$100 Million Lost in One Hour: Bitcoin Drops Spark Rampaging Liquidations

Bitcoin’s $4,000 drop sparked $700 million in liquidations, proving retail traders still wield power despite institutional dominance. Analysts now eye how these dual forces will shape BTC’s next move.

Retail Bitcoin traders made themselves heard today, causing $700 million in crypto liquidations. The price of BTC fell by around $4,000 as on-chain activity spiked, even though institutions kept buying.

Whether or not BTC keeps dropping or recovers soon, we need to pay attention to these dynamics. Corporate liquidity is very influential in the market, but it’s not the final arbiter of price.

Bitcoin Causes Surprise Liquidations

When Bitcoin hit two successive all-time highs earlier this week, it caused a little consternation in the community. This took place despite a lack of retail activity, with institutional investors powering the growth.

Crucially, these corporations continued making huge purchases while BTC’s value was inflated.

In other words, there have been fears that these inflows could profoundly alter market cycles. Arthur Hayes even proclaimed that the four-year cycle was dead and that global institutional liquidity would determine token prices now.

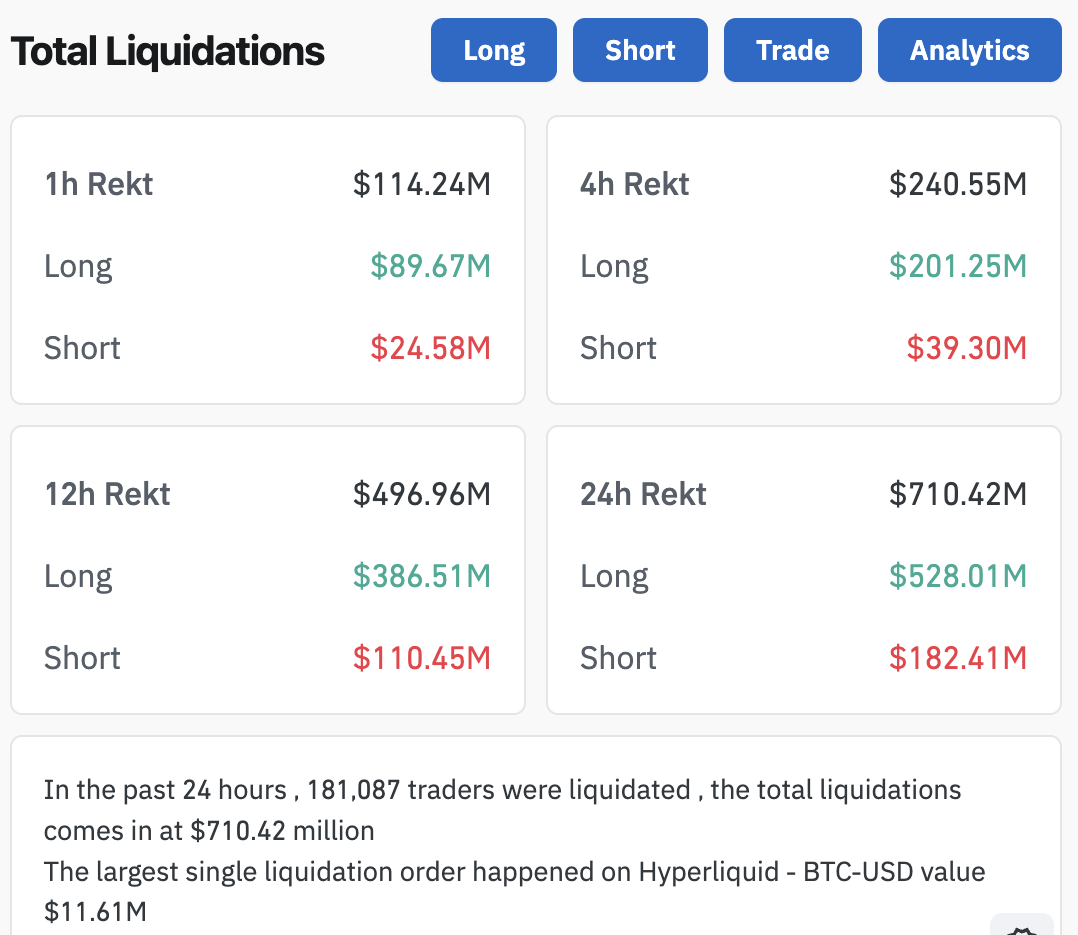

Today, however, these concerns seem less serious. Bitcoin fell around $4,000 in the last 24 hours, spawning a frenzy of crypto liquidations. Over $114 million in total short positions were eradicated in one hour:

Bitcoin Drops Cause Liquidations. Source:

CoinGlass

Bitcoin Drops Cause Liquidations. Source:

CoinGlass

Retail Traders’ Impact

A few key factors suggest that retail Bitcoin traders caused all these liquidations. For one thing, ETF issuers continued buying BTC at elevated rates, and the products are seeing huge inflows. Meanwhile, BTC’s on-chain trading activity has spiked between 4% and 5%, showing that activity is stirring awake.

Analysts have already identified some of the most likely causes for Bitcoin’s retreat to $120,000, which triggered these liquidations. They seem like pretty standard price actions; long-term traders are taking profits, holder accumulation rates sparked low confidence, etc.

Furthermore, there are even signs that BTC could rebound in the near future.

This, too, presents a useful opportunity to gather valuable market data. These new structural forces are very powerful, but they aren’t all-powerful.

Retail activity still spurred a major Bitcoin price dump, causing a cascade of liquidations. What new narratives can help explain this behavior and enable accurate predictions?

Whether Bitcoin keeps going up or down, these questions should be at the forefront of traders’ minds. These institutions are apparently going to keep stockpiling Bitcoin either way.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Fed Split: Should They Prioritize Fighting Inflation or Supporting Employment?

- Fed policymakers remain divided over prioritizing inflation control or labor-market support, with hawks like Bostic urging rate stability until inflation nears 2%. - Dovish officials argue slowing job growth (29,000 monthly payrolls in late 2024) demands rate cuts to sustain economic momentum despite inflation risks. - Tariff adjustments and delayed economic data complicate decisions, with Treasury's import relief measures facing criticism for potential inflationary rebound. - Looming student loan tax ch

YFI has dropped 7.68% over the past week during a period of heightened volatility and ongoing downward momentum

- YFI fell 7.68% weekly to $4747, reflecting ongoing bearish sentiment amid broader market weakness. - Technical indicators show bearish alignment (EMA/SMA below price) and key support at $4500–$4600 as critical near-term levels. - Historical backtesting reveals limited post-crash recovery potential, with buy-and-hold win rates between 48-62% after 10%+ drops. - YFI remains vulnerable to further declines without a significant shift in market dynamics or bullish catalysts.

Polkadot News Today: "Why Presale Investors Prefer BlockchainFX's AOFA License Instead of Polkadot or Polygon"

- BlockchainFX secures AOFA license, boosting investor confidence and attracting whale capital amid market shifts toward early-stage projects. - Its $11M+ presale offers tokens at $0.03 with a 50% bonus code, contrasting with slower growth curves of Polkadot and Polygon due to larger market caps. - The project's hybrid model combines regulatory credibility, utility-driven beta platform, and staking rewards, positioning it as a "super app" for multi-asset trading. - Aggressive ROI projections and $500K Glea

BCH Stock - 0.70% Potential Gain as Governance Improves

- BCH fell 0.02% in 24 hours and 5.51% monthly, with Goldman Sachs maintaining a Neutral rating and 0.70% upside target. - Institutional holdings showed mixed activity, including a 289.93% stake reduction by Baillie Gifford, while governance reforms aimed to enhance transparency. - Projected 19.4% revenue growth and $8.49 non-GAAP EPS signal modest recovery, though weak loan growth and bearish put/call ratio (4.11) highlight risks.