Bitcoin breaks through the $112,000 mark, Federal Reserve opens the door to cryptocurrencies: What happens next?

Bitcoin surged to over $112,000 after the US Federal Reserve indicated it would allow crypto companies to access its payment network. What does this mean for Bitcoin and the broader market?

Bitcoin Price Prediction: The Federal Reserve's Crypto Pivot Sparks Bullish Breakout

Bitcoin (BTC) is back in the headlines, with its price soaring above $112,000 after the United States Federal Reserve announced plans to explore "payment accounts" for cryptocurrency and fintech companies.

This move could allow digital asset firms direct access to the Fed's payment systems, which analysts are calling one of the most bullish institutional signals of the year.

This announcement coincides with Bitcoin's upward momentum, pushing the price to $112,413, while the overall cryptocurrency market capitalization has also rebounded to over $4.6 trillion.

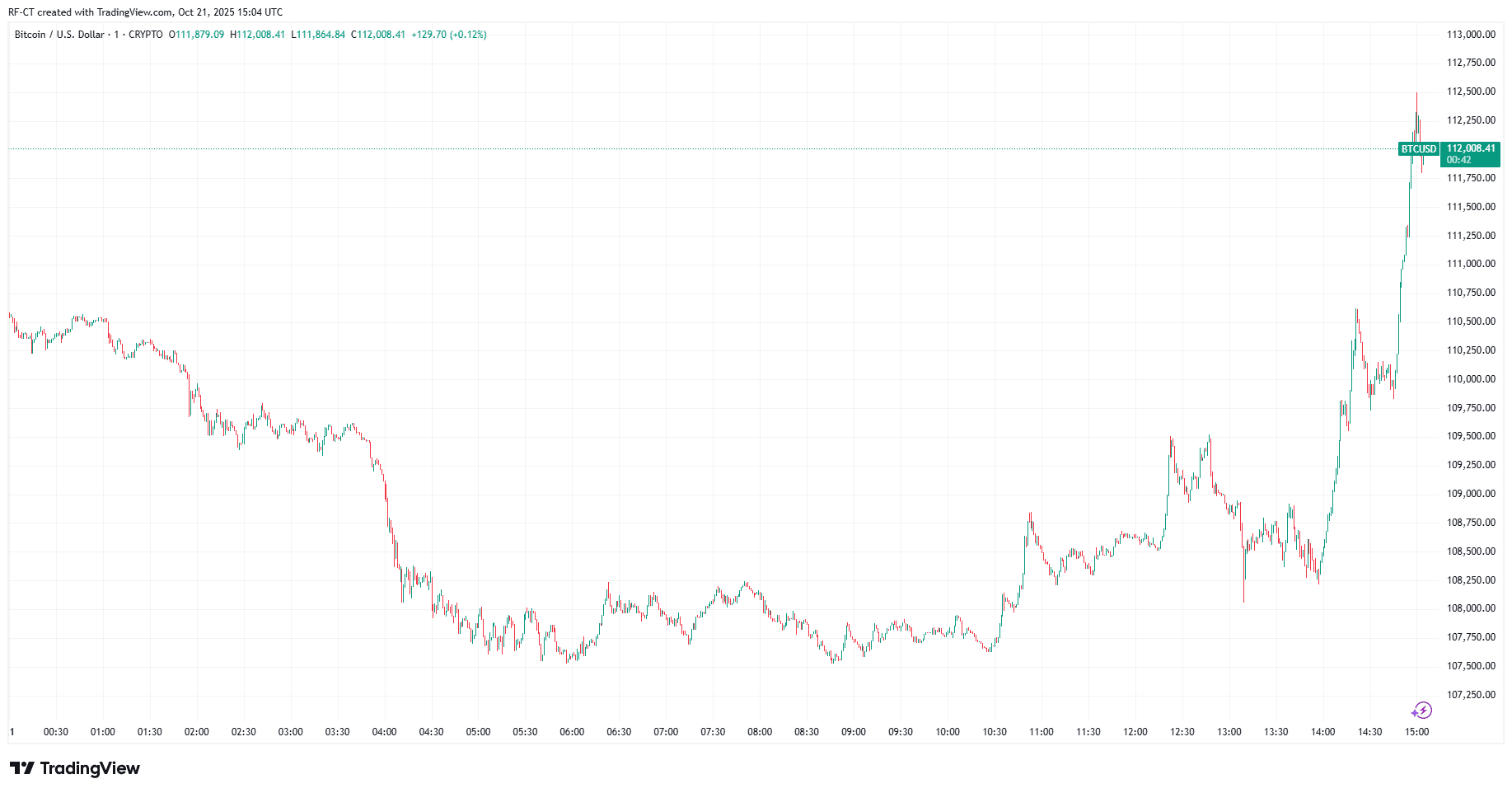

By TradingView - BTCUSD_2025-10-21 (1D)

By TradingView - BTCUSD_2025-10-21 (1D) Why the Fed's Decision Is a Game Changer

The Fed's new proposal will allow licensed fintech and cryptocurrency companies to open streamlined accounts at the central bank.

This means faster settlements, fewer intermediaries, and a more direct connection between the traditional banking system and blockchain-based payments.

According to Reuters, the plan will maintain restrictions, with no overdraft or lending privileges, but it marks a clear shift from isolation to integration.

After months of intense scrutiny, this regulatory openness signals a more collaborative phase between US regulators and the digital asset industry.

Market Reaction: Bitcoin Leads, Altcoins Follow

Following the news, Bitcoin surged nearly 5% intraday, breaking through the key resistance level of $111,500.

Ethereum (ETH) also gained momentum, trading around $3,900, while Solana (SOL) and XRP posted smaller but steady gains.

Sentiment on social media and institutional channels shifted sharply positive, with traders viewing this as a "crypto-institutional unlock" moment, where banks, fintech, and blockchain participants may soon operate within the same infrastructure.

Technical Outlook: Can Bitcoin Hold Above $112,000?

From a technical perspective, Bitcoin's breakout above $111,000 to $112,000 confirms a strong bullish reversal pattern after weeks of sideways consolidation.

The next resistance lies around $115,000 to $118,000, while the nearest support is near $108,000.

If Bitcoin can hold above this breakout level, it may retest the $120,000 area before the end of the month, with the potential to set new all-time highs ahead of the next Fed meeting.

RSI levels remain healthy, indicating room for further upside, and a significant increase in volume inflows confirms institutional participation.

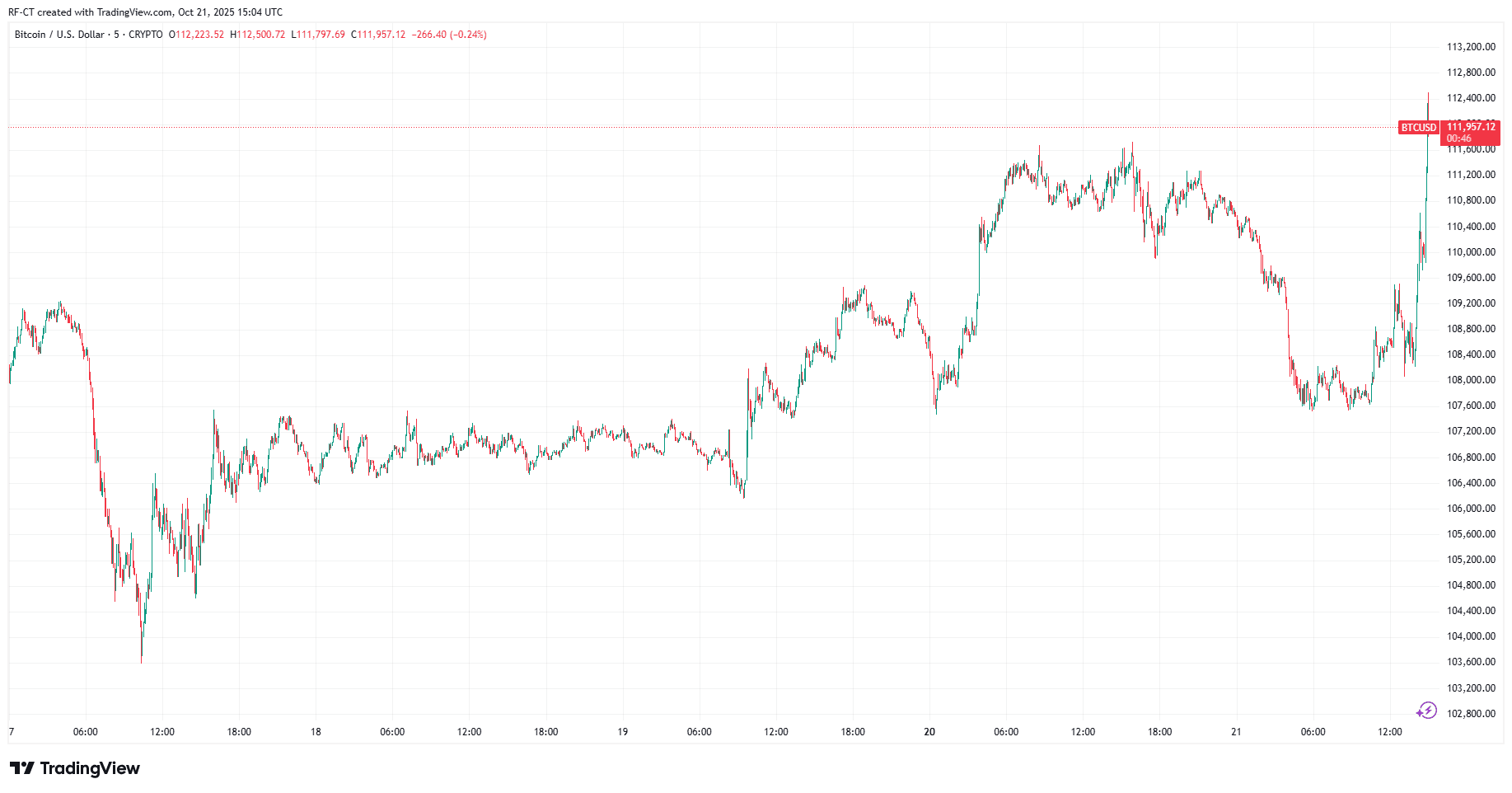

By TradingView - BTCUSD_2025-10-21 (5D)

By TradingView - BTCUSD_2025-10-21 (5D) Macro Outlook: Why Bitcoin May Keep Climbing

Beyond the charts, macro conditions are also favorable for crypto.

The Fed's softer stance, combined with easing inflation and the inclusion of digital asset infrastructure, could signal the start of a new bull cycle.

Analysts believe that if crypto companies gain partial access to the Fed's network, it could increase liquidity, lower transaction costs, and legitimize the use of stablecoins in the US economy—all of which reinforce Bitcoin's long-term narrative as digital gold.

Final Thoughts: Short-Term Volatility, Long-Term Strength

While Bitcoin's rapid surge may trigger short-term profit-taking, the fundamentals are becoming increasingly positive.

The Fed's move validates crypto's role in the financial system, something the market has been waiting for since 2021.

If Bitcoin holds above $110,000, the next short-term target could be $120,000 to $125,000, with the possibility of reaching $140,000 to $150,000 in early 2026, provided macro conditions remain supportive.

In short: The Fed has not only given Bitcoin a rally, but also legitimacy!

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

From DeFi Infrastructure to RWA Leader: How Ondo Seizes Every Market Opportunity

Exclusive Interview with HelloTrade: The "On-Chain Wall Street" Backed by BlackRock

After creating the largest bitcoin ETF in history, BlackRock executives are now reconstructing Wall Street on MegaETH.

US SEC Chairman Makes Bold Prediction: The Era of Global Financial On-Chain Has Arrived

SEC Chairman Atkins stated that tokenization and on-chain settlement will reshape the U.S. capital markets, creating a more transparent, secure, and efficient financial system.