HBAR Price Rallies 17% To Recover October Losses; What’s Next

Hedera’s 17% price surge has restored October’s losses, but mixed investor sentiment leaves its next move uncertain as traders watch for a potential breakout above $0.212.

Hedera (HBAR) recorded an impressive 17% rally in the past 24 hours, successfully recovering all its October losses. The sudden surge has sparked optimism across the market, yet investor sentiment remains cautious.

While technical indicators hint at a potential continuation, holders are showing mixed signals despite the strong price rebound.

Hedera Investors Show Doubt

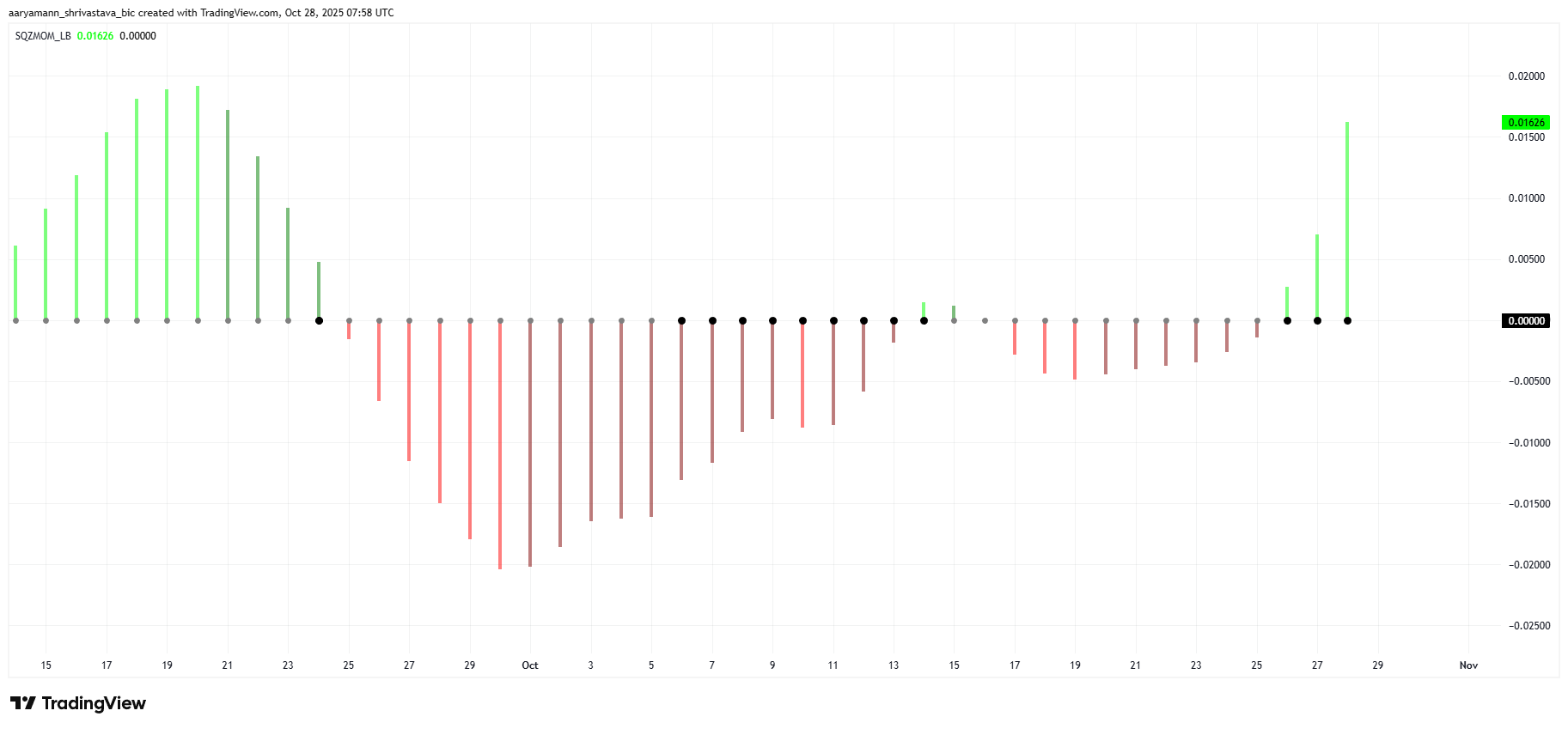

The Squeeze Momentum Indicator shows that Hedera is currently entering a buildup phase after more than a month of relative inactivity. This is signified by the appearance of black dots on the chart, indicating compression in volatility. Historically, such squeezes precede major breakouts once momentum shifts either bullish or bearish.

If this squeeze releases under bullish momentum, HBAR could benefit significantly. Given the recent uptick in price, a bullish breakout could propel the altcoin toward new short-term highs.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

HBAR Squeeze Momentum Indicator. Source:

TradingView

HBAR Squeeze Momentum Indicator. Source:

TradingView

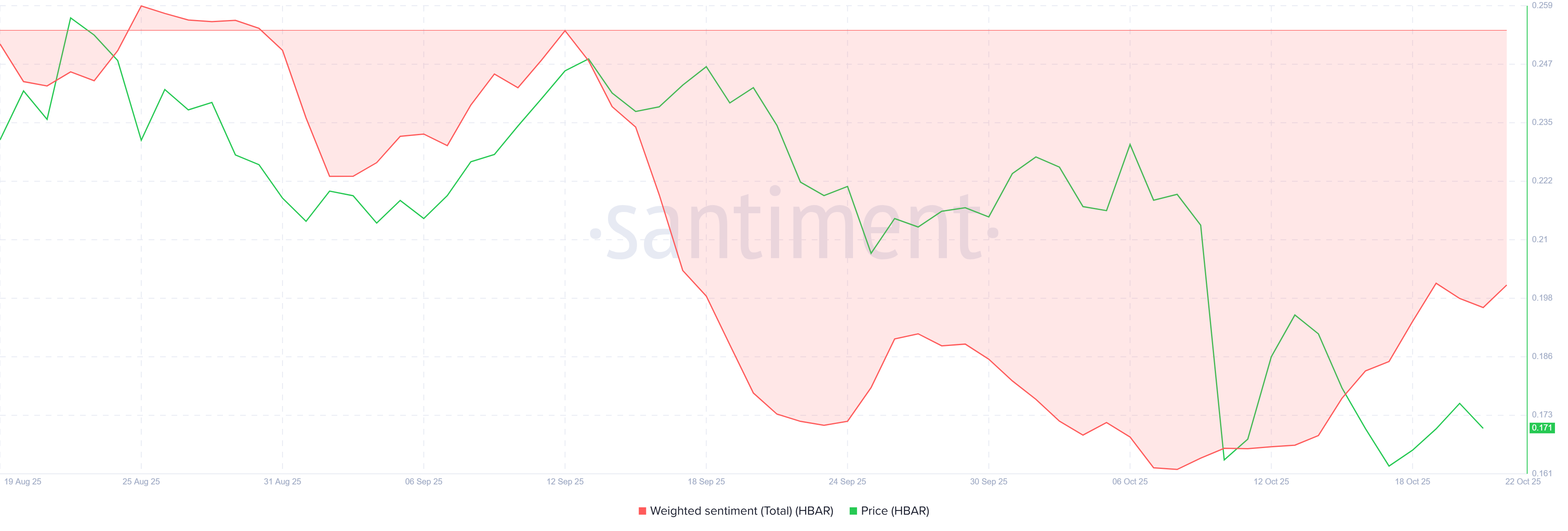

Despite the strong price performance, HBAR investors are still exhibiting bearish momentum. The sentiment indicator remains below the neutral 50 mark, signaling a lack of conviction among traders.

This negative outlook likely stems from the altcoin’s previous struggles to sustain gains earlier in the month. While the 24-hour rally showcases technical recovery, broader sentiment has yet to follow.

HBAR Weighted Sentiment. Source:

Santiment

HBAR Weighted Sentiment. Source:

Santiment

HBAR Price Could Continue Rallying

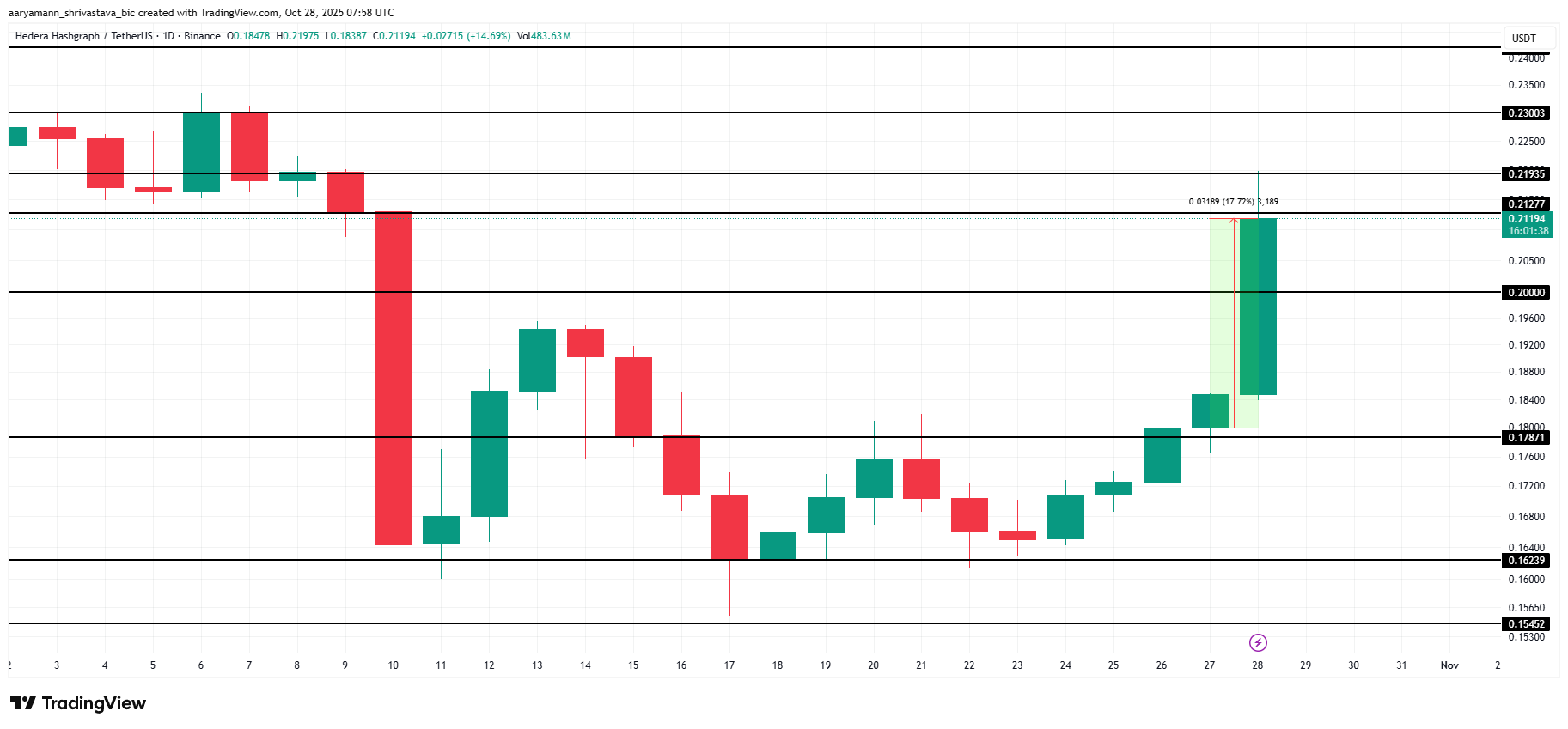

At the time of writing, HBAR is trading at $0.211, sitting just below the $0.212 resistance level. The altcoin could attempt to break above this barrier if investor confidence improves, setting the stage for continued upward momentum.

HBAR’s 17% surge has helped it fully recover from October’s losses. Should bullish momentum persist, the cryptocurrency could extend its gains toward $0.219 and potentially breach $0.230 in the coming sessions.

HBAR Price Analysis. Source:

TradingView

HBAR Price Analysis. Source:

TradingView

However, if selling pressure intensifies, HBAR could drop back to the $0.200 support level. A further decline below this could push prices toward $0.178, erasing recent gains and invalidating the current bullish outlook.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Cathie Wood warns: As interest rates rise next year, the market will be "chilled to the bone"

AI faces adjustment risks!

2025 Trading Guide: Three Essential Trading Categories and Strategies Every Trader Must Know

Clearly identify the type of transaction you are participating in and make corresponding adjustments.

BlackRock’s Stance Leaves Altcoin Enthusiasts on Edge

In Brief BlackRock's Bitcoin spot ETF boosted confidence, defying expectations of Bitcoin's end. Altcoin ETFs could eliminate current institutional investor limitations, spurring market growth. Lack of BlackRock's altcoin ETF may limit long-term support, risking market disillusionment.

Oversold but Not Over: TRUMP, UNI, and PI are Primed for Recovery