Securitize plots Nasdaq debut at $1.25b with tokenized equity

Securitize is targeting a $1.25 billion Nasdaq listing to redefine public share ownership, using its tokenized equity model to merge traditional markets with blockchain’s potential.

- Securitize plans a $1.25 billion Nasdaq listing through a Cantor-backed SPAC deal.

- The company intends to tokenize its own equity and expand institutional adoption of blockchain-based securities.

- Key investors including BlackRock and ARK Invest will roll their stakes into the newly listed entity.

According to an Oct. 27 filing with the U.S. Securities and Exchange Commission, Securitize has entered into a definitive business combination agreement with Cantor Fitzgerald’s SPAC, Cantor Equity Partners II.

The complex merger and a concurrent $225 million private investment in public equity, or PIPE, will result in the combined entity, which will retain the Securitize name and on the Nasdaq under the ticker symbol “SECZ.”

Notably, the company has announced its intent to tokenize its own equity post-listing, a move that would make its publicly traded stock a native digital asset on a blockchain.

Securitize backing and a market shifting toward tokenized equities

Securitize’s path to Nasdaq comes with strong institutional backing and a capital structure calibrated for a high-stakes market transition. The $225 million PIPE is being led by Arche and ParaFi Capital, whose allocation signals confidence in the commercial viability of tokenized securities.

More importantly, the company’s cornerstone investors, including BlackRock, ARK Invest, and Morgan Stanley Investment Management, are not cashing out. According to the deal’s framework, these existing backers will roll their entire stakes into the new public company, a powerful display of long-term conviction from institutions that have both funded Securitize and become its most prominent clients.

Securitize enters this public offering with a proven track record that underpins its ambitious valuation. The firm has already shepherded the issuance of approximately $4.5 billion in on-chain securities according to data from RWA.xyz . Its infrastructure powers major institutional initiatives, working with asset managers like BlackRock, Apollo, and VanEck to digitize everything from private equity and credit to real estate on blockchain networks.

The timing of Securitize’s tokenized equity plan is particularly strategic, aligning with a seismic shift in the traditional financial landscape. Just weeks ago, on September 8, Nasdaq itself filed a proposal with the SEC to amend its rules to allow the trading of tokenized securities on its main market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Mt. Gox delays $4B Bitcoin repayments: Bullish or bearish for BTC price?

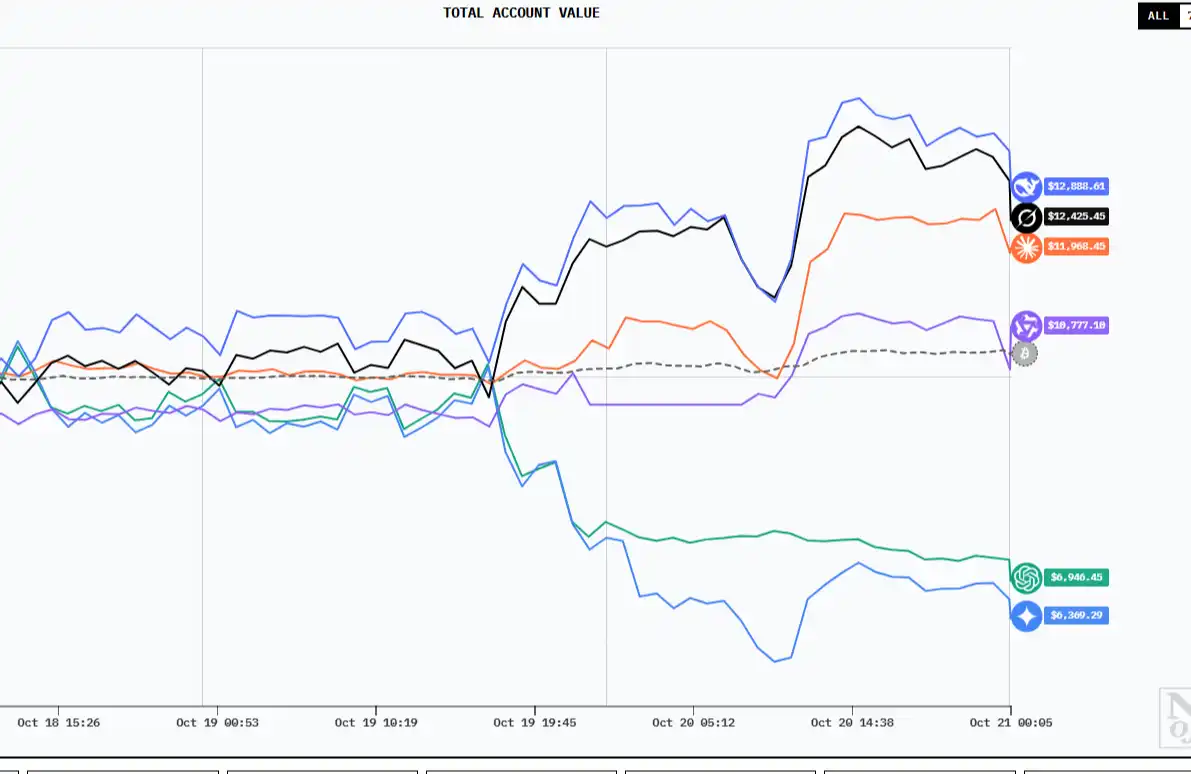

Six major AI "traders" ten-day showdown: Who can survive in a market with "no information asymmetry"?

AI is shifting from being a "research tool" to becoming a "frontline trader." So, how do they think?

Financial Black Hole: Stablecoins Are Devouring Banks

Stablecoins, acting as "narrow banks," are quietly absorbing liquidity and reshaping the global financial architecture.

$263 million political "war fund" in place, crypto industry ramps up for US midterm elections

This time, there are more super political action committees, and some have taken clearer stances in aligning with Republican candidates.