- BlackRock deploys $500M BUIDL fund on the Aptos blockchain.

- Jump Crypto launches Shelby, boosting Aptos’ enterprise appeal.

- Aptos price has rebounded, testing the key $3.50 resistance level.

The APT price is showing renewed strength as Aptos gains major institutional backing from global giants like BlackRock and Jump Crypto.

After dipping to a yearly low earlier this month, Aptos has staged an impressive comeback, fueled by real-world asset tokenisation and enterprise-grade innovation across its ecosystem.

Institutional backing revives Aptos’ momentum

Aptos has outperformed a sluggish crypto market , gaining around 5% in the past 24 hours to trade near $3.32.

This sharp rebound follows BlackRock’s expansion of its Digital Liquidity Fund (BUIDL) to the Aptos blockchain, a move that has injected $500 million worth of tokenised Treasuries into the network.

🚨 $500M more of @BlackRock 's BUIDL just landed on Aptos.

This pushes Aptos back into the Top 3 in RWAs, with $1.2B+ tokenized assets on-chain. And now, we're #2 in BUIDL adoption.

Institutions are choosing Aptos, the chain to move what matters. pic.twitter.com/vT3jfZYmPb

— Aptos (@Aptos) October 21, 2025

The deployment of BUIDL has pushed Aptos into the top tier of real-world asset (RWA) blockchains, sitting just behind Ethereum and zkSync Era.

Data shows that more than $1.2 billion in RWAs are now tokenised on Aptos, a milestone that marks growing trust from traditional finance.

Notably, BlackRock’s involvement brings not only prestige but also liquidity and credibility to the network.

Jump Crypto’s Shelby adds more fuel

In parallel, Jump Crypto has launched Shelby, a decentralised, high-performance storage layer developed in collaboration with Aptos Labs.

Storage is the missing layer. Blockchains run fast. Oracles work. Messages move across chains. But without high performance storage, real execution stays centralized.

We're building Shelby with @AptosLabs to fix that. https://t.co/VFtuFRQp4P

— Jump Crypto 🔥💃🏻 (@jump_) October 21, 2025

Designed to rival traditional cloud providers such as AWS and Google Cloud, Shelby enables sub-second latency, low-cost reads and writes, and improved scalability.

Its architecture reduces redundancy while maintaining high data durability through erasure coding.

The new system could become a backbone for decentralised applications that require real-time data access and high-speed processing.

By combining Aptos’s parallel execution engine and Move programming language with Shelby’s efficient data design, the two firms aim to create infrastructure suited for enterprise and AI-driven decentralised finance (DeFi).

This blend of performance and programmability is helping Aptos carve a niche in a crowded Layer-1 field.

APT price outlook: eyes on key resistance levels

As institutional adoption accelerates and on-chain liquidity grows, the Aptos price could continue to benefit from renewed investor confidence.

While short-term volatility remains, the network’s long-term fundamentals appear stronger than ever — anchored by innovation, partnerships, and a clear path toward real-world integration.

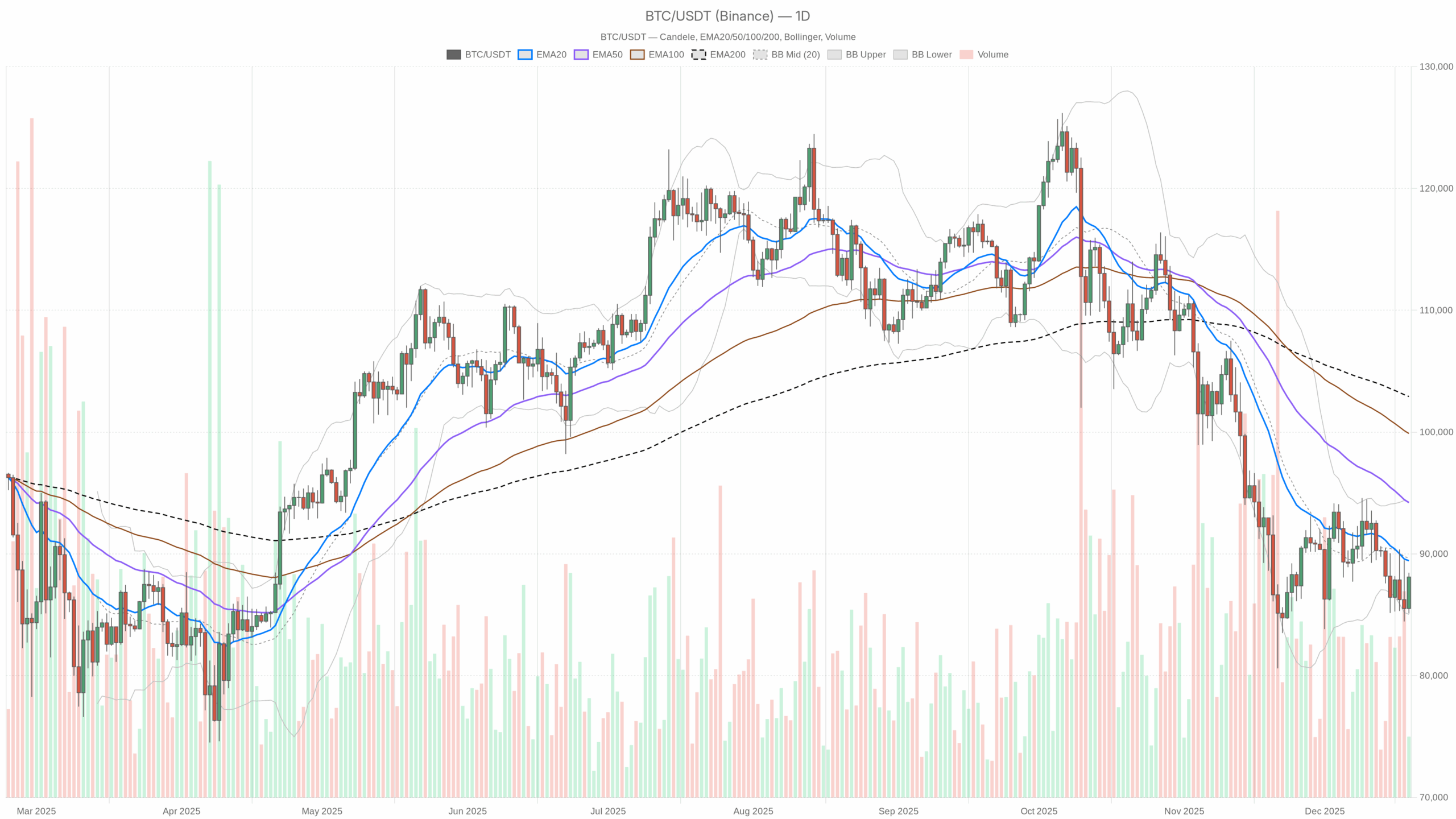

The Aptos price is currently testing resistance near $3.50 after rebounding from a recent low of $2.22.

Technical indicators show mixed signals, with moving averages flashing multiple sell alerts, although oscillators remain neutral.

The Relative Strength Index (RSI) hovers around 34, suggesting mild accumulation.

If APT breaks above $3.50, it could extend gains toward $3.85.

However, failure to maintain current momentum could see the token slip toward $3.00 or even retest its earlier lows.

Analysts like Michaël van de Poppe have noted that APT remains at one of its lowest valuations in years, hinting at potential upside if broader market sentiment improves.