Date: Sat, Oct 11, 2025 | 05:00 AM GMT

The cryptocurrency market has just witnessed one of the most devastating and unforgettable events in its history — a $19 billion liquidation wipeout that sent shockwaves across the entire digital asset ecosystem.

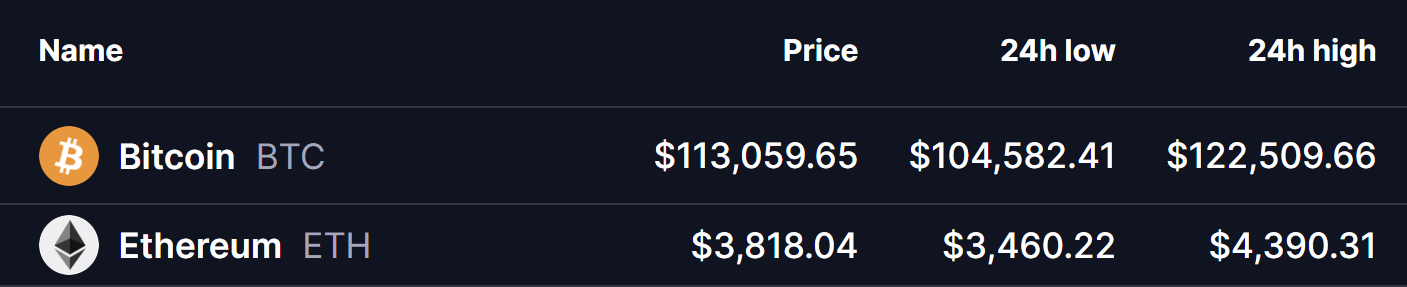

Within a span of hours, Bitcoin (BTC) and Ethereum (ETH) faced extreme volatility as panic selling engulfed the market. Bitcoin’s price plummeted to a 24-hour low of $104,582, while Ethereum tumbled to $3,460. The sudden crash triggered an altcoin massacre, with many tokens dropping over 50% in just a single minute — a brutal reminder of how quickly sentiment can shift in crypto markets.

Source: Coinmarketcap

Source: Coinmarketcap

Why Did the Crypto Market Crash?

The primary catalyst behind the crash was a major geopolitical shock. U.S. President Donald Trump announced a 100% tariff on goods imported from China, set to take effect on November 1.

This move marked the beginning of a fresh trade war between the two largest global economies, reigniting fears of economic instability. Markets worldwide reacted sharply, but the crypto sector bore the brunt as investors rushed to de-risk their portfolios.

Large holders, or whales, reportedly initiated heavy sell-offs immediately following the announcement, creating a domino effect of panic selling that spiraled into the largest liquidation event the market has ever seen.

$19B in Crypto Liquidations – A Record-Breaking Event

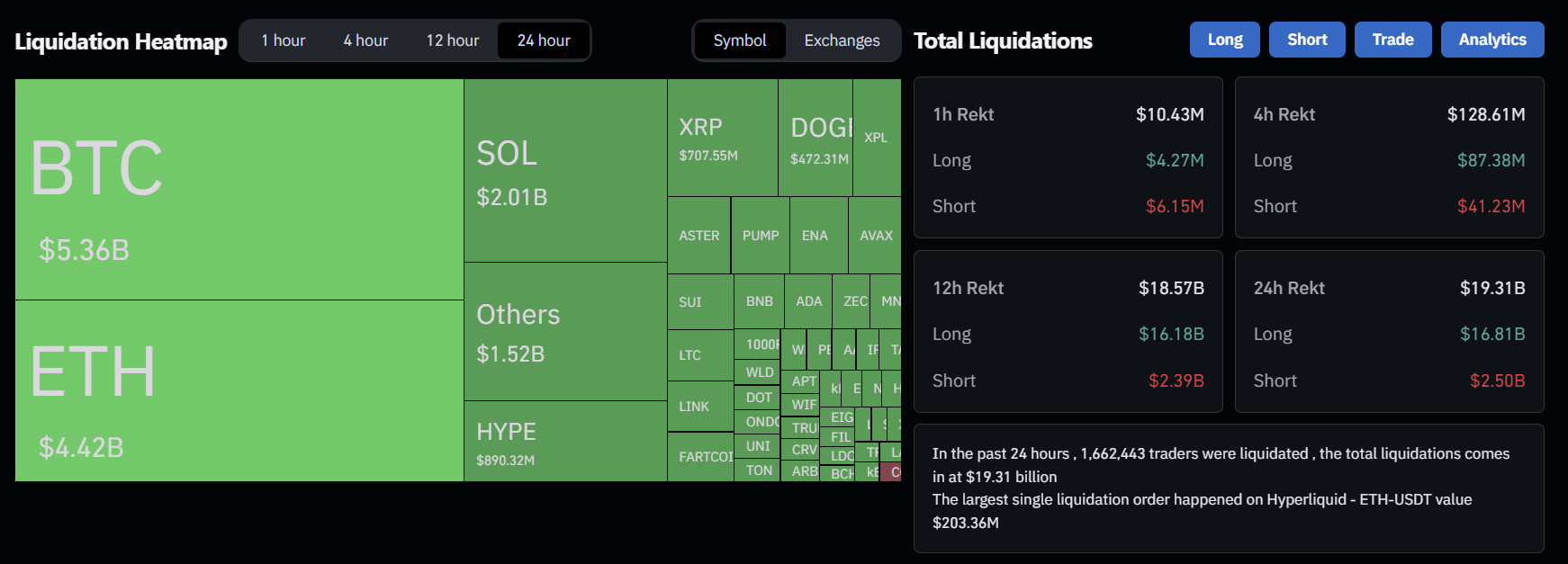

According to Coinglass , over $19 billion worth of leveraged positions were liquidated in the last 24 hours — marking the biggest single-day liquidation event in cryptocurrency history.

Out of this massive figure, approximately $16 billion came from long positions, as traders betting on higher prices were caught completely off-guard by the sudden crash. Meanwhile, short positions accounted for around $2.5 billion of the total wipeout.

Crypto Liquidations Data/Source: Coinglass

Crypto Liquidations Data/Source: Coinglass

What’s Next for the Market?

After the steep decline, the market is showing early signs of stabilization. Bitcoin has rebounded to around $113,000, recovering slightly from its sharp drop to $104,000.

However, sentiment remains extremely fragile. Analysts warn that the market might take time to rebuild confidence, as this unprecedented event has shaken investor trust and drained liquidity from multiple trading platforms.

Still, seasoned traders see opportunity amid chaos — noting that historically, such massive liquidations often create the foundation for a stronger long-term recovery, once the market digests the shock.

The $19B liquidation marks a turning point for the crypto market — a stark reminder that even in times of bullish optimism, geopolitical uncertainty can change everything overnight.