HBAR Price Forms Bullish Crossover – Is A Rally On The Horizon?

HBAR shows early signs of recovery with a bullish MACD crossover and improving RSI. A breakout above $0.178 could drive a rally toward $0.200, confirming bullish momentum.

Hedera’s (HBAR) price has traded sideways over the past few days, showing signs of consolidation after a period of weak investor participation.

Limited market support kept the token stagnant, but momentum appears to be shifting. Technical indicators suggest renewed optimism, hinting that a potential recovery may soon unfold for HBAR.

Hedera Shows Bullish Signs

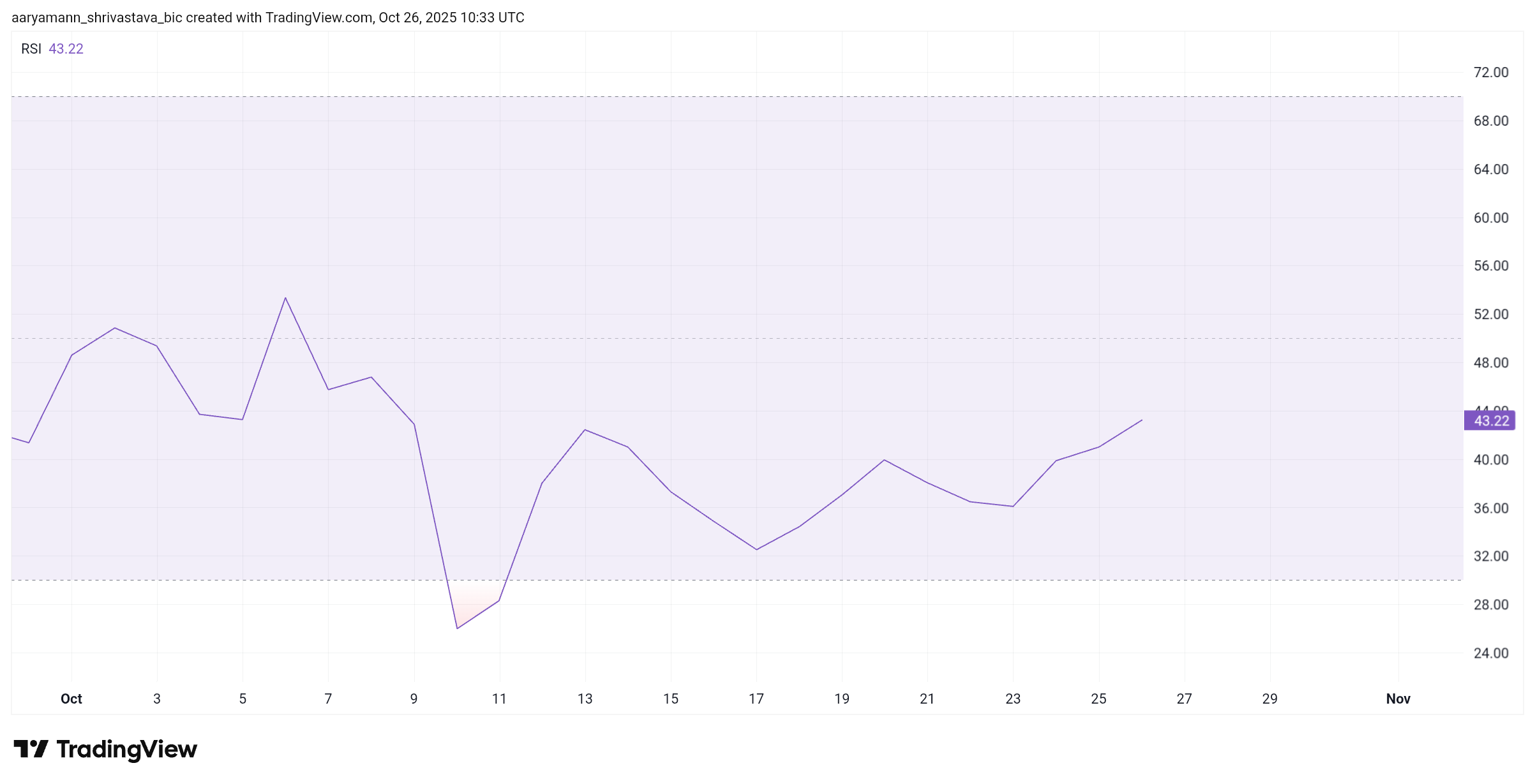

The Relative Strength Index (RSI) is showing an upward trajectory, indicating improving buying pressure on HBAR. This incline signals growing investor confidence after nearly three weeks of muted activity.

However, the RSI remains below the neutral 50.0 mark, suggesting the bullish momentum has not yet been fully confirmed.

A move above the 50.0 threshold would mark a transition into positive territory and signal the end of the recent 20-day bearish phase. This shift could attract fresh capital and trading interest, reinforcing the upward sentiment.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

HBAR RSI. Source:

HBAR RSI. Source:

HBAR RSI. Source:

HBAR RSI. Source:

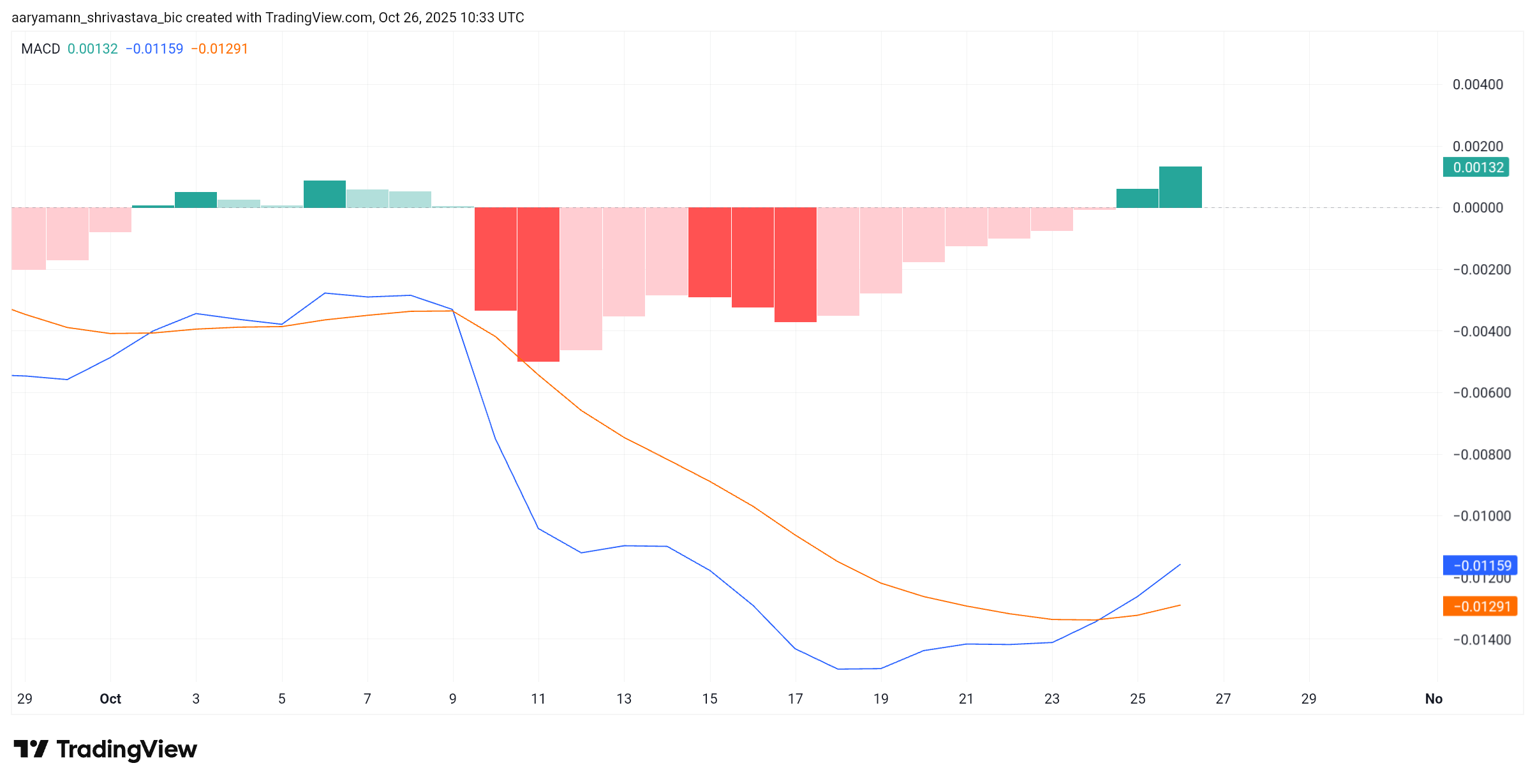

The Moving Average Convergence Divergence (MACD) indicator adds further weight to this potential reversal. In the short term, the MACD has just formed a bullish crossover, with the indicator line crossing above the signal line. This is a classic sign of waning bearish momentum and growing buying interest.

Such a crossover often precedes a price rebound, suggesting that market sentiment is turning more favorable. The shift indicates that HBAR is beginning to align with broader market cues supporting a risk-on environment. If momentum continues building, the cryptocurrency may enter a stronger phase of accumulation.

HBAR MACD. Source:

HBAR MACD. Source:

HBAR MACD. Source:

HBAR MACD. Source:

HBAR Price Can Breakout

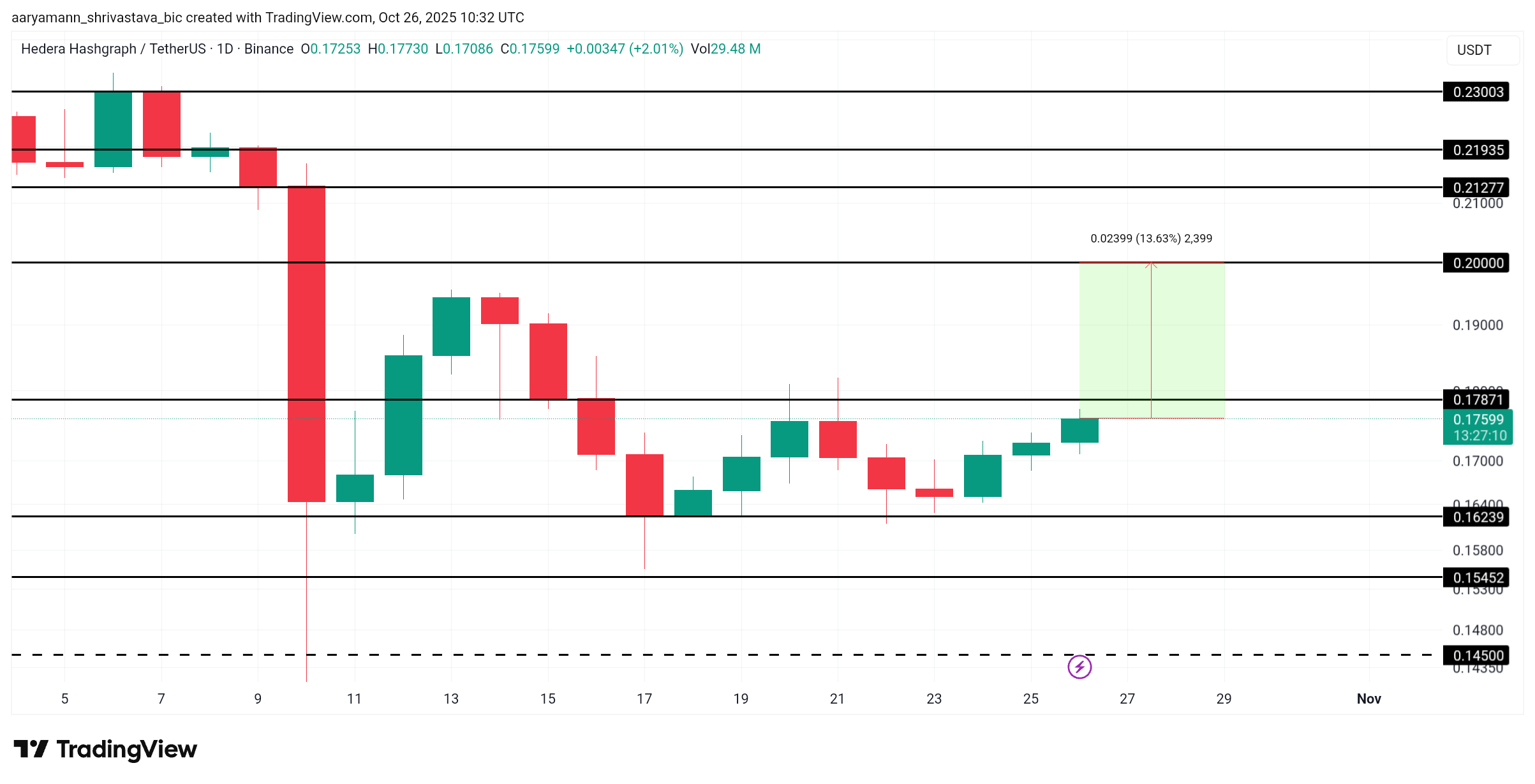

At present, HBAR’s price remains consolidated between $0.178 and $0.162. For the altcoin to initiate a clear breakout, it must close above the $0.178 resistance. Doing so would open the path toward the $0.200 psychological barrier, confirming a potential upward trend.

To reach $0.200, a 13.6% increase from current levels would be required. The bullish crossover on the MACD and the rising RSI suggest this move is achievable, provided investor participation continues.

HBAR Price Analysis. Source:

HBAR Price Analysis. Source:

HBAR Price Analysis. Source:

HBAR Price Analysis. Source:

However, if selling pressure returns, HBAR may retest support at $0.162, extending its consolidation phase. A breakdown below this level could invalidate the bullish thesis, pushing prices down to $0.154 and signaling renewed weakness.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana Whale Activity Confirms Growing Institutional Interest

Quick Take Summary is AI generated, newsroom reviewed. Wallets tied to FalconX and Wintermute recently bought 21k SOL (~$3.9 M) and 71.5k SOL (~$12.5 M) in one transaction. SOL currently trades near ~$190, matching transaction USD conversions of ~$3.9 M for 21k SOL (≈ $185 each). 71.5k SOL equals roughly 0.015% of Solana’s ~470 million circulating supply. Hong Kong’s SFC approved the first spot SOL ETF under ChinaAMC for listing on October 27, 2025.References X Post Reference

XRP ETF surpasses $100 million in assets under management

Ethereum consolidates near $4K as traders await breakout direction

Trending news

More[Bitpush Weekend Review] Trump nominates SEC crypto task force chief legal advisor Michael Selig as CFTC Chairman; Trump says at a private gathering that cryptocurrency could help solve the $35 trillion US debt problem; Bloomberg: Since the introduction of regulatory bills in the US, the proportion of stablecoins used for payments has surged by 70%

Solana Whale Activity Confirms Growing Institutional Interest

![[Bitpush Weekend Review] Trump nominates SEC crypto task force chief legal advisor Michael Selig as CFTC Chairman; Trump says at a private gathering that cryptocurrency could help solve the $35 trillion US debt problem; Bloomberg: Since the introduction of regulatory bills in the US, the proportion of stablecoins used for payments has surged by 70%](https://img.bgstatic.com/multiLang/image/social/6f7dc601c3d5c684dffeb2a0f54b0e661761530402644.png)