- The ASTER price is currently struggling near $1 amid heavy selling pressure.

- A short squeeze above $1.39 could spark a sharp rebound.

- Solana’s Percolator DEX threatens Aster’s market dominance.

The ASTER price is under pressure as new competition brews in the decentralized perpetual exchange market.

Solana co-founder Anatoly Yakovenko has unveiled “Percolator,” a new L1-native perpetual DEX designed to run directly on the Solana blockchain.

This development introduces a powerful new contender into an already tense market dominated by Aster and Hyperliquid .

Aster, once celebrated for its dominance in the on-chain derivatives space, now faces a critical turning point.

The timing of Solana’s move couldn’t be more disruptive, coming as Aster grapples with a sharp price drop and declining user activity.

Solana’s Percolator shakes up the market

Yakovenko’s new project, Percolator, is still in its early development phase but has already attracted widespread attention.

Built directly on the Solana blockchain, it promises fast, low-cost perpetual trading without relying on external layer-2 networks.

Early GitHub data shows key modules for funding rates, account validation, and position management are already in place, with stress-testing expected soon.

The Solana ecosystem’s reputation for high throughput and low transaction fees gives Percolator a strong foundation to compete with existing players.

If it delivers on performance, the DEX could pull liquidity and traders away from Aster and Hyperliquid.

That potential shift adds pressure to Aster, which is already battling to retain users amid shrinking trading volumes and outflows.

ASTER price fights to stay above $1

At the time of writing, Aster is holding slightly above the $1 psychological support after two days of declines.

Technical indicators suggest the token is on shaky ground.

The MACD has crossed below its signal line, signaling weakening momentum, while the RSI sits near 31 — close to oversold levels.

Source: CoinMarketCap

Source: CoinMarketCap

A breakdown below $1 could send the token toward the next key support at $0.94, while a rebound could see a retest of $1.27.

Aster’s market data paints a worrying picture.

The token trades at $1.01, down more than 34% over the past month. Its market cap has slipped to about $2 billion, with daily trading volume at $805 million.

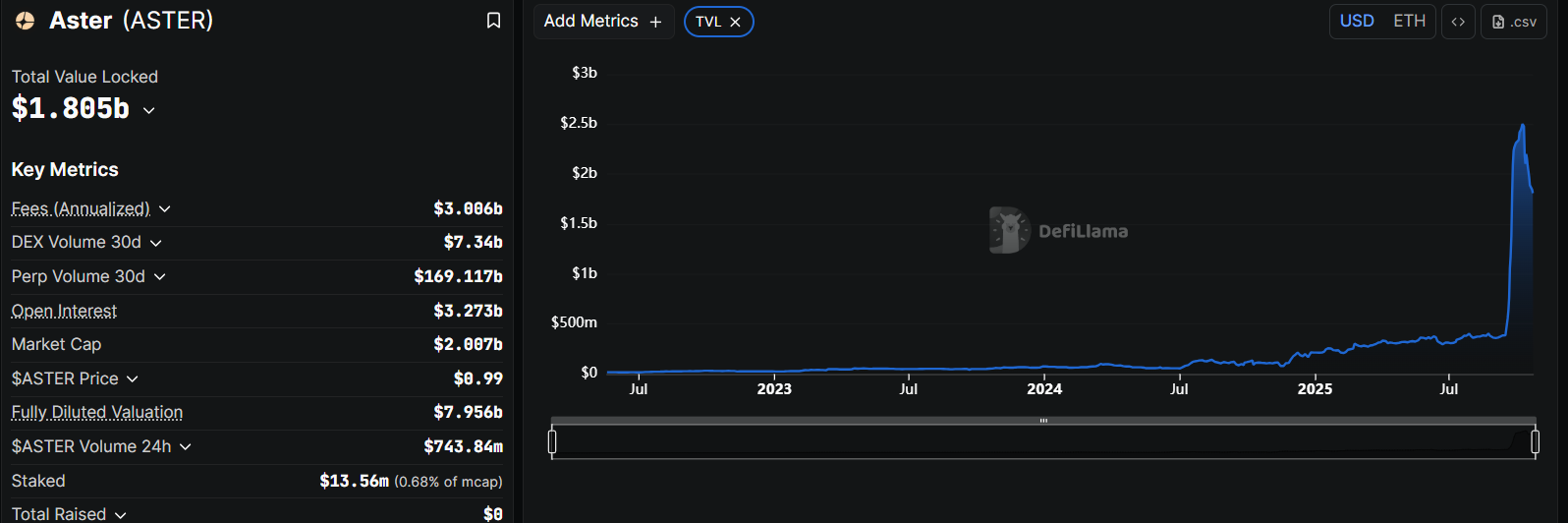

Aster’s Total Value Locked (TVL) has also contracted to $1.805 billion at press time, reflecting waning engagement from traders and liquidity providers.

Source: DefiLlama

Source: DefiLlama

Sentiment sours as usage crumbles

Over the past week, Aster has experienced $326 million in TVL outflows and a dramatic collapse in daily trading volume to just $78 million.

That compares poorly with Lighter and Hyperliquid, which still handle over $10 billion in daily trades.

This falloff in activity has raised concerns that traders are fleeing the protocol amid doubts about the sustainability of its incentive-driven growth.

Technical momentum remains bearish, with the formation of a MACD death cross and an Aroon Down reading near 93% reinforcing the downward bias.

Aster now trades in a weak demand zone between $1.03 and $1.14 — an area that historically offers little support.

If selling continues, analysts warn that the token could slide toward $0.70 or even $0.50.

Can a short squeeze save ASTER’s price?

Despite the gloom, some traders see a potential rebound setup forming.

The Money Flow Index (MFI) has dropped sharply from 80 to 38, suggesting retail investors are exiting.

However, derivatives data show that roughly 80% of positions remain short.

If the ASTER price climbs above $1.39, about $34 million in short positions could be liquidated on Binance alone, triggering a short squeeze.

A bullish RSI divergence adds weight to this scenario, showing sellers may be losing control.

If momentum shifts, a break above $1.39 could send prices toward $1.88 and $2.22.

But if the token falls below $1.05 or $0.92, the recovery setup would collapse, deepening the bearish trend.

For now, investors are watching whether Aster can stabilize and regain momentum before Percolator reaches full launch.

If Solana’s new DEX lives up to expectations, it could redefine the competitive balance across the entire decentralized derivatives landscape — and determine where the ASTER price heads next.