What’s Ahead for the Crypto Market This Week?

The coming week could set the tone for the final stretch of 2025. With the Federal Reserve expected to announce another interest rate cut and the Magnificent Seven tech giants reporting earnings, volatility is almost guaranteed. Let’s breakdown what the charts say for Bitcoin, Ethereum, and XRP—and the crypto market and how macro forces might shape their next big moves.

Crypto News: How the Fed and Earnings Could Shake Crypto Market

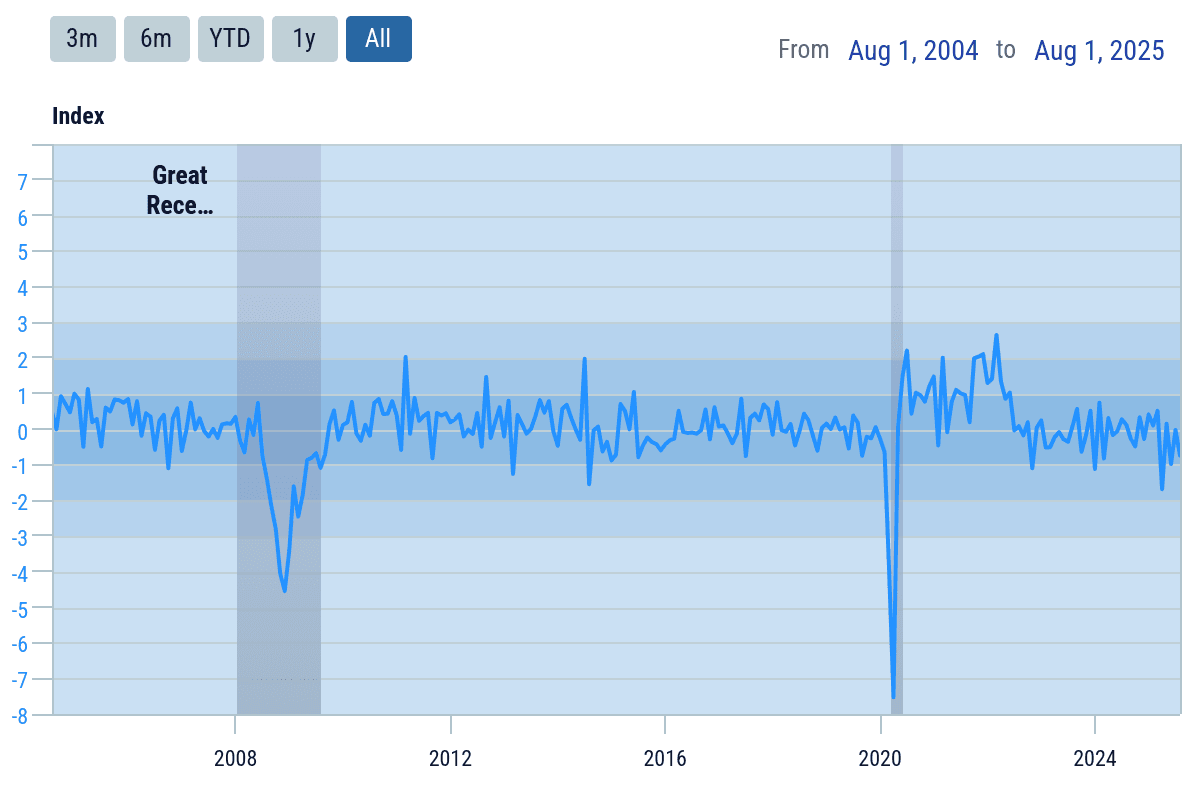

The U.S. Census Bureau Index of Economic Activity (IDEA)

The U.S. Census Bureau Index of Economic Activity (IDEA)

Crypto market has been tracking macro liquidity all year. A rate cut means cheaper capital, weaker yields, and a higher appetite for risk—all bullish for digital assets. But the catch is inflation remains sticky , and a government shutdown has delayed key economic data. That creates uncertainty, and markets hate guessing games.

Big Tech earnings —especially from Microsoft, Apple, and Alphabet—will also ripple through risk sentiment. If AI and cloud numbers surprise on the upside, we could see renewed enthusiasm spill over into crypto, mirroring past rotations between tech stocks and BTC. On the other hand, weak earnings could trigger short-term outflows from risk assets, including digital currencies.

Bitcoin (BTC): Can It Break Through 115K?

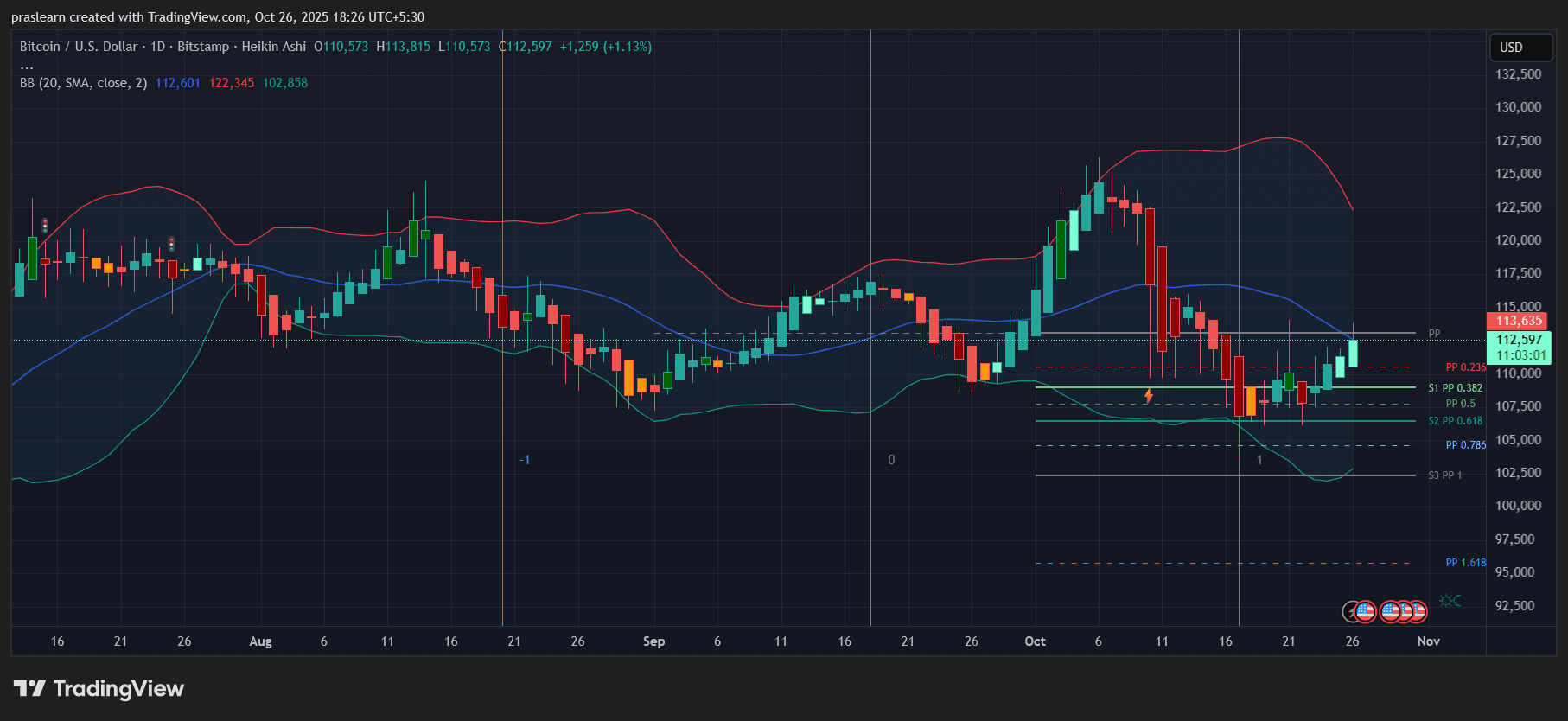

BTC/USD Daily Chart- TradingView

BTC/USD Daily Chart- TradingView

On the daily chart, Bitcoin has been quietly recovering from its October lows, now sitting around 112,600 with a 1.1% gain on the day. The Heikin Ashi candles show steady bullish momentum after a series of higher lows, suggesting accumulation. The Bollinger Bands are narrowing, which often precedes a breakout.

Key resistance sits near 115,000 (the upper pivot and prior rejection zone), while immediate support lies around 110,000. A daily close above the middle Bollinger band could invite more buyers, pushing BTC toward 118,000–120,000 by early November. But if the Fed disappoints or the dollar strengthens post-meeting, BTC could retest 107,000 before attempting another leg up.

This week’s prediction: bullish bias if rate cuts confirm and equity sentiment holds. Watch for a potential breakout toward 120,000.

Ethereum (ETH): Struggling to Reclaim 4,100

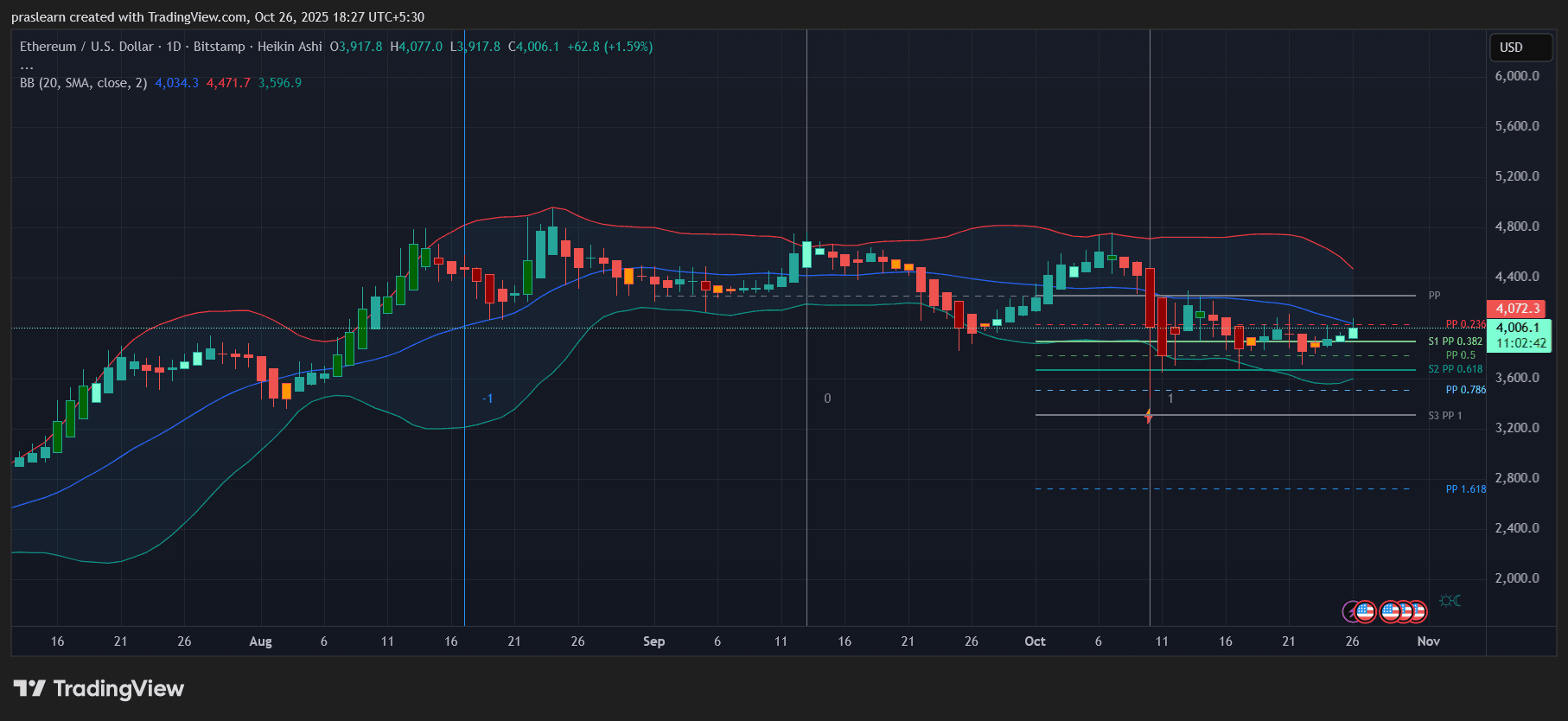

ETH/USD Daily Chart- TradingView

ETH/USD Daily Chart- TradingView

Ethereum’s chart paints a cautious but improving picture. ETH is hovering near 4,000, slightly above its midline Bollinger band. After weeks of sideways movement, the latest green Heikin Ashi candles show that buyers are slowly regaining control. However, ETH faces a wall of resistance around 4,072 (0.236 Fib pivot) and the 50-day SMA near 4,030.

The good news is that the lower band around 3,600 has held multiple times, signaling strong demand. If ETH can close decisively above 4,100, the next leg could target 4,400. Failure to do so keeps it stuck in a range, and a rejection here could pull it back to 3,800.

Macro-wise, Ethereum tends to outperform during dovish cycles, so a rate cut could reignite institutional interest—especially if AI-related earnings lift market sentiment.

This week’s prediction: neutral to bullish, with a breakout confirmation needed above 4,100 for momentum to build.

XRP: Early Signs of Recovery

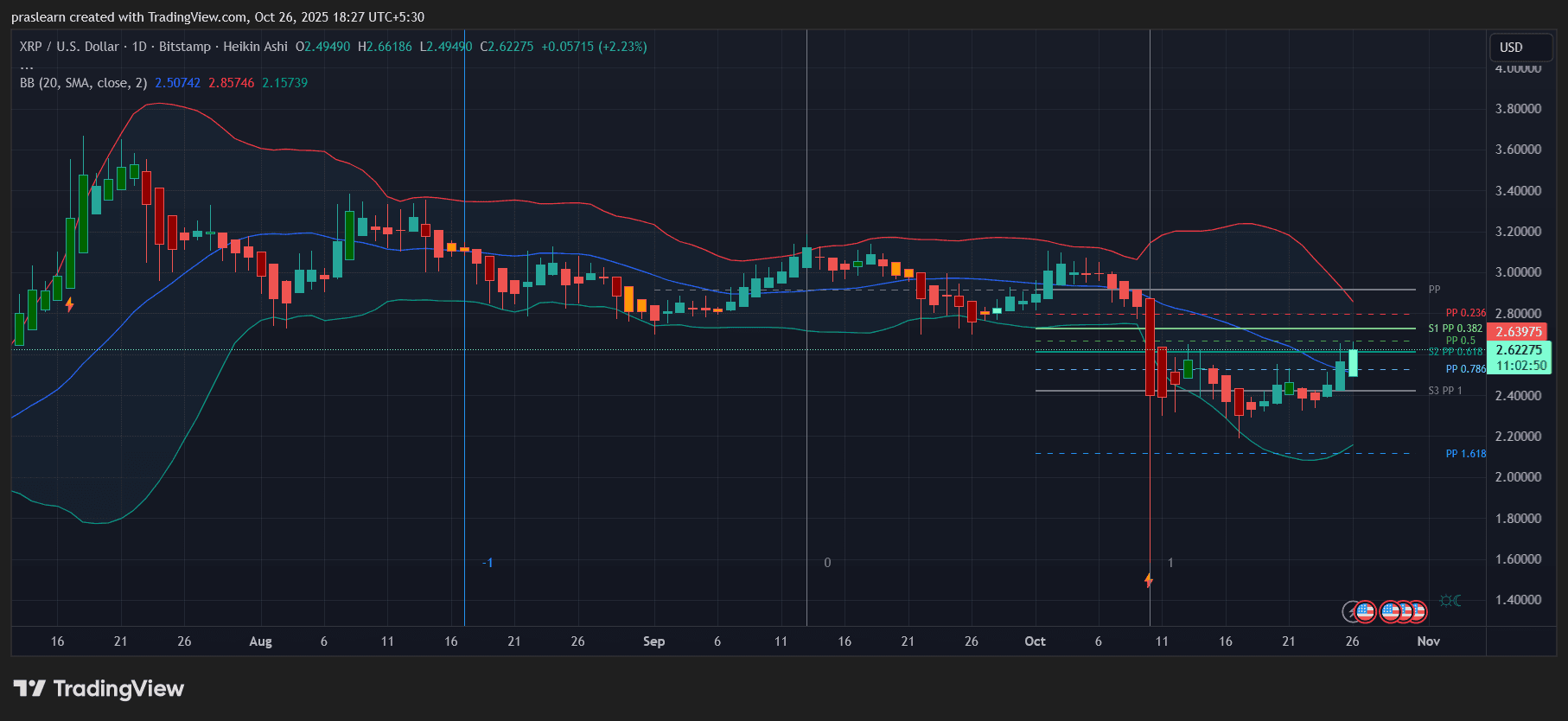

XRP/USD Daily Chart- TradingView

XRP/USD Daily Chart- TradingView

Among the top three, XRP looks the most technically oversold and ready for a bounce. It’s trading near 2.62 after a 2.2% daily gain, sitting just below its 0.382 Fibonacci pivot at 2.64. The price has crossed above the middle Bollinger band, hinting at a possible short-term reversal.

If buyers push through 2.70, XRP could extend toward 2.85—the upper band and psychological barrier. However, rejection at this level could drag it back to 2.40 or even the 0.618 support near 2.30. Volatility remains elevated, so expect sharp intraday swings.

This week’s prediction: bullish momentum building, with potential upside toward 2.80 if BTC remains steady and broader sentiment improves.

Crypto News: What to Expect in the Crypto Market This Week

The setup is clear: macro meets momentum. The Fed’s decision on Wednesday and Big Tech earnings through Thursday will dictate whether this rebound turns into a rally or stalls again.

If Powell confirms a dovish stance and markets interpret it as the start of a prolonged easing cycle, expect $BTC to challenge 115,000–120,000, $ETH to test 4,400, and $XRP to stretch toward 2.80. But any hint that inflation still worries the Fed—or disappointing tech results—could trigger another short-term pullback.

Bottom line: this is a pivotal week. Crypto is coiling under macro pressure, and whichever way it breaks next could define November’s direction.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Vitalik's New Article: The Possible Future of the Ethereum Protocol - The Verge

In fact, it will take us several years to obtain a validity proof for Ethereum consensus.

The Federal Reserve Opens a New Chapter: Cryptocurrency Officially Included in the Washington Agenda

The Federal Reserve held its first Payments Innovation Summit, discussing the application of stablecoins, tokenized assets, and DeFi in the payments sector. The conference proposed establishing Federal Reserve accounts with limited access to reduce risks and explored how to make traditional systems compatible with blockchain. Cryptographic technologies are now becoming a central topic in payment discussions, and institutional investors may prioritize assets like bitcoin and ethereum. Summary generated by Mars AI. The accuracy and completeness of this AI-generated summary are still being iteratively improved.

Peso crisis escalates, stablecoins become a "lifeline" for Argentinians

The role of cryptocurrency in Argentina has fundamentally changed.

Dogecoin’s Weekly Chart Reveals Clear Path Toward $1.50 as Parabolic Phase Begins