3 Altcoins To Watch In The Final Week Of October 2025

The crypto market is in a state of improvement as October comes to an end. With many end of the month upgrades awaiting, crypto tokens could be looking at positive developments going forward. BeInCrypto has analysed three such altcoins that are preparing for a shift that could prove to be beneficial going forward. Cronos (CRO)

The crypto market is in a state of improvement as October comes to an end. With many end of the month upgrades awaiting, crypto tokens could be looking at positive developments going forward.

BeInCrypto has analysed three such altcoins that are preparing for a shift that could prove to be beneficial going forward.

Cronos (CRO)

Cronos is gearing up for its EVM Smarturn upgrade next week, a significant milestone for the blockchain network. The update will introduce smarter accounts, enhanced EVM functionality, and stronger overall performance.

This upgrade could further boost CRO’s price, which has already climbed 10% in the past week to $0.154. If this level flips into firm support, momentum could push the token toward $0.160 and $0.171.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

CRO Price Analysis. Source:

CRO Price Analysis. Source:

However, if bullish sentiment weakens, CRO could retrace its gains. A price drop below $0.147 would signal fading momentum, with further losses possibly extending to $0.140. Sustaining strong technical support and investor participation remains essential to prevent a breakdown.

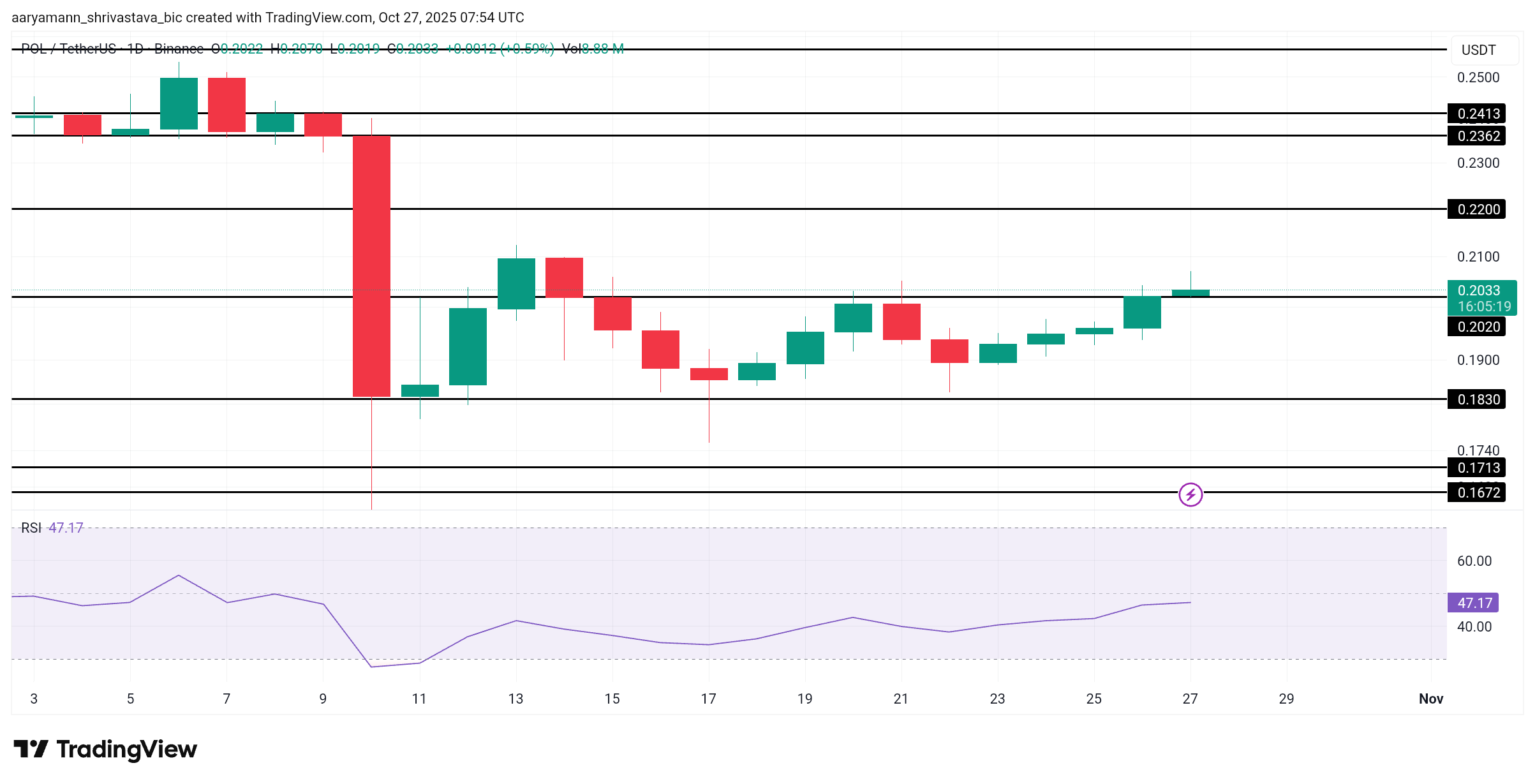

Polygon (POL)

One of the top altcoins, Polygon, is preparing for a crucial upgrade aimed at significantly enhancing its blockchain performance. The update will increase transaction throughput from 1,000 TPS to 5,000 TPS and reduce finality from 5 seconds to just 1 second.

The upgrade could drive POL’s price upward from $0.203 toward the $0.220 resistance level. To achieve this, the token must secure $0.203 as strong support.

POL Price Analysis. Source:

POL Price Analysis. Source:

However, the RSI remains in the negative zone below the neutral 50 mark, signaling weakening momentum. If selling pressure intensifies, POL’s price could drop to $0.183, invalidating the bullish outlook.

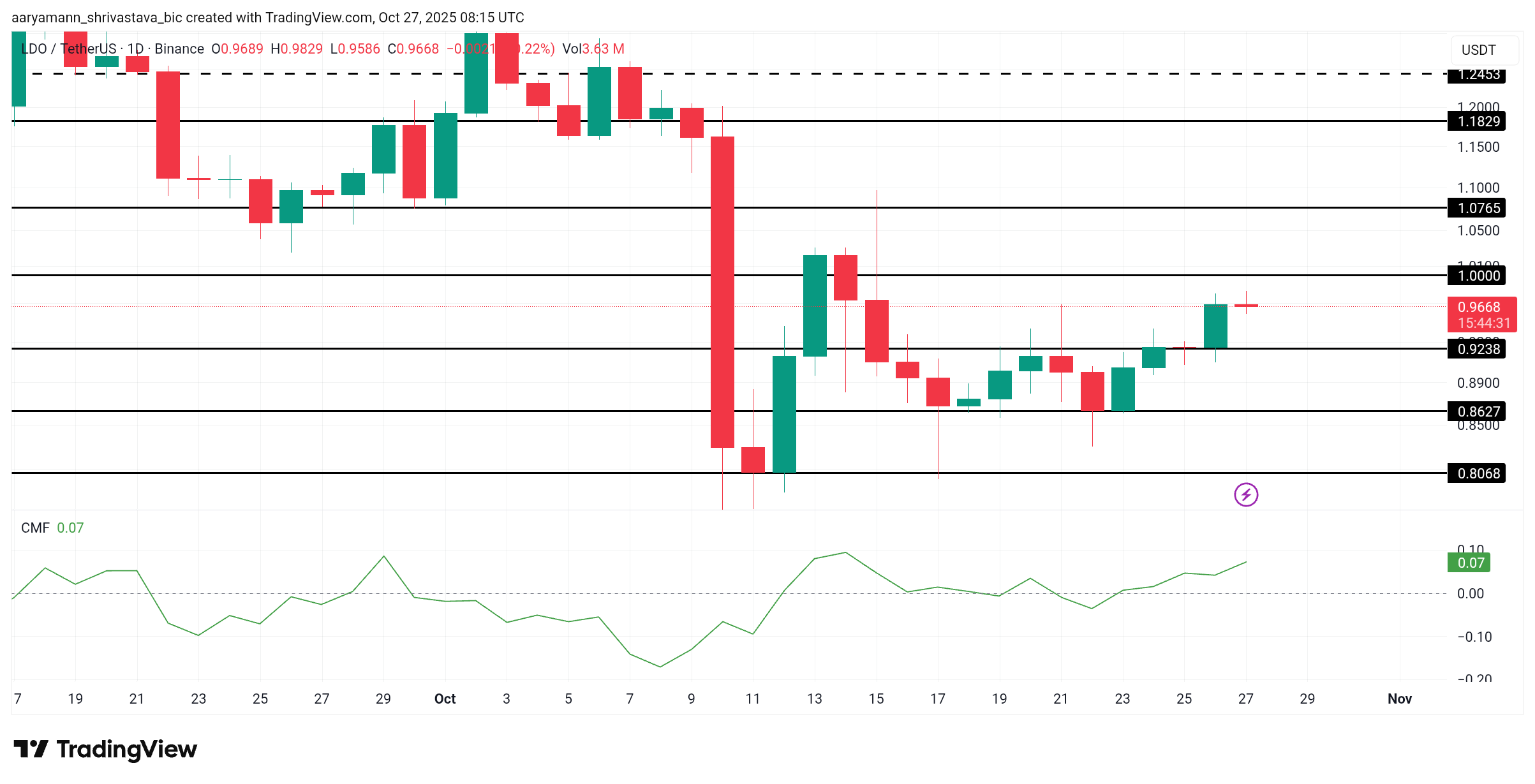

Lido DAO (LDO)

Lido V3, a significant upgrade, is scheduled to go live on the mainnet by the end of this month. The update will transform Lido from a simple liquid staking solution into a modular, transparent, and institution-grade staking infrastructure platform, enhancing scalability, governance, and security.

If momentum holds, LDO’s price could break above $1.00 and move toward $1.07. The Chaikin Money Flow (CMF) indicates consistent investor inflows despite lingering skepticism. This growing confidence signals increasing capital support, which could sustain the ongoing rally.

LDO Price Analysis. Source:

LDO Price Analysis. Source:

However, if investor sentiment weakens, LDO could face renewed selling pressure. A drop below $0.923 might trigger further losses, potentially driving the token down to $0.862. Losing these key support levels would invalidate the bullish outlook.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Next "Black Swan": "Tariff Refund Mega Deal", Wall Street and Individual Investors Are Placing Bets

Individual investors are participating in this game through emerging prediction markets such as Kalshi and Polymarket.

Since the U.S. legislation in July, stablecoin usage has surged by 70%!

After the "Genius Act" was passed in the United States, stablecoin payment volumes surged, with August transactions exceeding 10 billion USD. Nearly two-thirds of this amount came from inter-company transfers, making it the main driving force.

BlackRock Shifts $500 Million Funds to Polygon Network

In Brief BlackRock transfers $500 million to Polygon, enhancing blockchain integration in finance. The move shows increased trust in blockchain-based financial structures. It indicates a trend towards decentralization and long-term structural change in finance.

XRP Eyes $27 Target After Breakout Confirms Multi-Year Bullish Pattern