October 13 Key Market Insights, A Must-Read! | Alpha Morning Report

Featured News

1.Due to Trump's Moderate Speech, Cryptocurrency and Major U.S. Stock Index Futures Rebound

2.Binance Has Compensated $283 Million to Users Affected by USDE and Other Assets' De-pegging, Spot "Zero Price" Only a Display Issue

3.$216 Million Liquidated Across the Network in the Past Hour, Mainly Short Positions

4.Cryptocurrency Total Market Cap Rebounds Above $4 Trillion, 24-hour Increase of 5.6%

5.Macro Outlook for the Week: Powell Speech on Tuesday Night

Articles & Threads

1.《Weekly Review | Epic Cryptocurrency Market Crash Leads to 1.6 Million Liquidations; Monad Airdrop Claim Portal to Open on October 14》

After hitting a historic high of $126,000, Bitcoin experienced an epic crash. The U.S. Bureau of Labor Statistics is expected to release the CPI report during the government shutdown, and Binance Alpha launched various Chinese narrative meme coins on the contract platform.

2.《Traders' View | Why Did This Epic Market Crash Happen, and When Is the Right Time to Buy the Dip?》

October 11, 2025, a day that will be engraved in crypto history. Influenced by U.S. President Trump's announcement of restarting the trade war, the global market instantly entered panic mode. Starting at 5 a.m., Bitcoin began a nearly unsupported cliff-like decline, which quickly spread throughout the entire crypto market. However, why was this liquidation so intense? Has the market bottomed out? ReLive BlockBeats compiled perspectives from multiple market traders and well-known KOLs, analyzing this epic liquidation from the macro environment, liquidity, market sentiment, and other perspectives, for reference only.

Market Data

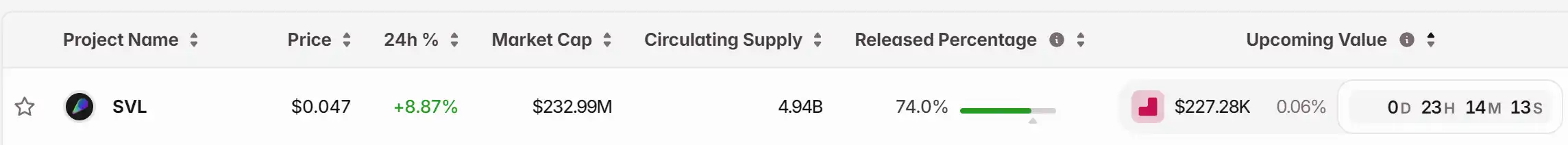

Daily Market Overall Funding Heatmap (as reflected by Funding Rate) and Token Unlocks

Data Source: Coinglass, TokenUnlocks

Funding Rate

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana's Abrupt Decline: Underlying Factors and What It Means for Investors

- Solana’s Q3 2025 sell-off reflects strong network performance (80M daily transactions) but a $352.8M company net loss from derivatives and financing costs. - Market sentiment diverged: $113.5B market cap growth vs. 6.87% stock drop post-earnings, driven by macroeconomic risks and regulatory uncertainty. - Upgrades like Alpenglow (150ms finality) and ZK Compression v2 (5,200x cost reduction) position Solana for institutional adoption despite short-term volatility. - Investors face a dilemma: 32.7% DeFi TV

DASH Price Increases by 1.78% Following Significant Insider's Share Sale Filing

- DoorDash’s stock rose 1.78% on Dec 2, 2025, despite a 20.32% weekly drop, showing long-term investor confidence. - Officer Lee Gordon S filed to sell 2,159 shares via Rule 10b5-1 plan, part of routine insider trading strategy . - Director Alfred Lin bought $100M in DASH shares, contrasting with 90-day insider sales of $174.5M. - Institutional investors showed mixed activity, with Panagora buying and Spyglass, Arrowstreet reducing stakes. - Analysts maintain "Moderate Buy" rating, projecting growth amid v

What's Causing the Latest BTC Price Swings: Is It a Macro-Fueled Reevaluation?

- Bitcoin's late 2025 volatility reflects macroeconomic pressures, Fed policy shifts, and regulatory changes impacting institutional demand. - Sharp price swings from $126k to $87k highlight sensitivity to inflation, interest rates, and leveraged trading risks amid delayed economic data. - New U.S. crypto laws and ETF approvals boosted institutional participation, but geopolitical risks and token unlocks maintained uncertainty. - A potential Fed rate cut and stabilizing inflation could reignite risk appeti

The ChainOpera AI Token Collapse: A Cautionary Tale for AI-Powered Cryptocurrency Markets?

- ChainOpera AI (COAI) token's 96% collapse in late 2025 exposed systemic risks in AI-blockchain markets, mirroring 2008 crisis patterns through centralized governance and speculative hype. - COAI's extreme centralization (96% supply in top 10 wallets) and tokenomics (80% locked until 2026) created liquidity crises, undermining blockchain's decentralized ethos. - Regulatory actions intensified post-crash, with SEC/DOJ clarifying custody rules and targeting fraud, yet CLARITY/GENIUS Acts created compliance