ChainOpera AI Jumps 96% in 24 Hours—But There’s One Red Flag

COAI’s 96% rally sparks rug pull concerns as 97% of tokens sit with top holders. While hype may lift prices to $21, a single whale sell could crash COAI to $5.

ChainOpera AI (COAI) has caught the crypto market’s attention after a staggering 96% price surge within 24 hours.

The sudden spike has drawn traders eager to capitalize on short-term profits, but it has also raised serious concerns. COAI may be showing a potential red flag that investors should approach with caution.

Why You Should Watch Out For ChainOpera AI

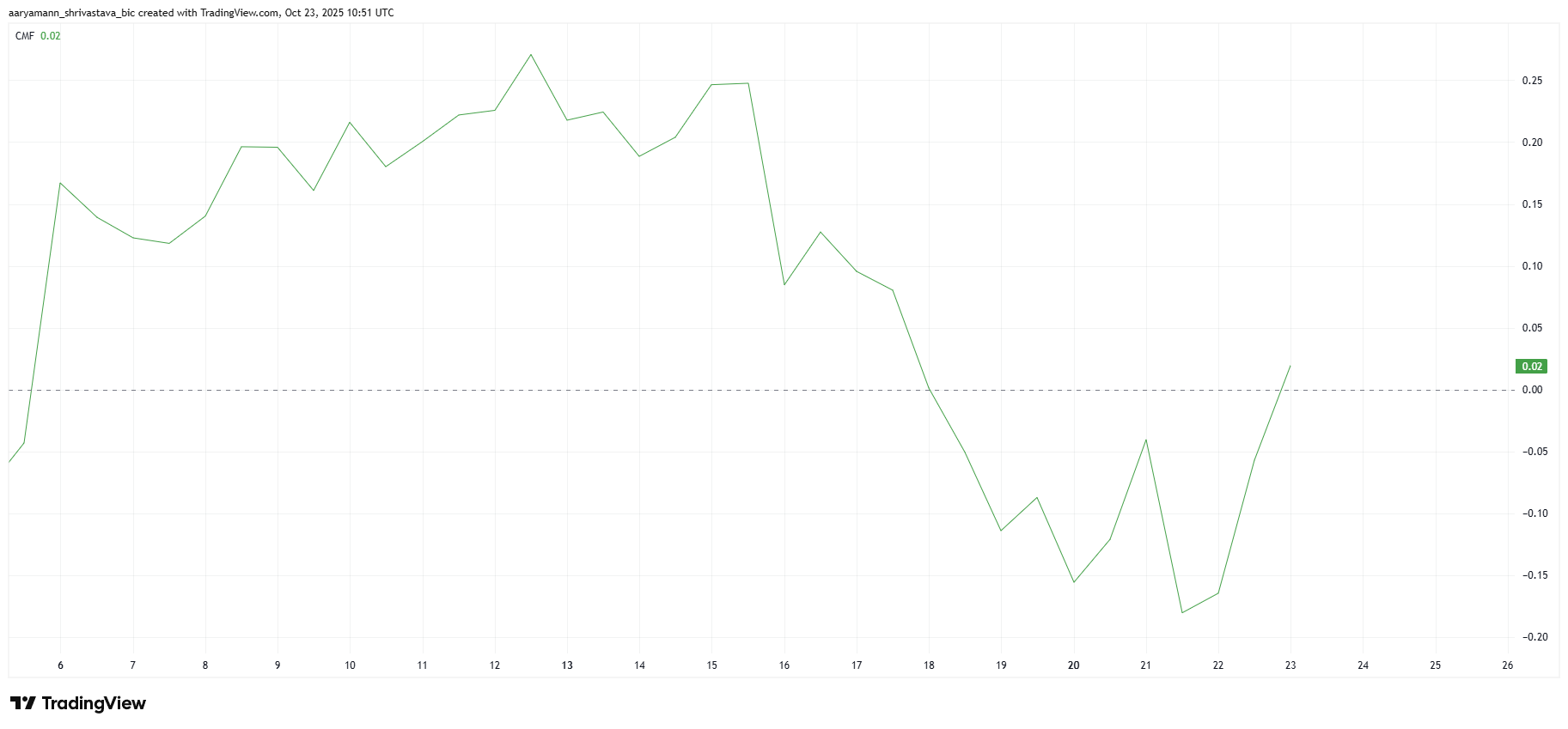

The Chaikin Money Flow (CMF) indicator for COAI has recorded a sharp uptick, signaling a surge in capital inflows. This trend suggests investors are rushing into the token, likely driven by fear of missing out (FOMO). With COAI trending across crypto forums and social platforms, enthusiasm among retail traders appears to be fueling its parabolic rise.

However, such inflow spikes often stem from speculative trading rather than long-term confidence. FOMO-driven activity can inflate valuations beyond sustainable levels, creating conditions ripe for volatility.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

COAI CMF. Source:

COAI CMF. Source:

COAI CMF. Source:

COAI CMF. Source:

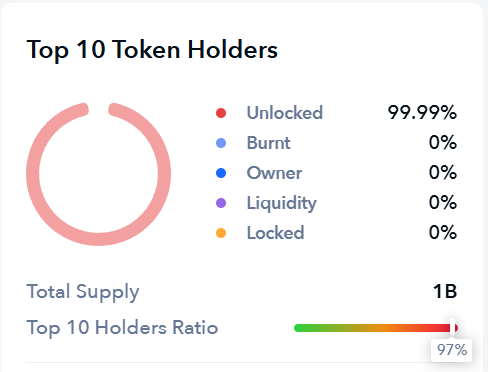

On the macro side, the DeFi Scanner data shows COAI’s risk profile, which highlights that the top 10 wallets control roughly 97% of the token’s circulating supply. This level of concentration is a major red flag, indicating centralized control that could destabilize the market at any time.

If even one of these large holders decides to sell, the effect could be catastrophic. Such a move would likely trigger a chain reaction of panic selling and liquidity drain, sending COAI’s price into a freefall.

COAI Token Holder Data. Source:

COAI Token Holder Data. Source:

COAI Token Holder Data. Source:

COAI Token Holder Data. Source:

COAI Price Could See A Drop

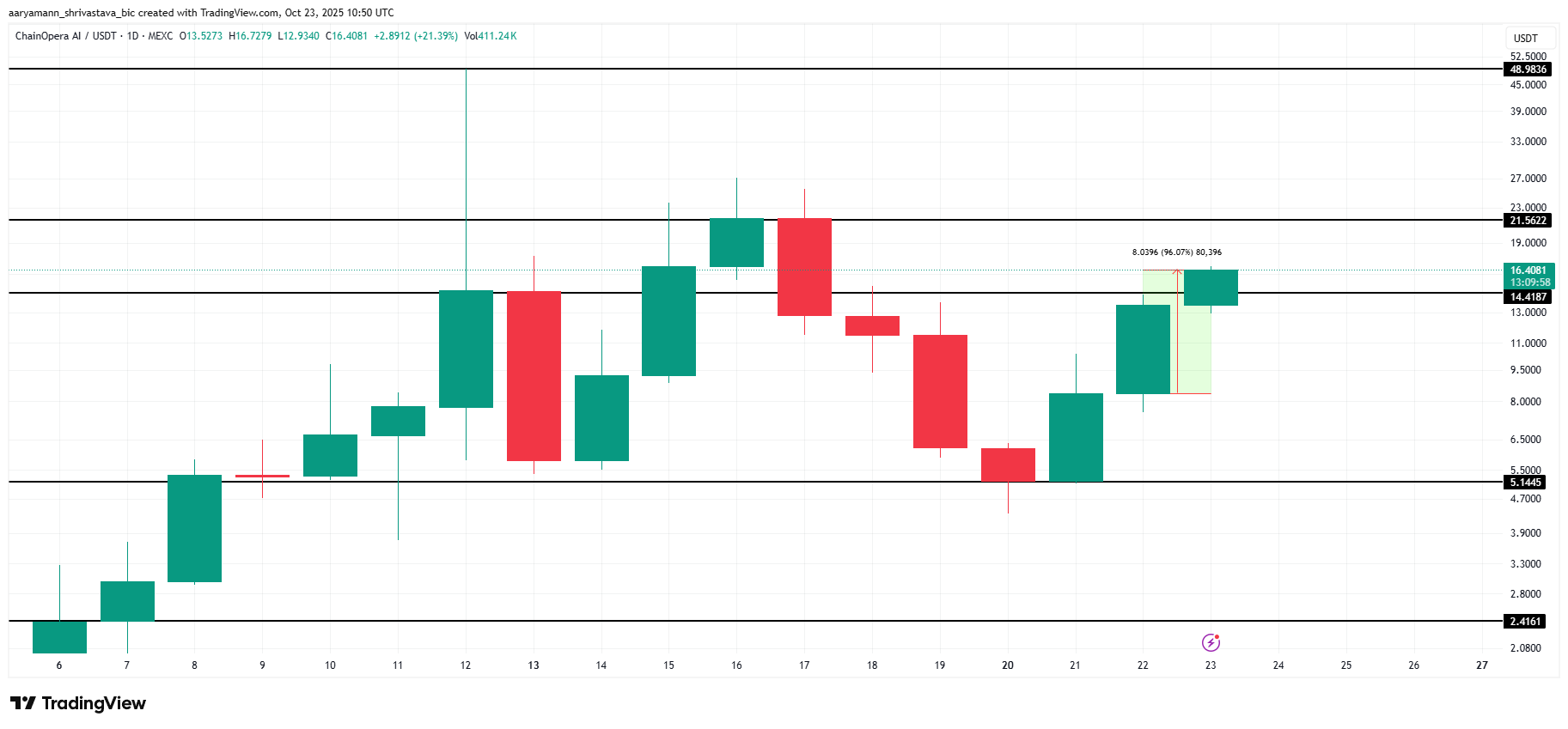

COAI’s 96% rally in a single day would normally be viewed as bullish momentum. Yet, in this case, the rapid climb may signal speculative excess rather than genuine growth. The speed of the rise is amplifying concerns about the sustainability of its valuation.

The concentration of supply and inflated demand indicate that COAI could face a steep correction. If selling pressure emerges, the price could drop from $16 to $5 almost instantly, erasing most of the recent gains.

COAI Price Analysis. Source:

COAI Price Analysis. Source:

COAI Price Analysis. Source:

COAI Price Analysis. Source:

Conversely, if the top wallets refrain from offloading their holdings, COAI could extend its rally beyond $21. Sustained confidence could even push the token toward its all-time high of $48, though the risk of collapse remains significant.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Will Zcash's ZEC return to $500 or higher before 2026?

Bitcoin's ‘bear flag pattern’ targets $67K as BTC spot demand slumps

Bitcoin Hash Ribbons flash ‘buy’ signal at $90K: Will BTC price rebound?

How to achieve an annualized return of 40% through arbitrage on Polymarket?

By demonstrating arbitrage structures with live trading, this provides a clear reference for the increasingly intense arbitrage competition in the current prediction markets.