Analyst: This bull market is driven by long-term spot investors; if their influence starts to wane, the market will quickly turn bearish.

BlockBeats News, on October 20, crypto analyst Willy Woo stated that the liquidity driving the previous bull market peak mainly came from the "paper hands" derivatives market. "Paper hands" are essentially short-term speculative tools—people are willing to enter the market to gamble, but will not stay for the long term.

This cycle is showing a different trend. "Paper hands" liquidity has already started to fade, while long-term spot liquidity remains stable for now. However, this does not signal a bullish "supercycle." Once long-term investors' spot liquidity begins to decline, the market will quickly turn bearish.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

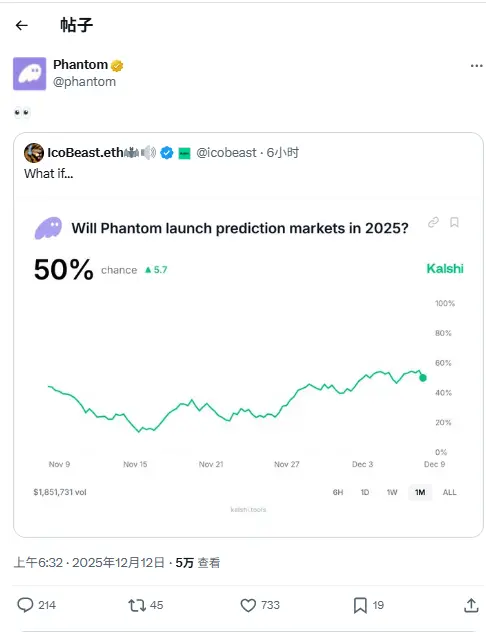

Phantom reposts a Polymarket prediction screenshot, hinting at a possible launch of a prediction market.

YouTube introduces a new option to pay US creators with stablecoins

A certain exchange launches x402 V2, supporting payments in different currencies through the same interface.