XRP Price Correction Risks Grow as Token Approaches Overvaluation

XRP faces correction risks as overvaluation signs grow. With rising NVT and holder selling, the token could fall below $2.35 unless it reclaims $2.54 resistance.

XRP has failed to register a meaningful recovery in recent days, despite broader market attempts at stabilization. The altcoin’s recent movement indicates growing weakness, with its momentum fading as on-chain data points to potential overvaluation.

As selling signals strengthen, XRP may face increased downside pressure in the coming sessions.

XRP Holders’ Concerning Actions

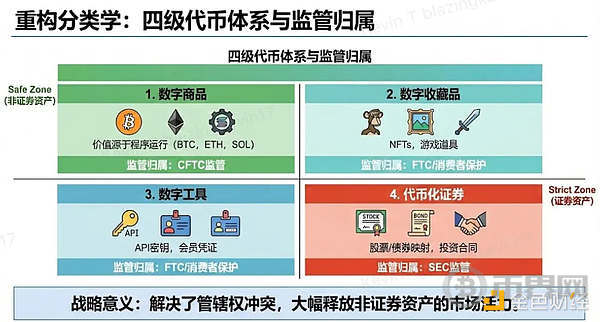

The Network Value to Transactions (NVT) Ratio for XRP has surged sharply, suggesting that recent minor price upticks are not backed by real transaction activity. This divergence between valuation and on-chain utility highlights growing hype-driven trading behavior rather than fundamental network growth. Historically, such conditions have often preceded short-term corrections.

A rising NVT Ratio typically signals overvaluation, as market capitalization outpaces actual blockchain usage. For XRP, this pattern indicates that enthusiasm among traders is outpacing organic network demand.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

XRP NVT Ratio. Source:

Glassnode

XRP NVT Ratio. Source:

Glassnode

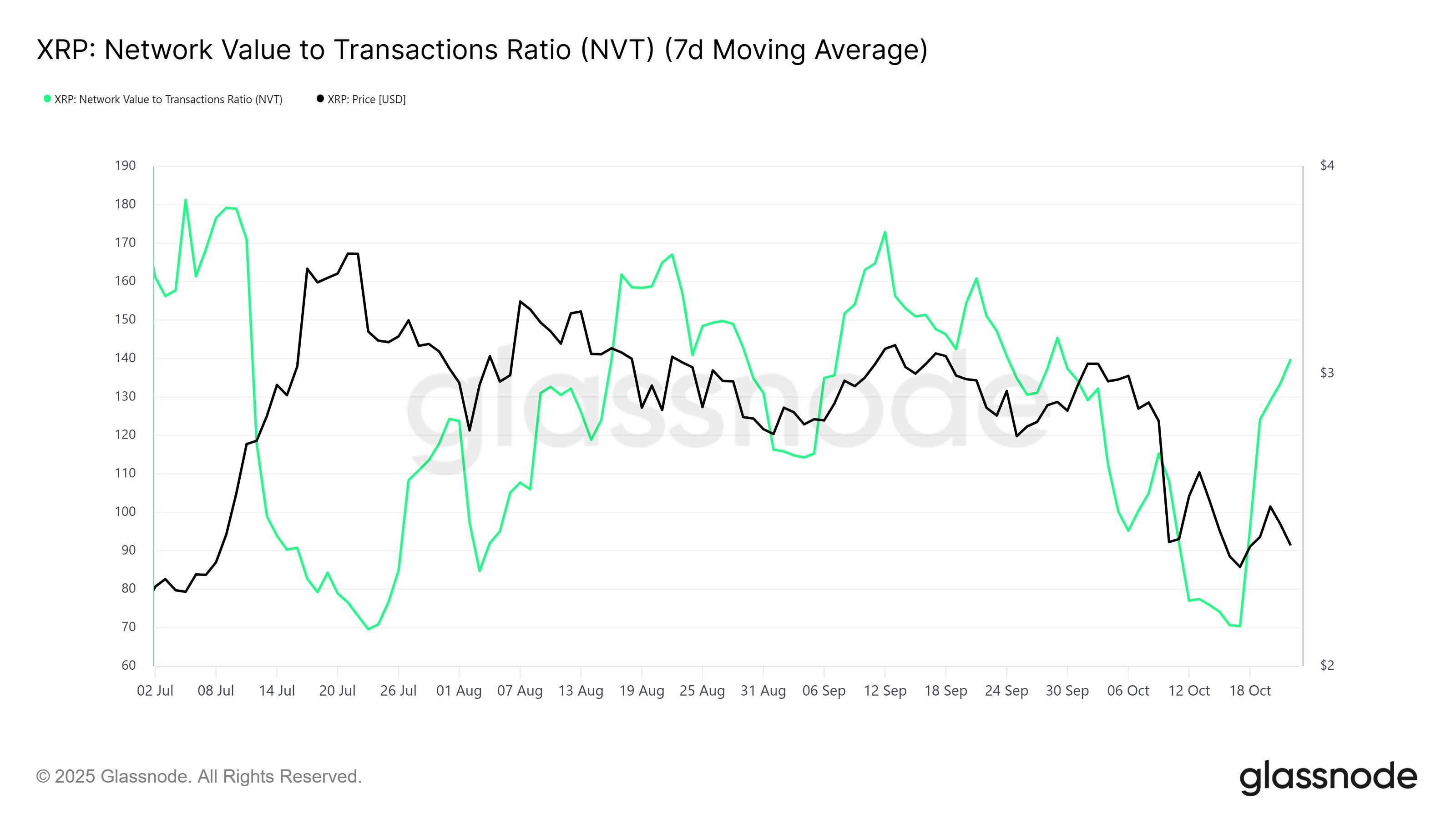

On the macro front, XRP’s Liveliness metric—a measure of long-term holder (LTH) activity—has recorded a notable uptick. This rise reflects increasing movement among previously dormant coins, suggesting that long-term investors are beginning to sell. The trend implies a shift in sentiment among holders who may be losing patience amid stagnant price action.

The lack of sustained growth appears to be driving LTHs to secure profits before potential declines. When experienced holders start distributing their assets, it often signals reduced conviction in near-term gains.

XRP Liveliness. Source:

Glassnode

XRP Liveliness. Source:

Glassnode

XRP Price Is Stuck

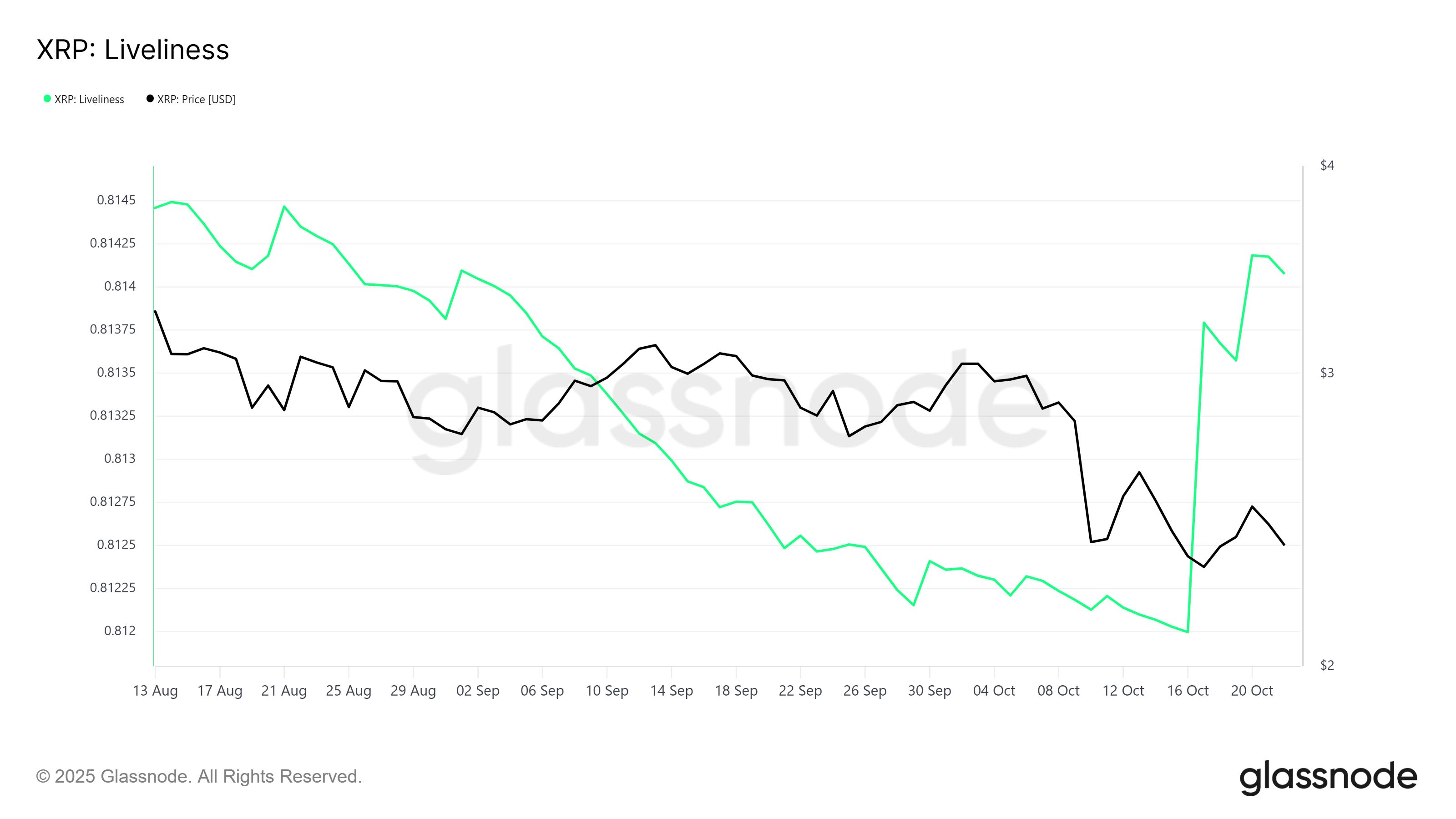

XRP is currently trading at $2.41, holding slightly above the $2.35 support level while remaining capped below the $2.54 resistance. Market volatility has narrowed, but momentum indicators continue to lean bearish as selling pressure builds across exchanges.

Given these factors, XRP could face a short-term correction if weakness persists. A drop below the $2.35 support might send the price toward $2.27, with further losses potentially extending to $2.13. Such a move would reinforce bearish sentiment in the market.

XRP Price Analysis. Source:

TradingView

XRP Price Analysis. Source:

TradingView

However, if investor demand strengthens and buying activity returns, XRP could rebound from current levels. A successful push above $2.54 resistance may clear the path for a climb toward $2.64, invalidating the bearish outlook and signaling renewed market optimism.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Trump to interview pro-crypto Christopher Waller for next Fed Chair: WSJ

Ethereum Spot ETFs Face Alarming $223.7M Exodus: 4th Day of Major Outflows

Bitcoin ETF Shock: $277.4 Million Flees US Funds as BlackRock Leads Outflow