Another Year, Another Delay: Mt. Gox Keeps $4 Billion in Bitcoin Off the Market

Bitcoin rallied past $115,000 after Mt. Gox postponed its long-awaited creditor repayments by another year. The defunct exchange will now hold its 34,689 BTC until October 2026, easing market pressure and pushing BTC toward fresh highs.

Mt. Gox’s prolonged repayment saga extends into 2026, keeping 34,000 BTC off the market and easing near-term sell pressure.

The move delays what would have been a supply shock to the Bitcoin market for the third time. It was initially set for October 31, 2023, and October 2025 after that.

Mt. Gox Repayment Extension Eases Immediate Bitcoin Sell-Off Fears

Bitcoin rose nearly 4% in the past 24 hours to trade at $115,559 as of press time. The move follows Mt. Gox again, delaying its long-awaited creditor repayments by another year, now set for October 31, 2026.

INTEL: Mt. Gox has delayed creditor repayments by another year, now due Oct 2026. The exchange still holds 34,689 BTC awaiting distribution.

— Solid Intel 📡 (@solidintel_x)

A Japanese court authorized the decision, meaning roughly 34,689 BTC will remain locked away for at least another twelve months. This limits the immediate risk of a large-scale selloff.

Bitcoin (BTC) Price Performance. Source:

Bitcoin (BTC) Price Performance. Source:

The new notice, dated October 27, 2025, from rehabilitation trustee Nobuaki Kobayashi, explains that while “repayments to eligible creditors are largely completed,” many cases remain unresolved due to incomplete procedures and administrative issues.

“It has become desirable to make the repayments to such rehabilitation creditors to the extent reasonably practicable,” Kobayashi stated in the letter, citing court approval for the one-year extension.

Legal Delays and Lingering Fallout

The extension highlights the lingering technicalities of the 2014 Mt. Gox collapse. Hackers stole around 850,000 BTC worth $450 million from what was once the world’s largest Bitcoin exchange.

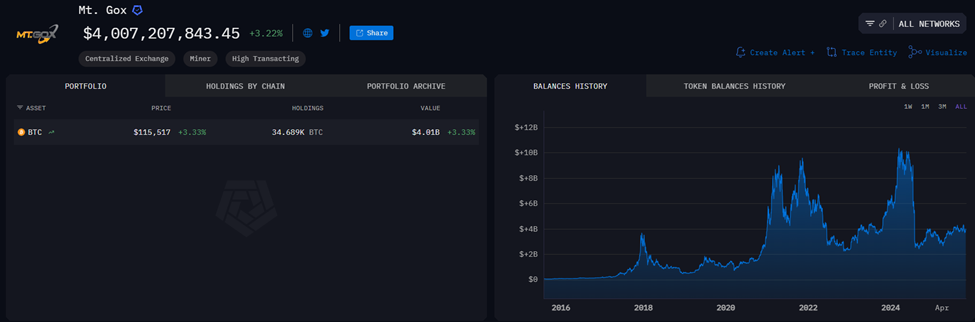

Over 127,000 users have awaited compensation for over a decade, as legal proceedings and asset recovery efforts dragged on. Blockchain data still shows the exchange’s wallets holding 34,689 untouched BTC, valued at over $4 billion at current prices.

Mt. Gox BTC. Source:

Mt. Gox BTC. Source:

According to BeInCrypto’s earlier reporting, Mt. Gox wallets recently showed movement for the first time in seven months, fueling speculation about test transfers ahead of distributions.

Analysts noted that similar activity in the past preceded repayment events. However, the latest development regarding a one-year delay assuages the market and serves as a stabilizing event for Bitcoin.

CryptoQuant analyst Mignolet previously warned that if the trustee fails to secure further extensions, the eventual release of 34,000 BTC could “become a catalyst for creating FUD once again.” This has now been avoided.

Mt. Gox pushes repayments to 2026!Say goodbye to immediate sell-off fears!Market breathing room just got extended.

— 𝐊𝐚𝐦𝐫𝐚𝐧 𝐀𝐬𝐠𝐡𝐚𝐫 (@Karman_1s)

The fears abounded as weakening liquidity in OTC (over-the-counter) markets raised concerns. Unlike last year, that volume is now weakening, raising uncertainty about whether the market could absorb 34,000 Bitcoins at once as it did before.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ultiland: The new RWA unicorn is rewriting the on-chain narrative of art, IP, and assets

Once attention forms a measurable and allocatable structure on-chain, it establishes the foundation for being converted into an asset.

Crypto 2026 in the Eyes of a16z: These 17 Trends Will Reshape the Industry

Seventeen insights about the future summarized by several partners at a16z.

The Federal Reserve's $40 billion purchase of U.S. Treasuries is not the same as quantitative easing.

Why is RMP not equivalent to QE?