Did Pi Coin’s Price Just Lose Its Shot At Recovery As 32% Jump Fails?

Pi Coin (PI) witnessed a sharp 32% price surge in the past 24 hours, sparking hopes of a sustained rally. However, the optimism was short-lived as investors seemingly used the brief rally to offload holdings. The altcoin’s momentum now faces growing pressure, with technical indicators signaling a potential breakdown if selling continues. Pi Coin Outflows

Pi Coin (PI) witnessed a sharp 32% price surge in the past 24 hours, sparking hopes of a sustained rally. However, the optimism was short-lived as investors seemingly used the brief rally to offload holdings.

The altcoin’s momentum now faces growing pressure, with technical indicators signaling a potential breakdown if selling continues.

Pi Coin Outflows Surge

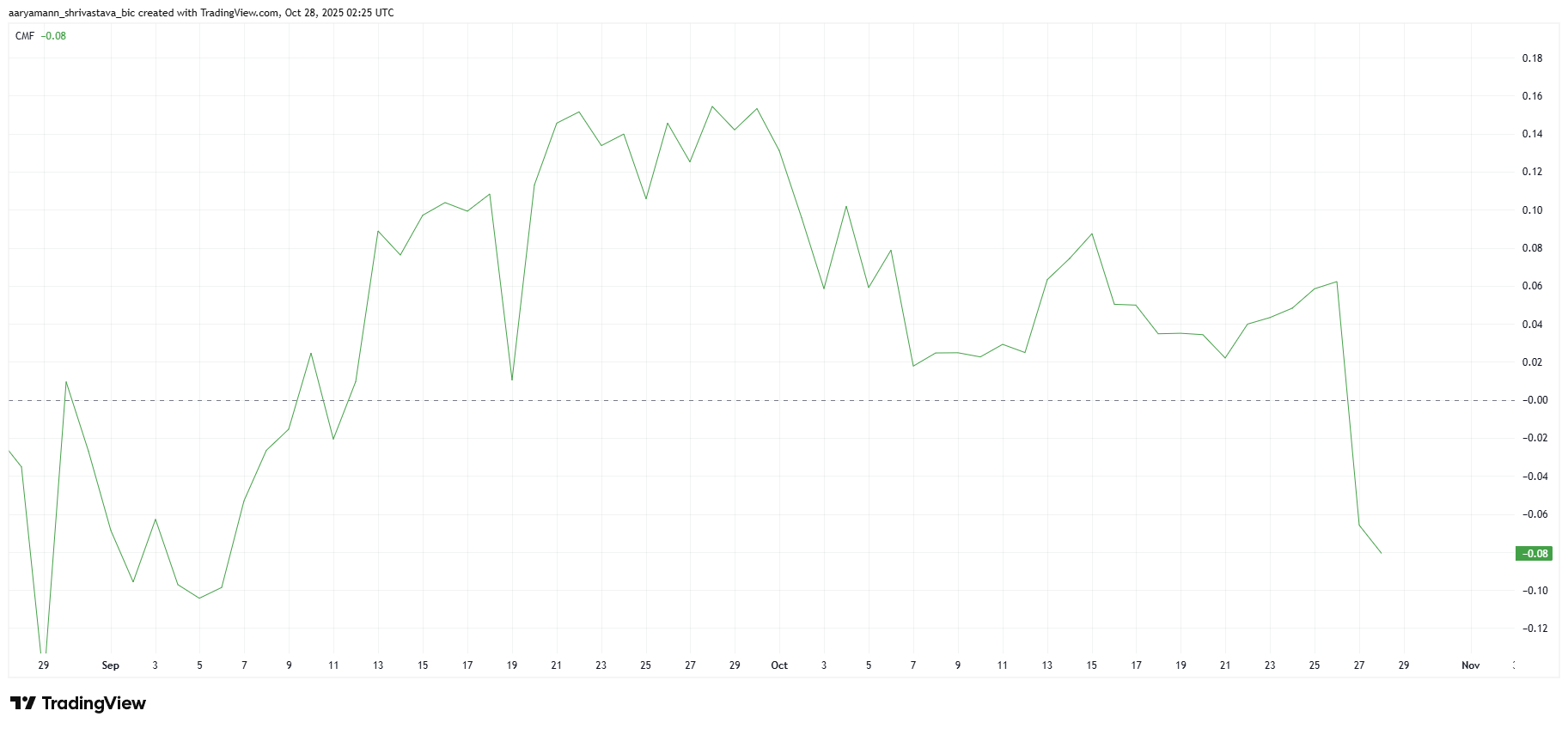

The Chaikin Money Flow (CMF) indicator paints a concerning picture for Pi Coin. Over the past 24 hours, CMF has recorded a steep downtick, falling to a near two-month low. This trend reflects massive capital outflows, suggesting that traders may have taken profits quickly instead of holding for further gains.

Such sharp declines in CMF often signal growing bearish sentiment. Pi Coin holders appear to have exited their positions amid the intra-day 32% price rise, leading to heavy outflows. This sudden reversal in sentiment could limit near-term recovery prospects, especially if investor confidence continues to wane.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

Pi Coin CMF. Source:

TradingView

Pi Coin CMF. Source:

TradingView

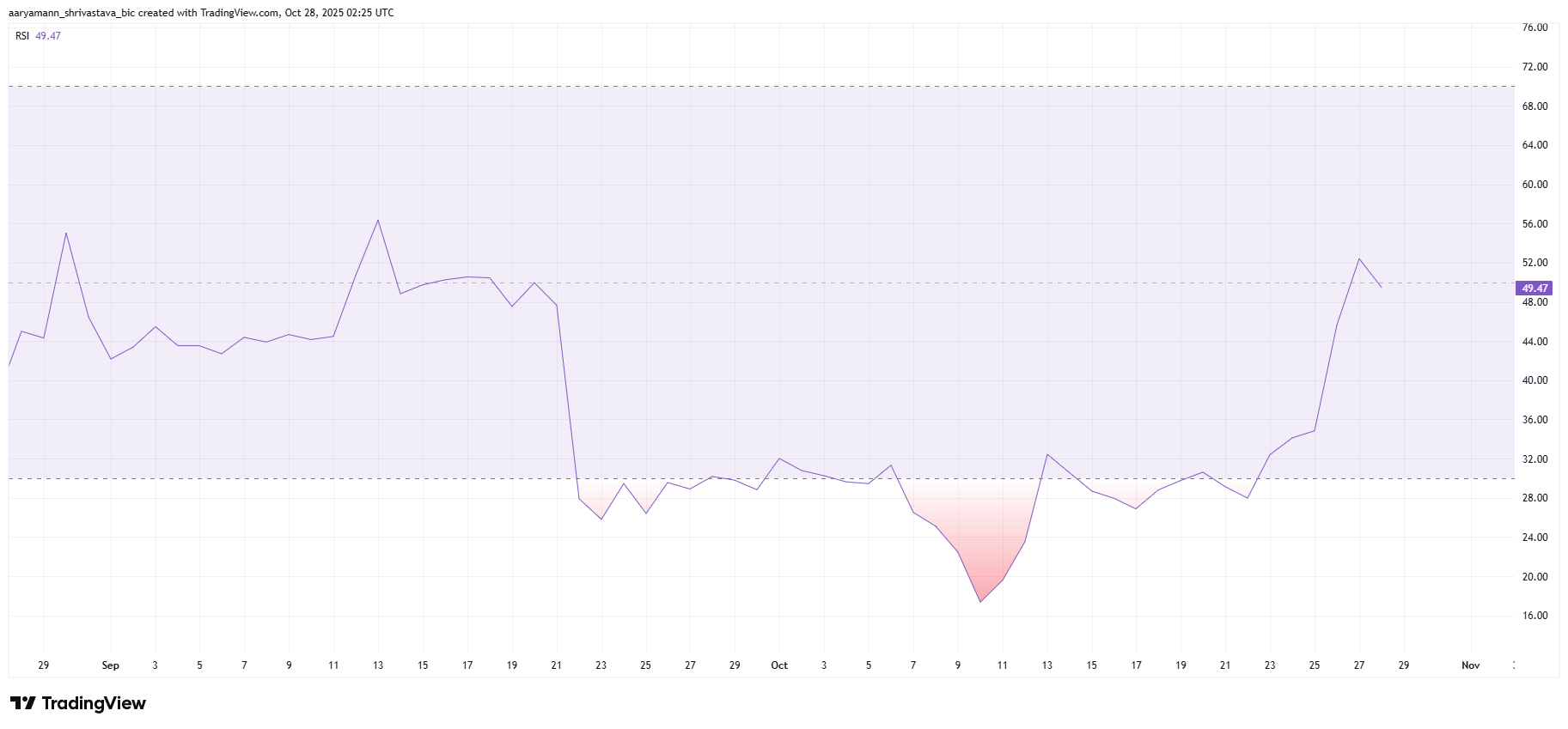

On the macro level, Pi Coin’s Relative Strength Index (RSI) is showing a different story. The RSI has spiked sharply over the last 24 hours, moving from the bearish territory below 50.0 to the positive zone. This upward shift usually suggests renewed bullish momentum and the potential for continued short-term gains.

However, despite the improving RSI, the ongoing outflows may hinder the rally. If selling persists, it could offset the positive technical momentum, keeping Pi Coin price range-bound.

Pi Coin RSI. Source:

TradingView

Pi Coin RSI. Source:

TradingView

PI Price May Struggle To Rally

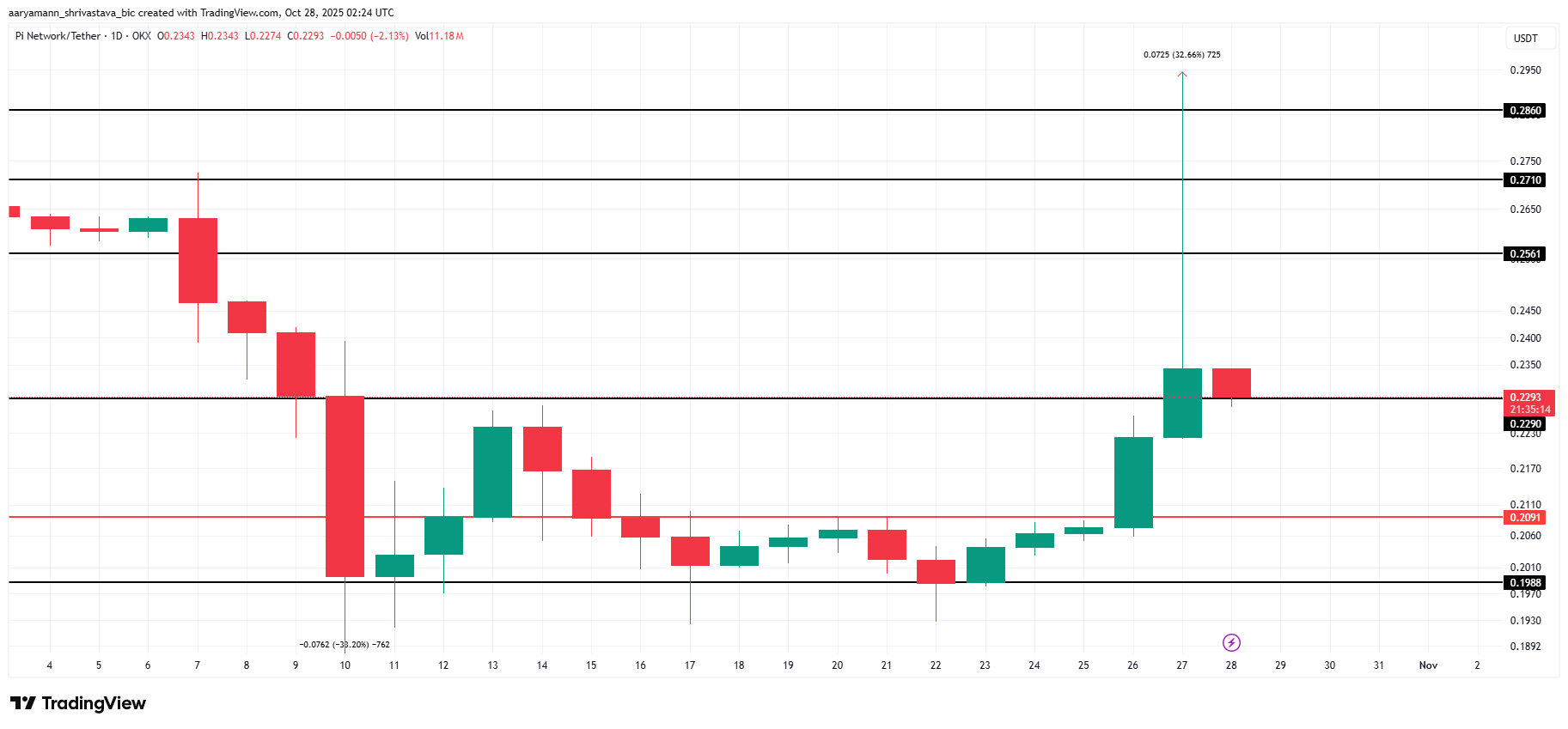

Pi Coin’s price stands at $0.229 at the time of writing, holding right above its critical support at the same level. This zone could serve as a launchpad for a potential rebound, provided buyers step back in with conviction.

If Pi Coin manages to hold and bounce from $0.229, it could climb toward $0.256 or even higher. Such a move would indicate renewed market strength and partial recovery from recent profit-taking.

Pi Coin Price Analysis. Source:

TradingView

Pi Coin Price Analysis. Source:

TradingView

Conversely, if the $0.229 support fails, the price may drop to $0.209 and potentially retest $0.198. This would invalidate the bullish outlook and confirm a short-term bearish continuation for Pi Coin.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

From Spotlight to the Sidelines: The Bubble Burst of 8 Star VC-Backed Projects

Is it because the model is unsustainable, the ecosystem has yet to launch, the competitors are too strong, or is there simply insufficient market demand?

The Next "Black Swan": "Tariff Refund Mega Deal", Wall Street and Individual Investors Are Placing Bets

Individual investors are participating in this game through emerging prediction markets such as Kalshi and Polymarket.

Since the U.S. legislation in July, stablecoin usage has surged by 70%!

After the "Genius Act" was passed in the United States, stablecoin payment volumes surged, with August transactions exceeding 10 billion USD. Nearly two-thirds of this amount came from inter-company transfers, making it the main driving force.

BlackRock Shifts $500 Million Funds to Polygon Network

In Brief BlackRock transfers $500 million to Polygon, enhancing blockchain integration in finance. The move shows increased trust in blockchain-based financial structures. It indicates a trend towards decentralization and long-term structural change in finance.