Bitcoin Miner TeraWulf's Stock Soars on Google-Backed AI Expansion Plans

On a largely bleak Tuesday for Bitcoin mining stocks, TeraWulf's share price soared nearly 17% after the Nasdaq-listed firm said it was adding more artificial intelligence compute power through an ongoing, Google-backed joint venture with AI cloud company Fluidstack.

TeraWulf stock (WULF) closed at $17 per share following the news. Shares have since dipped to $15.60 in after-hours trading.

The Easton, Maryland-based company said the two will develop 168 MW of critical IT load at a site in Abernathy, Texas in the second half of this year under a 25-year hosting commitment. TeraWulf will hold a majority stake of 51% in the joint venture, an announcement said.

TeraWulf and Fluidstack in August had already signed a deal to work together with the plan of building a new data center, backed by Google.

"This is exactly the evolution we outlined: converting advantaged infrastructure positions into contracted megawatts with investment-grade counterparties and doing so at strategic scale," TeraWulf CEO Paul Prager said.

Among other leading miners on Tuesday, Riot Platforms tumbled 6.2%, while CleanSpark and MARA Holdings fell nearly 5.2% and nearly 3.5%, respectively, according to Yahoo Finance. IREN was off almost 4%.

Mining Bitcoin has grown more challenging after last year's halving cut the amount of digital coins earned from 6.250 to 3.125.

Despite Bitcoin's price rising, it hasn't risen as quickly as previous cycles but the difficulty of minting coins has become harder, prompting miners to look for new revenue sources.

Top publicly-traded miner Hut 8 in August unveiled plans to develop 1.53 gigawatts of new capacity across four U.S. sites. Google last month announced a separate deal to backstop a deal between Fluidstack and Bitcoin miner Cipher, giving Google the right to buy a 5.4% stake in Cipher.

Bitcoin mining stocks this year have risen on news of such companies' initiatives that tap into the dramatic growth of artificial intelligence technology.

Bitcoin was recently trading below $113,000, a 1.6% drop over the past 24 hours. It has fallen about 10% since hitting an all-time high above $125,000 earlier this month, according to crypto data provider CoinGecko.

In a Myriad prediction market, about two in three respondents agree with crypto trader Mando that BTC's next move will be to $120,000 instead of dropping to $100,000 as entrepreneur KBM expects.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Mt. Gox delays $4B Bitcoin repayments: Bullish or bearish for BTC price?

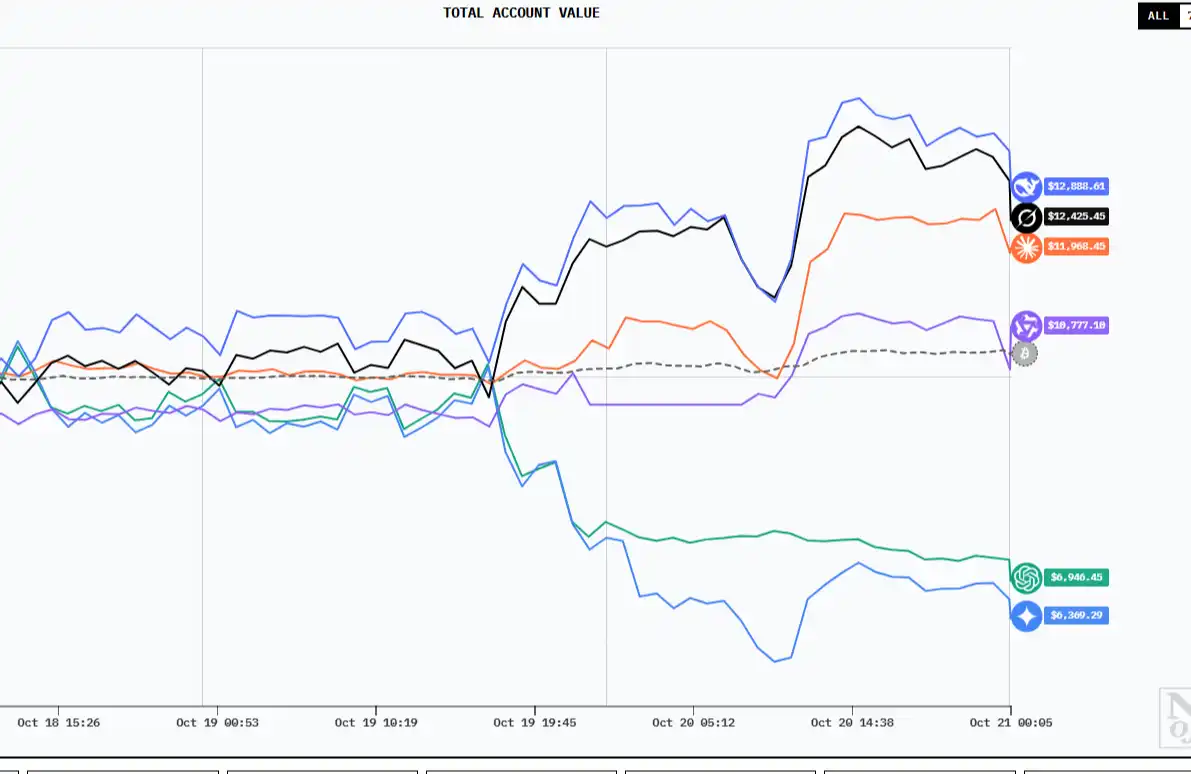

Six major AI "traders" ten-day showdown: Who can survive in a market with "no information asymmetry"?

AI is shifting from being a "research tool" to becoming a "frontline trader." So, how do they think?

Financial Black Hole: Stablecoins Are Devouring Banks

Stablecoins, acting as "narrow banks," are quietly absorbing liquidity and reshaping the global financial architecture.

$263 million political "war fund" in place, crypto industry ramps up for US midterm elections

This time, there are more super political action committees, and some have taken clearer stances in aligning with Republican candidates.