Radpie - The upcoming "Convex" for RDNT

Since the Penpie $PNP IDO launch, its price once surged 5x. Riding on this momentum, Magpie announced it will continue to launch the "Convex" for Radiant $RDNT—Radpie—in the subDAO model. With multiple narratives supporting it, will Radpie be able to replicate or even surpass the returns of PNP?

Magpie is taking advantage of the momentum to announce the continued launch of Radiant $RDNT's "Convex"—Radpie—under the subDAO model. With the support of multiple narratives, can it replicate or even surpass the returns of PNP?

This article will introduce you to the Radpie mechanism, product advantages and disadvantages, narrative tags, and related participation information within the Magpie ecosystem.

A. Radpie Mechanism

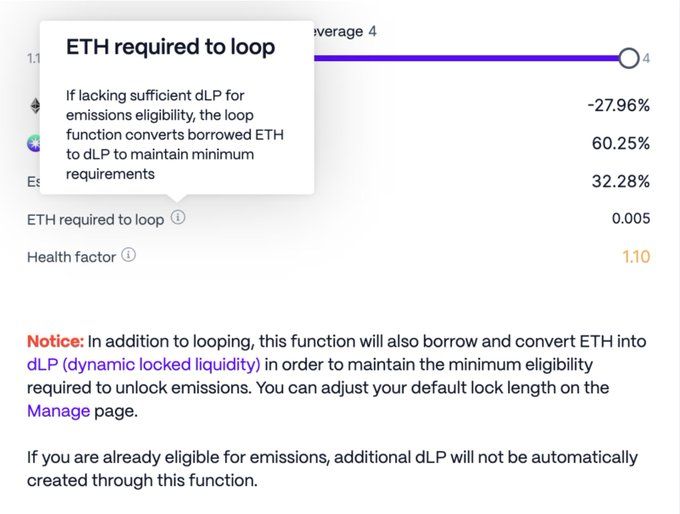

Simply put, Radpie is to RNDT what Convex is to Curve. The cross-chain lending protocol and Layerzero concept Radiant has implemented restrictions on liquidity incentives. In short, you need to indirectly lock up a certain amount of RNDT to earn mining rewards. Specifically, you need dLP equivalent to 5% of your deposit amount; dLP is an LP token of an 80% RDNT / 20% ETH Balancer pool. If your ratio falls below 5%, you will not receive RDNT emission rewards.

If you use RDNT's one-click loop function, once your dLP ratio is below 5%, the system will automatically borrow funds to buy dLP for you.

This also brings better sustainability to RDNT. After all, while you are mining RDNT, you are also providing long-term liquidity for RDNT.

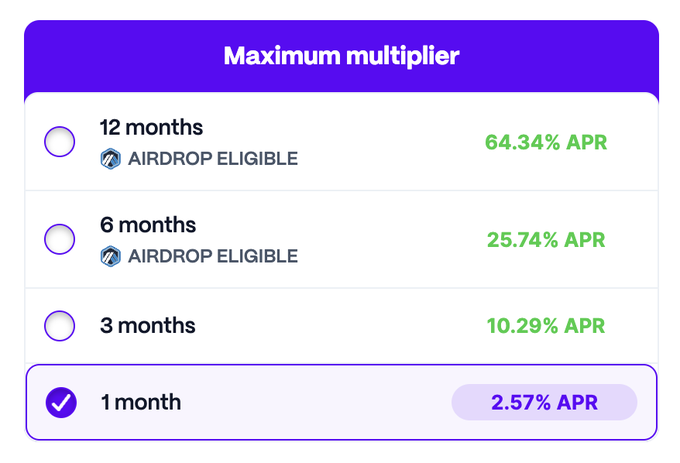

After all, dLP has a lock-up period requirement, and the longer you lock, the higher the APR.

What Radpie does is to pool dLP and share it with DeFi miners, allowing DeFi miners to mine without holding RDNT. This is quite similar to Convex's shared veCRV. The pooled dLP will also be given mDLP tokens, just like how CRV is converted to cvxCRV through Convex.

For RNDT holders, they can form dLP and then convert it to mDLP through Radpie, enjoying high yields while holding RNDT positions. The logic is similar to cvxCRV, since dLP contains 80% RNDT and its price movement is very close to RDNT. For the Radiant project, this is also a good thing. After all, once converted to mDLP, it is perpetually locked, sending part of RNDT directly into the black hole to support RDNT's long-term liquidity. In addition, it helps attract more lightweight users.

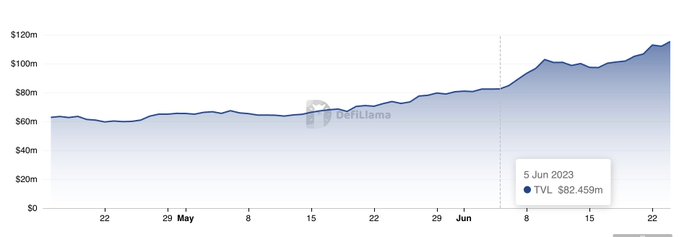

For example, as shown in the figure below, Pendle began to accelerate growth after the launch of the Pendle ecosystem's "Convex" product, and Radiant is also expected to benefit from this.

The only drawback is that, unlike Pendle/Curve, Radiant does not allocate incentives through voting, so it lacks bribe income.

However, Radiant has made it clear that it will continue to build its DAO, so governance rights are expected to gain more value in the future. Naturally, Radpie, which holds a large amount of governance rights (dlp), is also expected to benefit from this.

B. Product Advantages and Disadvantages

Similar to Penpie, Radpie is also a project standing on the shoulders of giants, so its upper and lower limits are relatively clear. In comparison, Aura's FDV is 35% of Balancer's, while Convex's is 14% of Curve's. As RDNT is a project with a $300 million FDV and listed on Binance, Radpie's valuation is also somewhat comparable.

The disadvantage is that Radpie does not have the same horizontal expansion capability as its parent DAO Magpie. However, it will also benefit from the internal and external circulation system among Magpie's various subDAOs. Please refer to the next section for details.

C. Narrative Tags

LayerZero / ARB Airdrop / Super-sovereign Leveraged Governance / Internal and External Dual Circulation / subDAO will be Radpie's narrative tags.

LayerZero: RNDT is a well-known LayerZero concept token, and Radpie will naturally use LayerZero to achieve cross-chain interoperability.

ARB Airdrop: RNDT DAO has decided to airdrop 40% of the ARB it receives to newly locked dLPs in the coming period, and 30% will be airdropped equally to dLPs that remain locked over the next year. Radpie happens to be launching at this time and is expected to participate in sharing this feast of over 2M ARB, which is very helpful for the project's launch.

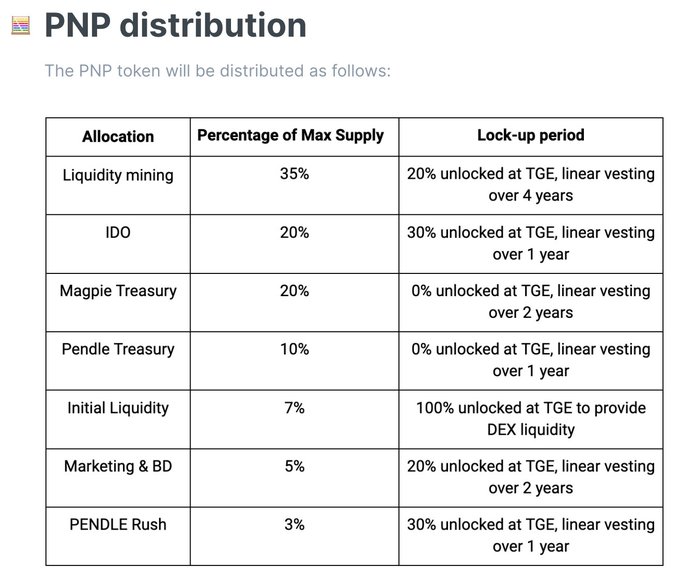

Super-sovereign leveraged governance: As usual, a large amount of RDP will be allocated to the Magpie treasury. On one hand, the income from these tokens will be distributed to MGP holders; on the other hand, when Radiant DAO makes decisions, MGP holders can also participate through the RDP they control.

Considering that MGP in RDP and RDP in RDNT both participate as a whole, this actually comes with a kind of leverage. If MGP votes for a certain proposal and holds the majority of RDP shares, as long as others do not collectively oppose, it will basically pass. In RDNT voting, 100% of dLP controlled by Radpie will also vote for this option. This is the essence of super-sovereign leveraged governance.

Internal and external dual circulation: This is a unique system formed by Magpie's expansion through the subDAO model in the governance rights track.

For example, the mdLP/dLP trading pair will most likely be deployed on wombat, obtaining more wom incentive emissions by bribing vlMGP holders. If mDLP is listed on Pendle in the future, then Radpie will bribe Penpie.

The tokens emitted in this way remain within the Magpie ecosystem, which is the so-called internal circulation—keeping the benefits within the system and reducing net external expenditure.

External circulation refers to resource sharing among multiple projects to reduce costs and increase efficiency. For example, Ankr obtains Pendle incentives through Penpie Bribe. If Radiant opens Bribe in the future, it will naturally be easy to negotiate.

subDAO: It is not difficult to see that both super-sovereign leveraged governance and the internal and external dual circulation system are based on Magpie's expansion through the subDAO model. In addition to the above two points, subDAO actually has other benefits. First, in the current environment full of rugs, the most important thing for a project is reputation, and the subDAO model can inherit the reputation of the parent DAO. Second, compared to direct integration, providing independent tokens can fully leverage the advantages of tokenomics to achieve growth. Third, it provides the market with more betting tools, ensuring that the parent project can keep up with most narratives.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

MetaMask Launches $30M On-Chain Rewards Program

BlockDAG’s $50 Target Sends Shockwaves! Tron Turns Bullish While Monero Traders Face Wild Volatility