ClearBank Joins Circle to Bring USDC and EURC to Europe’s Banking Rails

ClearBank partners with Circle to integrate USDC and EURC across Europe, merging regulated banking infrastructure with blockchain payment rails to enable faster, cheaper, and MiCA-compliant cross-border transactions for financial institutions and fintech clients.

ClearBank has signed a framework deal with Circle Internet Financial to expand USDC and EURC in Europe. The move connects ClearBank’s regulated banking systems with Circle’s blockchain rails to deliver faster and cheaper cross-border transfers.

The partnership, announced on Monday, shows how traditional banks are beginning to integrate digital currencies into payment systems. Europe is racing to adopt Markets in Crypto-Assets (MiCA)-compliant stablecoins and tokenized settlement models.

Banks Adopt Stablecoins for Real-World Settlement

ClearBank will join the Circle Payments Network (CPN) and integrate with Circle Mint. This setup allows financial institutions and fintechs to issue and redeem stablecoins directly.

“This collaboration marks a milestone in connecting regulated banking systems with blockchain-based payments,” said Mark Fairless, CEO of ClearBank. “By combining our cloud platform with Circle’s digital-asset expertise, we can help clients transact globally at internet speed,” he added.

Circle’s Vice President for Partnerships EMEA, Sanja Kon, described the deal as “a step toward an open, programmable financial system.” She said it would deliver “greater transparency, efficiency, and reach” to institutional payments.

In September, Circle worked with Deutsche Börse Group to bring USDC and EURC settlement to 360T Markets. These steps show the growing link between banks and tokenized money networks.

Founded in 2016, ClearBank is a UK-based regulated fintech bank. It provides payment infrastructure, clearing, and embedded financial services. The firm remains privately held and is not publicly listed.

Europe’s Digital Currency Shift Gains Momentum

At the same time, ClearBank’s move comes as the European Union prepares the MiCA rule, which is due in 2026. It will require stablecoin issuers to keep one‑to‑one reserves and publish audits.

In addition, several banks are already testing digital currencies. For example, ING and ABN AMRO tried euro‑based tokenized deposits. Banco Santander tested blockchain bond settlements through the European Investment Bank’s platform. The Swiss National Bank ran wholesale CBDC trials with six banks, showing how public and private institutions use blockchain.

According to data from the European Blockchain Observatory, more than 60 percent of EU financial firms have launched or plan blockchain payment pilots by 2026. Consequently, analysts think this growth could put Europe ahead of the US in regulated digital finance.

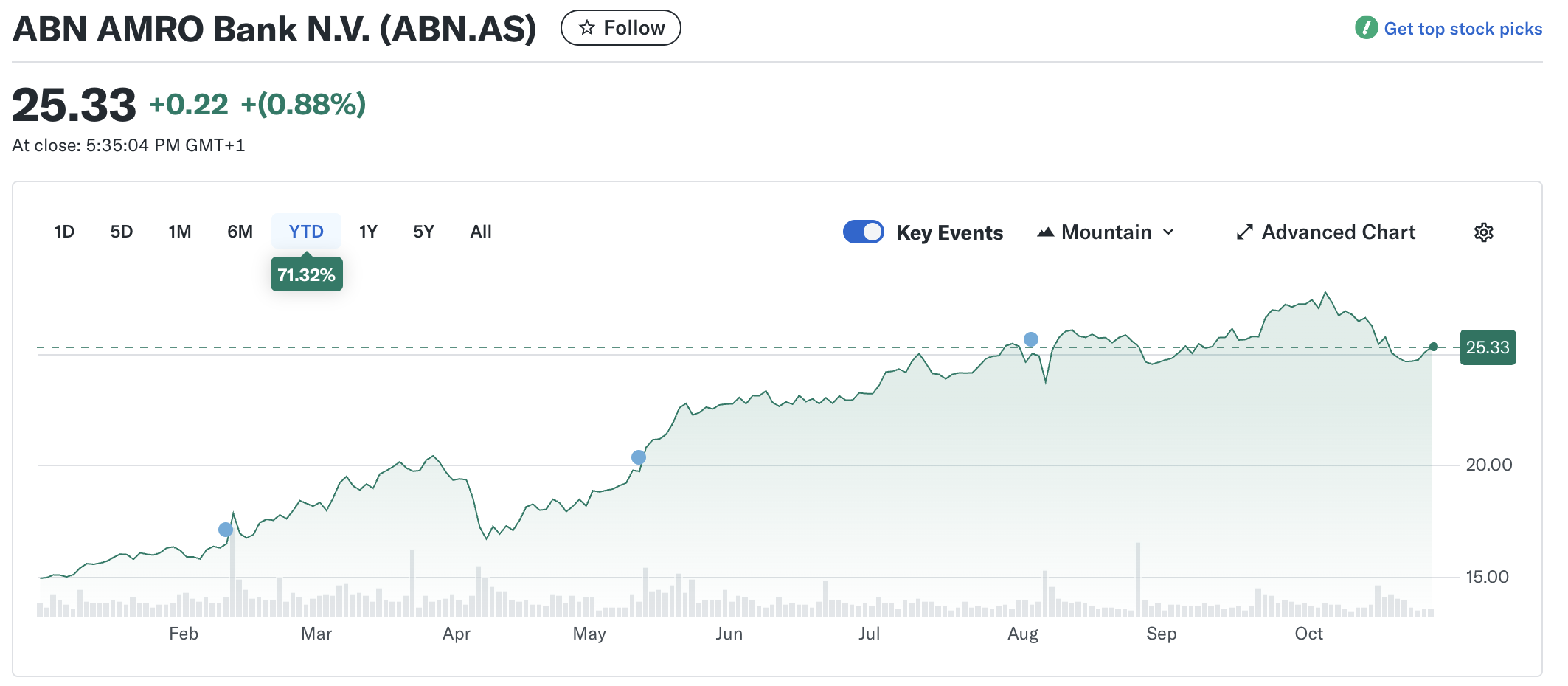

ABN AMRO stock performance YTD / Source: Yahoo Finance

ABN AMRO stock performance YTD / Source: Yahoo Finance

In market terms, both banks have also shown solid performance this year. ING’s stock has climbed about 55 percent year‑to‑date, while ABN AMRO has surged roughly 71 percent, reflecting strong investor confidence in Europe’s financial sector.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Next "Black Swan": "Tariff Refund Mega Deal", Wall Street and Individual Investors Are Placing Bets

Individual investors are participating in this game through emerging prediction markets such as Kalshi and Polymarket.

Since the U.S. legislation in July, stablecoin usage has surged by 70%!

After the "Genius Act" was passed in the United States, stablecoin payment volumes surged, with August transactions exceeding 10 billion USD. Nearly two-thirds of this amount came from inter-company transfers, making it the main driving force.

BlackRock Shifts $500 Million Funds to Polygon Network

In Brief BlackRock transfers $500 million to Polygon, enhancing blockchain integration in finance. The move shows increased trust in blockchain-based financial structures. It indicates a trend towards decentralization and long-term structural change in finance.

XRP Eyes $27 Target After Breakout Confirms Multi-Year Bullish Pattern