- Analysts see parallels between potential Fed pivot now and the Aug 2019 QT halt that preceded 2021 altseason.

- Anticipated end of QT plus expected rate cuts could inject significant liquidity into altcoins.

- Bitcoin dominance chart shows potential breakdown, a classic technical signal favoring altcoins.

Talk of a potential altseason is gaining serious traction as market participants eye an upcoming Federal Reserve policy shift, drawing strong parallels to the conditions that preceded the explosive 2021 altcoin rally, led by Ethereum (ETH).

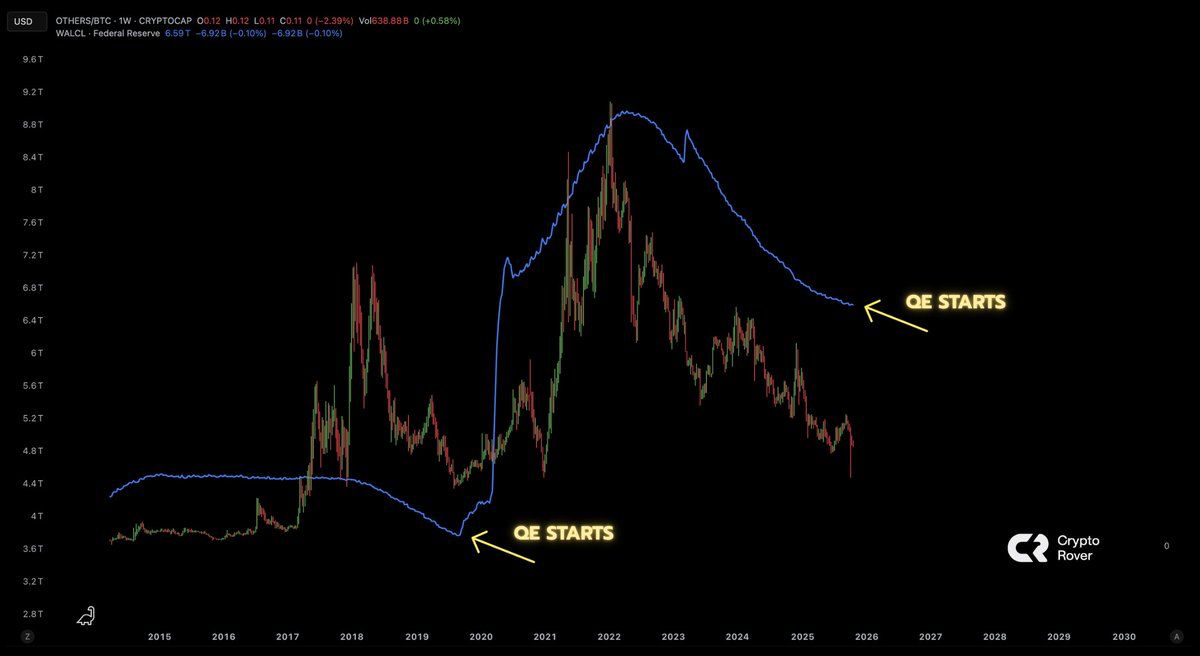

Market analyst Crypto Rover likened the anticipated start of Quantitative Easing (QE) next week to the 2019-2021 events. After the Fed ended its balance sheet runoff in August 2019, the OTHERS/BTC pair experienced a market reversal, and the altcoin market exploded in the subsequent months.

Related: Is a Full-Blown Altseason Coming After CPI Data Release and CZ’s Pardon?

Source: X

Source: X

Reasons Why Altcoins Can Rally After Next Week’s FOMC Meeting

Liquidity Surge Amid Imminent Fed Interest Rate Cuts in October and December

The global money supply is expected to experience a sharp uptick in growth after next week’s end of Quantitative Tightening. The global money supply has been rising in the past two years, fueled by geopolitical instability and the dedollarization that was escalated by the BRICS movement.

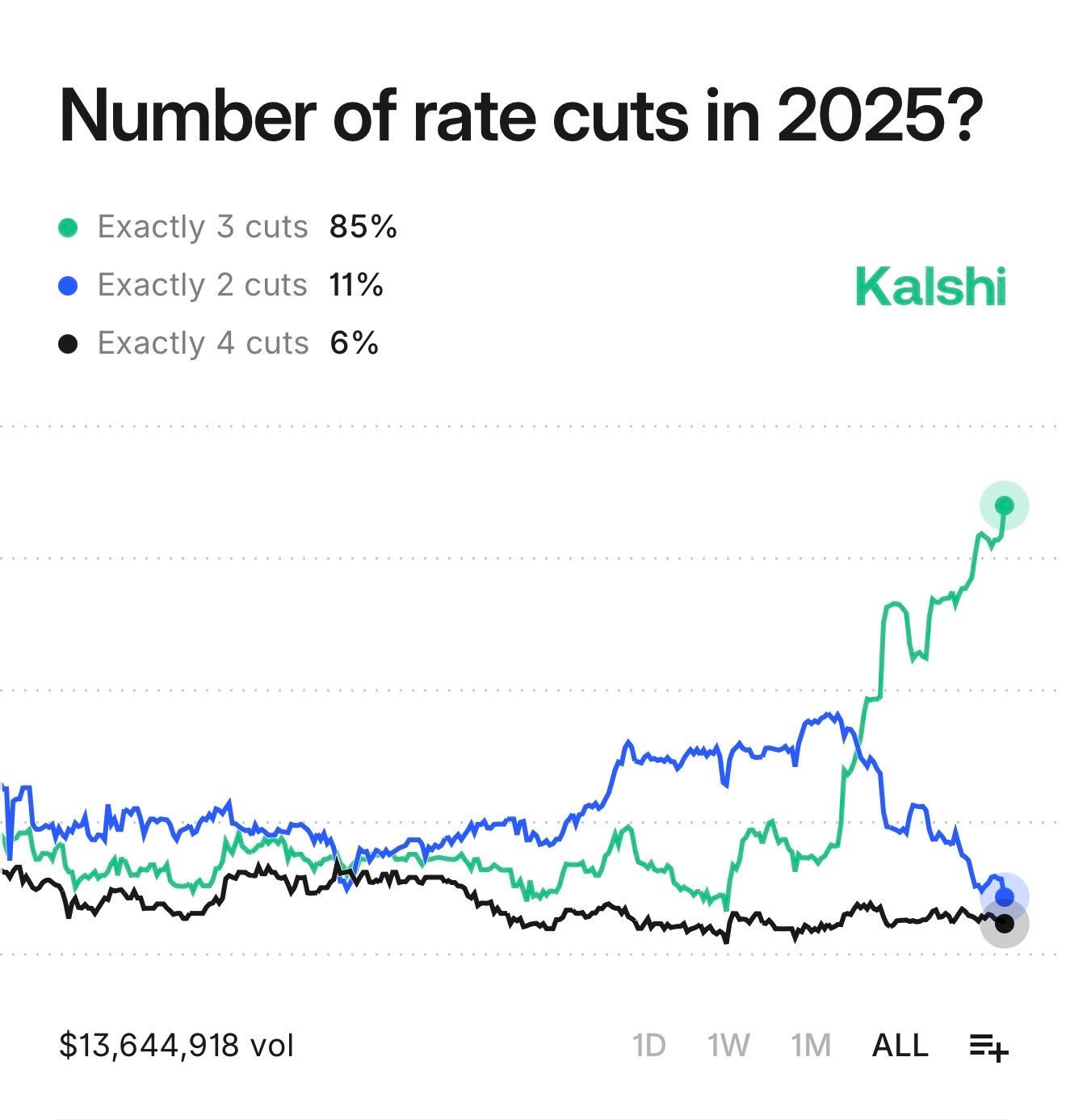

The expected start of the Fed’s QE will coincide with the second Interest Rate cut of 2025, whereby Kalshi and Polymarket traders are predicting a 25 bps reduction in October and December.

Source: Kalshi

Source: Kalshi

Notably, the Fed’s total assets as a percentage of nominal GDP have fallen to 21.6%, the lowest since Q4 2020. Precisely, the Fed’s total assets have declined by around $2.37 trillion during this period, to about $6.60 trillion, the lowest since April 2020.

Technical Signal Flashes: Is Bitcoin Dominance Breakdown Confirming Altseason?

Complementing the macro picture are crucial technical signals within the crypto market itself. Bitcoin dominance – the measure of Bitcoin’s market cap relative to the total crypto market – has been in a strong uptrend for much of the past two years as institutional inflows favored BTC.

Source: X

Source: X

However, recent chart analysis suggests this dominance trend may be breaking down. Technical analysts point to Bitcoin dominance potentially falling below a key multi-year rising support line. A confirmed breakdown here is a classic signal often preceding periods where capital rotates aggressively from Bitcoin into altcoins (altseason).

Source: X

Source: X

The total altcoin market cap chart reportedly shows fractal patterns similar to those seen before previous major bull cycles, suggesting the market structure itself is coiled for a potential explosive move.

Counterpoint: Could the Bull Market Top Already Be In? (Ali Martinez)

Source: X

Source: X

Meanwhile, crypto analyst Ali Martinez has cautioned that the bull market cycle may have already completed. The crypto analyst highlighted that the Bitcoin price, in the last two bull cycles, hit its bull market top exactly 1,064 days after the bear market bottom.

Since the BTC price hit its bottom in November 2022 until its ATH of about $126,220, it has taken exactly 1,064 days. As such, the potential crypto downside in the coming weeks and months cannot be fully ruled out.

Related: Altseason October 2025 Outlook as BTC Dominance Eases; ETFs and Rate Cuts Set the Turn