3 Altcoins Crypto Whales Are Buying After Cooler US CPI Print

After a cooler US CPI print boosted rate-cut hopes, crypto whales are quietly rotating into three altcoins — PEPE, CAKE, and WLFI. Each shows strong accumulation and bullish setups that could define the next leg of the altcoin rebound.

Crypto whales are ramping up the accumulation of several altcoins after the US September CPI data, released on October 24. It came in cooler than expected at 3.0% versus a 3.1% forecast. The softer inflation print has lifted rate-cut expectations and renewed confidence in risk assets.

As markets price in a potential dovish shift from the Fed, whales are quietly rotating into three altcoins they expect to lead the next rally. Or at least a rebound.

Pepe (PEPE)

As markets lean toward a dovish Fed stance, whales appear to be rotating capital into select altcoins that could gain from easier liquidity — and Pepe (PEPE) is one of them. The token is up over 6%, week-on-week.

Over the past 24 hours, Pepe whales increased their holdings from 155.75 trillion to 156.13 trillion tokens. This means adding about 0.38 trillion PEPE, worth roughly $2.7 million at the current PEPE price.

This quiet accumulation suggests that crypto whales are positioning early. More so as the probability of an October rate cut climbs above 98%, fueling expectations of broader market relief.

PEPE Whales:

Santiment

PEPE Whales:

Santiment

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

On the 4-hour chart, the PEPE price has been consolidating inside a symmetrical triangle since October 13. It is a structure known to precede sharp breakouts.

A clean move above $0.0000072 could trigger a 12% rally toward $0.0000079. And that would put Pepe among the altcoins crypto whales are buying with technical conviction.

Another signal supporting this view is a possible golden crossover between the 20-period EMA (red line) and the 50-period EMA (orange line). The EMA, or exponential moving average, tracks recent price direction by giving more weight to recent candles.

When the short-term EMA crosses above the longer one, it shows momentum shifting toward buyers. It is something altcoin whales often look for when confirming trend reversals.

PEPE Price Analysis:

TradingView

PEPE Price Analysis:

TradingView

Still, PEPE remains a volatile trade. A drop below $0.0000069 could expose $0.0000064. But as long as whales are adding and price stays within the tightening pattern, Pepe remains one of the coins whales are buying into strength rather than fear.

PancakeSwap (CAKE)

After PEPE, another token catching the attention of crypto whales is PancakeSwap (CAKE). It is a DeFi asset often favored during improving market sentiment.

Whales appear to have shifted positions shortly after the CPI-driven rebound in risk appetite, raising their holdings from 44.87 million CAKE on October 24 to 55.05 million, a net gain of over 10.18 million CAKE.

At the current price of $2.69, that adds up to roughly $27.3 million in new accumulation, suggesting growing conviction that the market’s softer tone may fuel further upside.

CAKE Whales:

Santiment

CAKE Whales:

Santiment

On the technical side, CAKE’s structure reinforces this optimism. Between October 10 and 24, the token formed a higher low even as the Relative Strength Index (RSI) — which measures buying versus selling strength — made a lower low. This hidden bullish divergence often signals trend continuation, meaning the broader uptrend CAKE has maintained over the past year (up more than 50%) could still be intact.

Currently trading near $2.69, CAKE faces stiff resistance at $2.72, a level that has capped every rally attempt since October 22. If buyers can close a candle above that threshold, momentum could extend toward $3.45, the next major resistance zone on the daily chart.

CAKE Price Analysis:

TradingView

CAKE Price Analysis:

TradingView

The RSI trend backs this view, with readings curling upward as buying strength rebuilds.

However, if the token fails to stay above $2.27, the bullish setup weakens. Whale impatience or broader altcoin market pressure could then send CAKE sliding toward $1.54. That is a strong support area, last tested during the Black Friday crash.

For now, though, the combination of rising whale holdings, steady on-chain conviction, and technical stability keeps PancakeSwap on the shortlist of altcoins crypto whales are buying during this post-CPI cooling period.

World Liberty Financial (WLFI)

The final name on whales’ radar appears to be World Liberty Financial (WLFI) — a politically charged token often tied to Trump-linked market themes.

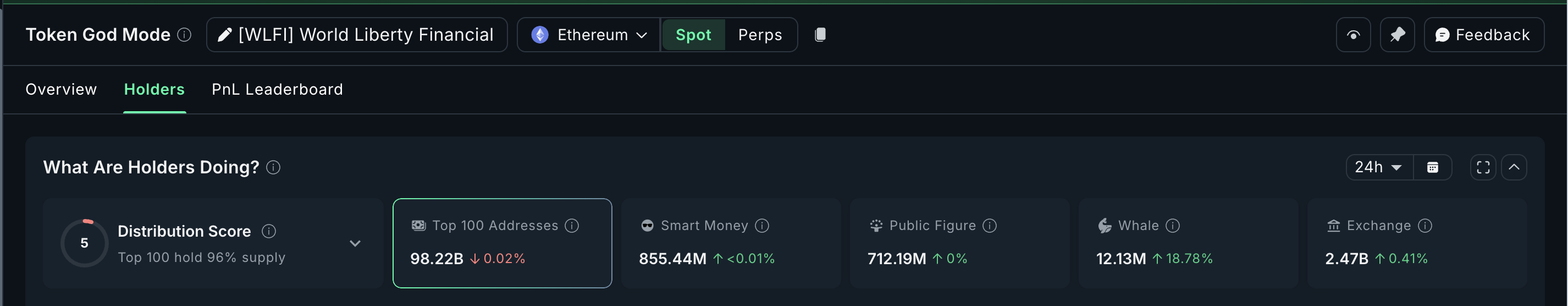

Whales have sharply increased exposure to WLFI, raising their holdings by 18.78% in the past 24 hours to a total of 12.13 million WLFI. At the current price of $0.13, that’s roughly $1.57 million worth of tokens added to wallets in a single day.

WLFI Whales:

Nansen

WLFI Whales:

Nansen

The buying spree follows not only the cooler US CPI print but also the anticipation of a potential Trump–Xi Jinping meeting expected this week. That could further speculation around political and narrative-based altcoins. The timing of this accumulation suggests whales may be positioning for a sentiment rebound tied to these macro catalysts.

On the 4-hour chart, WLFI even shows early technical signs of recovery. Between October 13 and 25, the price formed a lower low. The Relative Strength Index (RSI) — which measures the balance between buying and selling momentum — made a higher low. This bullish divergence signals that sellers may be losing strength, and buyers are starting to step in.

Currently trading near $0.133, the WLFI price faces its first resistance at $0.14. A clean break above that could confirm momentum strength and send prices toward $0.15, implying a 15% near-term rally.

However, WLFI remains volatile. If the price fails to hold the $0.13 support, a drop toward $0.11 remains likely.

WLFI Price Analysis:

TradingView

WLFI Price Analysis:

TradingView

For now, the combination of fresh whale buying, political event speculation, and an improving RSI trend makes WLFI one of the more intriguing altcoins crypto whales are buying after the CPI print — and potentially the most narrative-driven bet of the three.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

On the night of the Federal Reserve rate cut, the real game is Trump’s “monetary power grab”

The article discusses the upcoming Federal Reserve interest rate cut decision and its impact on the market, with a focus on the Fed’s potential relaunch of liquidity injection programs. It also analyzes the Trump administration’s restructuring of the Federal Reserve’s powers and how these changes affect the crypto market, ETF capital flows, and institutional investor behavior. Summary generated by Mars AI. This summary was produced by the Mars AI model, and the accuracy and completeness of the generated content are still being iteratively updated.

When the Federal Reserve is politically hijacked, is the next bitcoin bull market coming?

The Federal Reserve announced a 25 basis point rate cut and the purchase of $40 billion in Treasury securities, resulting in an unusual market reaction as long-term Treasury yields rose. Investors are concerned about the loss of the Federal Reserve's independence, believing the rate cut is a result of political intervention. This situation has triggered doubts about the credit foundation of the US dollar, and crypto assets such as bitcoin and ethereum are being viewed as tools to hedge against sovereign credit risk. Summary generated by Mars AI. The accuracy and completeness of this summary are still in the process of iterative updates.

x402 V2 Released: As AI Agents Begin to Have "Credit Cards", Which Projects Will Be Revalued?

Still waters run deep, subtly reviving the narrative thread of 402.

When Belief Becomes a Cage: The Sunk Cost Trap in the Crypto Era

You’d better honestly ask yourself: which side are you on? Do you like cryptocurrency?