Bitcoin Surges Past $112,000 as the Fed Opens Doors to Crypto: What’s Next?

Bitcoin Price Prediction: Fed’s Crypto Pivot Ignites a Bullish Breakout

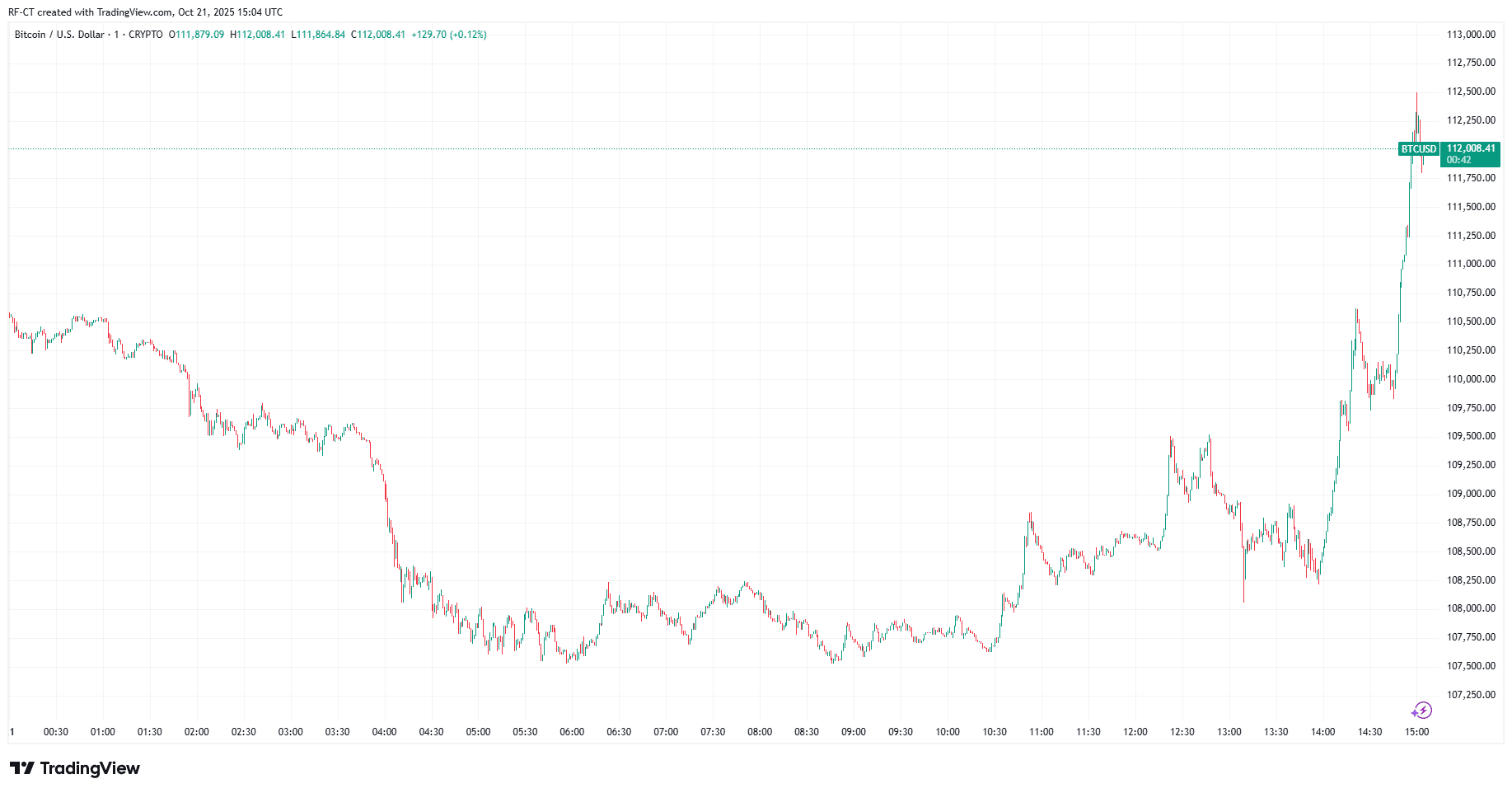

Bitcoin (BTC) has once again made headlines, surging past the $112,000 mark after the U.S. Federal Reserve revealed plans to explore “payment accounts” for crypto and fintech firms.

This move could give digital-asset companies direct access to Fed payment rails, a development analysts are calling one of the most bullish institutional signals of the year.

The announcement coincided with Bitcoin’s renewed upward momentum, pushing the price as high as $112,413, while overall crypto market capitalization climbed back above $4.6 trillion.

By TradingView - BTCUSD_2025-10-21 (1D)

By TradingView - BTCUSD_2025-10-21 (1D)

Why the Fed’s Decision Is a Game-Changer

The Fed’s new proposal would allow licensed fintech and crypto firms to open streamlined accounts with the central bank.

That means faster settlements, fewer intermediaries, and a more direct connection between the traditional banking system and blockchain-based payments.

According to Reuters , the program would remain restricted with no overdrafts or lending privileges, but it marks a clear shift toward integration rather than isolation.

This regulatory openness comes after months of heavy scrutiny and signals a more collaborative phase between U.S. regulators and the digital-asset industry.

Market Reaction: Bitcoin Leads, Altcoins Catch Up

Following the news, Bitcoin jumped by nearly 5% intraday, breaking above key resistance at $111,500.

Ethereum (ETH) also gained momentum, trading around $3,900, while Solana (SOL) and XRP posted smaller yet steady gains.

The sentiment across social media and institutional channels turned sharply positive, with traders framing this as the “crypto-institutional unlock” moment where banks, fintechs, and blockchain players could soon operate within the same infrastructure.

Technical Outlook: Can Bitcoin Hold Above $112,000?

From a technical standpoint, BTC’s breakout above $111K–$112K confirms a strong bullish reversal pattern after weeks of sideways action .

The next resistance sits around $115,000–$118,000, while the nearest support lies near $108,000.

If Bitcoin sustains above this breakout level, it could retest the $120,000 zone before the end of the month, potentially setting up for a new all-time high ahead of the next Fed meeting.

RSI levels remain healthy, indicating room for further upside, and volume inflows have picked up sharply, confirming institutional participation.

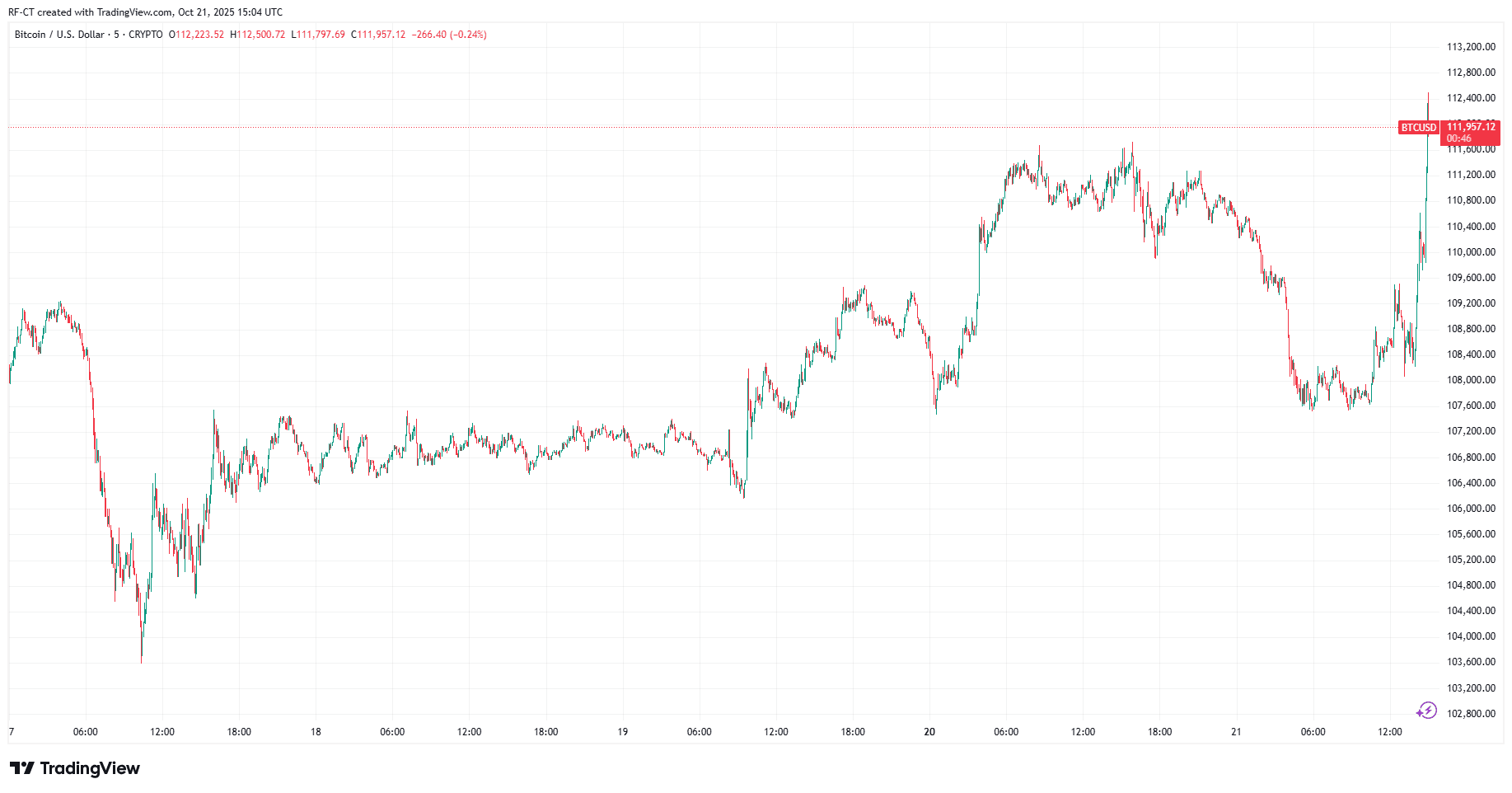

By TradingView - BTCUSD_2025-10-21 (5D)

By TradingView - BTCUSD_2025-10-21 (5D)

Macro Outlook: Why Bitcoin Could Keep Climbing

Beyond the charts, macro conditions also favor crypto.

The Fed’s softening stance combined with easing inflation and infrastructure inclusion for digital assets could mark the start of a new bullish cycle.

Analysts argue that if crypto firms gain partial access to the Fed’s network, it could boost liquidity, lower transaction costs, and legitimize stablecoin use within the U.S. economy, all of which reinforce Bitcoin’s long-term narrative as digital gold.

Final Thoughts: Short-Term Volatility, Long-Term Strength

While Bitcoin’s quick rise may trigger short-term profit-taking, the fundamentals are turning increasingly positive.

The Fed’s move validates crypto’s role within the financial system, something the market has been waiting for since 2021.

If BTC holds above $110K , the next leg could target $120K–$125K in the short term and $140K–$150K by early 2026, provided macro conditions remain supportive.

In short: the Fed just gave Bitcoin more than a rally, it gave it legitimacy!

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

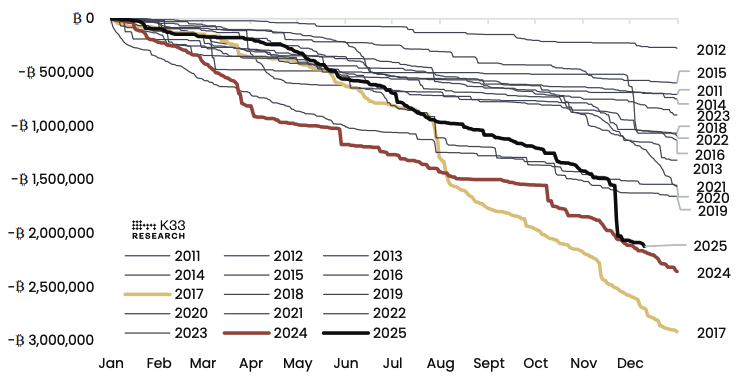

Sell-side pressure from long-term Bitcoin holders nears saturation: K33

Unveiled: Infrared’s Token Generation Event Kicks Off on Berachain

IoTeX Publishes MiCA-Compliant Whitepaper to Expand EU Market Access for IOTX

BlackRock moves 47K Ethereum in a day: But the real story isn’t a sell-off