$15 Billion Bitcoin Black Ledger: The Rise and Fall of Telecom Fraud Kingpin Chen Zhi

Chen Zhi, a 28-year-old from Fujian, founded Prince Group, the largest real estate conglomerate in Cambodia. He was later indicted by the U.S. Department of Justice for alleged transnational online fraud and money laundering, with $15 billion worth of bitcoin seized. His fraudulent empire involved large-scale online gambling and "pig-butchering" scams, and maintained operations by bribing public officials in multiple countries. Although he enjoyed a reputation as a philanthropist and entrepreneur in Cambodia, the true nature of his business empire has now been exposed.

Jiemian News Reporter: Wang Sisi, Zhao Meng

Jiemian News Editor: Liu Haichuan

Chen Zhi, who hails from a small town in Fujian with an ordinary family background, founded Cambodia's largest real estate group at the age of 28, quickly becoming one of the most prominent local tycoons. Ten years later, he was accused by the U.S. Department of Justice of being the mastermind behind a "transnational online fraud empire," with approximately $15 billion worth of bitcoin seized; the UK also imposed sanctions on him, freezing 19 properties in London and all his assets in the UK.

Even before the U.S. indictment, Chinese public security authorities had already launched an investigation into him. A 2023 verdict showed that his associated online gambling company was involved in cases exceeding 5 billion yuan. To this day, Chen Zhi still serves as an executive and shareholder in multiple companies, most of which continue to operate normally.

Chen Zhi's family back home recalled that someone once went to Cambodia to be his driver and returned a few years later driving a Bentley; many villagers went abroad to work for him as "henchmen," with annual salaries starting at one million yuan. The villagers generally knew that his main "business" in Cambodia was fraud, and some, upon hearing of the U.S. sanctions, sighed, "This day was bound to come."

Jiemian News interviewed several people close to Chen Zhi, reviewed the U.S. Department of Justice's indictment, and visited the casino under Prince Group in Sihanoukville, Cambodia, in an attempt to reconstruct the rise and fall of this "online fraud empire."

The indictment shows that Chen Zhi and his associates kept ledgers recording multiple transactions of bribes to foreign officials—millions of dollars spent on luxury goods, yachts, and the use of diplomatic passports for convenient travel; the ledgers also systematically reflected the management and profitability of each Prince Group scam camp, specifying the responsible floors and buildings for each project, and even detailing the different "pig-butchering" scam methods used for different countries and regions.

These ledgers provided direct, quantifiable evidence for the charges of online fraud and money laundering against Chen Zhi, also revealing the dark network behind his wealth.

"People like him should have been arrested long ago"

Short, with a large forehead, speaking with a Fujian accent, his car was a Rolls-Royce, always accompanied by bodyguards. This was Yang Ling's first impression of Chen Zhi. In 2020, while working overseas, Yang Ling met Chen Zhi for the first time during a business meeting in northern Myanmar.

According to Yang Ling, several bosses present at the time all operated casinos in Southeast Asian countries, "all from Fujian." In her impression, Chen Zhi looked about 1.68 meters tall, and his short stature was accentuated by the bodyguards around him, but his eyes always revealed a certain "ruthlessness."

Qiu Yifan, also from Lianjiang County, is a fellow townsman of Chen Zhi. He said Chen Zhi is from Xiao'ao Town, Lianjiang County, with a high school education. Qiu Yifan also mentioned that before going abroad, Chen Zhi worked as an internet café administrator in Guangdong and Jiangsu for 2-3 years, then engaged in data trading and transmission, and ran matchmaking and gaming social websites. Later, Chen Zhi formed a team to run private servers for the game "Legend" (pirated servers), which became his first pot of gold.

Public information shows that Chen Zhi was born in Fujian in 1987. According to the website of his personally invested Singapore fund management company DW Capital Holdings, Chen Zhi is "a young business prodigy," whose first entrepreneurial venture was investing in a small internet café in Fujian. In 2011, Chen Zhi entered the Cambodian real estate market, developing "unknown waters." He gradually expanded, founding Prince Holding Group.

Xiao'ao Town is located in the southeast of Lianjiang, facing the Matsu Islands across the sea to the east, bordering Guantou to the south, Dongdai to the north, and adjacent to Lianjiang city center to the west. Located at the confluence of the Minjiang and Aojiang river estuaries, it features unique coastal landscapes and has served as a filming location for several movies and TV dramas such as "Hero Zheng Chenggong" and "That Mountain, That Sea."

In this seaside tourist town, Chen Zhi came from an ordinary family. Someone familiar with Chen Zhi's parents told Jiemian News that the Chen family's economic status was average for Lianjiang County. Locals couldn't say exactly when Chen Zhi went to Cambodia, but they "all knew it was for fraud."

Lin Bing, also from Xiao'ao Town, said Chen Zhi has an older brother, also in Cambodia. Lin Bing revealed that many people from several villages near Xiao'ao Town went to Cambodia to work for Chen Zhi. "Once there, they would crazily add Chinese people on WeChat, then lure them into online gambling through chatting. Who knows how many families were ruined." Lin Bing's tone was full of disdain, "People like him should have been arrested long ago."

Correspondingly, recently, the U.S. Department of Justice announced an unprecedented transnational crime case involving the seizure of about 127,271 bitcoins (worth about $15 billion), the largest cryptocurrency asset seizure in U.S. history, exposing Chen Zhi's "online fraud empire" to the world.

According to civil forfeiture and criminal indictments filed by the U.S. Attorney's Office for the Eastern District of New York, Chen Zhi (English name Vincent), who holds passports from China, Cambodia, Vanuatu, Saint Lucia, and Cyprus, is accused of leading one of Asia's largest transnational criminal organizations, causing billions of dollars in losses to global victims. Nearly ten co-defendants are also named, though not identified.

The indictment shows that since around 2015, Chen Zhi built at least 10 scam compounds in Cambodia. These compounds were surrounded by high walls and barbed wire, with thousands of cross-border workers seeking job opportunities trafficked there, forced to carry out large-scale online fraud under threats of violence.

The indictment specifically names three compounds: Jinbei Compound (located in Sihanoukville, Cambodia, associated with Jinbei Casino), Golden Fortune Technology Park (located in Chrey Thom, also known as "Jinyun Technology Park"), and Mango Park (located in Kampong Speu Province, also known as "Jinhong Park").

In September 2019, Jiemian News reporters visited several scam compounds in Sihanoukville, Cambodia. At that time, Cambodia was cracking down on online gambling and fraud, forcing many scam compounds to close or relocate, but Jinbei Compound continued to "operate" as usual. Several people trapped in the compound sent messages for help to reporters. It was rumored that the Jinbei Compound "boss had connections." The casino inside Jinbei Entertainment City was lavish, with a constant stream of players, open all night.

Jinbei Entertainment City under Prince Group.

Jinbei Entertainment City under Prince Group. Insiders told Jiemian News that in recent years, Chen Zhi's compounds have shifted to targeting the U.S. and European markets.According to U.S. Treasury data, financial losses from online investment fraud in the U.S. have continued to rise in recent years, totaling over $16.6 billion.

The indictment shows that the main scams run by Prince Group compounds were so-called "pig-butchering" scams, a type of carefully designed investment fraud. Chen Zhi personally participated in managing these bases and kept detailed profit records, clearly labeled as "pig-butchering."

At Prince Group's Jinhong Park, a ledger kept by Chen Zhi detailed the types of scams handled by different floors, including "Vietnam order fraud," "Russian order fraud," "U.S. and European investment script chatting," and "Chinese fake orders."Internal documents also included manuals on how to build trust with victims, even suggesting the use of "not-so-attractive" female photos as avatars to make accounts appear more authentic and credible.

Chen Zhi is charged with two counts: Wire Fraud Conspiracy and Money Laundering Conspiracy. Due to the huge amount involved, if convicted, he could face up to 40 years in prison.

The Establishment of the "Fraud Empire"

In October, after Chen Zhi was indicted, the Prince Group he founded in 2015 also came under the spotlight.

Prince Group is headquartered in Phnom Penh, Cambodia, and is one of the largest conglomerates in the country. It claims to operate over 100 business entities in more than 30 countries, with businesses covering real estate development, financial services, tourism, and consumer services. Its well-known subsidiaries include Prince Real Estate Group, Prince Bank, and Awesome Global Investment Group.

Chen Zhi's business empire is spread throughout Cambodia, with real estate investments alone reaching $2 billion, including the large shopping mall Prince Plaza in Phnom Penh.

Moreover, Chen Zhi's business ambitions have long extended overseas. Since February 2025, Prince Group haslaunched a "strategic layout" in China, with showrooms already opened or being prepared in Japan, Thailand, Vietnam, Russia, and other countries. Related content about the opening of these showrooms can still be found on internet platforms.

However, the indictment reveals the true nature of this business empire: fraud and money laundering account for the vast majority of Prince Group's income, while many of its legitimate businesses are unprofitable or even loss-making, serving only to cover up fraud and money laundering.

To improve the efficiency of fraud, Chen Zhi and his co-defendants purchased advanced equipment. The indictment shows that in 2018, a co-defendant bought millions of phone numbers and account passwords from illegal online markets, and Chen Zhi himself kept documents describing a "Golden Fortune Technology Park"—an automated call center equipped with 1,250 phones, controlling 76,000 social media accounts.

Automated call center used for scams in the fraud compound. Image from the indictment released by the U.S. Department of Justice

Automated call center used for scams in the fraud compound. Image from the indictment released by the U.S. Department of Justice The indictment alleges that a co-defendant boasted in the summer of 2022 that in 2018, Prince Group made over $30 million a day from "pig-butchering" scams and related illegal activities, with annualized revenue of about $11 billion. On an annual basis, this was nearly one-third of Cambodia's GDP that year.

Prince Group frequently used violence to maintain the operation of its scam bases. In one incident, Chen Zhi approved the beating of someone "causing trouble" at the base but instructed "not to beat him to death," adding, "We must keep an eye on them and not let them escape." The indictment includes images kept by Chen Zhi showing evidence of violence, with visible injuries on several people. The indictment states thata 25-year-old Chinese citizen was brutally murdered in 2023, an incident linked to Prince Group.

To protect the criminal enterprise, Chen Zhi and his co-defendants systematically bribed public officials in multiple countries. One co-defendant was appointed as Prince Group's risk control director, specifically to monitor investigations and conduct corrupt dealings with foreign law enforcement officials.

In May 2023, co-defendant-2 communicated with a senior official who said he could help Prince Group co-defendants get out of trouble. In return, co-defendant-2 offered to "take care of" the official's son.

Bribery ledgers kept by Chen Zhi show that in 2019, a co-defendant bought a yacht worth over $3 million for a senior government official. Chen Zhi himself also bought luxury watches worth millions of dollars for another high-ranking official. In 2020, that official helped Chen Zhi obtain a diplomatic passport, which Chen Zhi used to travel to the U.S. in April 2023.

The indictment alleges that co-defendant-2 once boasted: "Whenever there is a law enforcement crackdown on the scam compounds, we come out unscathed." Chen Zhi himself also bragged to others about his special connections, including exchanging bribes for advance notice of law enforcement actions to evade sanctions.

127,271 Bitcoins

Prince Group's fraud extended to the U.S. mainland. In the Eastern District of New York, a local organization called The Brooklyn Network assisted Prince Group's Jinbei Compound in carrying out investment scams. Scammers contacted victims via messaging apps, claiming to make money investing in cryptocurrency or forex markets. They introduced victims to so-called "account managers," who provided bank account information and created investment portfolios on fake trading platforms.

However, these bank accounts were actually opened by The Brooklyn Network under shell company names at New York financial institutions. The victims' funds were not invested but misappropriated and laundered through these accounts. The "growth" shown on the trading platform was entirely fake. When victims tried to withdraw large sums, they were told to pay transaction fees, taxes, or legal fees, and eventually, all contact was cut off.

From May 2021 to August 2022, The Brooklyn Network, on behalf of Prince Group, defrauded and laundered over $18 million from more than 250 victims in the Eastern District of New York and across the U.S.

Chen Zhi and his co-defendants laundered huge criminal proceeds through a complex multilayered network. This included using money brokers specializing in money laundering to receive fraud proceeds stolen from Prince Group's scam activities, then channeling the funds back to Prince Group. A common method was to collect scam proceeds in the form of bitcoin or stablecoins, then convert them to fiat currency. The launderers would then use these funds to buy clean bitcoin or other cryptocurrencies.

The indictment alleges that Chen Zhi directly participated in coordinating these money laundering activities and discussed with co-defendants the illegal money brokers and underground banks he used. Chen Zhi kept documents explicitly mentioning "BTC whitening" and "BTC money laundering personnel."

Huione Group, based in Cambodia (hereinafter referred to as "Huione"), was identified as the main money laundering institution in this operation. The U.S. Treasury Department's Financial Crimes Enforcement Network (FinCEN) stated that from August 2021 to January 2025, Huione laundered at least $4 billion, including at least $37 million from North Korea-related cyber theft; at least $36 million from virtual currency investment scams; and about $300 million from other cybercrimes.

According to Huione's official website, it was founded in 2014 as an innovative company aiming to bring leading fintech services to the world. Several insiders told Jiemian News that Huione has some connection to Prince Group. Some said Huione's founder was once Chen Zhi's subordinate, "apparently the former finance manager of Prince Group."

Huione's reputation as the "world's largest online black market" has long been established. U.S. company Elliptic, dedicated to preventing crypto financial crime, found that Huione built a "one-stop crime platform" on Telegram (a cross-platform instant messaging app), gathering numerous third-party vendors selling tech tools, personal data, and money laundering services, mainly serving Southeast Asian crypto scam groups and illegal online operators. In May 2015, Telegram comprehensively blocked Huione-related channels and groups.

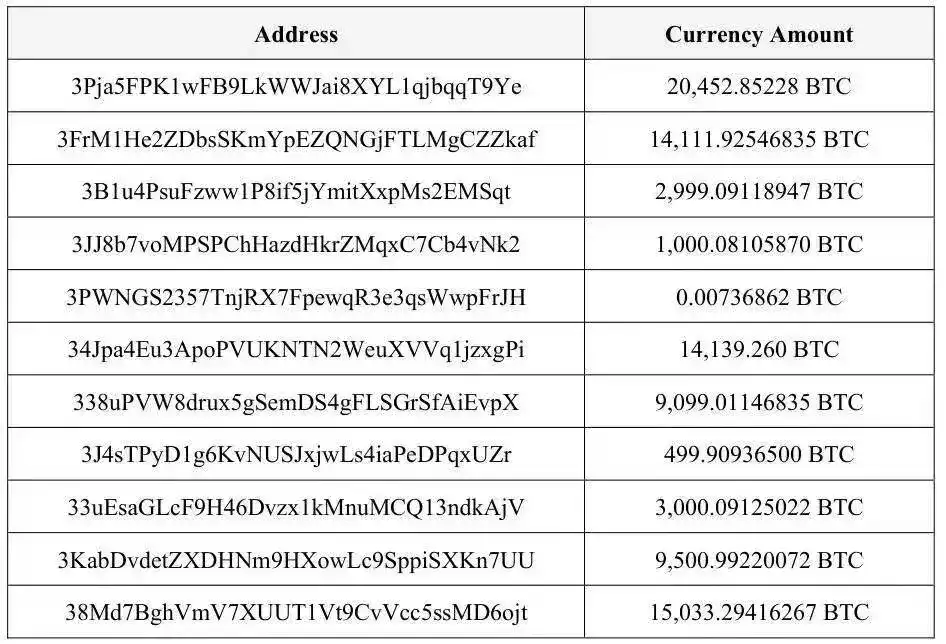

By 2020, Chen Zhi had accumulated about 127,271 bitcoins in laundered proceeds, stored in non-custodial wallets where he personally controlled the private keys. At current market value, these bitcoins are worth about $15 billion.These cryptocurrencies were stored in 25 cryptocurrency addresses, all belonging to non-custodial wallets controlled and tracked by Chen himself. Chen Zhi personally recorded the wallet addresses and mnemonic phrases corresponding to each private key.

Virtual currency addresses purchased by Chen Zhi after money laundering (partial). Image from the indictment released by the U.S. Department of Justice

Virtual currency addresses purchased by Chen Zhi after money laundering (partial). Image from the indictment released by the U.S. Department of Justice FBI cryptocurrency analysts determined that the 25 cryptocurrency addresses controlled by Chen Zhi could be divided into 13 clusters, showing similar funding source patterns. These addresses mainly received funds from two sources: cryptocurrency mining and indirect transfers from centralized exchanges (especially those uncooperative with U.S. law enforcement).

The money laundering process used complex "decentralized processing" and "centralized transfer" techniques: large amounts of cryptocurrency were repeatedly split into dozens of wallets, then re-aggregated into fewer wallets, serving no commercial purpose other than to obscure the source of funds.

For example, one case showed that funds from a bitcoin mining pool were split into 22 separate addresses, then re-merged into a centralized transfer address, and then transferred to a wallet controlled by Chen Zhi. Another case showed that funds from an exchange were split into 27 addresses, also transferred out through the same centralized transfer address.

Chen Zhi used fraud proceeds to fund large-scale cryptocurrency mining operations, including Laos-based Warp Data and its Texas subsidiary, as well as a mining company. This mining company once operated the world's sixth-largest bitcoin mining business. Chen Zhi boasted to others that these mining operations were "highly profitable because there are no costs."

Investigations also found that bitcoin transfers from exchanges closely matched mining revenues in both timing and amount, indicating a deliberate attempt to create the illusion that all funds came from mining.

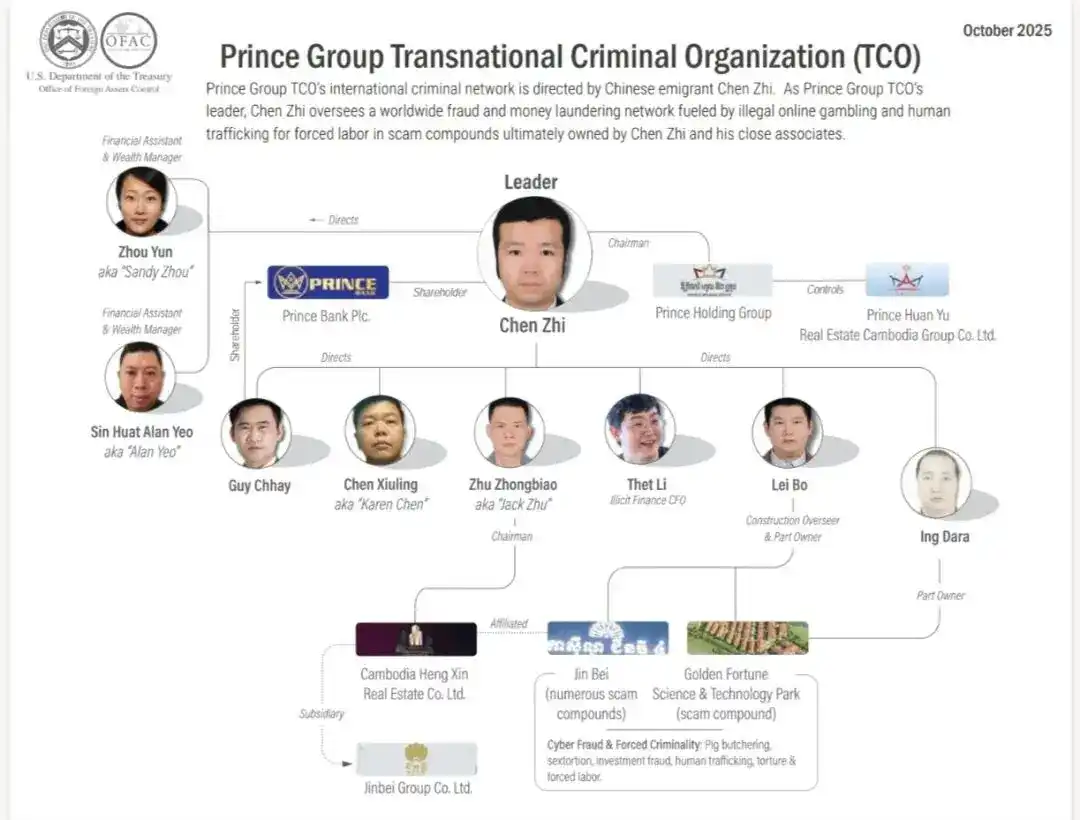

The indictment shows that a total of 128 companies and 18 individuals have been sanctioned by the U.S. Treasury Department's Office of Foreign Assets Control (OFAC) for their association with Prince Group. Most of these people are Prince Group members or Chen Zhi's relatives, with related companies registered in Cambodia, Singapore, the British Virgin Islands, the Cayman Islands, and the Pacific island nation of Palau, most of which are "offshore shell companies with no obvious actual commercial or business activity."False statements were provided when opening accounts for these companies.

Chen Zhi and Prince Group's criminal network. Image from OFAC

Chen Zhi and Prince Group's criminal network. Image from OFAC For example, one company claimed when opening an account that it was for "proprietary trading and investment," with income sources as "personal wealth," and monthly transactions of about $2 million, but bank records showed that in February 2020, there were actually about $22.5 million in deposits and $21.8 million in withdrawals, an underestimation of over 1,000%. This is suspected of violating multiple U.S. laws.

Ultimately, some of these funds were used for luxury travel, entertainment, and the purchase of expensive items. Purchases included watches, yachts, private jets, vacation homes, high-end collectibles, and rare items. Among these artworks was a Picasso painting purchased through a New York City auction house.

Chen Zhi's Group Was Once Investigated Domestically

Jiemian News found that over the past 15 years, Chen Zhi has been active in China's capital markets, involving fields such as healthcare, entertainment, technology, and commerce. In 2010, Chen Zhi served as the legal representative and executive director of Jiangmen Dacheng Medical Equipment Co., Ltd. In 2011, he was a director of Jiangxi Damai Interactive Entertainment Technology Co., Ltd.

In the following years, he successively became an executive in several domestic healthcare and commercial companies. To this day, Chen Zhi is still the manager and executive director of Taizhou Gangbiao Trading Co., Ltd. and Zhuhai Yisheng Biotechnology Co., Ltd. In the former, Chen Zhi also holds 100% of the shares.

Tianyancha shows thatTaizhou Gangbiao Trading Co., Ltd. (formerly known as Lianyungang Pubiao Trading Co., Ltd.), established in 2012 and located in Taizhou, Zhejiang Province, is mainly engaged in wholesale business. Its business scope includes: food sales; retail of edible agricultural products; sales of gifts and flowers; furniture sales; cosmetics sales; retail of jewelry; sales of auto parts; sales of Class II medical devices, etc. In 2015, the company was listed as an abnormal business for failing to submit annual reports for 2013 and 2014 as required.

Jiemian News found that Chen Zhi has invested in 12 domestic companies to date, of which 4 are marked as "deregistered" and 1 as "revoked." The company in which he holds the largest share and investment is Chongqing Quisu Infinite Equity Investment Fund Management Co., Ltd. (hereinafter referred to as "Quisu Fund"), which is still active.

Tianyancha shows that Quisu Fund was established in 2015,and is a high-tech venture capital fund focused on internet, mobile internet, mobile games, and related industries. The first phase of the fund reached 500 million yuan, providing financial support for Chinese internet startups and enterprises.Its registered capital is 50 million yuan, with Chen Zhi holding 70% of the shares.

In July 2021, the company was listed as an abnormal business by the Chongqing Liangjiang New Area Market Supervision Administration for failing to disclose its annual report within the deadline. In October 2024, Quisu Fund was again listed as an abnormal business for being unreachable at its registered address or place of business.

On December 9, 2022, the Asset Management Association of China (hereinafter referred to as "AMAC") issued the "Announcement on Deregistering the Private Fund Manager Registration of 27 Institutions Including Chongqing Zhengyin Guanghui Equity Investment Fund Management Co., Ltd. That Failed to Submit Special Legal Opinions Upon Expiry" (hereinafter referred to as the "Announcement").

The "Announcement" shows that27 private fund managers, including Quisu Fund, had abnormal business conditions and failed to submit compliant special legal opinions within three months after written notice. Therefore,AMACderegistered the private fund manager registration of these 27 institutions and recorded the situation in the capital market integrity database.

In March 2025, after a spot check, the Chongqing Securities Regulatory Bureau again stated regarding Quisu Fund: The company had its private fund manager qualification revoked by AMAC on December 9, 2022, and no longer has the qualification to conduct private fund business, nor may it use the words "fund," "fund management," "private placement," or similar names to engage in private fund business activities.

However, as of now, Quisu Fund has not changed its name.

On the morning of October 22, Jiemian News reporters called the Chongqing Securities Regulatory Bureau regarding this matter. The bureau stated that since Quisu Fund's private fund qualification was revoked in December 2022, they have repeatedly urged it to change its name and have issued relevant risk reminders to the public.

As for whether there were any previous violations or compliance issues, the Chongqing Securities Regulatory Bureau could not give an accurate answer due to the long time since Quisu Fund's deregistration. The staff explained, "His private fund qualification has been revoked for three years, and it is no longer under our jurisdiction." For more questions, the staff suggested consulting other local departments in Chongqing.

In fact, before the joint UK-US indictment, there had already been crackdowns on Chen Zhi's group in China.

In 2020, the Beijing Public Security Bureau set up the 5.27 task force to investigate the "Cambodia Prince Group major cross-border online gambling crime group"; in 2023, the Wangcang Court in Sichuan Provinceheard a major cross-border online casino case. The defendantYuan Mouhua was found to have partnered with Prince Group stakeholders since 2016 to set up an online gambling company targeting Chinese citizens,with the amount involved exceeding 5 billion yuan.

Prisoners abused inside the online fraud compound. Image from the indictment released by the U.S. Department of Justice

Prisoners abused inside the online fraud compound. Image from the indictment released by the U.S. Department of Justice Turbulence in Cambodia

On one hand, he is called a "cyber fraud kingpin" by the U.S. and UK; on the other, he is a prominent figure in Cambodia's business community, enjoying a stellar reputation.

Ten years ago, since the founding of Prince Group, Chen Zhi seemed intent on displaying his "charitable" side. In Cambodia, he launched numerous charity projects. Prince Group collectively branded them as "Prince Charity," claiming to focus on education and youth development, healthcare, community engagement, and sports. Chen Zhi himself is lauded on the official website as a "respected entrepreneur in Cambodia's business community."

Among the so-called Prince Charity projects, there is a "Chen Zhi Scholarship" named after him, described as a flagship project. Partner institutions include Royal University of Phnom Penh (Information Technology Engineering, Computer Science, International Business Management, Media and Communication); Institute of Technology of Cambodia (Civil Engineering); National University of Management (Digital Economy and Tourism).

It is not hard to see that the sponsored students are all in fields related to Chen Zhi's business empire. Whether this is intentional talent cultivation is unknown.

According to its official website, over seven years, it has provided full scholarships, stipends, internships, and job opportunities to 400 Cambodian university students. In addition, the website states: "More than 280 charity events have been launched, benefiting over 1.5 million people, with total donations exceeding $18 million."

In disaster relief and healthcare, Prince Group has also made several large-scale donations. An article on its website mentions that Chen Zhi actively responded to local government calls, donating money and supplies for epidemic prevention and disaster relief. "Over the past six years, Prince Group Holdings has invested more than $2 billion in Cambodia."

In the past two years, Chen Zhi and his Prince Group have won multiple international business awards: Cambodia's Best Socio-Economic Development Contribution Award (International Finance Awards), Outstanding Person of the Year (2024 Global Economics Awards), and Corporate Social Responsibility Innovation Achievement Award (2025 Asia-Pacific Stevie Awards).

In Cambodia, Chen Zhi is not only a well-known entrepreneur and philanthropist, but he has also been officially awarded the title of "Oknha" by the government.

Recently, Cambodian Ministry of Interior spokesman Du Suka stated that the Cambodian government hopes the U.S. and UK will provide sufficient evidence when taking legal action against Prince Group and its founder Chen Zhi.

He said the procedures for Chen Zhi to obtain Cambodian citizenship complied with legal requirements. Du Suka believes Prince Group's operations in Cambodia fully comply with local laws and enjoy the same treatment as other investment enterprises in Cambodia.

He also said that if conclusive evidence is presented, Cambodia is willing to cooperate with the investigation. At the same time, Du Suka emphasized that no lawbreakers would be sheltered, "but the Cambodian government itself has not accused Prince Group or Chen Zhi of any wrongdoing."

In any case, the fermentation of the Chen Zhi and Prince Group incident has stirred up a tsunami-like wave in Cambodia. A local Chinese-language media practitioner said that his friends have all been discussing the matter recently, and Cambodian citizens have left messages on social media, saying they have seen Chen Zhi's true colors, "This tumor must be eradicated," "He should be arrested," and so on.

Chen Zhi's current whereabouts are unknown, and the information on the official website of Prince Group remains as of April 2025, with the latest news titled "Prince Group Wins 'Chen Zhi Scholarship' Silver Award, Supporting the Popularization of Education in Cambodia."

The official website of Prince Group does not disclose any public contact phone number, only an email address. Jiemian News sent an interview request to Prince Group via this email, but had not received a reply as of press time. A person claiming to be a former employee of Prince Group's branding department told Jiemian News that Chen Zhi was involved in many types of projects within the group, including both legitimate businesses and gray or even illegal operations, but grassroots employees had limited knowledge. After the case was exposed, some former employees feared being implicated, "everyone is on edge."

After this incident, many Cambodians, worried that their virtual currency stored at Huione would disappear, lined up at Huione's offline branches to withdraw cash. Some people, unable to wait, had to cash out through other channels at a 10% discount.

On the afternoon of October 17, a Chinese woman queued for three hours at the Phnom Penh branch and finally got her money. She filmed a video of the crowded queue at the scene and advised those coming to withdraw cash to bring snacks and a stool, "There are too many people."

(Yang Ling, Qiu Yifan, and Lin Bing are pseudonyms)

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

On-chain Credit Guarantee Trading Mechanism Based on TBC Underlying Technology: Exploring a New Global Trust System for Commodity Circulation

The trust dilemma faced by traditional e-commerce and the potential breakthrough offered by blockchain.

Research Report|In-Depth Analysis and Market Cap of Common Protocol (COMMON)

XRP’s Dip Volume Drama and Solana’s EMA Struggle: Shakeout or Sneaky Rebound?

2025: The Most Bizarre Crypto Cycle in History—Manipulation, Collapse, and the Rebirth of a New Order