Clarification on U.S. Treasury Leadership and Crypto Statements

- No official statement from the U.S. Treasury confirming crypto market gains.

- Janet Yellen remains the recognized U.S. Treasury Secretary.

- Regulatory focus is on addressing cryptocurrency market risks.

Reports circulate online about a ‘Treasury Secretary Bessent’ claiming imminent economic gains tied to cryptocurrency, but no such statements are corroborated by official sources as of October 2025.

This situation highlights the need for caution and verification amidst misinformation, underscoring the importance of relying on verified data and statements from official authorities in financial markets.

Recent discussions highlight confusion over Treasury announcements, with no verifiable news of crypto market growth claims by a non-existent Treasury Secretary Bessent. Official channels confirm Janet Yellen holds the office amid ongoing regulatory discussions.

Speculations arose from unauthorized sources suggesting major investment shifts linked to crypto assets. These claims were unfounded, with official U.S. Treasury communications led by Janet Yellen emphasizing regulatory concerns without referencing economic boosts or leadership changes.

Market analysts are uncertain about claims suggesting gains in productivity due to crypto investments, citing a lack of substantial evidence from recognized authorities. Investor sentiment remains cautious as robust oversight discussions continue.

The potential ramifications of unverified statements could mislead stakeholders. Emphasis has been placed on the importance of accurate, official information regarding financial markets and regulation to avoid financial uncertainty.

Financial markets observe the situation closely, aware that unverified claims can impact investor decisions. Regulatory transparency is critical, as Yellen’s confirmed statements have focused on policy gaps rather than market optimism.

Regulatory focus continues on minimizing systemic risks, inspired by past crypto exchange collapses . Yellen advocates for closing regulatory gaps and enhancing market oversight, without suggesting a boosted economic outlook through crypto-driven initiatives.

Janet L. Yellen, U.S. Treasury Secretary, “The recent failure of a major cryptocurrency exchange and the unfortunate impact that has resulted for holders and investors of crypto assets demonstrate the need for more effective oversight of cryptocurrency markets” – U.S. Treasury Press Release .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

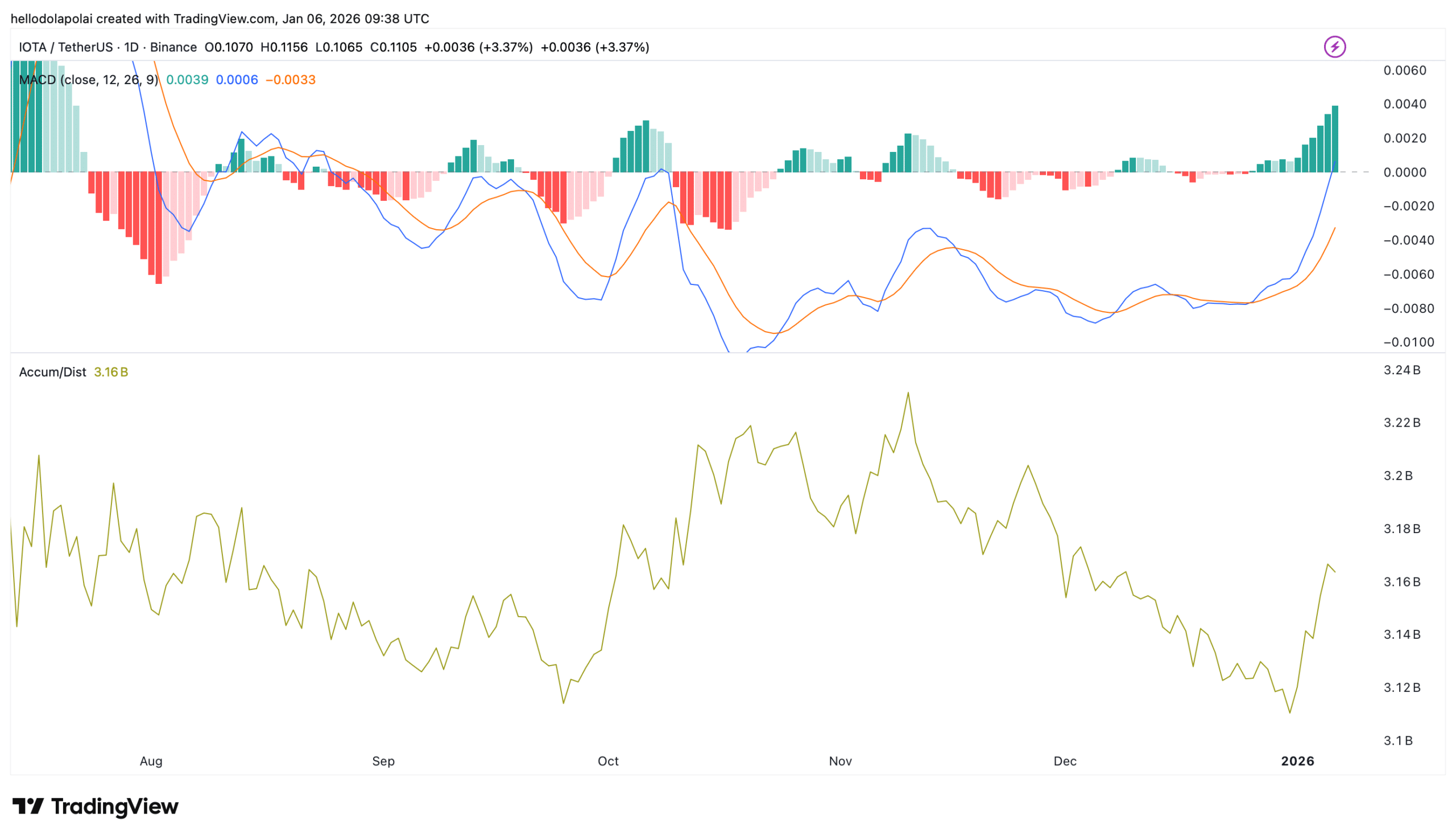

Decoding IOTA’s 35% weekly rally and the RISKS still ahead

PEPE Price Prediction: PEPE Is Building Strong Support at This Level – Next Move Could Triple Your Money

Web3's largest gaming and meme token PepeNode will shut down within 48 hours.

BlockDAG About to Explode in January 2026? Why It’s Being Compared to Kaspa as Presale Nears Its End