How Did Zcash Defy The Crypto Market Crash To Hit An All-Time High?

Zcash (ZEC) defied a $20 billion crypto liquidation wave, soaring 450% in a month to reach a four-year high.

Zcash (ZEC) has emerged as one of the few digital assets to rally amid one of the harshest liquidation waves in recent crypto history.

As nearly $20 billion in leveraged positions vanished following President Trump’s unexpected tariff announcement, the privacy-focused cryptocurrency surged to a four-year high.

Why is Zcash Price Rising?

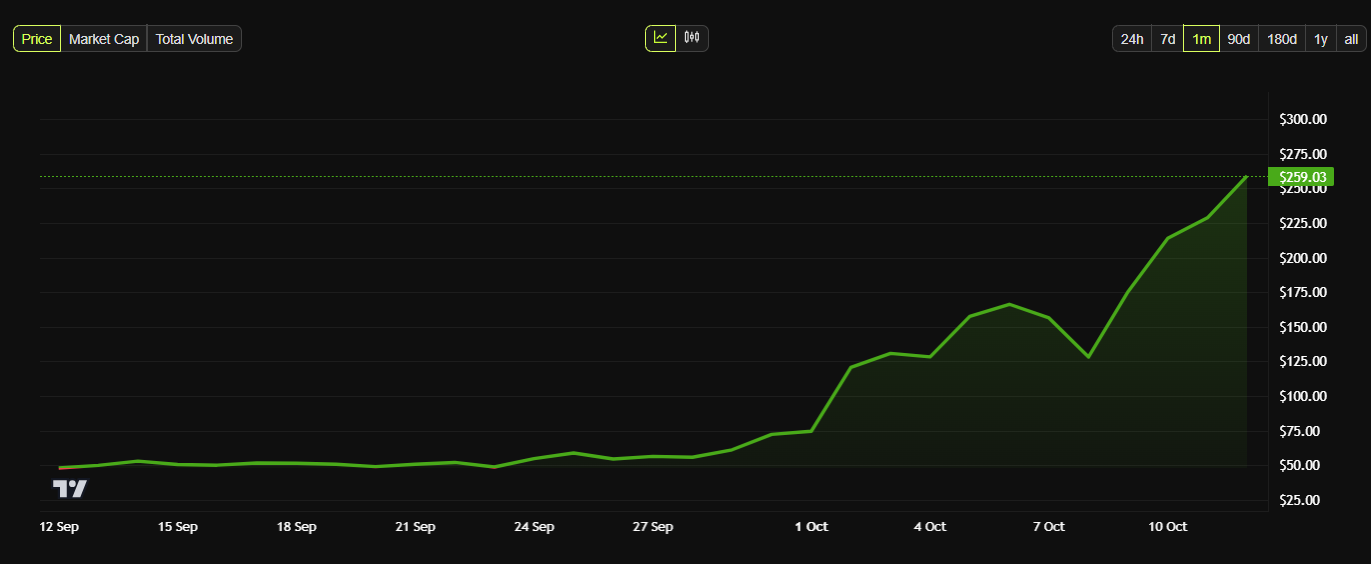

Data from BeInCrypto showed ZEC price briefly touching $282.59 on October 11 before easing to about $257.96. Even after that pullback, the token posted a 15% daily gain—its strongest since late 2021, when it last traded near $295.

This continues an upward movement for a digital asset that has climbed over 100% this week and nearly 450% in the past month.

Zcash’s Price Performance in the Last 30 Days. Source:

Zcash

Zcash’s Price Performance in the Last 30 Days. Source:

Zcash

Zcash’s rally has been aided by crypto traders’ rotation into privacy-centric projects following increased financial surveillance by global authorities.

Moreover, the token’s positive performance has been amplified by industry figures such as Barry Silbert, founder of Digital Currency Group. Notably, he has reshared multiple Zcash-related updates in recent days.

Outside of that, some community members have pointed out that Zcash remains undervalued relative to its fundamentals.

Mert Mumtaz, CEO of Helius Labs, argued that ZEC has operated as a proof-of-work, fully distributed network for nine years.

According to him, the project offers user sovereignty, advanced encryption, and Bitcoin-like tokenomics at a fraction of the market capitalization of peers such as Litecoin or Cardano.

Mumtaz also cited a “renaissance” of developer activity, with new contributors focusing on performance improvements and exchange integrations.

Considering this, he argued that the token “is the most obvious mispricing in crypto,” while adding that:

“The community using the power of crypto and public markets to breathe life back into the project,” Mumtaz said.

Launched in 2016, Zcash uses zero-knowledge proofs to enable private transactions without revealing the sender, receiver, or amount. These features are missing in top cryptocurrencies like Bitcoin and Ethereum.

So, as governments worldwide increase financial surveillance, Zcash’s shielded-transaction model is regaining relevance among privacy-minded users.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Growing Enthusiasm for Zcash (ZEC) and What It Means for Privacy-Focused Cryptocurrencies: Navigating Strategic Opportunities Amid Regulatory Ambiguity

- Zcash (ZEC) emerged as a leading privacy-centric cryptocurrency in 2025, balancing financial confidentiality with compliance-ready features amid regulatory scrutiny. - Its 248% October price surge and 18% December crash highlighted volatility driven by macroeconomic shifts and privacy coin demand outpacing Bitcoin . - Institutional adoption grew as firms like Reliance Global Group and Grayscale leveraged Zcash's optional privacy model to meet regulatory reporting requirements. - Strategic initiatives foc

ICP Network Expansion: A Comprehensive Review of Blockchain Integration and Infrastructure Scalability

- ICP's 2025 strategic upgrades (Flux, Magnetosphere, Vertex) enhanced scalability, AI integration, and cross-chain interoperability through Chain Fusion technology. - Institutional partnerships with Copper and UNDP, plus $237B TVL growth, demonstrate ICP's enterprise-grade security and real-world utility in digital credentialing and DeFi. - Caffeine AI platform and chain-of-chains architecture enable natural language app development, attracting businesses seeking decentralized cloud alternatives. - Despit

AWS and Cloudflare Failure Show the Real Risk of Centralized Cloud

The Federal Reserve's Change in Policy and Its Growing Influence on Blockchain-Based Innovation

- The Fed's 2025 GENIUS Act and FedNow infrastructure catalyzed blockchain growth, boosting Solana's capital inflows and institutional adoption. - Regulatory clarity for stablecoins (1:1 reserves, AML safeguards) drove $315B market cap and $9T annual transactions, reshaping digital finance. - Solana's 5,000 TPS and partnerships with Visa/Stripe/BlackRock positioned it as a FedNow alternative for cross-border settlements and tokenized assets. - Hybrid infrastructure models (FedNow + permissionless chains) m