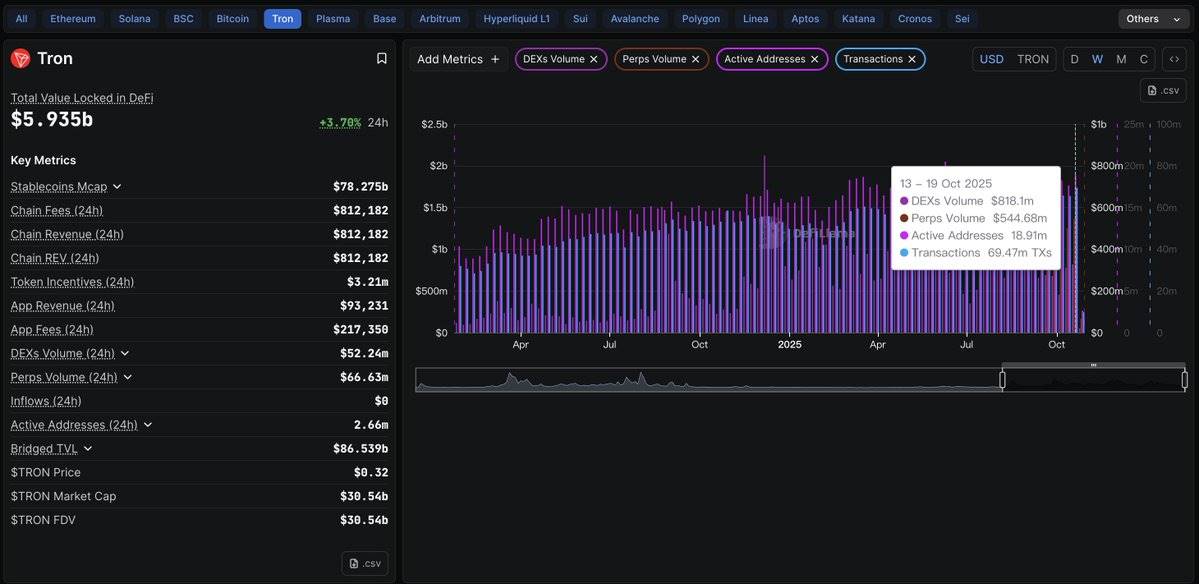

Are Bitcoin Price Models Still a Reliable Guide for Investors in 2025?

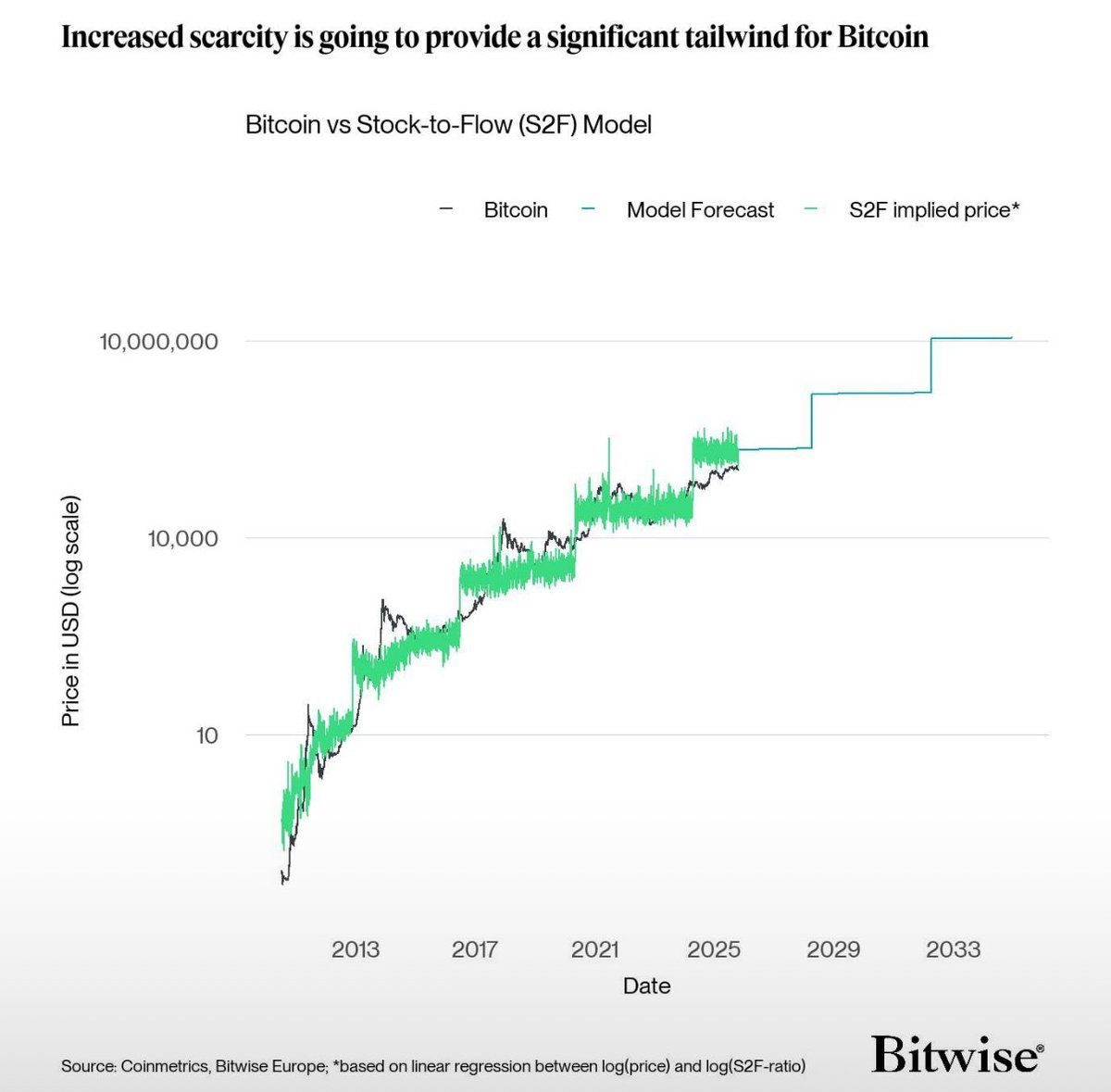

Bitcoin’s famed Stock-to-Flow model predicts massive gains, but analysts argue its scarcity-based logic no longer fits a demand-driven market. Competing models like BAERM and Power Law offer more grounded forecasts but even they have some shortcomings.

Bitcoin’s (BTC) Stock-to-Flow (S2F) model is flashing one of its most bullish forecasts yet, projecting BTC to reach $222,000. However, a Bitwise analyst has cautioned that Bitcoin’s maturing market may be outgrowing its predictive frameworks.

As Bitcoin’s presence in global finance grows, the reliability of price forecasting models becomes crucial. Once a cornerstone of long-term valuation, the S2F model is now being re-examined as shifting market forces challenge its core assumptions.

Has Bitcoin Outgrown the Stock-to-Flow Model?

For context, the Stock-to-Flow model measures Bitcoin’s value based on scarcity. It compares the existing supply (stock) to the annual new supply (flow). The higher the ratio, the scarcer and supposedly more valuable Bitcoin becomes.

PlanB created the model in 2019. It links Bitcoin’s price increases to its halving events, which reduce new coin issuance every four years. The Stock-to-Flow model forecasts that Bitcoin could climb to $222,000 by 2026.

Over the longer horizon, the model projects a staggering 10-year valuation of $10.9 million per BTC, representing an annualized compound growth rate (CAGR) of roughly 58.3%.

However, André Dragosch, Head of Research for Europe at investment firm Bitwise, suggested that investors should exercise caution when leveraging the S2F model, as it may no longer fully capture the realities of today’s Bitcoin market.

“The S2F model is undeniably one of the more bullish frameworks – but use it with caution. Its statistical issues and exclusion of demand-side drivers limit its reliability,” Dragosch wrote.

Stock-to-Flow Model’s Bitcoin Price Prediction. Source:

André Dragosch on X

Stock-to-Flow Model’s Bitcoin Price Prediction. Source:

André Dragosch on X

The analyst highlighted Kripfganz’s criticism of the model. In 2020, the economist argued that it is ‘misspecified’ because Bitcoin’s halvings, which double the S2F ratio every four years, make the variable time-dependent rather than stochastic.

“Beyond theory, Bitcoin has consistently underperformed the S2F-implied price. Residuals show a negative drift and are non-stationary, suggesting omitted variables and statistical flaws,” Dragosch added.

Furthermore, the analyst stressed that Bitcoin’s macro environment has evolved since PlanB’s early analyses.

“Today, institutional demand (via Bitcoin ETPs and treasury holdings) outweighs the annualised supply reduction from the latest Halving by more than 7x,” he noted.

Beyond Scarcity: BAERM and Power Law in the Spotlight

In addition to S2F, Dragosch compared two other widely referenced Bitcoin valuation models, pointing to more measured but still bullish trajectories.

The Halving Supply Shock Model, also known as the ‘Bitcoin Autocorrelated Exchange Rate Model’ (BAERM), measures how each Bitcoin halving affects price over time using past price data. It also accounts for the declining impact of supply shocks.

The BAERM model currently estimates Bitcoin’s ‘fair value’ at $159,000, projecting $173,000 by the end of 2025 and $7.59 million over ten years. It has historically shown a strong predictive fit, with around 88% R² since the second halving.

Despite its strengths, BAERM may now be ‘somewhat outdated,’ according to Dragosch, since it does not fully account for the influence of institutional buying or changing adoption trends.

“It also doesn’t account for a reacceleration in returns via an S-curve type of adoption pattern. However, if you still believe in the high importance of Halvings – this model is for you,” the analyst remarked.

Lastly, the Power Law model ties Bitcoin’s price to a time-based formula. While it lines up with a striking 99% R² in log-log regressions, it is notably conservative.

Its 10-year Bitcoin price prediction sits at $2.03 million, much lower than S2F or BAERM, based on the idea that returns will continue to decline as Bitcoin ages. Yet, the ongoing shift in market structure means that even cautious forecasts may need to reflect new, demand-driven growth possibilities.

“Technological adoption curves tend to follow an S-curve pattern of demand with re-accelerating demand during the transition from ‘early adopters’ to the ‘early majority.’ This is severely challenging the diminishing returns hypothesis of the Power Law. Moreover, the market structure has essentially changed since January 2024 with the rise of ETFs and institutional buyers. Past post-Halving performance patterns might not apply anymore,” Dragosch stated.

Thus, while classic models like Stock-to-Flow, BAERM, and the Power Law still offer valuable perspectives on Bitcoin’s long-term trajectory, they increasingly fall short of capturing today’s demand-driven market. The next market cycle may reveal whether these frameworks evolve or give way to a new paradigm.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

25 basis points not enough? The market bets that the Federal Reserve will continue to cut rates—will Powell signal a shift this time?

Facing internal disagreements and immense political pressure, how will Federal Reserve Chairman Powell signal the future policy path? This may be the key factor determining the direction of the market.

70,000 On-chain Data Reveal Meteora Airdrop: 4 Whale Addresses Take 28.5%, Over 60,000 Retail Users Share Only 7%

The airdrop also involved controversial addresses, including individuals linked to insider trading scandals and large holders with abnormal behavior, which further intensified the community's trust crisis and exposed the project to the risk of class action lawsuits.

The Story of the x402 Foundation: From Advancing the x402 Protocol to Becoming the Golden Key for AI Payments

How does the x402 Foundation turn a single line of code into the golden key for AI payments?

The Return of the Great Sage: How Justin Sun’s “Sun Wukong” Creates a Latecomer’s Contract Legend?

The rise of Sun Wukong not only represents Justin Sun’s strategic positioning in the decentralized contract sector once again, but also symbolizes the resurgence of the Chinese DEX narrative.