Why Dogecoin’s Rally May Falter Amid Bearish Divergence and Dropping Whale Demand

Dogecoin’s recent gains may not hold for long. Despite a steady climb, weakening inflows and falling whale demand point to a potential correction unless new buyers step in.

Leading meme asset Dogecoin (DOGE) has seen a steady price rise over the past two weeks, trading within an ascending parallel channel on the daily chart. Currently priced at $0.2605, the coin’s value has climbed 17% in the past 14 days, extending optimism across the meme coin market.

However, there’s a catch. A key momentum indicator has formed a bearish divergence, signaling that DOGE’s rally may lack organic support and could be due for a correction. Meanwhile, large holders, known as whales, appear to be slowing down their accumulation, further dampening the bullish outlook.

DOGE Price Strength Faces Test

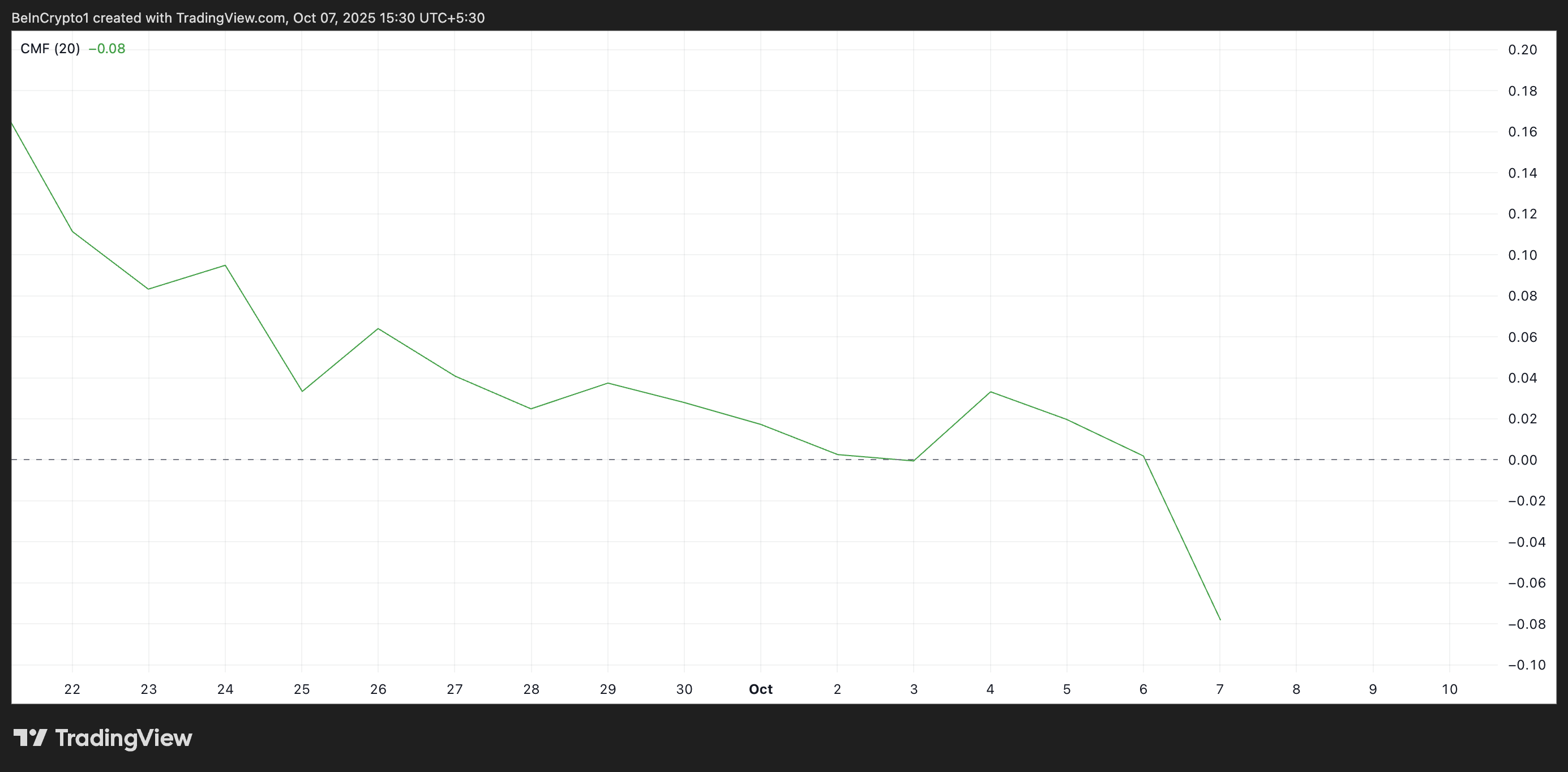

While DOGE has posted double-digit gains in the past two weeks, its Chaikin Money Flow (CMF), a key indicator that tracks capital inflows and outflows, has declined, forming a bearish divergence. This momentum indicator is below the zero line at -0.08 at press time.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

DOGE CMF. Source:

TradingView

DOGE CMF. Source:

TradingView

A bearish divergence occurs when an asset’s price continues to climb while its CMF indicator trends downward. This means that less capital flows into the asset despite the price growth.

Such divergences typically precede pullbacks, suggesting that DOGE’s short-term momentum could weaken if buying activity does not recover.

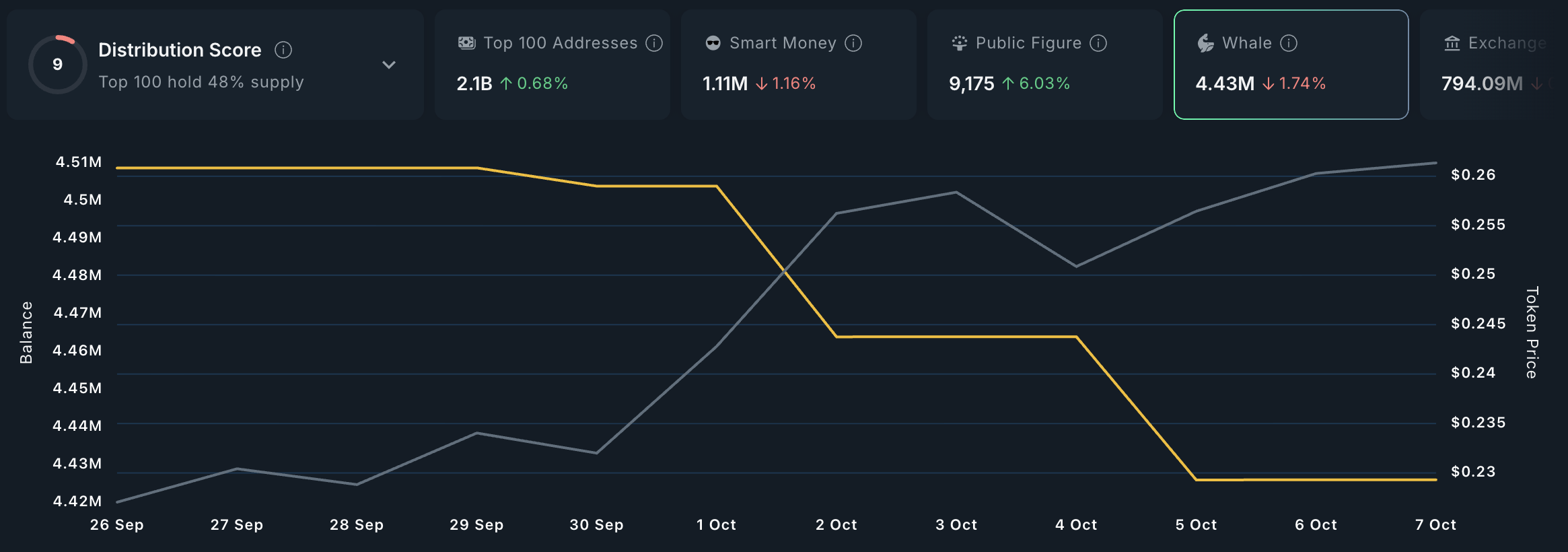

In addition, on-chain data has revealed a drop in whale activity. According to Nansen data, large investors holding DOGE coins worth more than $1 million have reduced their supply by 1% in the past two weeks. At press time, this cohort of DOGE investors holds 4.43 million DOGE.

Dogecoin Whale Activity. Source:

Nansen

Dogecoin Whale Activity. Source:

Nansen

Whales play a crucial role in sustaining market momentum. When their demand declines during a rally, it often reflects a lack of conviction behind the price move. This could be a red flag for traders banking on continued upside.

Can New Demand Save the Meme Coin?

If buying pressure continues to wane, DOGE could face a short-term correction toward the lower boundary of its ascending parallel channel, potentially testing $0.2574 as near-term support. If this price floor gives way, the meme coin’s price could experience a deeper decline toward $0.2018.

Dogecoin Price Analysis. Source:

TradingView

Dogecoin Price Analysis. Source:

TradingView

On the other hand, if new demand enters the market, the coin could break above the upper line of its current channel, which forms resistance at $0.2797. If successful, DOGE price could reach for $0.2980.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Market sentiment in the crypto space remains fragile; even the positive news of the "U.S. government shutdown" ending failed to trigger a meaningful rebound in bitcoin.

After last month's sharp drop, Bitcoin's rebound has been weak. Despite traditional risk assets rising due to the US government reopening, Bitcoin has failed to break through a key resistance level, and ETF inflows have nearly dried up, highlighting a lack of market momentum.

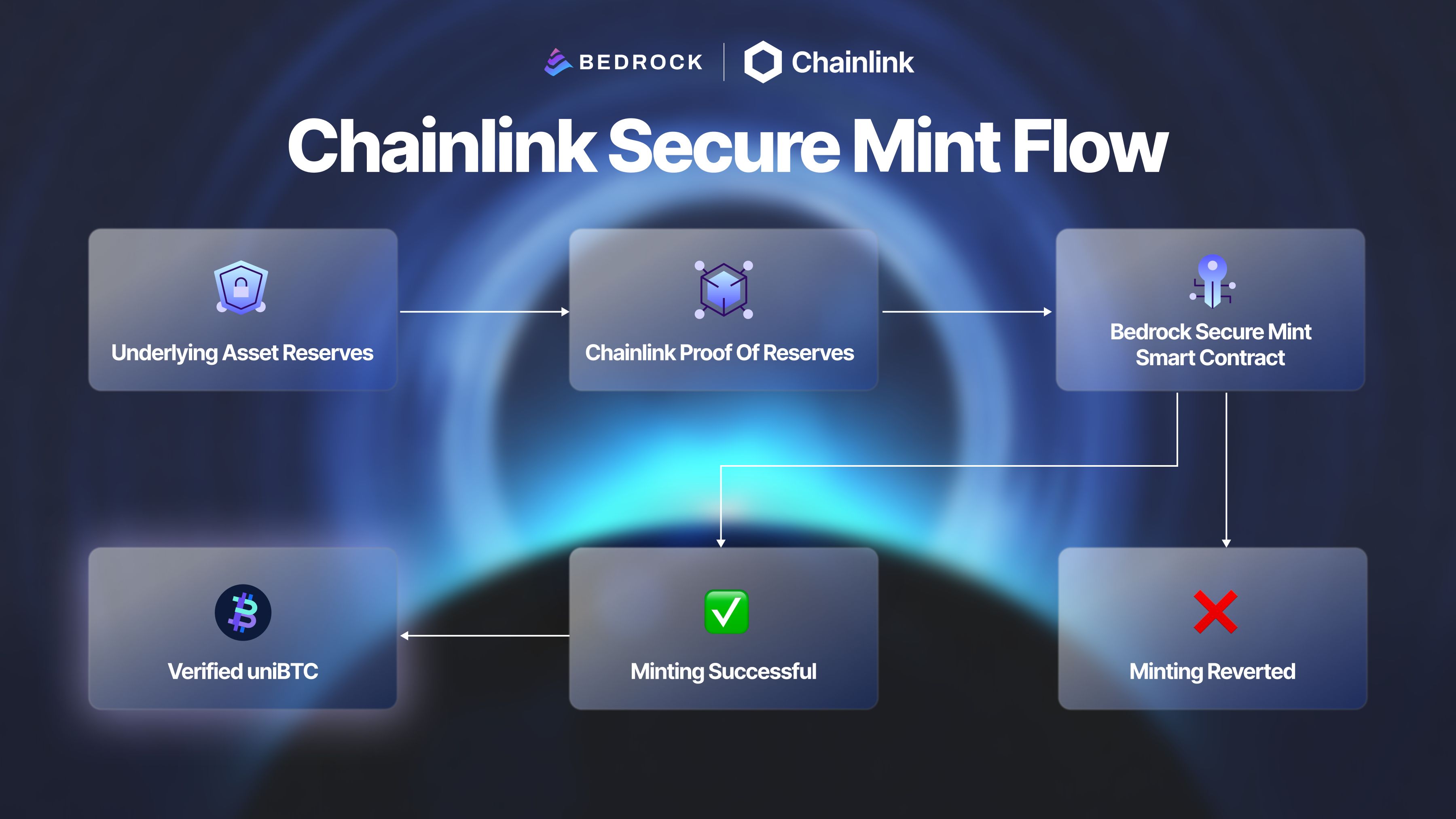

How Bedrock Strengthens BTCFi Security With Chainlink Proof of Reserve and Secure Mint

By winning the championship with Faker, he earned nearly $3 million.

Faker's sixth championship also marks fengdubiying's legendary journey on Polymarket.

Trending news

MoreMarket sentiment in the crypto space remains fragile; even the positive news of the "U.S. government shutdown" ending failed to trigger a meaningful rebound in bitcoin.

Bitget Daily Digest (Nov 12)|Solana financial firm Upexi posts record quarterly results; Nick Timiraos: “Fed increasingly divided over December rate cut”; Injective launches native EVM mainnet, advancing MultiVM roadmap