Pi Coin Price Ending 2-Week Consolidation Requires This From Investors

Pi Coin remains stuck near $0.207 as weak inflows limit breakout potential. A surge past $0.209 could spark recovery, but losing $0.198 may trigger further downside.

Pi Coin’s price has entered another phase of sideways movement after several attempts to break past resistance failed. Over the past few days, the cryptocurrency has remained largely stagnant, lacking strong investor participation.

Pi Coin’s price continues to hover within a narrow range, signaling hesitation among traders waiting for a clearer market direction.

Pi Coin Needs Support

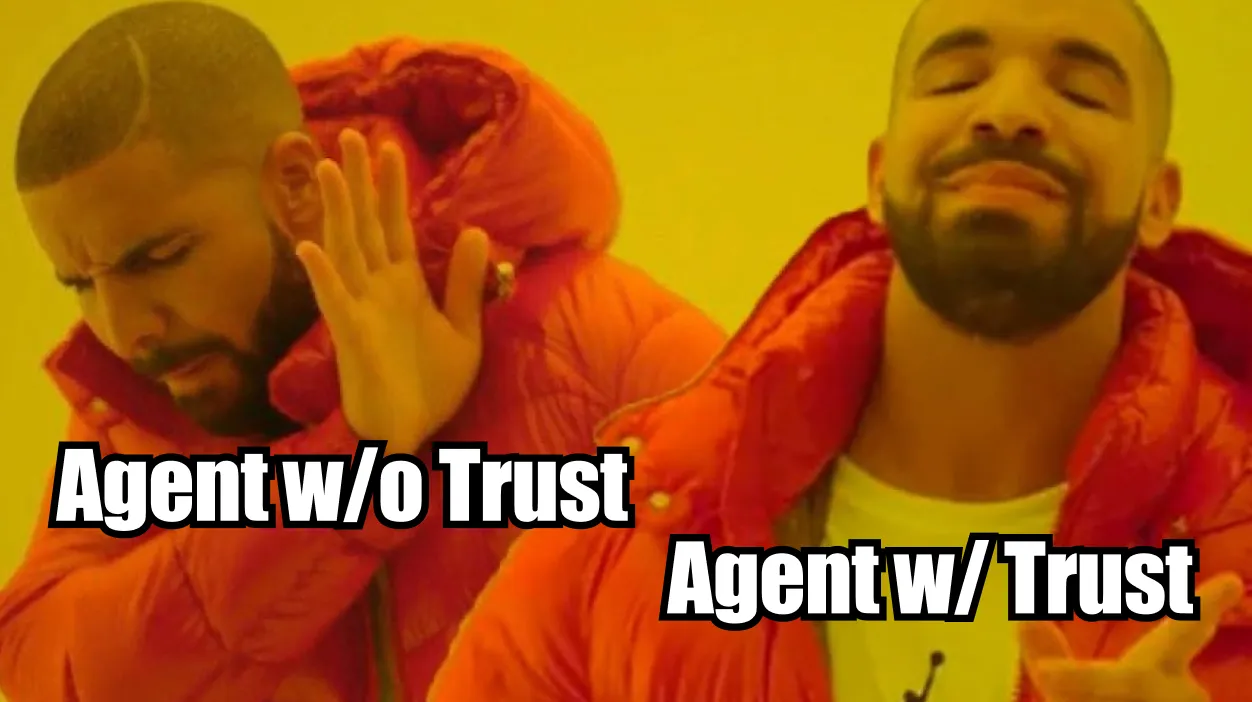

The Chaikin Money Flow (CMF) indicator shows inflows into Pi Coin are slowly increasing, but the pace remains modest. This signals that while investor interest is gradually returning, it is still insufficient to fuel a meaningful breakout.

Without stronger capital inflows, the coin’s recovery could remain subdued in the short term.

Historically, rising inflows often serve as a catalyst for sustained rallies, but current CMF readings suggest liquidity pressure persists. To support a bullish reversal, Pi Coin needs consistent accumulation from investors and renewed participation from large holders.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

Pi Coin CMF. Source:

Pi Coin CMF. Source:

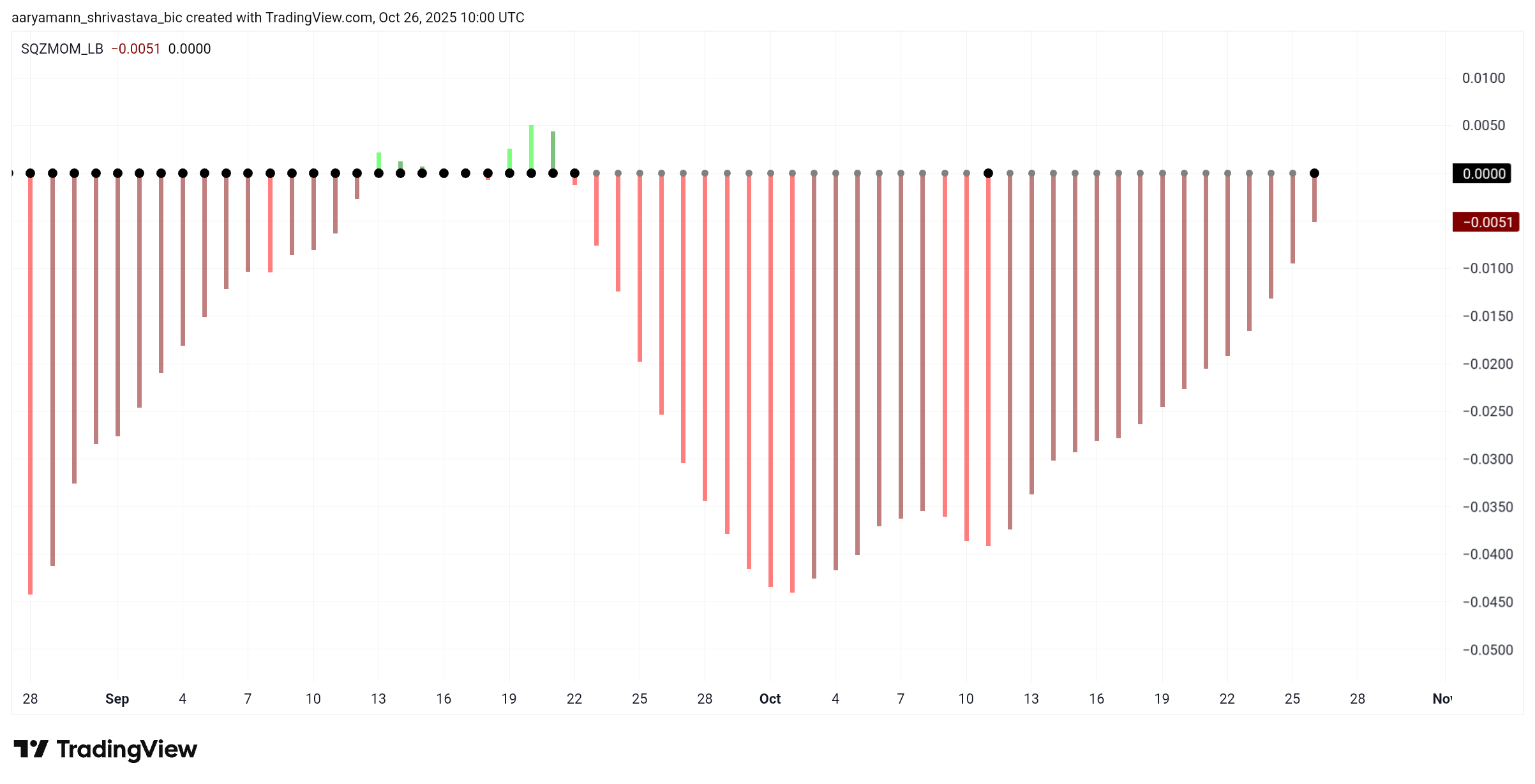

From a macro perspective, Pi Coin’s market momentum is showing early signs of stabilization. The Squeeze Momentum Indicator reveals that bearish pressure is gradually fading, indicating that sellers may be losing control. However, momentum remains muted as traders await confirmation of a trend reversal.

A squeeze buildup on the chart suggests a potential volatility expansion is approaching. If this squeeze releases in favor of the bulls, Pi Coin could experience a notable price jump.

Pi Coin Squeeze Momentum Indicator. Source:

Pi Coin Squeeze Momentum Indicator. Source:

PI Price Needs To Breakout

Pi Coin is currently priced at $0.207, sitting just below the $0.209 resistance. The altcoin has remained rangebound for nearly two weeks, holding above the critical $0.198 support zone. This consolidation phase highlights indecision among traders as both bulls and bears struggle for control.

If market inflows strengthen, Pi Coin could break through the $0.209 resistance and rally toward $0.229. Sustained buying volume and renewed investor participation will be essential for this move. A confirmed breakout above $0.209 would signal improving momentum and attract new short-term traders.

Pi Coin Price Analysis. Source:

Pi Coin Price Analysis. Source:

However, if Pi Coin faces bearish headwinds, the price could continue consolidating or dip below $0.198. A break under this support might push the coin toward $0.180, invalidating the bullish outlook. Weak inflows and selling pressure would likely reinforce this downside scenario.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025: The Most Bizarre Crypto Cycle in History—Manipulation, Collapse, and the Rebirth of a New Order

4E: Declining Bitcoin illiquidity supply may suppress price rebound

Pieverse to launch x402b protocol, supporting BNB Chain gas-free payments and compliant receipts

In-depth Analysis of Talus: How Digital Workforce is Changing the Way We Work?

Exploring how Talus builds an autonomous digital economic system through blockchain-based AI agent trust infrastructure.