Aster Price Vulnerable To Crash Below $1 After Falling 15% in 24 Hours

Aster’s price faces growing pressure after a sharp 15% drop. With RSI and CMF signaling weakness, a fall below $1.00 could accelerate losses unless buyers step in soon.

Aster (ASTER) is witnessing steep losses after a sharp 15% decline in the last 24 hours. The token’s ongoing downtrend highlights a lack of support from both investors and the broader market.

With sentiment weakening, Aster risks losing its crucial psychological support at the $1.00 level, threatening further downside.

Aster May Not Survive

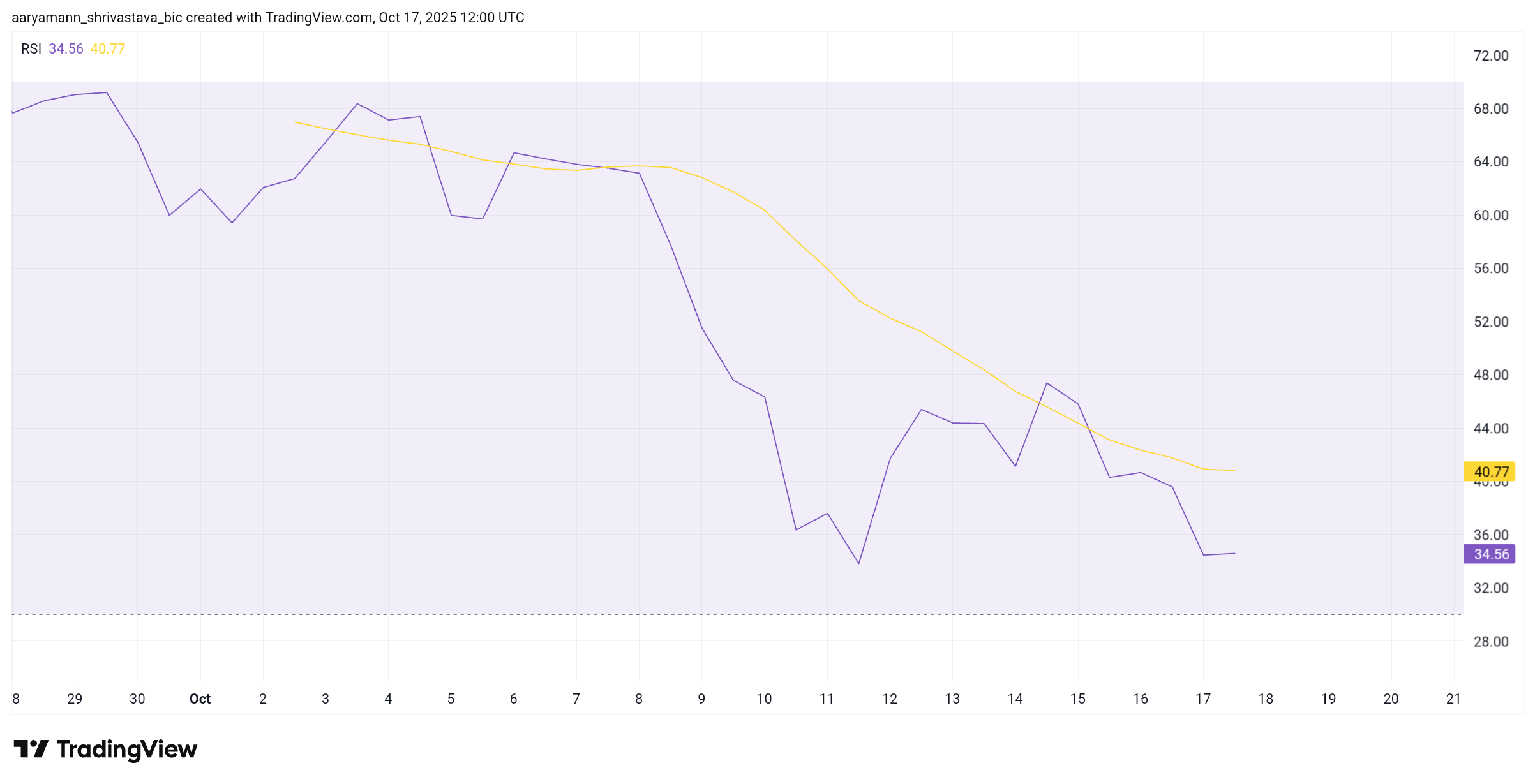

The Relative Strength Index (RSI) currently sits well below the neutral 50 mark, indicating strong bearish momentum. This downward movement reflects increasing selling pressure among investors, many of whom are liquidating positions amid heightened volatility. Unless momentum reverses soon, Aster’s price could remain under heavy strain in the short term.

However, a drop into the oversold zone—typically below the 30 level—could present an opportunity for reversal. Historically, such dips have often marked turning points for oversold assets. For Aster, reaching this point could trigger renewed buying interest as traders attempt to capitalize on discounted prices.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

ASTER RSI. Source:

ASTER RSI. Source:

ASTER RSI. Source:

ASTER RSI. Source:

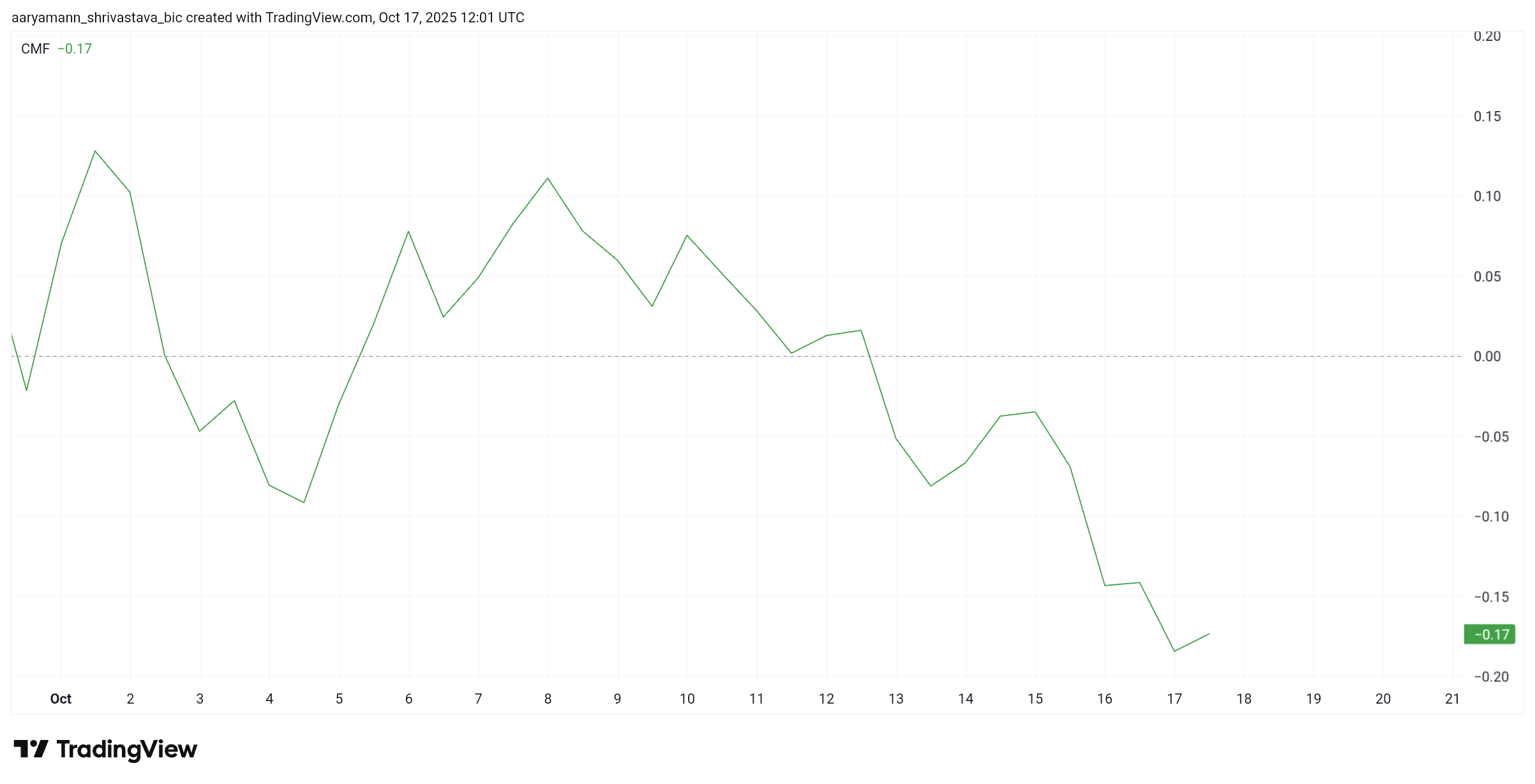

The Chaikin Money Flow (CMF), which measures the flow of capital into and out of an asset, continues to fall deeper into negative territory. This signals that investors are pulling money out of Aster, reflecting waning confidence in the altcoin’s near-term performance. Sustained capital outflows often precede prolonged downtrends.

This trend suggests that Aster may struggle to attract fresh liquidity. Without renewed inflows, the token’s price is unlikely to stabilize or recover meaningfully. Investor hesitation amid broader market weakness could further amplify the bearish momentum and drive Aster closer to critical support levels.

ASTER CMF. Source:

ASTER CMF. Source:

ASTER CMF. Source:

ASTER CMF. Source:

ASTER Price On Trouble

Aster is trading at $1.07 at press time, maintaining a fragile hold above the $1.00 support level. This threshold is psychologically significant, as breaking below it could accelerate panic selling.

If the bearish momentum strengthens, Aster could fall below $1.00 and test the $0.88 support. This would extend the investors’ losses and dampen the recovery sentiment further.

ASTER Price Analysis. Source:

ASTER Price Analysis. Source:

ASTER Price Analysis. Source:

ASTER Price Analysis. Source:

Conversely, should Aster reclaim the $1.17 resistance as support, the token could stage a rebound. A successful recovery from this point might push Aster toward $1.38, signaling the potential start of a short-term bullish correction.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BitMine buys $70M ETH while Tom Lee revises Bitcoin prediction

Bitcoin mispricing deepens as BTC trades below $100K, but not for long: Bitwise

Solana on-chain flows flag notable supply shift as SOL trades near key support

ETH briefly touches $3K but traders remain skeptical: Here’s why