand the scope gradually after effective control over foreign exchange outflows has been demonstrated." He reiterated his concerns, saying, "From the perspective of the authorities responsible for foreign exchange management, this issue is highly alarming. If a Korean won stablecoin is launched, there is a significant possibility of bypassing foreign exchange controls." In response to Democratic Party lawmaker Ahn Do-jae's suggestion to support the introduction of a Korean won stablecoin, Governor Rhee clearly expressed a different stance, stating, "My view is completely different from yours." At the same time, he pointed out, "I do not believe that launching a Korean won stablecoin will reduce the demand for dollar stablecoins, as those who want to convert assets into dollars will still choose to use dollar stablecoins." He also added, "Although it is still too early to say that dollar stablecoins will dominate the Korean won payment market, their usage will inevitably increase significantly in the future, so further efforts are needed to improve relevant regulatory measures."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

A whale accurately bought the dip in ETH twice, with a total profit of $29 million.

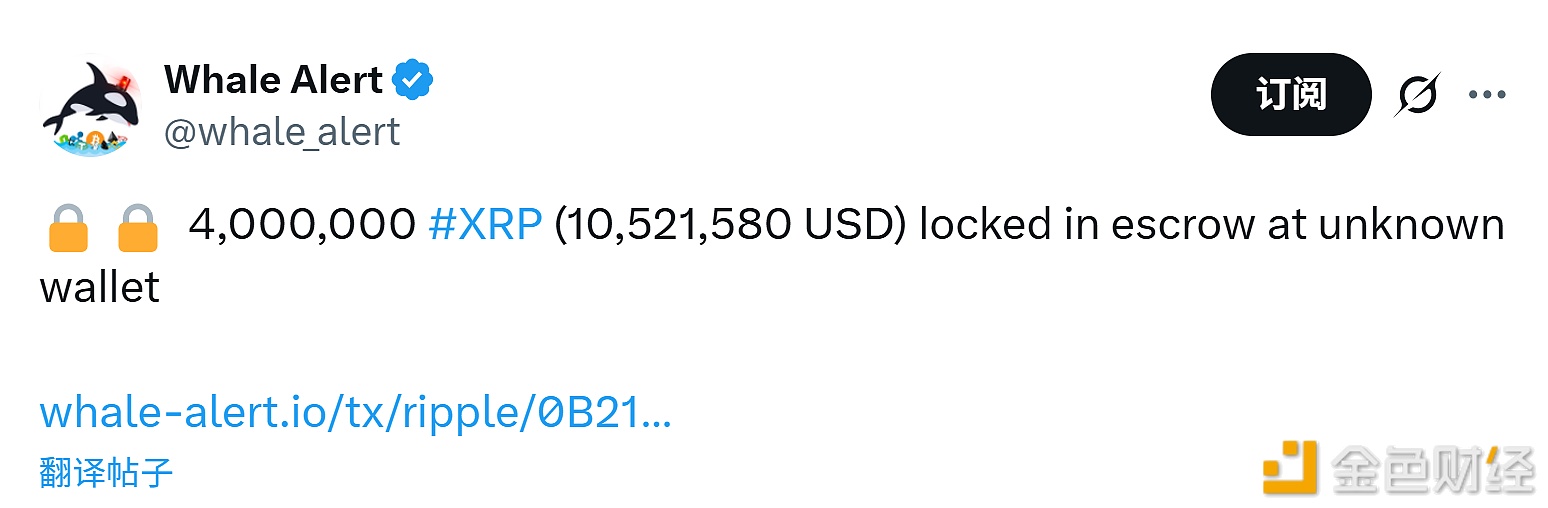

4 million XRP have been locked in an escrow account of an unknown wallet

Spot gold surged $20 in the short term, now quoted at $3992.21 per ounce.

UBS says clients are increasingly focused on hedging downside risks