Crypto ETF Weekly Report | Last week, US Bitcoin spot ETFs saw a net inflow of $446 million; US Ethereum spot ETFs saw a net outflow of $243 million

The first Solana exchange-traded fund in Hong Kong, "ChinaAMC Solana ETF," has been approved.

Compiled by: Jerry, ChainCatcher

Performance of Crypto Spot ETFs Last Week

US Bitcoin Spot ETFs Net Inflow of $446 Million

Last week, US Bitcoin spot ETFs saw three days of net inflow, with a total net inflow of $446 million.

Last week, 9 ETFs were in a net inflow state, with the main inflows coming from IBIT, ARKB, and FBTC, with inflows of $324 million, $54 million, and $52.3 million, respectively.

Data source: Farside Investors

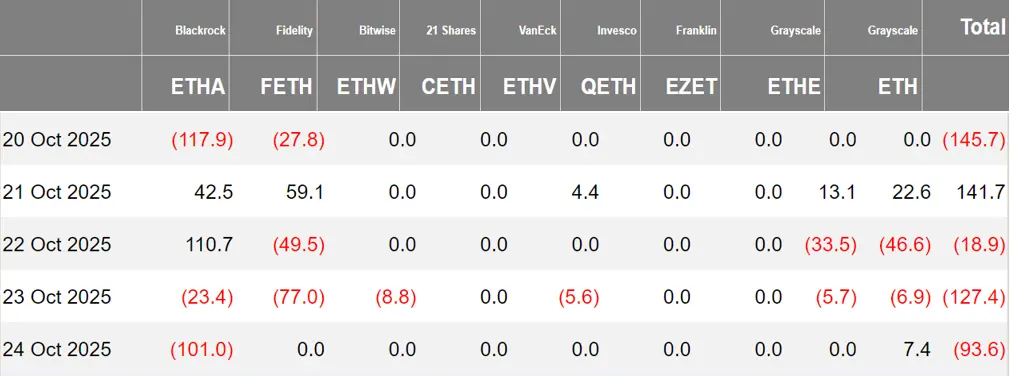

US Ethereum Spot ETFs Net Outflow of $243 Million

Last week, US Ethereum spot ETFs saw four days of net outflow, with a total net outflow of $243 million.

The main outflow last week came from BlackRock ETHA, with a net outflow of $95.2 million. Six Ethereum spot ETFs were in a net outflow state.

Data source: Farside Investors

Overview of Crypto ETF Developments Last Week

Caixin: Hong Kong's First Solana Spot ETF Does Not Include Staking

According to Caixin, the Hong Kong Securities and Futures Commission has approved the listing of the "ChinaAMC Solana ETF" on the Hong Kong Stock Exchange. Although Hong Kong regulations now allow virtual asset spot ETFs to offer staking services, the ChinaAMC Solana ETF does not include staking. Industry insiders revealed that this may be due to a previous incident where staking service provider Klin was suspected of being hacked, leading to a theft incident at Swiss-based crypto platform SwissBorg, prompting Hong Kong regulators to believe that the staking function requires more cautious evaluation.

155 Crypto ETF Applications Pending Approval in the US, Led by Bitcoin and Solana

According to Bloomberg, as of now, there are 155 crypto-based exchange-traded product (ETP) applications in the US, covering 35 digital assets. Bitcoin and Solana each have 23 applications, XRP has 20, and ETH has 16.

Although the US government shutdown has delayed the approval process, industry experts remain optimistic that approval is imminent. Recently, issuers have been actively submitting 2x, 3x leveraged ETFs and products with staking mechanisms, reflecting a "land grab" trend in the crypto ETF market. Analysts point out that investors prefer to diversify into emerging digital assets through index and actively managed ETFs rather than single tokens. Since the launch of spot Bitcoin and Ethereum ETFs in January and July 2024, BTC ETF assets under management have reached nearly $150 billion, and ETH ETFs about $24 billion.

US Asset Management Firm T.Rowe Files for Crypto ETF

US asset management firm T.Rowe has filed for a crypto ETF.

The ETF is named “T. ROWE PRICE ACTIVE CRYPTO ETF” and aims to outperform the FTSE US Listed Crypto Index, which consists of the top 10 crypto assets by market capitalization that meet the US SEC's general listing standards.

Hong Kong's First Solana Exchange-Traded Fund "ChinaAMC Solana ETF" Approved

According to Hong Kong Economic Times, the Hong Kong Securities and Futures Commission has officially approved the first Solana (SOL) spot ETF, issued by ChinaAMC (Hong Kong), making it the third approved crypto spot ETF after Bitcoin and Ethereum, and the first of its kind in Asia.

This ETF (code: 03460) is expected to be listed on the Hong Kong Stock Exchange on October 27, with RMB counter (83460) and USD counter (9460). Each trading lot is 100 units, with a minimum investment of about $100. Its virtual asset trading platform is OSL Exchange, with a management fee rate of 0.99% and an annual recurring expense ratio of about 1.99%.

Standard Chartered Hong Kong to Launch Virtual Asset ETF Trading Service in November

According to Ming Pao, Standard Chartered Hong Kong recently conducted a survey under the HKMA's "e-HKD+" project and found that three-quarters of high-end clients are interested in digital assets, and nearly 80% of respondents intend to participate in digital asset investment activities in the next 12 months.

Ho Man Chun, Head of Wealth Solutions at Standard Chartered Hong Kong, said the bank will launch virtual asset ETF trading services in November, allowing clients to participate in emerging investments through the Standard Chartered platform, thus diversifying their asset allocation and wealth management choices.

VanEck Submits Lido Staked Ethereum ETF Application

According to official sources, ETF issuer VanEck has submitted an S-1 registration application to the US SEC for the “VanEck Lido Staked ETH ETF,” which aims to allow investors to earn Ethereum staking rewards through Lido protocol's staked ETH token, stETH.

Kean Gilbert, Head of Institutional Relations at Lido Ecosystem Foundation, said: "This application marks the growing recognition of liquid staking as a core component of Ethereum infrastructure. Lido protocol's stETH demonstrates that decentralization and institutional standards can coexist, laying the foundation for broader market development."

This ETF will hold stETH, benefiting from its fully audited smart contracts, deep secondary market liquidity, and integration with leading custodians and exchanges. If approved, the ETF will provide institutional investors with a compliant and tax-efficient channel to participate in Ethereum staking within a regulated investment framework.

Osprey Submits S-1 Application for Solana Spot ETF to US SEC

21Shares Submits New INJ ETF Application

Opinions and Analysis on Crypto ETFs

Glassnode: Bitcoin ETF Net Inflow Recovery Usually Indicates Demand Rebound and Early Trend Reversal

Glassnode posted data on social media indicating that spot Bitcoin ETFs have seen net capital outflows, a phenomenon often concentrated near local market lows and accompanied by fading market sentiment. When capital flows stabilize or turn positive, historical patterns suggest this usually marks the early stage of demand recovery and trend reversal.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Fed Decision, Big Tech Earnings, and Global Talks Ahead

Fed rate decision, Big Tech earnings, and US-China talks to shape markets this week.Fed Rate Decision Takes Center StageBig Tech Earnings: Microsoft, Alphabet, Meta, Apple, AmazonTrump-Xi Meeting Adds Geopolitical Weight

Solana Faces Selloff, Filecoin Builds Strength, and BlockDAG Rockets Past $425M Ahead of Genesis Day!

Explore Solana’s struggle to hold $180 and Filecoin’s bullish wedge. Plus, learn more about BlockDAG’s record-breaking $430M presale as its Genesis Day countdown accelerates!Solana’s Price Pullback Sparks UncertaintyFilecoin Consolidates Near $1.55BlockDAG: Entering the Final Countdown to Genesis Day!Final Thoughts

Australia’s Crypto Laws Get Thumbs Up — With a Catch

Australia’s draft crypto laws are welcomed, but vague terms may hinder growth, warn industry leaders.Why Definitions Matter in CryptoStriking the Right Balance

Filecoin Gives Back Most of Early Gains, Remains Barely Higher