Retail Crypto Activity Doubles Amid Worldwide Regulatory Progress

Global retail crypto transactions increased by more than 125 percent between January and September 2025. According to blockchain intelligence firm TRM Labs reported this growth in its Crypto Adoption and Stablecoin Usage Report released Tuesday. The expansion mirrors similar growth rates observed throughout 2024.

Most transaction activity centered on practical applications rather than speculation. Payments, remittances, and value preservation in volatile economic conditions accounted for the majority of transactions. TRM Labs stated that individuals now play an increasing role in shaping the industry's evolution. The diversified ecosystem includes more structured service providers and institutional participants.

The United States experienced consecutive years of double-digit expansion beginning in 2023. TRM Labs attributed this growth to political, regulatory and structural factors. The GENIUS Act for stablecoins and the CLARITY Act for market structure both passed Congress. The US also established a joint taskforce with the United Kingdom on digital assets. Pakistan saw similar growth patterns with the government establishing the Pakistan Crypto Council. Statista estimates Pakistan will reach 28 million crypto users in 2026 from a population of 250 million.

Why This Matters

The 125 percent surge demonstrates that regulatory clarity directly impacts user adoption rates. TRM Labs reported that the US market expansion reflects more than enthusiasm. It shows the compounding effect of regulatory clarity and political commitment. President Trump signed the GENIUS Act into law on July 18, 2025, after it passed with bipartisan support.

stablecoin transaction volumes surpassed Visa and Mastercard combined in 2024. The legislation requires stablecoin issuers to maintain 100 percent reserves in high-quality liquid assets. Issuers must disclose reserve composition monthly and submit to annual audits when market capitalization exceeds $50 billion. These requirements provide consumer protection while enabling growth.

The practical use cases prove crypto adoption extends beyond investment speculation. Individuals in countries with capital controls or limited foreign exchange access use crypto as an alternative. Bangladesh ranks 14th globally for adoption despite no licensed platforms operating legally. This pattern repeats across North African countries including Algeria, Egypt, Morocco and Tunisia. All four rank in the top 50 for worldwide adoption despite crypto being banned or restricted.

We previously reported that 15 US states are moving forward with plans for Bitcoin reserves, with Pennsylvania, Arizona and New Hampshire proposing allocations up to 10 percent of public funds. This government interest occurred largely without mainstream media attention. Institutional adoption operates independently of traditional media coverage patterns.

Industry Implications

The data shows crypto is moving into the financial mainstream across diverse regulatory environments. TRM Labs found adoption has accelerated where regulatory clarity and institutional access exist. In other jurisdictions, adoption expanded despite formal restrictions or outright bans. These contrasting dynamics point to a consistent global trajectory toward mainstream financial integration.

Stablecoins represent a key trend underscoring this shift. Hong Kong passed its Stablecoin Ordinance in May 2025, requiring issuers to obtain licenses. The European Union's Markets in Crypto-Assets framework addresses stablecoins through e-money tokens and asset-referenced tokens. Only licensed institutions can issue these instruments under EU law. The global coordination suggests regulatory frameworks will continue evolving toward standardization.

A 2023 report by the Financial Stability Board and International Monetary Fund reached similar conclusions about bans. The agencies stated that blanket prohibitions prove ineffective and often increase incentives for people to use cryptocurrencies. TRM Labs noted that jurisdictions with bans often outrank countries with permissive or regulated frameworks. This suggests grassroots demand for alternative financial tools can outweigh formal restrictions.

The competitive landscape for stablecoins appears set for major changes. Major banks including JPMorgan, Bank of America and Citi are in early talks to issue a unified digital dollar. Traditional financial institutions entering the space will reshape market dynamics. However, their reliance on high-fee customer bases may limit their ability to compete with existing providers. The regulatory clarity provided by the GENIUS Act will likely accelerate both institutional adoption and competition among issuers.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Analyst Analysis: XRP Faces Risk of Falling to $1

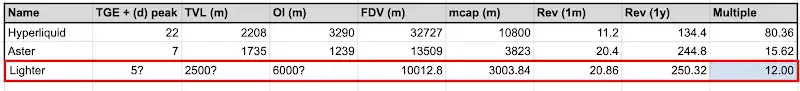

Opinion: Why Lighter Is Seriously Undervalued