StableStock and Native Launch 24/7 Tokenized-Stock Trading on BNB Chain

October 27th, 2025 – Singapore, Singapore

StableStock , the on-chain stock-liquidity infrastructure, has partnered with Native , a next-generation decentralized exchange, to bring real U.S. equities onto BNB Chain.

The first batch—worth nearly $10 million—includes “Mag7” tech giants (sTSLA, sNVDA, sAAPL), mid-cap favorites (sCOIN, sGLXY, sINTC, sCRCL), and DAT stocks (sBMNR, sSBET, sBNC, sALTS), alongside the debut of sQQQ, sCOPX, and sBLSH thematic assets — offering investors broad on-chain exposure from leading tech equities to commodities and alternative markets.

For the first time, users can buy and trade fully backed U.S. stock tokens on-chain, 24 hours a day, directly with stablecoins, either through the “Swap” page on StableStock’s official website or via integrated wallets such as Native Swap and OKX Wallet.

Each token follows StableStock’s sToken standard, maintaining a 1:1 peg with the underlying share while remaining freely composable across DeFi.

“StockFi”: A New Chapter in the Financialization of Equities

StableStock calls this new frontier StockFi — Stock + DeFi — the financialization and decentralization of global equities. Over the past decade, crypto has put currencies, commodities, and credit on-chain. Stocks, one of the world’s largest asset classes, have remained offline. StableStock aims to change that through a multi-layered system linking custody, issuance, and trading.

From Vision to Reality: StableStock’s Three-Phase Roadmap

To bring its StockFi vision to life, StableStock has outlined a clear three-phase strategic roadmap:

1. Infrastructure — connects TradFi rails and enables stablecoin purchases of real stocks (underway with the Native launch).

2. Ecosystem Products — launching StableVault (Nov. 2025) to let users earn yield on sTokens, and StableLeverage (early 2026) to bring margin trading on-chain.

3. Open Collaboration — supports builders to create stock-backed stablecoins, perpetuals, and options once the foundation is live.

“Stocks will become the next great on-chain asset class — after stablecoins,” said Zixi Zhu, StableStock’s CEO. “StockFi isn’t just a concept, it’s a structural shift already underway. As real equities gain on-chain liquidity and programmability, the boundaries of global finance are being redrawn.”

About StableStock

StableStock is an on-chain stock-liquidity infrastructure bridging regulated brokers and DeFi protocols. It enables global users to buy, trade, and earn yield on tokenized equities 24/7—making real stocks as liquid, composable, and programmable as stablecoins. Incubated by YZi Labs Easy Residency and backed by top-tier VCs, StableStock has raised a multi-million USD seed round with participation from YZi Labs, MPCi , and Vertex Ventures.

About Native

Native is another form of DEX, PMM DEX, that utilize a RFQ-based pricing system, and on chain DEX Pool for settlement to provide efficient onchain maker liquidity.

Contact

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

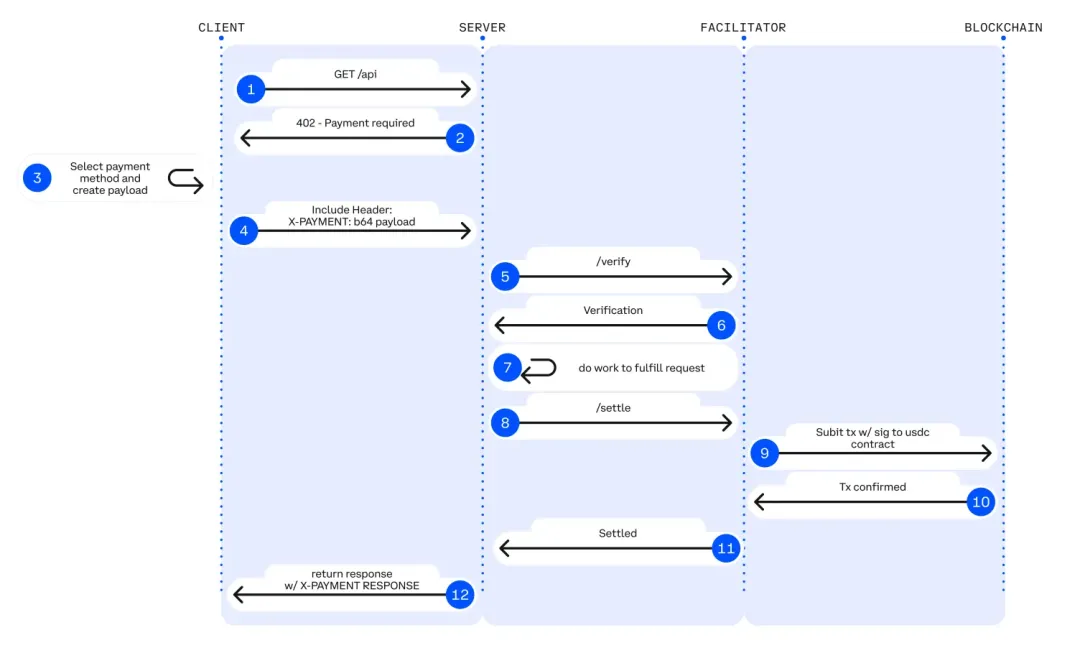

IOSG Weekly Brief|x402 - A New Standard for Crypto Payments by Digital Agents

x402 is a revolutionary open payment standard that activates the HTTP 402 status code to embed payment functionality at the Internet protocol layer. This enables native payment capabilities between machines, driving the transformation of the Internet from an information network to a machine economy network, and creating a value transfer infrastructure for AI agents and automated systems without the need for human intervention.

Exclusive Interview with Aptos Founder Avery Ching: Not a General-Purpose L1, Focusing on a Global Transaction Engine

Aptos is not positioned as a general-purpose L1, but rather as a home for global traders, focusing on being a global trading engine.

Pharos adopts Chainlink CCIP as cross-chain infrastructure and utilizes Data Streams to empower the tokenized RWA market

Pharos Network, a programmable open finance Layer-1 blockchain, announced the adoption of Chainlink CCIP as its cross-chain infrastructure and the use of Chainlink Data Streams to provide sub-second low-latency market data. Together, they aim to build a high-performance, enterprise-grade tokenized RWA solution to drive the large-scale development of institutional asset tokenization.

XRP Holds Strong Above $2.60 as Buyers Maintain Upward Momentum