Date: Mon, Oct 06, 2025 | 01:40 PM GMT

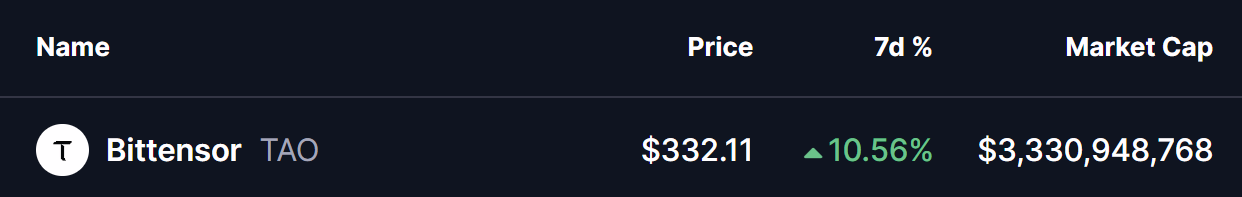

The cryptocurrency market is showing strength as Bitcoin (BTC) and Ethereum (ETH) have both surged over 11% in the past seven days. Riding on this market-wide momentum, several altcoins are flashing bullish technical signals — and one of the most notable among them is Bittensor (TAO).

Over the past week, TAO has gained around 10%, but what’s more interesting is its emerging technical setup, which hints at a potential upside breakout in the near term.

Source: Coinmarketcap

Source: Coinmarketcap

Falling Wedge Pattern in Play

On the daily chart, TAO appears to be forming a falling wedge — a bullish pattern that often signals weakening bearish pressure and a possible trend reversal.

Recently, TAO’s correction brought its price down to the wedge’s lower boundary near $290.89, a key support level that has once again held firm. After testing this zone, TAO bounced back and is now trading around $332.98, sitting just below its 100-day moving average (MA) at $354.51.

Bittensor (TAO) Daily Chart/Coinsprobe (Source: Tradingview)

Bittensor (TAO) Daily Chart/Coinsprobe (Source: Tradingview)

Historically, this moving average has acted as a strong resistance zone. Therefore, a decisive breakout above it could be the first confirmation of renewed bullish momentum.

What’s Next for TAO?

If TAO manages to defend its wedge support and closes above the 100-day MA, traders could see the token climb toward the upper resistance line of the wedge. A confirmed breakout from this level — ideally followed by a retest of the breakout zone — could set the stage for an extended rally, potentially driving the token above $518 in the coming weeks.

Conversely, if TAO fails to maintain its position above the current range, it may revisit the lower support trendline before bulls make another attempt to push higher.

For now, the structure suggests that TAO is at a key inflection point — either preparing for a bullish breakout or one last retest before upside momentum takes over.