ChainOpera AI’s COAI Tops Market Gainers, But Skeptics Cry ‘Scam’

ChainOpera AI’s COAI token rocketed over 70% amid growing hype, but concerns over ownership concentration and legitimacy now divide the market — highlighting the thin line between innovation and speculation in crypto.

ChainOpera AI’s native token, COAI, has surged over 70% in the past 24 hours, emerging as the market’s top gainer.

As the coin continues to gain momentum, the market appears divided — while some remain bullish on the altcoin, others are raising concerns about the project.

COAI Price Skyrockets as Traders Turn Bullish on the Altcoin

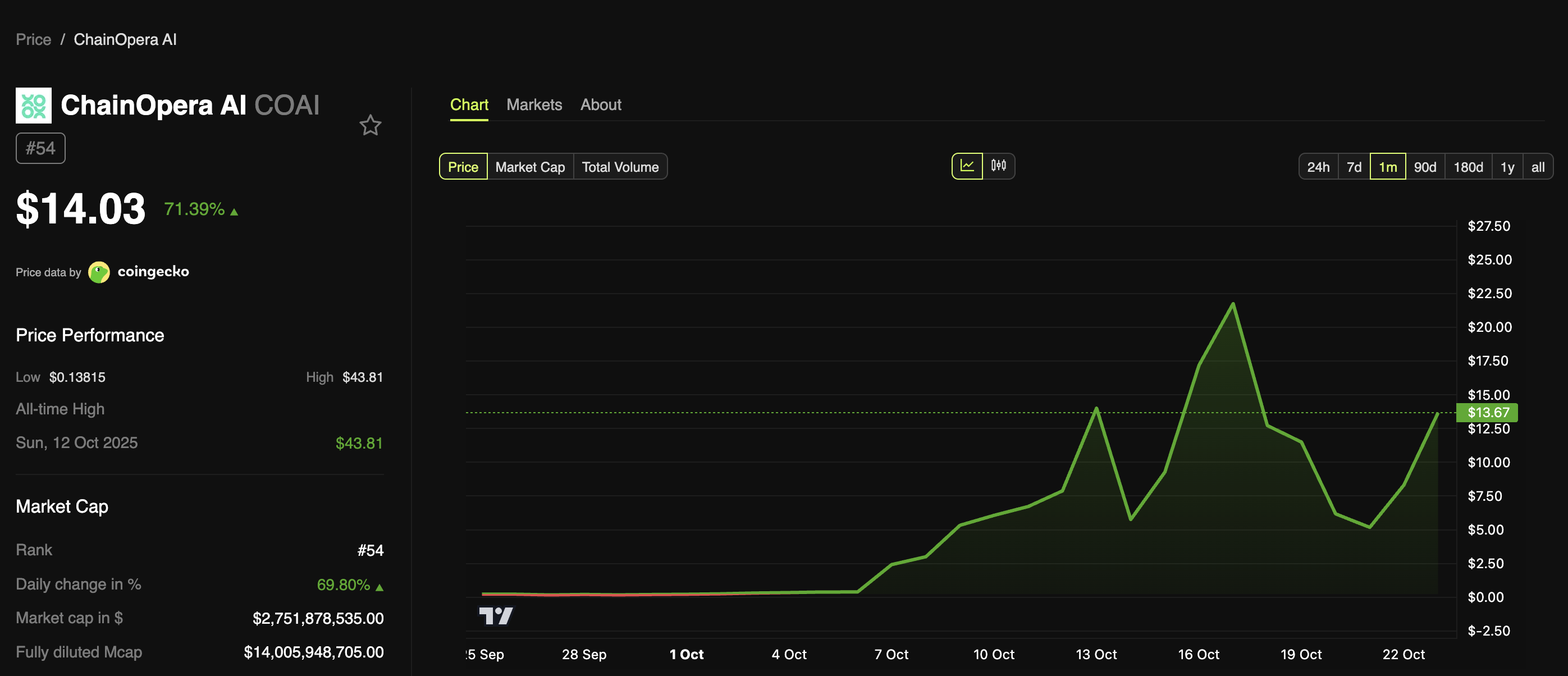

The COAI token has staged a major comeback after experiencing a post-all-time high correction. BeInCrypto Markets data showed that the altcoin has pumped 71.39% over the past 24 hours, outperforming the broader crypto market.

COAI’s performance placed it as the highest daily gainer among the top 300 coins on CoinGecko. Furthermore, 77% of the traders maintain a bullish stance on the token. At the time of writing, it traded at $14.

ChainOpera AI (COAI) Price Performance. Source:

ChainOpera AI (COAI) Price Performance. Source:

In addition to price, COAI is also seeing broader investor adoption. Despite only being a month old, the token has drawn over 50,000 holders.

“Thanks for the love of our community. Now COAI has more than 50000 holders!” the team posted.

Furthermore, the token has also captured massive interest from the community. Data from analytics platform LunarCrush shows the COAI was mentioned 2,393 times in a single day, marking a 1,308% jump from its usual daily activity.

COAI’s Social Mentions. Source:

COAI’s Social Mentions. Source:

A recent analysis of over 2,000 COAI posts indicated that sentiment was driven by three themes: trading opportunity (35%), the Bitget listing (30%), and ChainOpera’s focus on decentralized AI (20%).

“Traders see $COAI as a potential investment opportunity, with many posts highlighting the potential for gains and the project’s focus on AI…..The project’s focus on AI and its integration with blockchain is seen as a positive factor, with many users promoting it as a potential ‘next big thing.'” LunarCrush stated.

Experts Warn COAI Could Be the Next Major Crypto Scam Amid Rapid Rise

Despite COAI’s sharp rise, skepticism remains. Data highlighted that ten wallets hold 87.9% of tokens, raising centralization concerns. Previously, blockchain analytics firm Bubblemaps claimed that a single entity is behind half of the top-earning COAI wallets.

“I thought COAI was just another hype coin, but turns out it was worse- a full on scam in motion. Fake product with a made-up AI story. Fake decentralization….And CEXs helped it by listing this garbage. Retail gets dumped on while insiders walk away rich. It’s time this space stops rewarding frauds,” an analyst remarked.

Another analyst, Viktor, drew parallels between COAI and MYX Finance (MYX), calling the former ‘the top scam of October.’

“I am very much of the opinion that the scale of the scams that are allowed on Binance and Bybit perps is now unprecedented, after seeing M, MYX, AIA and COAI all happen in two months,” he wrote.

While proponents see COAI as a promising project at the intersection of AI and blockchain, critics warn it could be another short-lived hype or worse — a coordinated scam. As debates intensify, only time will tell whether COAI proves its legitimacy or fades as just another cautionary tale in the crypto market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

What signals emerged from the latest Fintech conference held by the Federal Reserve?

The Federal Reserve held its first Payments Innovation Conference, discussing the integration of traditional finance and digital assets, stablecoin business models, applications of AI in payments, and tokenized products. The conference introduced the concept of a "streamlined master account" aimed at lowering the threshold for crypto companies to access the Federal Reserve’s payment systems. Participants believe asset tokenization is an irreversible trend, and that AI and blockchain technology will drive financial innovation. The Federal Reserve views the crypto industry as a partner rather than a threat. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

On the Eve of Peso Collapse: Argentinians Use Cryptocurrency to Preserve Their Last Value

Due to economic turmoil and foreign exchange controls, Argentinians are turning to cryptocurrency arbitrage, profiting from the difference between stablecoin rates and official or parallel market exchange rates. Cryptocurrency has shifted from a speculative tool to a means of protecting savings. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved.

Uniswap v4 Accelerates Launch: Brevis Drives the Next Wave of DeFi Adoption

Uniswap v4 introduces Hook and Singleton architecture, supporting dynamic fees, custom curve logic, and MEV resistance, which enhances trading execution efficiency and developer flexibility. Aggregators face integration challenges and need to adapt to non-standardized liquidity pools. Brevis’s ZK technology provides a trustless gas rebate, accelerating the adoption of v4. Summary generated by Mars AI. This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

US September CPI falls short of expectations across the board, Fed rate cut is a certainty

CPI confirms the trend! U.S. core inflation unexpectedly eased in September, making an October rate cut almost certain. Traders are increasingly betting that the Federal Reserve will cut rates two more times this year...