Altcoin Market Breakout Looms as Bitcoin Dominance Weakens

After a long accumulation phase, altcoins are showing early signs of revival. With Bitcoin dominance nearing resistance and on-chain data turning bullish, the conditions for a major Altseason breakout may finally be aligning for crypto investors.

The stability of market capitalization structure and the emergence of bullish reversal indicators create ideal conditions for liquidity rotation across the crypto landscape. The potential weakening of Bitcoin dominance further supports these conditions.

Both technical signals and market psychology suggest that a new Altseason cycle may be forming, setting the stage for the next major Altcoin market breakout.

Market Recovery And the End of the Accumulation Phase

After months of correction, the global crypto market is showing clear signs of revival. According to CoinGecko, total market capitalization has reached USD 4 trillion again, marking a significant recovery following a prolonged period of stagnation. However, investor attention is no longer solely on Bitcoin (BTC). The spotlight is gradually shifting to altcoins, digital assets beyond Bitcoin, which are often considered the leverage for the next leg up of the market.

As analyst Michael van de Poppe highlighted, the altcoin market has endured the longest bear cycle, lasting nearly four years with persistent declines against Bitcoin. Yet, current technical indicators display striking similarities to late 2019 and early 2020, the period right before the market entered a strong uptrend. Specifically, MACD has formed a bullish divergence. While RSI is hovering in the oversold zone, it signals exhaustion of selling pressure and a potential reversal in sight.

Altcoin market analysis. Source:

Michael van de Poppe

Altcoin market analysis. Source:

Michael van de Poppe

On-chain data further reinforces this perspective. An analyst on X noted that the monthly market cap structure for altcoins remains intact, suggesting that the accumulation phase has not been disrupted. The so-called “manipulation phase,” when whales and institutions shake out retail investors, may have ended, paving the way for a broad-based recovery.

Another analyst points out that the market appears to be repeating the same sentiment cycle as in 2021, when most investors doubted that Altseason would return, right before altcoins exploded within weeks. Such patterns indicate that the Altcoin market breakout could catch the majority off guard again.

Bitcoin Dominance And the Liquidity Shift Toward Altcoins

One of the most closely watched signals today is Bitcoin Dominance (BTC.D), the ratio measuring Bitcoin’s share of the total crypto market.

BTC.D chart. Source:

Seth

BTC.D chart. Source:

Seth

According to Seth, BTC.D is currently retesting the Ichimoku cloud around 59%, a key resistance zone that previously marked turning points in past market cycles. Should Bitcoin dominance be rejected at this level, it could trigger a massive rotation of liquidity from Bitcoin into altcoins, igniting the long-anticipated Altseason.

BTC.D chart. Source:

TradingView

BTC.D chart. Source:

TradingView

Further analysis by DamiDefi adds that the strongest confirmation of an upcoming altcoin breakout would occur when BTC.D closes below 57% on the monthly chart while ETH/BTC breaks above 0.041. These thresholds indicate that investors are beginning to prefer holding altcoins over Bitcoin, a classic precursor to every major Altseason. Both indicators are nearing their critical levels, implying that the market tension could soon be released.

ETH/BTC ratio. Source:

TradingView

ETH/BTC ratio. Source:

TradingView

In parallel, the TOTAL2 chart, representing the total altcoin market capitalization excluding Bitcoin, shows that prices are testing an eight-year ascending trendline dating back to 2017, which acted as strong support during the 2018 and 2020 crashes. Maintaining this structure could provide the launchpad for a widespread Altcoin market breakout in the coming months.

“Now is NOT the time to be bearish on alts. Legendary months lie ahead for this market. Timing is always difficult, but I think we’re close,” another analyst commented on X.

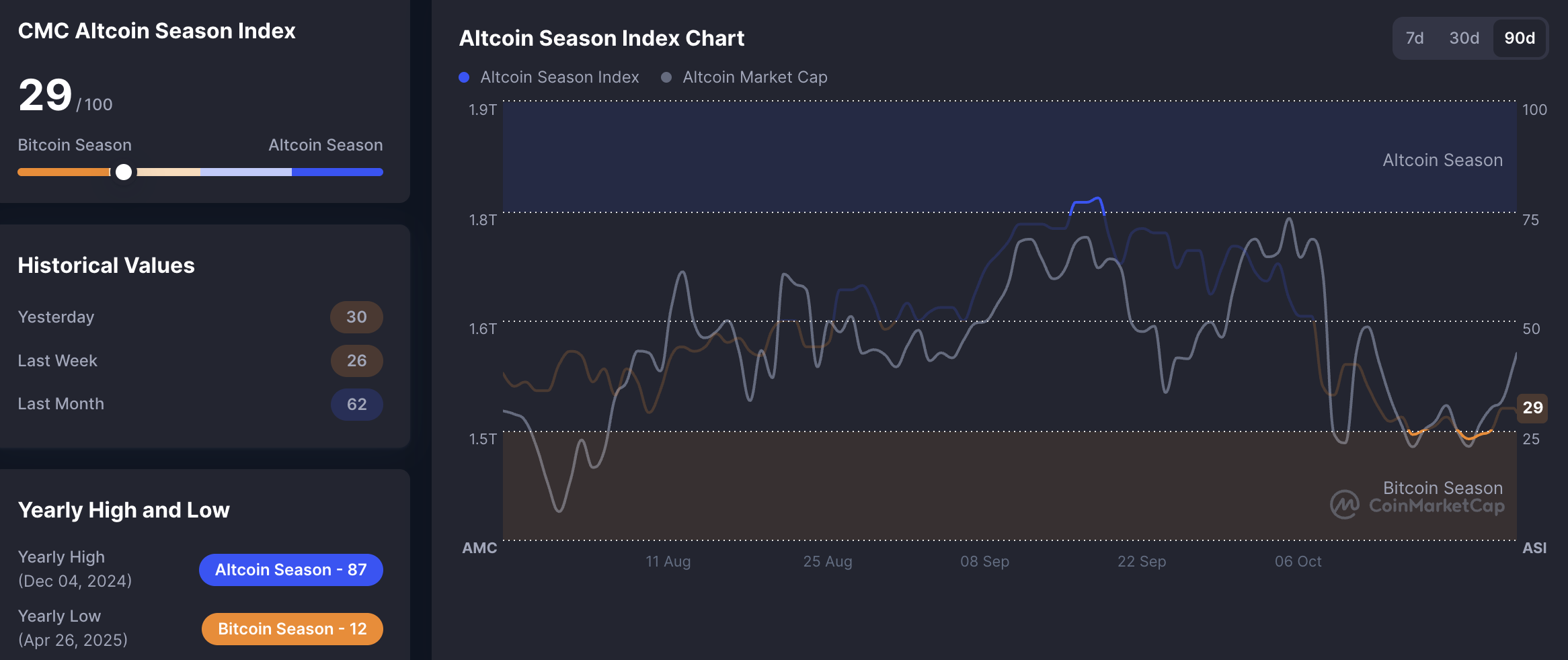

Altcoin Season Index. Source:

CMC

Altcoin Season Index. Source:

CMC

Meanwhile, the Altcoin Season Index, which measures the relative performance of altcoins against Bitcoin, remains near the same lows at the 2022 bear market bottom. This indicates that investor sentiment toward altcoins is currently in a “wait-and-see” mode. Still, any strong trigger could ignite a wave of FOMO (Fear of Missing Out) similar to previous cycles.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

JPMorgan to Accept Bitcoin, Ethereum as Loan Collateral

Crypto New Token Launch Craze: Reviewing the New Wave of Wealth Opportunities

A quick overview of new project investment opportunities such as MegaETH, Momentum, and zkPass.

Tariff clouds temporarily ease, is the bull market horn sounding again?

This article analyzes the reasons behind the recent significant surge in the crypto market, mainly attributing it to progress in tariff negotiations between China and the United States, as well as positive signals released by macroeconomic data.