21shares Launches a Pendle ETP on SIX Swiss Exchange Indicating Growing Institutional Recognition for Pendle

October 28th, 2025 – Singapore, Singapore

Asset manager 21Shares has launched an exchange-traded product (ETP) called APEN based on Pendle — a development that signals deepening institutional recognition of Pendle’s role in bridging traditional fixed-income markets with Decentralized Finance (DeFi).

One of the most notable metrics underlining Pendle’s traction is its recent achievement: the protocol has settled $70 billion in yield, effectively creating a bridge between the roughly $140 trillion global fixed-income market and crypto-native infrastructure. This milestone is supported by onchain market behavior that sees Pendle’s approach as an emerging link between traditional finance and decentralized systems. Link here

Another indicator of Pendle’s traction is its latest product called Boros, designed for trading funding rates from various centralized and decentralized exchanges in a DeFi-native environment. Boros recently achieved an accumulated trading volume of $2.83 billion in just 3 months, underlining the potential of trading funding rates.

In the words of 21Shares’ Karim, Senior Digital Asset Researcher:

“PENDLE potential TAM is the massive interest rate derivatives, which alone represent $500T+ in TradFi. Fixed yields aren’t just a pillar of institutional finance, they are the market” — AbdelmawlaKarim

For institutional investors — asset managers, hedge funds, pension funds and other large-scale capital allocators — the launch of the 21Shares Pendle ETP presents several important themes: first, that institutional capital is beginning to adopt yield-tokenisation platforms; second, that protocols like Pendle are maturing beyond experimental to investible, regulated-friendly instruments; and third, that the broader narrative of DeFi accessing the massive fixed-income market is moving from theory into execution.

Institutional adoption in focus

Institutional investors typically demand scale, liquidity, transparency, and regulated access. Traditional fixed-income markets offer scale, but often suffer from opacity, illiquidity for some instruments, and high entry thresholds. Pendle’s architecture transforms yield streams into tradeable tokens, enabling access, transparency, and composability — features that align with institutional tooling. By packaging Pendle’s exposure into an ETP, 21Shares renders this ecosystem accessible via familiar capital-markets infrastructure—custody, reporting, regulatory frameworks—bridging DeFi protocols with institutional workflows.

Recent commentary from analysts reinforces this trend: one X-post from TheDeFinvestor highlights how yield-tokenization has grown ready for institutions, underscoring the platform’s revenue-generating capabilities.

What this means for Pendle and institutions

The ability of Pendle to settle tens of billions in yield, coupled with billions in trading volume via Boros, reflects both adoption and liquidity — two critical hallmarks for institutional viability. The 21Shares ETP is more than a product launch; it is symbolic of a shift in institutional attitudes toward DeFi-native infrastructure. As Pendle continues to integrate real-world assets and yield markets, its utility for professionals is likely to expand.

Looking ahead

With the institutional gateway now established via the 21Shares ETP, Pendle is positioned to scale its offerings—whether via fixed-rate instruments, yield tokenization of new asset classes, or deeper tradable products. For institutions looking to access the ~$140 trillion fixed-income market through a programmable, permissionless lens, Pendle offers a contemporary avenue.

In summary, the launch of the 21Shares Pendle ETP signals more than recognition—it marks a juncture where the world’s largest crypto-yield trading platform is entering the infrastructure of institutional finance. With tens of billions settled, billions in trading volume, and ETP access, Pendle is moving from innovation to institutional-ready infrastructure.

About Pendle

Pendle is the world’s largest crypto-yield-trading platform that enables users to separate and trade the future yield streams of yield-bearing assets in DeFi. By enabling the tokenization of both principal tokens and yield tokens, Pendle has created a foundation for programmable fixed-income-style exposure in blockchain.

For further reading, Pendle’s announcement is available on X:

Contact

Growth

Pendle Media Relations

Pendle

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Mt. Gox delays $4B Bitcoin repayments: Bullish or bearish for BTC price?

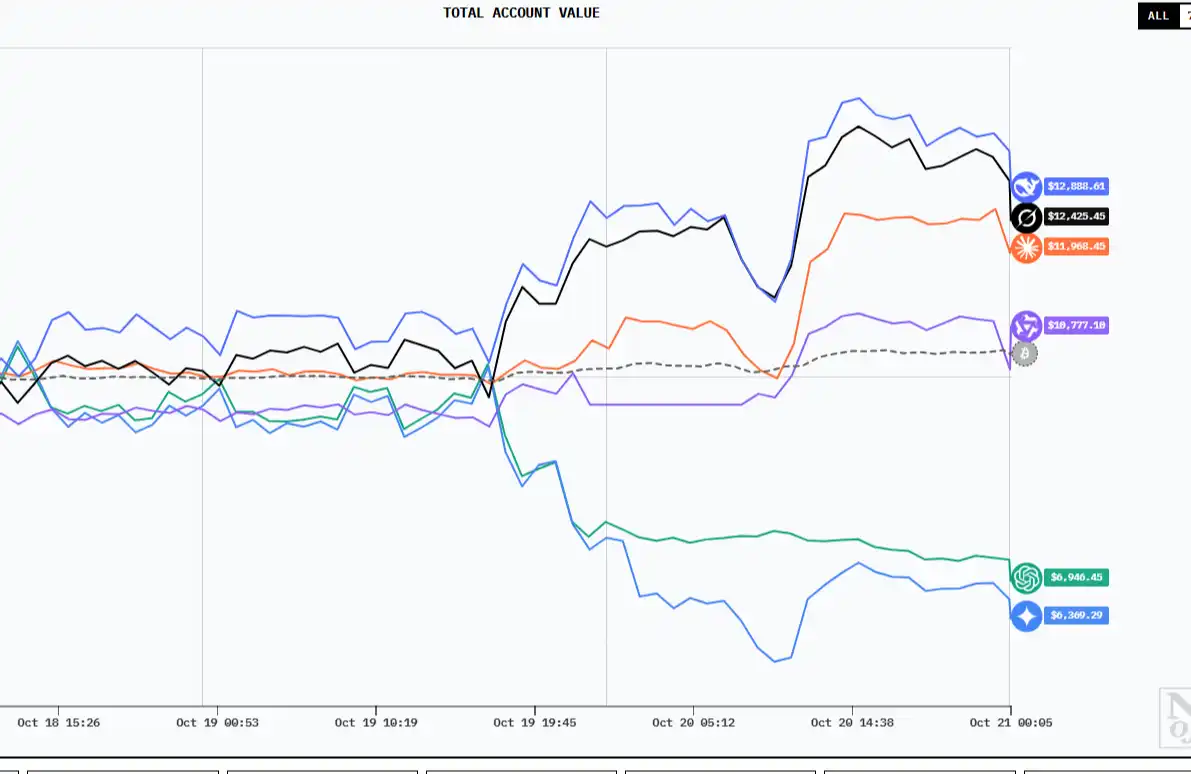

Six major AI "traders" ten-day showdown: Who can survive in a market with "no information asymmetry"?

AI is shifting from being a "research tool" to becoming a "frontline trader." So, how do they think?

Financial Black Hole: Stablecoins Are Devouring Banks

Stablecoins, acting as "narrow banks," are quietly absorbing liquidity and reshaping the global financial architecture.

$263 million political "war fund" in place, crypto industry ramps up for US midterm elections

This time, there are more super political action committees, and some have taken clearer stances in aligning with Republican candidates.